Europe exhibits a need for diesel resupply, that both US and Asian origin barrels need to price to fill

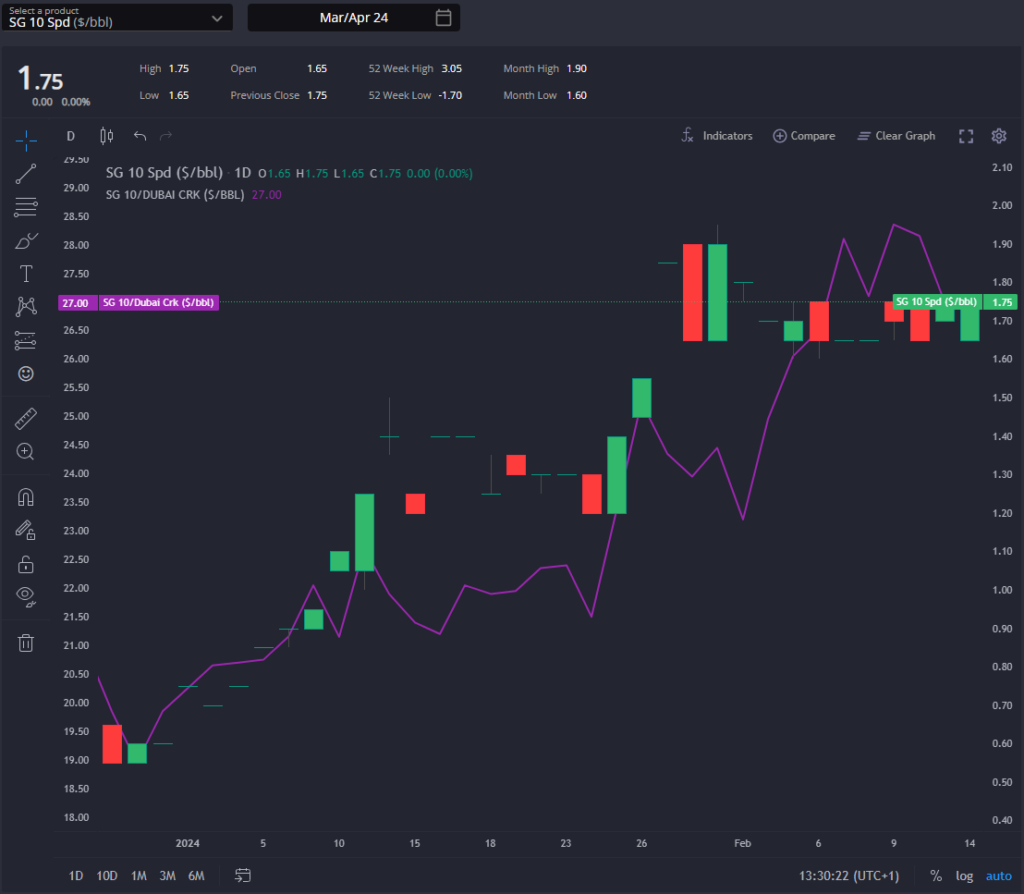

This week, Singapore cracks and spreads appeared to have reached a ceiling, evidenced by March’s spread shrinking from +$1.90 to +$1.75 /bbl over the past week.

