Increased marginal diesel resupply to Europe as its maintenance period really begins to start

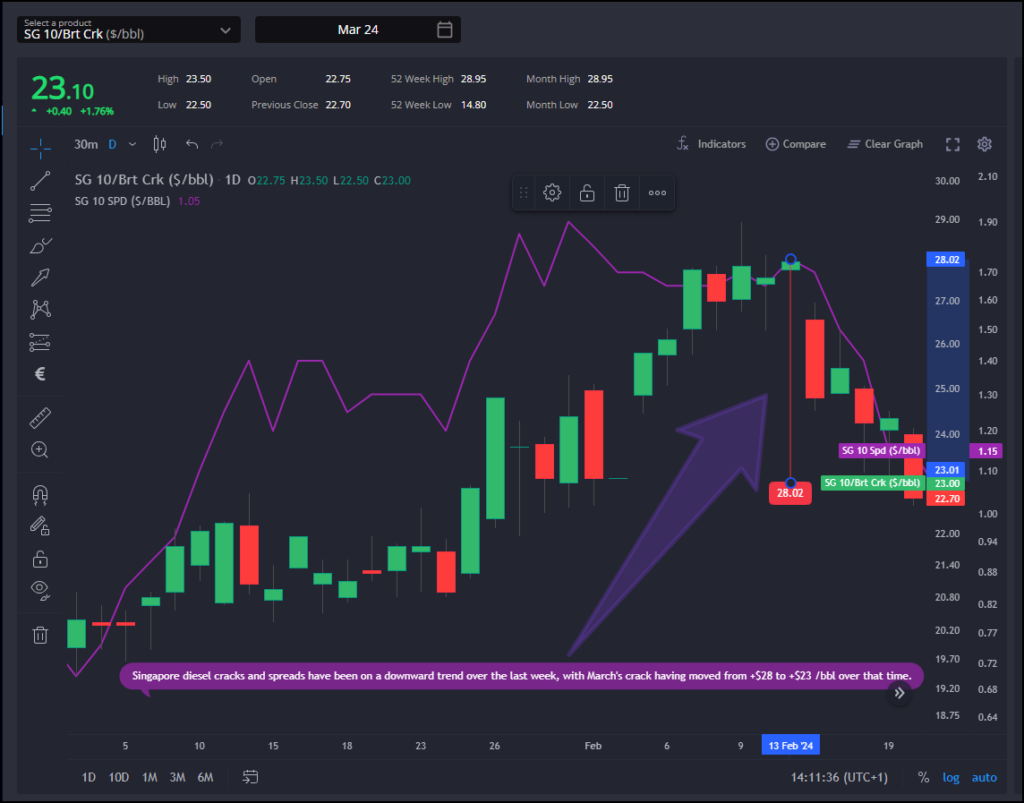

Over the past week, Singapore diesel cracks and spreads have experienced a downward trajectory, evidenced by March’s crack falling from +$28 to +$23 /bbl during this period.

