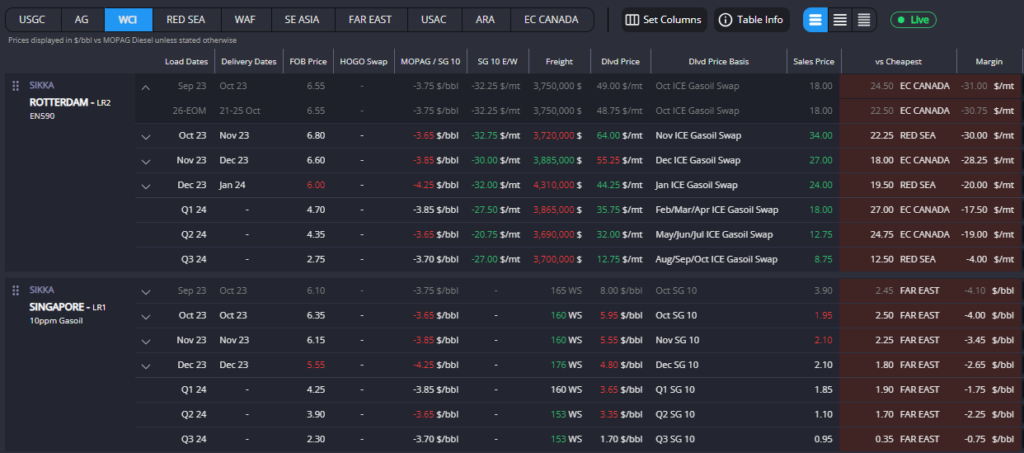

HOGOs narrow steeply, all arbs into Europe appear closed whilst Singapore prices up; reflected in slight narrowing of the East West

The Red Sea route has held its position of previous weeks as the most cost-effective arb into Europe, but recent developments have altered the picture.

A downturn in European sales prices has not only closed the door on the Red Sea arbitrage but has closed all other arbs into Europe until the distant horizon of Q2/Q3 2024.

Rotterdam’s LR2 sales prices tell the tale, sliding from a promising +$23 to a less enticing +$10/mt versus the October ICE GO Future.

This pricing shift echoes throughout the market, dampening the spirits of ICE GO spreads and cracks with October’s ICE GO crack falling from +$36.50 to +$33.50/bbl in the last week.