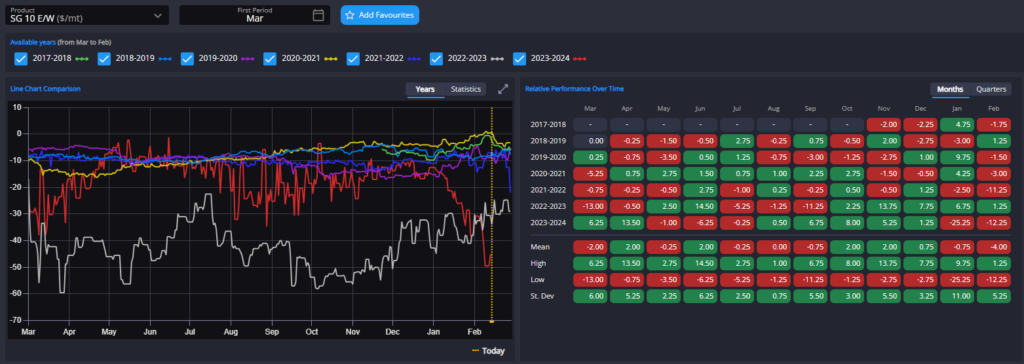

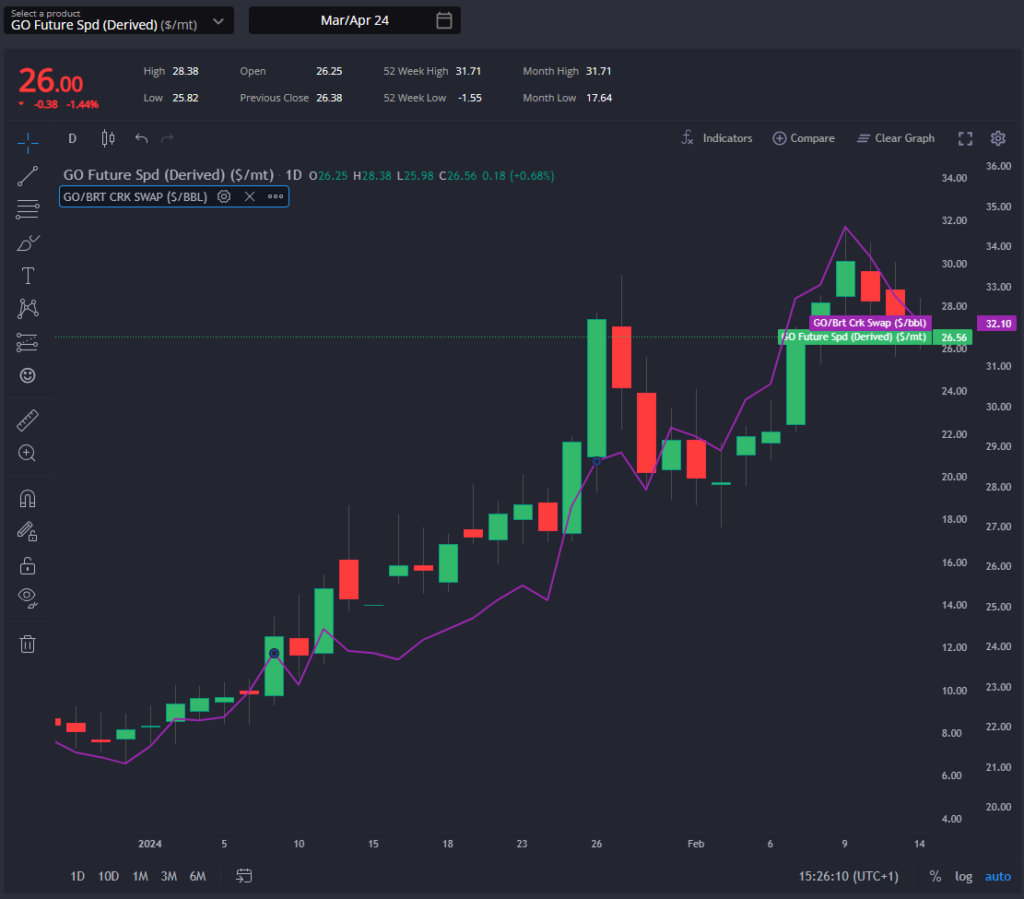

A similar pattern emerged in the GO E/W, which has widened to its widest seasonal position in at least six years, propelled by the sustained strength in Europe.

