European component pricing opening E10 blend margin in first step towards wider Q2 TA Arb, with plenty of support across the Atlantic to strengthen the RBOB complex

A widening European gas-nap spread is helping to re-open the E10 blend margins in Europe, with strong premiums on high-octane components not enough to stop E10 blending from looking particularly attractive to European players.

Most April blending windows have seen a ~$10/mt uptick in econs over the last week, with EBOB cracks simultaneously reaching seasonal record highs just shy of $24/bbl.

With little to no arb outlets viable out of Europe at the moment, however, the outlook for the European gasoline market as we move onto into Q2 rests solely on the intensity of the turnarounds ahead and the ability of the local E10 market to absorb additional supply given current open blend margins.

Current forward pricing is beginning to look somewhat unsustainable despite the turnaround season being just around the corner, however, with even Nigeria now pointing toward the AG and Singapore for resupply thanks to an E/W spread that has reached double-digits and will almost certainly need to be cut back.

The other consequence of a widening gas-nap spread – which itself should narrow again shortly given encouraging naphtha demand indicators in Europe – is some improvement in the TA Arb econs.

Arb margins for blenders remain closed, but current levels should see a healthy baseline of RBOB being able to make the voyage come April.

This will unlikely be enough to clear the European overhang, however, and with PADD-1 inventories not exactly bursting at the seams, there’s certainly still room for the April and May TA Arb spreads to widen.

The E/W widening out to double-digits has not only significantly closed any prospect for European barrels to move East, but it is has also opened up significant potential flows from Asia into both WAF and West Coast Americas.

New and returning volumes out of the AG, as well as a likely rebound in Chinese gasoline exports following a slow start to the year amidst higher crude intake are seeing plentiful supply in the East of Suez.

As such, despite a decent pull from arbs within and out of the region, it will unlikely be enough to balance supply and support a rally in the Sing92 complex, which will need to look for particularly healthy regional demand in the months ahead or risk the need to turn to refinery signals (lower cracks) to avoid oversupply.

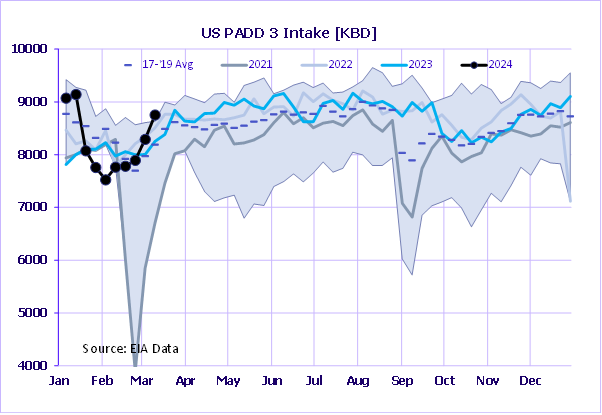

Oversupply is something that the US market is not yet worried about, with PADD-3 crude intake ramping up significantly in the last few weeks, beginning to compensate for lower running earlier in the year and already hitting record seasonal highs in the latest data.

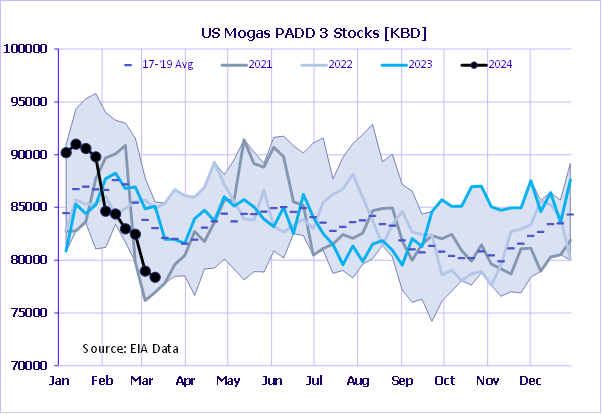

Some hiccups remain to be overcome, but with BP’s Whiting refinery restarting, these levels are set to push higher, with the recent trend in PADD-3 inventories set to reverse quickly.

That being said, with importers across both North and South America looking to the USGC for resupply as opposed to Europe currently, the call on USGC gasoline supply from domestic demand, restocking needs, as well as arb outlets across the region are likely to provide an impetus to boost the RBOB complex (spreads/cracks) and in turn widen the paper TA Arb spread in the coming weeks.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com