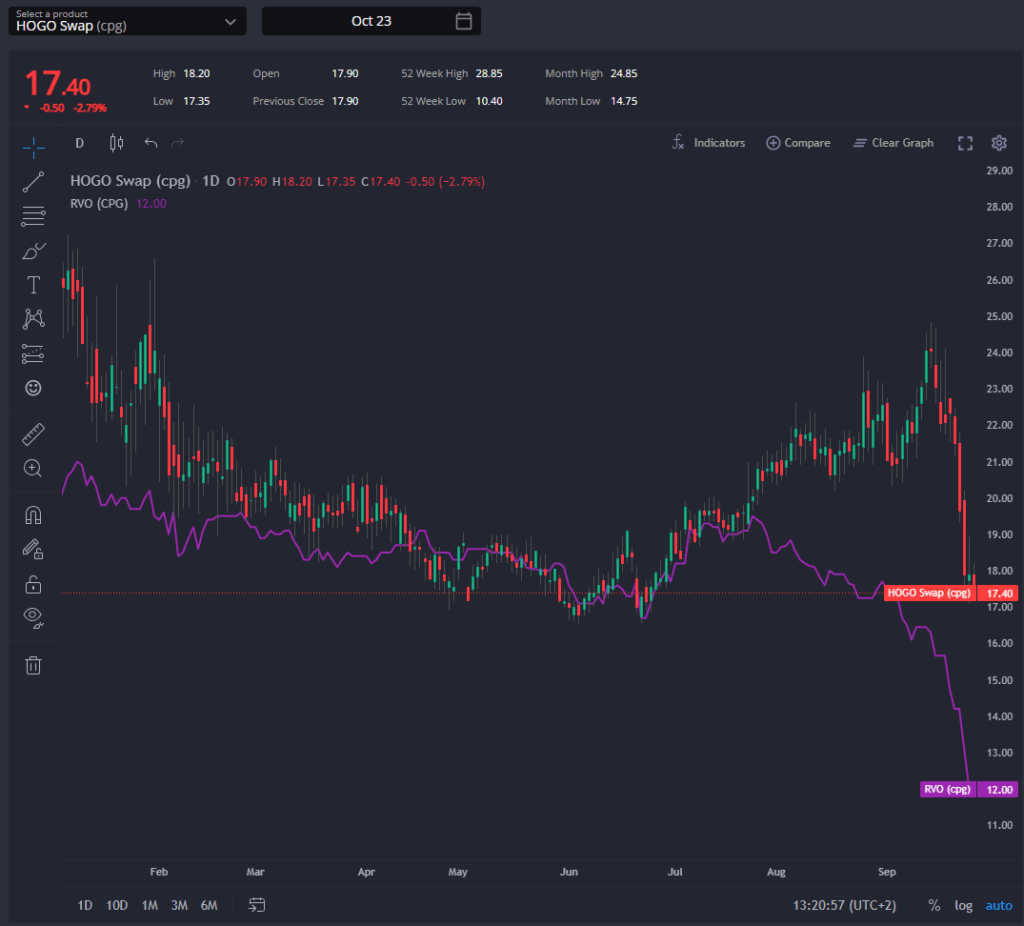

The Heating Oil versus Gasoil (HOGO) spread narrowed this week from +22.5 to +17.50 cpg, influenced by a partial rollback of Russia’s export ban and the lowest Renewable Volume Obligation (RVO) levels since December 2021.

Interestingly, the USGC Transatlantic (TA) arbitrage has risen in terms of cost-effectiveness into Europe, surpassing WCI and matching AG arb econs.

While the TA arb hasn’t fully opened, reports from US sources indicate an uptick in cargo sales destined for this route. Europe seems poised to welcome these additional shipments.

AG and Red Sea cargoes maintain their westward preference of previous weeks, although the above-mentioned price fluctuations combined with increasing Singapore sales prices and a modest narrowing of the East/West spread have left WCI cargoes evenly balanced between East and West landings.

Despite ARA stocks maintaining relative stability, the closure of all European arbitrage opportunities for Q4 2023 raises questions about the future. We anticipate increases in European sales prices, spreads, and cracks that will breathe life into these closed arbs.

The USGC has asserted itself as the most cost-effective source for a multitude of Latam destinations, with Brazil at the forefront.

Several factors contribute to this resurgence, including the Russian export ban, a noteworthy drop in the USGC differential (reaching its lowest point since February before the Russian diesel sanctions), and above-mentioned shifts in the HOGO.

Notably, more vessels are navigating this route, illustrated by vessels like LRs Flagship Violet and UOG Harriet G.

This cost-effectiveness extends beyond Brazil, as the USGC now challenges Asian-origin barrels even into Argentina and along the West Coast of Latin America. The absence of Russian products, akin to West Africa’s situation, drives Argentina to source its barrels increasingly from ARA.

Nevertheless, the West Coast of Latin America and the US continues to draw substantial volumes from Asia (diesel and jet fuel), in large part due to persistent challenges at the Panama Canal.

Although October Heating Oil (HO) crack swaps experienced a dip this week, declining from +$44.50 to +$40 /bbl, the need for HO cracks to remain at these elevated levels in the short to medium term remains pressing.

Such a rebound is vital to continue to incentivise ULSD production and to secure or retain cargoes, especially as the winter season looms on the horizon.

Taiwanese and South Korean barrels continue to vie for the position of most cost-effective option for deliveries to Singapore.

This rivalry persists despite both nations seeing their FOB prices rise in recent weeks, primarily due to the strong demand from the West Coast of the United States and Latin America.

The Russian export ban has played a role in bolstering Singapore’s sales prices, providing an advantageous backdrop for these Asian barrels.

Additionally, the increased FOB premia in the West Coast of India (WCI) further strengthen the position of South Korean and Taiwanese barrels as the top choices for Singapore-bound shorts.