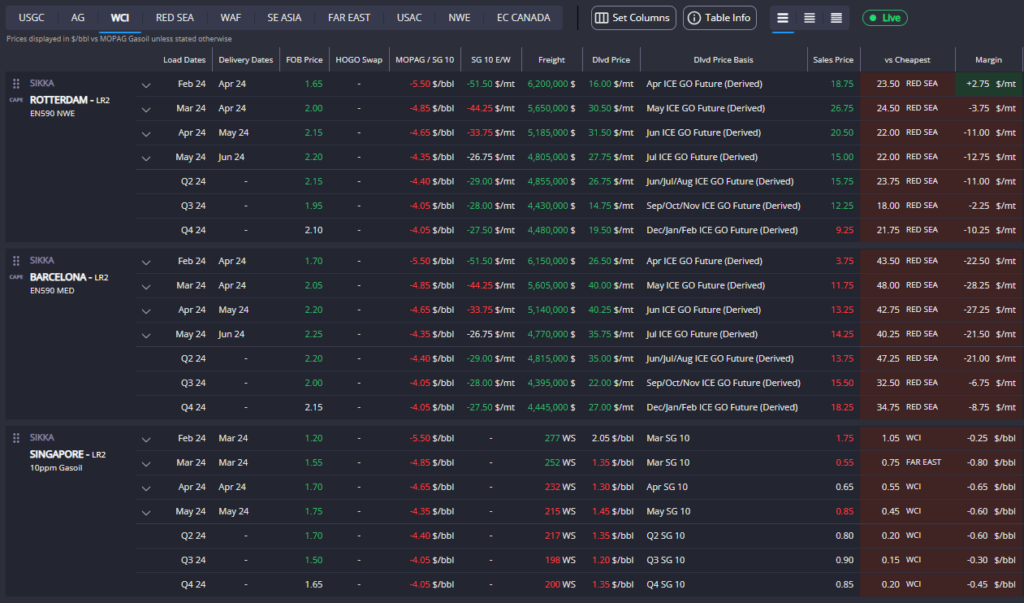

Calculations taking into consideration Cape routing (these calculations to be released into the Platform shortly) notably suggest that WCI (and AG) arb routes now target Northwest Europe rather than Singapore.

This shift should offer some respite to Singapore cracks and spreads.

However, with persistently low premia in South Korea and China, a market dynamic highlighted by the first recorded Chinese diesel export to the US West Coast in over three years, continued high imports into Singapore are anticipated, particularly as regional freight rates show signs of slight decline in the near term.

Moreover, as recent refinery issues in these regions are resolved, the downward trend in Singapore pricing is expected to persist into the medium term.

