French refineries move into 15th day of strike action

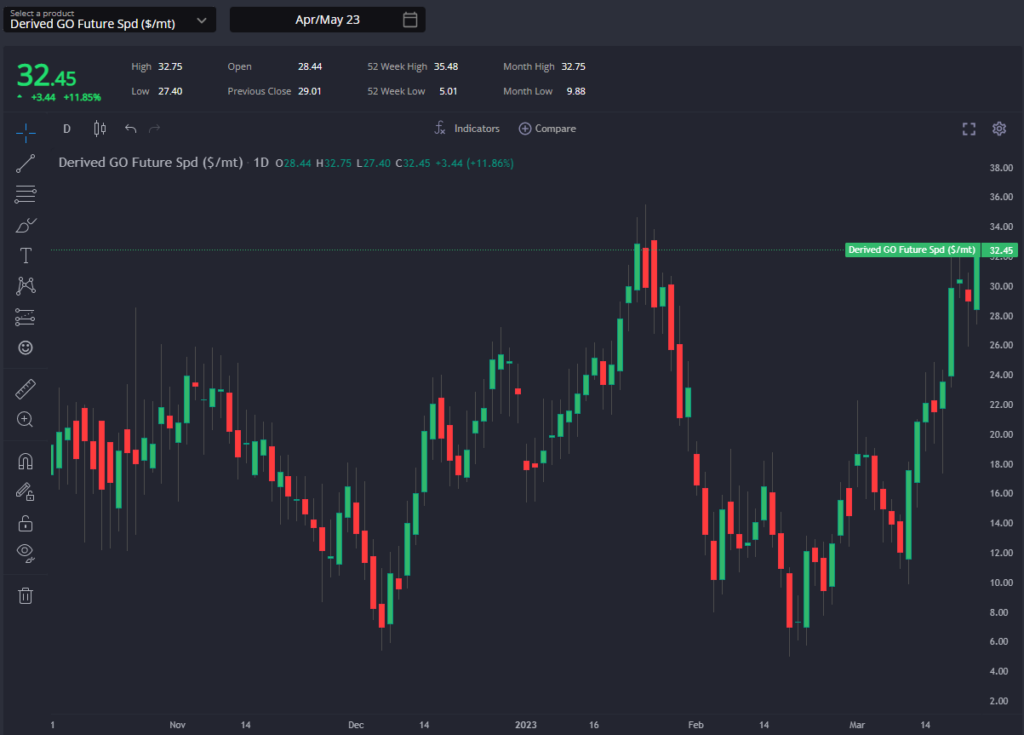

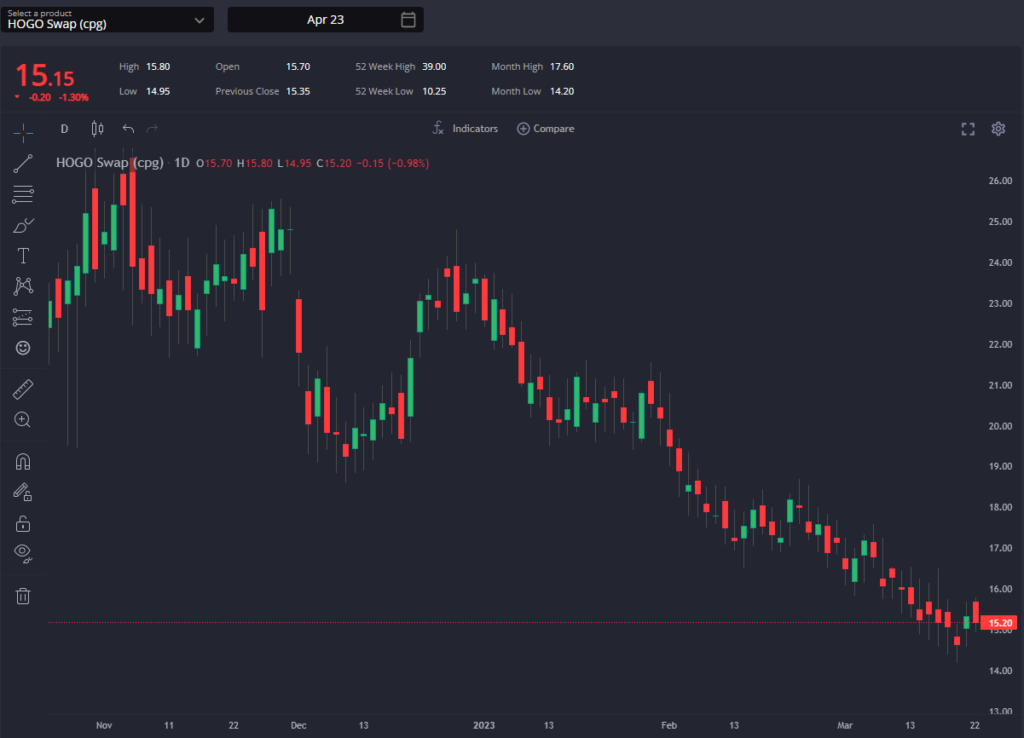

With the European complex strengthening on the back of short-term supply upsets in France, both ICE Gasoil spreads and the HOGO have been pointing towards an Atlantic Basin market geared firmly towards the European market.

As we have mentioned previously, the inventories built up in anticipation of the Russian sanctions implementation can only provide a buffer to the European market for so long, and with unexpected supply upsets now in play, NWE in particular will need to price higher to attract additional supplies coming in from further afield.

However, hope for European resupply remains on the horizon as the TA arb into the MED (Barcelona) emerges as the best option for those arriving in late April or early May. We have seen recently, that the HOGO has narrowed consistently to try its best to open this arb and allow Europe to take volumes otherwise destined for PADD-1.

However, we would add the caveat that the most recent report from EIA showed that distillate fuel stocks in PADD 1 fell to six week lows, opening up the question of how long such low HOGO swap spreads can be sustained before the HO complex is forced to react.

Despite the strengthening fundamental picture in the Atlantic Basin, the AG and EoS arbs into Europe remain tightly shut (albeit opening briefly on the AG arb into ARA earlier this week). The reason for this? The AG/SG 10 spread has narrowed, effectively closing off this route, whilst the April and May E/W has yet to react to the most recent developments in Europe.

Despite strong Russian inflows in the AG (these flows outstripped AG-origin barrels flowing the other way through the Suez in recent weeks), physical premiums in the AG have somewhat stabilised, with barrels finding homes in south and east Africa as well as into SE Asia.

However, with AG barrels staying in the EoS, this will be weighing on the SG 10 complex as Singapore outlets remain well-supplied, and we would expect also the April and May E/W spreads to widen sharply in the coming days and weeks if the French supply outages persist.

Indeed, looking at the South East Asia distillate market, we find that Singapore’s best source of ULSD supply lies in the Taiwanese and South Korean refineries. However, as the week began, these arbs were briefly opened before being promptly closed once again.

These barrels having found alternative homes in Australia, USWC and WCSAM instead. Adding to Singapore’s challenges, the arrival of a VLCC (the Olympus) carrying ULSD out of the AG in early March further impacted the region’s values, whilst Singapore middle distillate stocks were reported at their highest since November 2021 this week.

Yet, hope remains as the ongoing industrial action in France draws AG, WCI and Red Sea barrels away, potentially reopening these vital Taiwanese and Korean arbs into Singapore in the coming week.

As noted last week, we witness that the USGC remains the preferred source of supply for WCSAM. Albeit, perhaps as a sign of continuing Atlantic Basin tightness, with some challenge from floating ULSD barrels in Lome. A number of Total/CSSA fixtures have been fixed along this route.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com