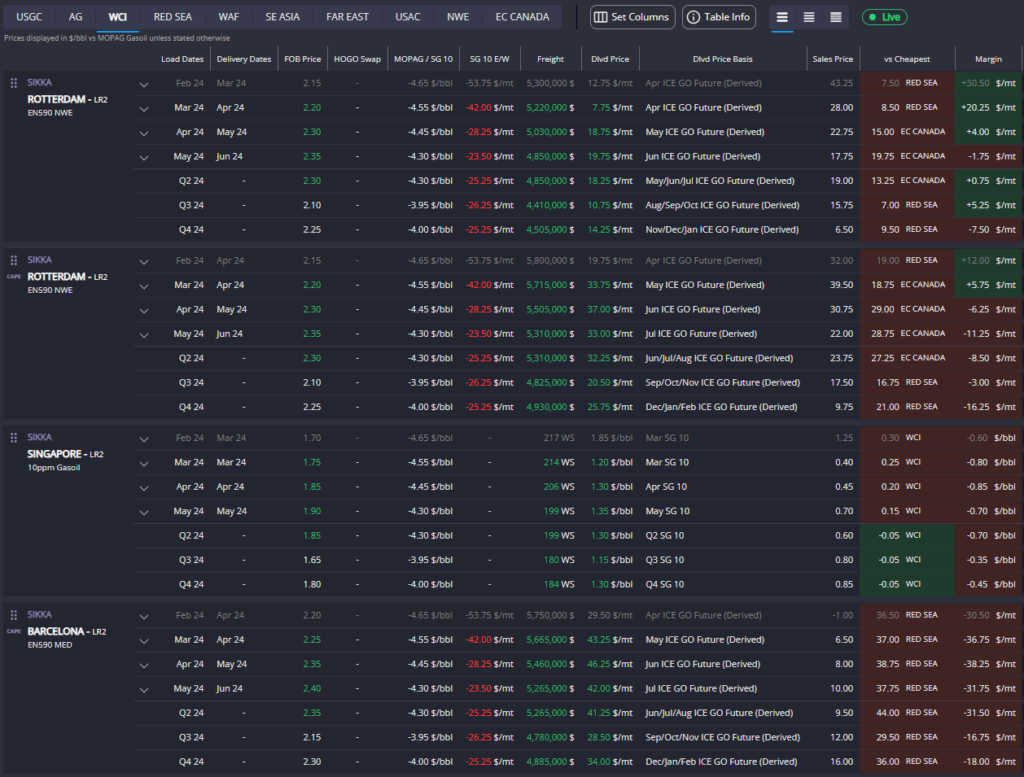

This decline can be attributed primarily to increased arrivals from WCI (and the AG), propelled by the narrowing of the GO E/W spread in January and particularly high freight costs hindering voyages to Europe.

Adding to this pressure is the sustained high level of Chinese diesel and jet fuel exports that are expected to persist into March (gasoil/diesel 1.06 million mt, jet fuel 2.21 million mt), as per insights from our Singapore-based colleague Thomas Cho.

Looking ahead in the short to medium term, this bearish trend in Singapore diesel prices is anticipated to persist, especially with Middle Eastern turnarounds largely concluding by the end of February.

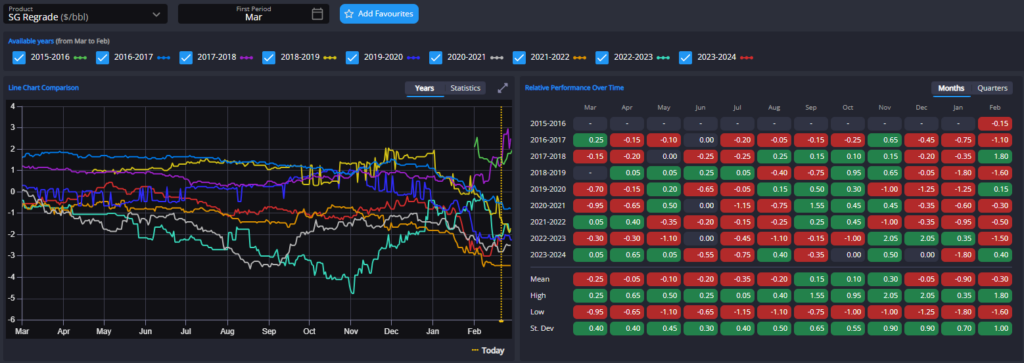

Meanwhile, the regrade has seen a marginal recovery with March’s figures presently narrowing from -$3 to -$2.3 /bbl.

However, with European jet demand lacklustre, as noted by our European jet broker contacts citing holidays, backwardation, and subdued demand, the jet market outlook appears bleak.

The closure of all Asian-origin jet arbitrage routes to Europe, except those from the Red Sea, further contributes to the bearish sentiment for Asia Pacific jet.

This closure, coupled with the aforementioned surge in Chinese jet exports, paints a challenging picture for the region’s jet market in the near term.