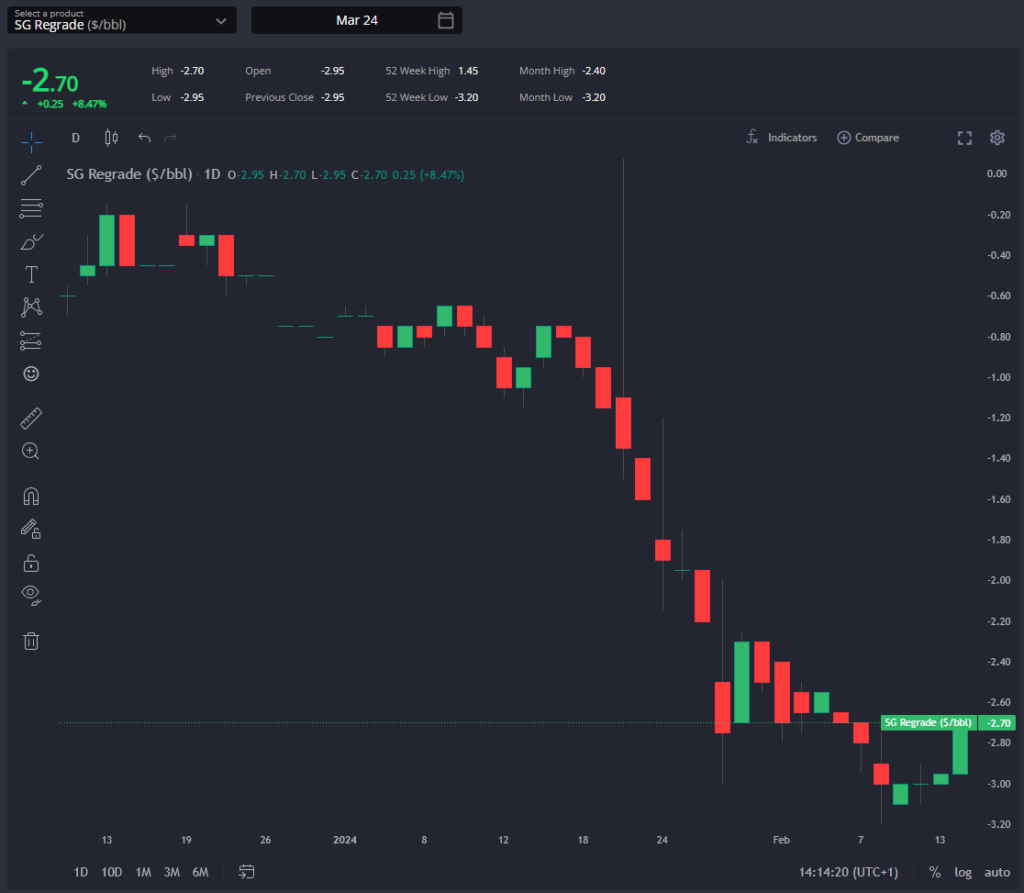

Similarly, a modest recovery in Singapore regrade offers relief in the medium term to European jet premia which have been on a downward trajectory since November 2023 due to flagging local demand. Fewer jet arbs from the Asia Pacific region should be expected as a result.

Two important caveats however are that European jet passenger numbers have been below 2019 levels since the start of the year and AG/WCI jet premia sit at their lowest levels since August 2023.

Echoing trends in Singapore, European cracks and spreads have witnessed a decline over the past week, albeit to a lesser extent.

This shift is likely to be partially attributed to the, above-mentioned, recent redirection of AG and WCI arbs toward Europe despite needing to factor in the longer voyage around the Cape.

Despite this adjustment, a bullish outlook prevails for European diesel with supportive market sentiment evidenced by significant purchases of European gasoil by fund managers, totalling an increase of 17 million bbls, whilst divesting from U.S. diesel by 7 million bbls this week.

This bullish sentiment towards European diesel is underpinned by positive indications regarding the European economy, and its implications for an increase in European demand for diesel.

Moreover, the closure of the USGC TA arbitrage, which remains shut by $10-$15 /mt, adds further support to this prevailing sentiment.

