PADD-3 needs to price to export once more if it avoids another freeze-off, with European competition strong into the East as Atlantic Basin pricing points to soft demand

Physical premiums in the USGC, which had been threatening to move off their recent bottom, have softened once more as exports out of the US fell through the New Year.

PADD-3 exports in the most recent weekly data sets have been disappointing, with the return to ‘normal’ arb pricing levels by mid-December hampering the region’s ability to maintain the highs of late-November and early-December.

With PADD-3 now entering 2024 with 10% higher inventories than in previous years, the imminent risk of a freeze-off of refining capacity could actually be a blessing in disguise as a way to help curb inventory growth.

A raft of refinery turnarounds and some emerging unscheduled outages are also likely to help here, but we cannot shake the impression that demand for export barrels is simply lacklustre currently in the Atlantic Basin, with exports and physical premia dropping despite already attractive pricing.

We are already beginning to see Houston pricing falling further in the prompt, and this will likely continue (with help from a narrowing TA) to secure additional outlets for these barrels.

The very shut TA arb may continue to be a hindrance for European blenders, but there are plenty of opportunities elsewhere for the European market to place excess barrels into.

Not much has changed in the last few weeks, with opportunities open into African and ME destinations.

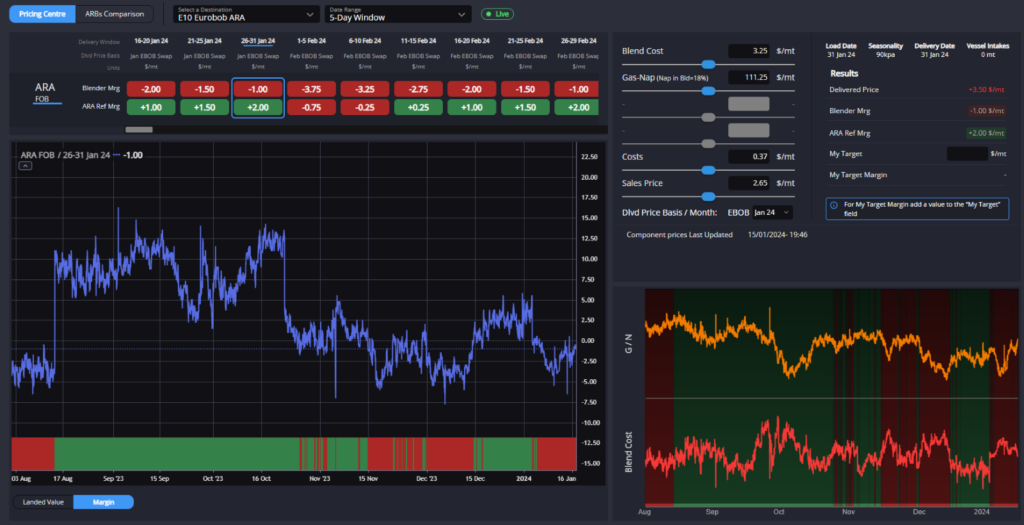

This has begun to narrow the E/W spread once more, but not yet by enough to shut these opportunities despite high freight costs – largely thanks to widening European gas-nap spreads and increasing naphtha pricing in the EoS.

In Europe, those open arb opportunities appear to not be enough to swallow all excess components, however.

With physical premiums dipping (helped by a wider gas-nap), the E10 blender margin is very almost open once more – signalling a need to soak up these components in a market which is struggling to see enough demand for its export barrels.

This goes to the wider picture of a lacklustre demand environment around the world, with WoS destinations in particular perhaps not picking up the volumes that would be expected even in the slower winter months.

By contrast, the EoS market has been strengthening once more, and should continue to do so as supply constraints remain. Singapore-origin barrels in particular are now pricing competitively into Australia, which is being reflected also in an increase in the TC7 rates.

With refinery outages mounting in the region and demand remaining apparently robust, prices on physical components and semi-finished streams flowing into Singapore are moving higher and should help to give both SG92 spreads and cracks a boost in the weeks to come.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com