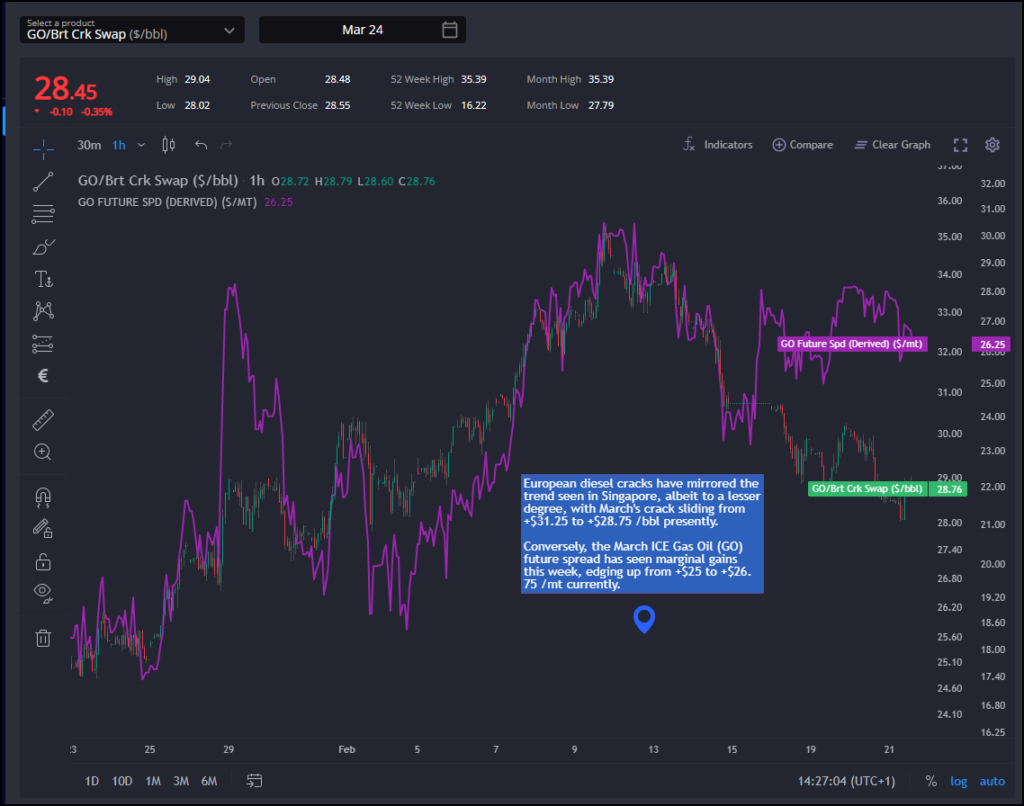

European diesel cracks have mirrored the trend seen in Singapore, albeit to a lesser degree, with March’s crack presently sliding from +$31.25 to +$28.75 /bbl.

This decline is believed to be in anticipation of the conclusion of maintenance periods in both the US and the Middle East and coupled with some profit-taking at these historically high crack levels.

Conversely, the March ICE GO future spread has seen marginal gains this week, edging up from +$25 to +$26.75 /mt currently, coinciding with the commencement of spring European maintenance in March and April.

Investor activity reveals a bullish sentiment prevailing on both sides of the Atlantic, with funds purchasing European gas oil (+11 million bbls) and US diesel (discussed in detail later).