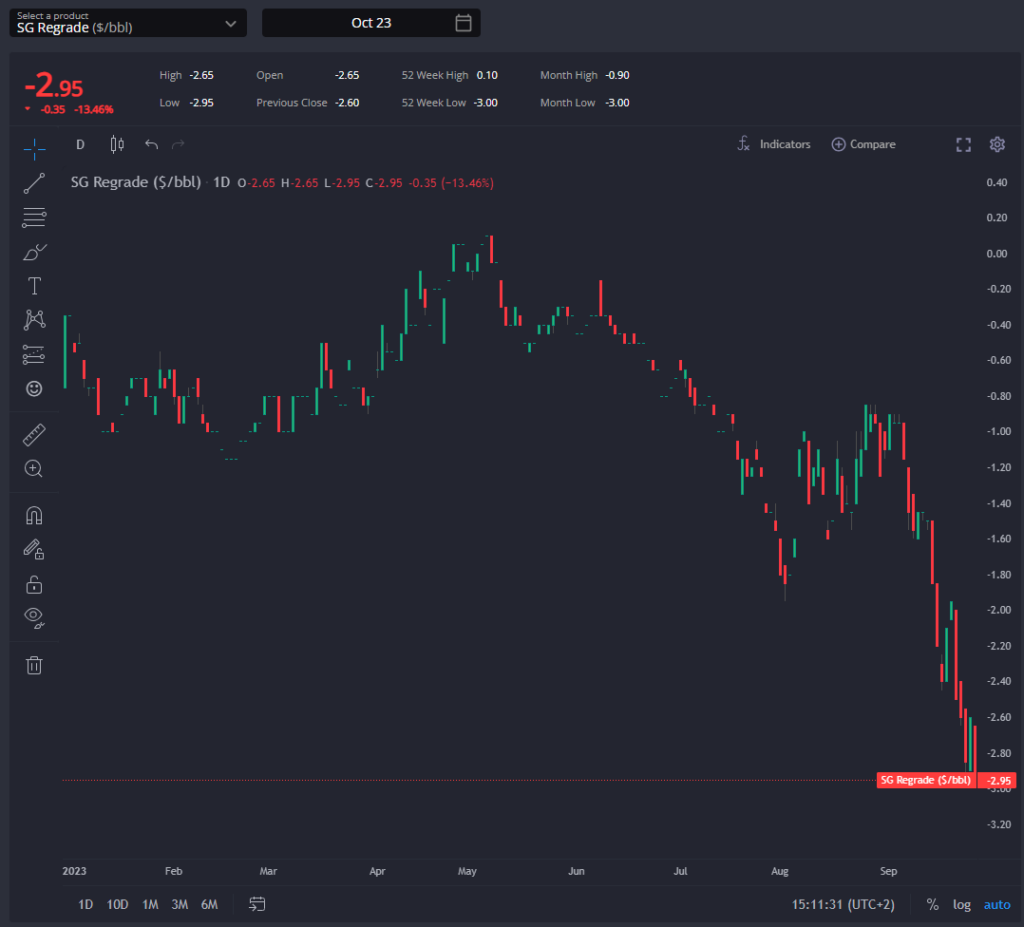

However, recent fluctuations have impacted Singapore’s diesel cracks, with October cracks slipping from +$31 to +$29.50 /bbl over the past week.

This decline can be attributed to an anticipated surge in Chinese distillate exports for October, with market participants estimating exports of 1.2 to 1.3 million mt of gasoil and 1.4 to 1.86 million mt of jet fuel.

This growing volume of Chinese jet fuel exports have contributed to October’s Singapore regrade moving to its widest recorded position, reaching -$2.95 /bbl this week.

Consequently, arbitrage opportunities from the AG and WCI into Europe for November arrival are nearly open, and the prospect of increased Asian-origin jet fuel arbitrage opportunities to Europe and the United States is on the horizon.

This is especially as we have seen European sales prices increase sharply of late with European LR2 sales premia having moved to their highest level since January 2023 this week.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com