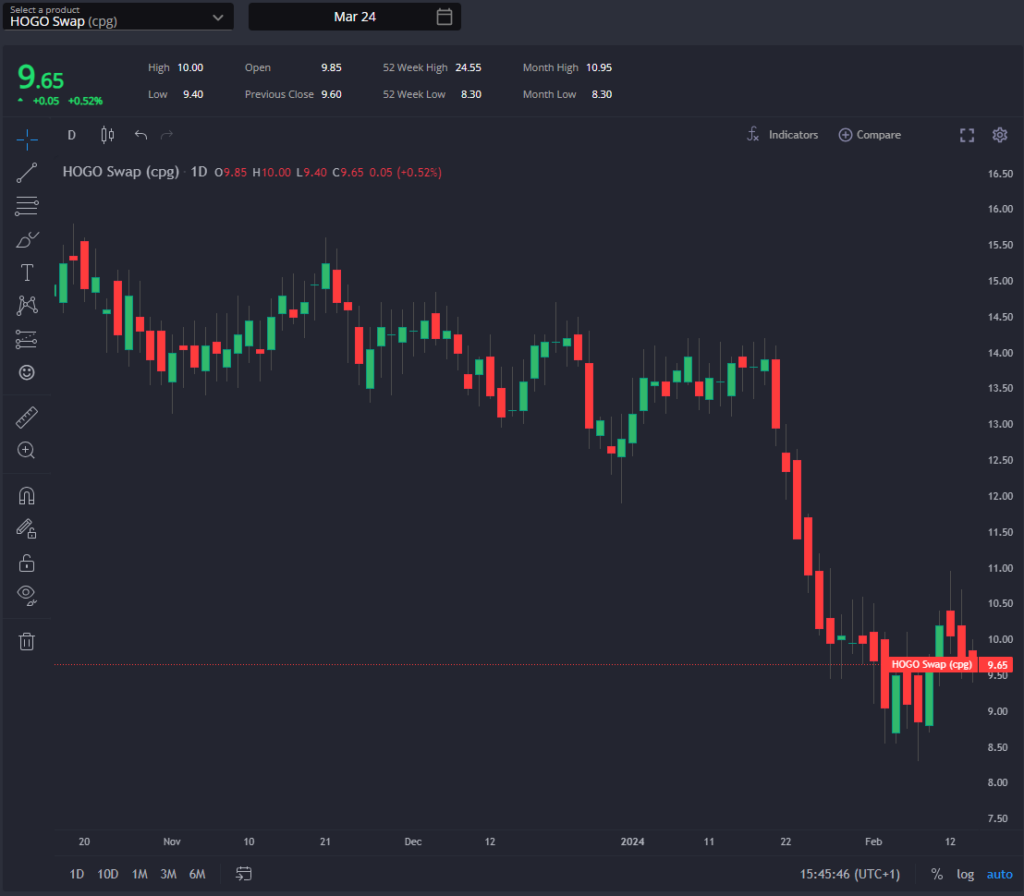

We feel that Europe’s continued need for diesel must necessitate an upward price adjustment, or conversely, a downward adjustment in the HO complex, to facilitate the opening of this arbitrage. This would equate to a reversal in the recent widening of the HOGO.

The, above-mentioned, widening of the HOGO swap in the past week contrasts with the plateauing of HO cracks and spreads.

Several key issues form elements of this picture: Firstly, Russian diesel exports which compete with those from USGC into Latin America should be subject to change amidst reports of Ukrainian attacks and general issues at Russian refineries combined with the approach of the Russian harvest season.

This has already led to declines in Russian diesel exports, which have currently reached 2-3 month lows.

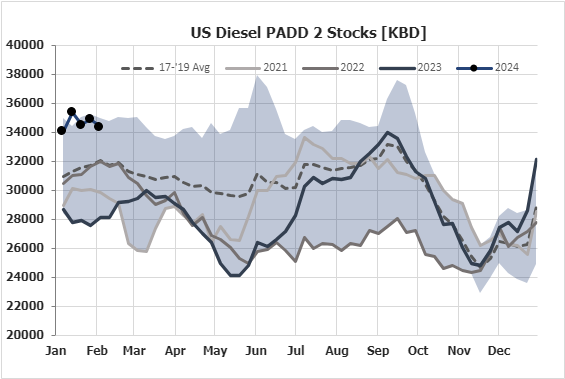

Additionally, diesel prices in the U.S. Midwest have increased following the BP Whiting outage and combined with earlier optimism surrounding the U.S. economy, buoyed by recoveries in manufacturing and freight sectors and murmurs of Federal Reserve interest rate reductions.

However, diesel stocks in the U.S. Midwest have been increasing rapidly since November, prompting minimal pipeline flows from the U.S. Gulf Coast to PADD 2 and marking the lowest November EIA diesel pipeline stats in six years, excluding 2020.

Furthermore, the unexpected uptick in the U.S. Consumer Price Index (CPI) to 3.1% versus 2.9% stirs hesitations over Federal Reserve rate reductions, thrusting inflation and economic apprehensions back into the limelight.

These factors underscore our contention that the HO complex (and the HOGO) needs to move to price to export to Europe (and Latin America) in the short term.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com