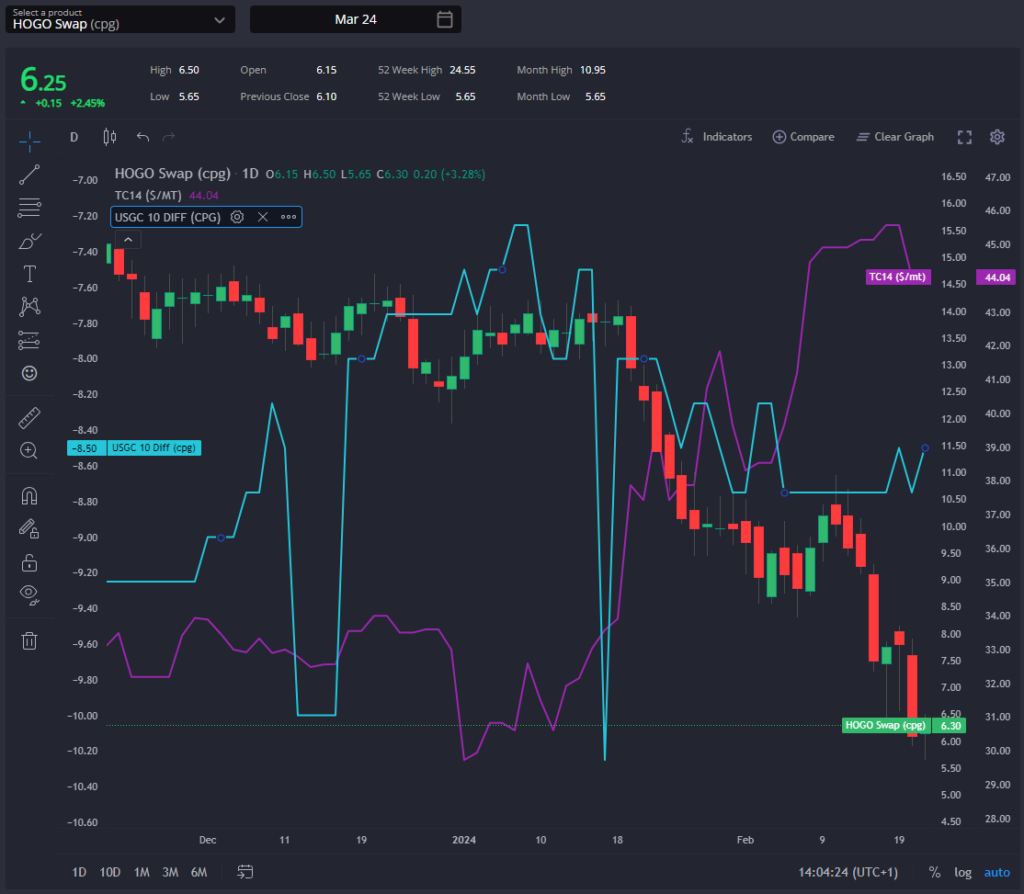

Despite this, March’s HOGO has continued to narrow, presenting open or close-to-open diesel arbitrage opportunities from the USGC to Europe for March/April arrival.

Furthermore, weakness in New York diesel pricing at the front has opened the diesel arbitrage from the USAC to Europe, leading to a notable increase in fixtures for this route booked to load before the end of February.

Our Freight Commodity Owner David Thwaite sees this as an “Interesting development …which should potentially weaken TC2 and strengthen TC14 on the freight side…”.

Meanwhile, March’s GO E/W has widened after an initial narrowing at the beginning of the week, prompting March loaders for WCI and the AG to now point towards Europe/West, as per our recently released “around the Cape arb” calculations.

There are clear signs of increased marginal supply from Asia and the US into Europe and European demand remains lacklustre, albeit showing some signs of improvement.

Despite these challenges, we maintain a neutral to bullish outlook for European diesel, driven by lingering production issues stemming from light crude slates and the impending peak of European maintenance in mid-April.

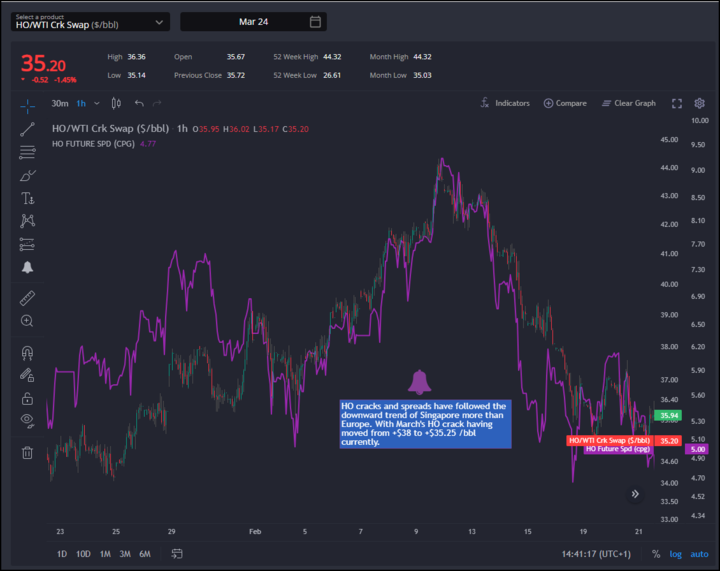

HO cracks and spreads have exhibited a more pronounced decline, closely mirroring the trend observed in Singapore rather than Europe. March’s HO crack has fallen from +$38 to +$35.25 /bbl presently.

This dip is attributed to several factors, including expectations of resuming US crude runs following the conclusion of maintenance, coupled with concerns about the pace of the US economic recovery and ensuing diesel demand.

Consequently, both the USGC and USAC diesel arbitrage routes to Europe appear either open or on the verge of opening.

Despite this decline, investor activity indicates a bullish sentiment toward US diesel, with funds acquiring +10 million bbls this week.

This suggests that this rapid decline may have been overly aggressive and could soon stabilize.

Adding to this picture, Ukrainian drone attacks have significantly impeded Russian crude runs, plunging to their lowest levels since April/May 2022 since January.

This disruption has reverberated globally, particularly impacting the US and Asian markets. Consequently, there is an anticipated surge in demand from Latin America and Africa in the short to medium term, offering some respite to US diesel pricing.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com