Europe strong but room to the upside limited as supply should begin to ramp up

European gasoline is currently enjoying an unseasonably robust position, characterised by several key factors.

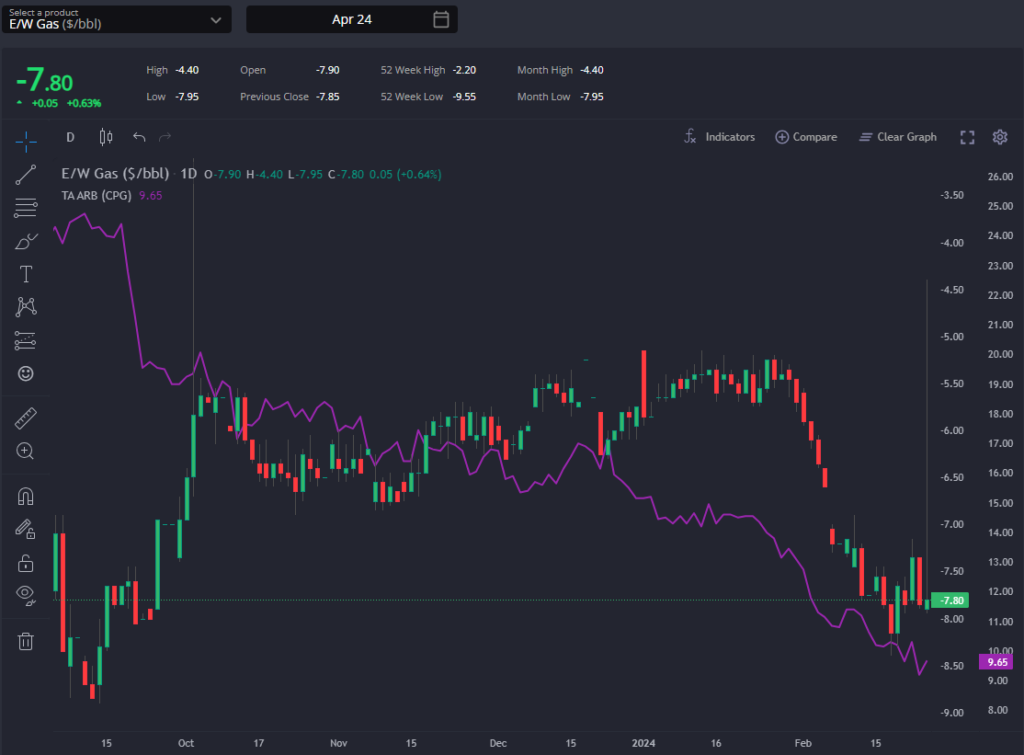

Firstly, the prompt TA arb is historically narrow, shutting opportunities into PADD-1. Additionally, the E/W, which was already negative, has widened by approximately $3 per barrel this month.

