Narrowing gas-nap shuts TA arb, but US complex should pick up as we move through Q1

We open this week with TC2 falling sharply as vessels that swarmed across the Atlantic in December are struggling to find volumes to move back TA with the RBOB arb still so shut.

The RBOB arb has narrowed thanks to gas-nap closing once more, which is masking the impact of lower freight rates.

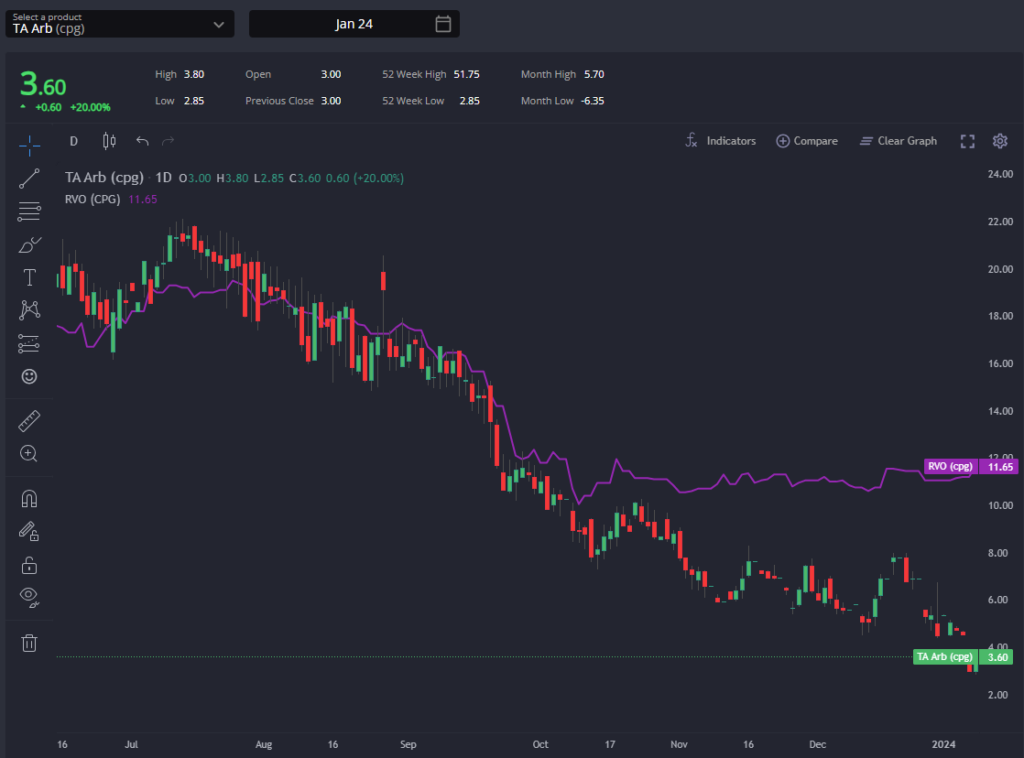

Furthermore, the paper TA arb has been narrowing further, with the US side of the equation weakening as the system continues to want to price volumes out and avoid attracting additional barrels in on vessels looking for opportunities coming back across the Atlantic.

This dynamic should change in the coming weeks, however, with both PADD-2 and PADD-3 supply finally coming under some real constraint as largescale turnarounds kick in and exports should remain high given relative landed prices into key export destinations.

We are already beginning to see some narrowing of the USGC’s advantage over ARA as the supplier-of-choice across the Atlantic Basin as component pricing in PADD-3 picks up, and we would expect this dynamic to accelerate through the weeks ahead as component availability tightens.

As an interesting aside, RIN values in the US continue to not be the driver of the narrower TA arb, having dislocated from this spread back in Oct/Nov 2023.

Whilst we are not in a position to comment on the future direction of RINs, and therefore RVO, so long as they remain as range-bound as they have been in recent months, we can assume that the pressure on the TA arb that continues to afflict prompt assessments will remain firmly in place.

The narrowing gas-nap spread has leant on the E10 blend margin in ARA, wiping out what was briefly a positive blend margin at the turn of the year.

The European gasoline market is yet to feel the additional pull expected in the light of an early turnaround season this year, and instead has given a muted response thus far to being the cheapest source of supply into South America, WAF, EAF, and parts of the Middle East in the prompt.

Higher naphtha premiums as that market reacts more vividly to Red Sea logistics issues and turnarounds are hampering E10 blend activities, but comparatively rangebound higher octane component pricing is helping ARA’s competitiveness remain intact.

Finally, component pricing in Singapore has seen something of a resurgence since the start of the New Year, with premiums on typical streams from NE Asia in particular halting their previous downward trend.

Still, current forward pricing suggests that Singapore blended barrels are returning to some level of competitiveness on the export market, having displaced US-origin barrels into Australia and European-origin barrels into Saudi Arabia and Pakistan as of March arrival.

This is largely on the back of lower freight rates, though we would some movement in both the E/W and the underlying SG 92 market (cracks/spreads) as a result, with both set to strengthen on the back of the increased call on Singapore blended barrels with AG maintenance kicking into gear in the weeks ahead.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com