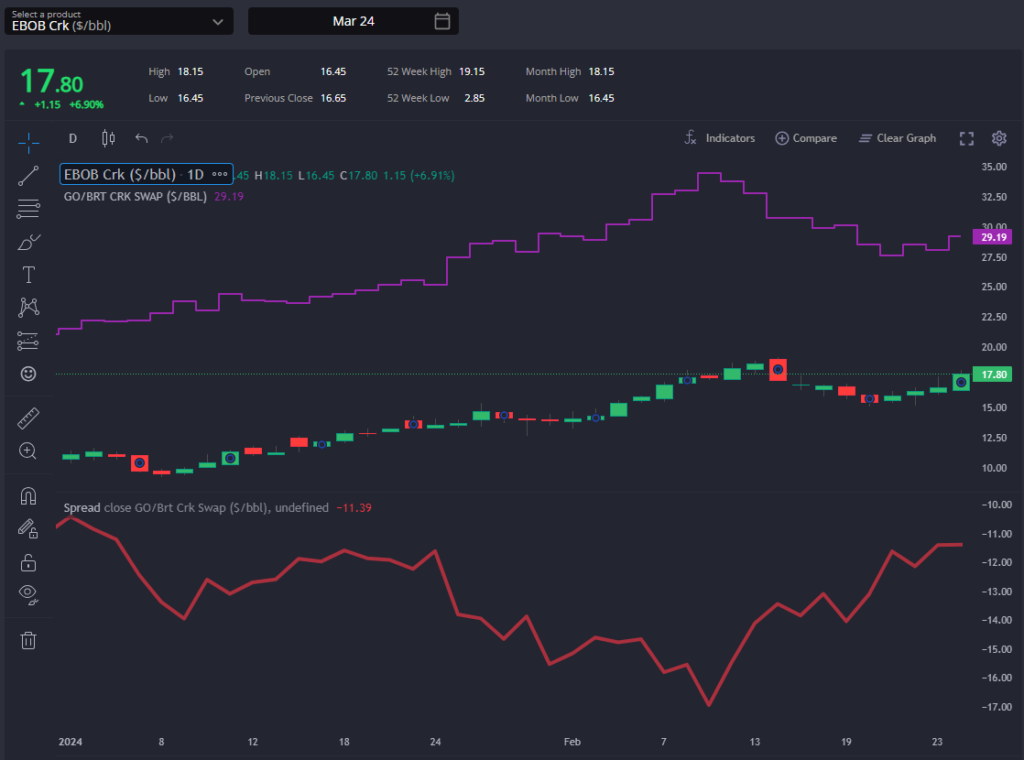

Moreover, cracks are steadily approaching the $20 per barrel mark once again, further bolstering the strength of the European gasoline market. However, it is likely that the recent peak of this uptrend has been reached.

This is because the wide open E10 blend margins expected through March will contribute additional supply to the market. Furthermore, the movements in the E/W differentials have offset any potential pull on European barrels from the East.

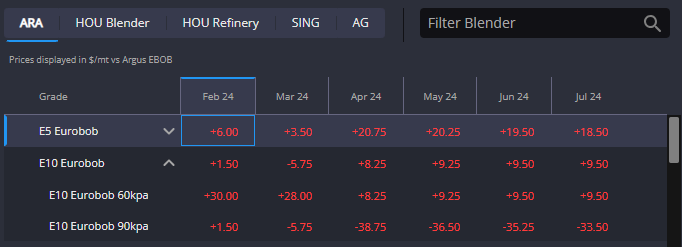

Interestingly, with April EBOB currently trading almost $30/mt higher than March EBOB, the cost to blend those grades is actually even further apart.

Whilst it should be possible to blend March E10 for around a $6/mt discount vs the underlying March EBOB swap, it is more like an $8/mt premium over the April EBOB swap to do the same once we reach Q2.

This potentially points to a market which has already slightly underpriced April EBOB, and might need to respond later in March lest physical supply doesn’t match current expectations.

The relative strength of the European gasoline market has widened spreads against other benchmarks. However, this strength has resulted in the closure of the second-quarter TA arb and has led to AG/Sing pricing dominating export opportunities into the East.

Presently, Singapore blenders have opportunities across Asia and the Americas, with the East of Suez (EoS) balance expected to tighten in the coming weeks as European barrels cease flowing East and the Americas increasingly source from Asia rather than the US Gulf Coast.

A significant benchmark arb, specifically the flow into the West Coast of Mexico, has recently shifted strongly towards being sourced out of Asia. Consequently, it is anticipated that arbs closely aligned with this trend, such as North Asia to US West Coast, will soon witness an increase in volumes.

Finally, although arb opportunities out of the USGC still appear limited through March and April, we have seen an uptick in vessels moving towards PADD-3 – presumably in anticipation of greater product availability/export demand in the weeks ahead.

Whilst I will let my colleagues talk about the prospects for diesel and naphtha exports out of the USGC, with crude intake having now remained significantly impaired in the last five weeks of data, gasoline yields low and exports historically high (as foretold by the forward arb pricing through January), there is little prospect of significant gasoline availability for export continuing out of the USGC in March.

We see little prospect of the USGC returning to the export market beyond its home territories of Florida and Mexico through the coming weeks/months, and this should improve the prospects of PADD-1 needing to look toward Europe for resupply come mid-Q2.

With the May TA Arb having dipped below 9cpg, this particular contract looks ripe to be a key mechanism that will need to move higher once more as we move into Q2.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com