Economic slowdown, large EoS arrivals and falling cracks/spreads paint negative picture for European diesel complex

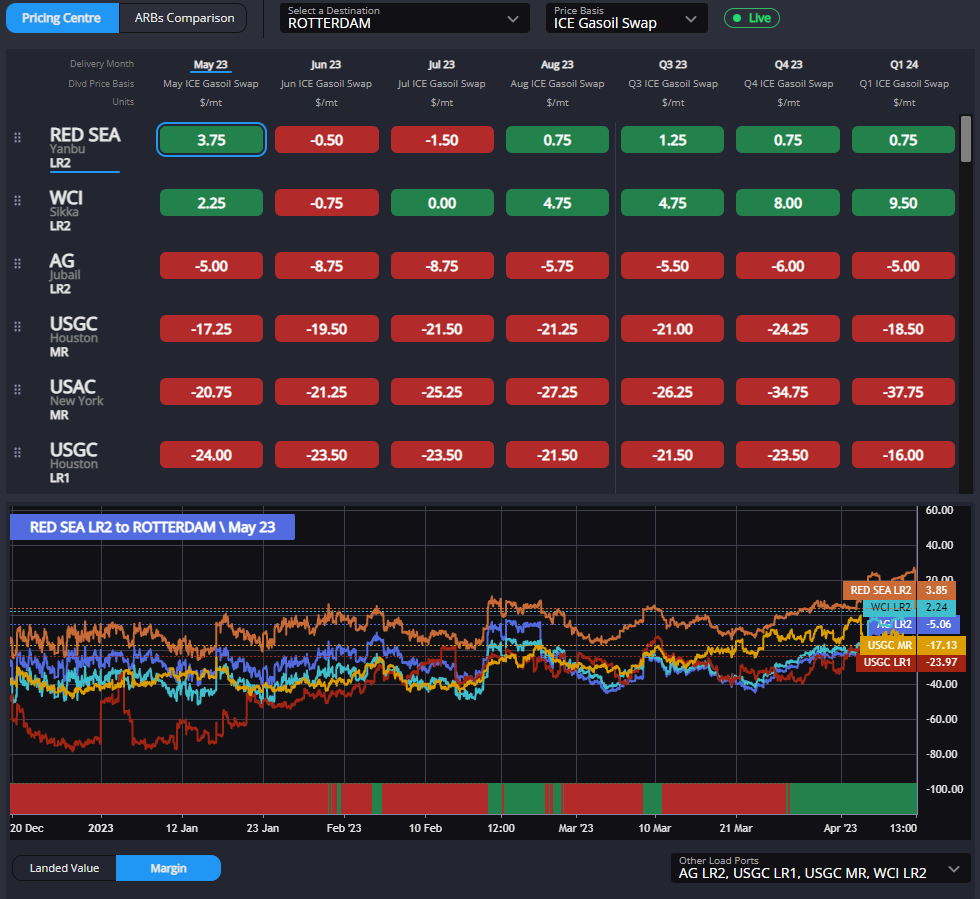

WCI arbs, on the back of falling FOB prices fuelled by reduced export duties, have opened the arb into Rotterdam all down the curve.

They have joined the typical European first point of supply of late, the Red Sea, in being open for the rest of the year. Given that the opening of additional arb windows has come firmly from a weakening in the EoS rather than an increased pull into Europe, we can expect the large volumes of EoS diesel arrivals into ARA over the coming weeks/months to further pressure spreads and cracks here.

A clear demonstration of the increased volumes available in the AG can be seen in the VLCC Olympus, which is currently loading 240KT of ULSD at Ruwais, pointing at NWE.

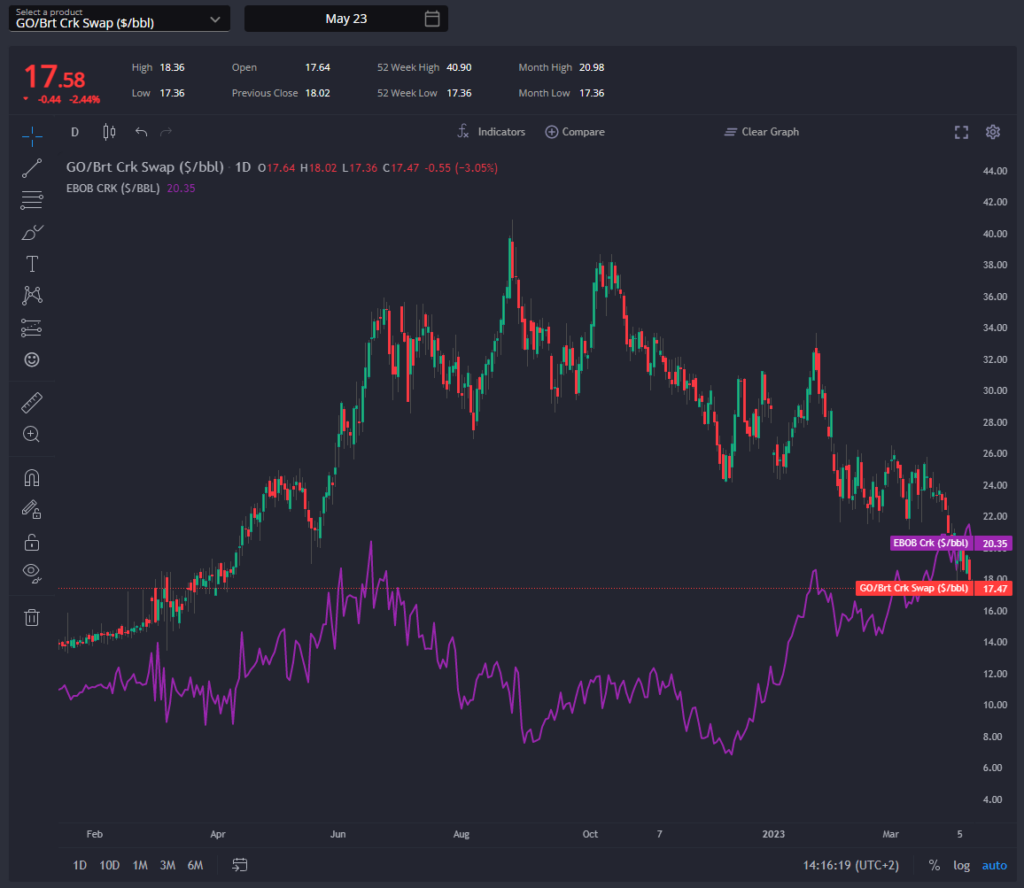

With the April E/W spread having opened to its widest point since end Feb, to encourage this substantial number of arrivals into ARA, we should expect to see some narrowing of the E/W over the coming weeks as the European leg weakens to discourage further inflows.

It remains possible that this develops into a race to the bottom between Singapore and NWE regions, keeping the spread wider, but we would expect a narrower E/W going forward which should in turn see some of these fixtures point to Singapore region once more.

European diesel cracks, lowest in over a year, and spreads, lowest since early December, have and should continue to fall under the weight of these arrivals. We expect to see some yield switching soon, if not already, in European refineries under the weight of these reducing cracks/margins.

The MED diesel diff, in a slightly converse manner, has practically doubled over the past week to its highest level since Mid-March.

However, with French refineries and ports coming out of industrial action on Tuesday, this trend is not one we would expect to continue, with some of the EoS arrivals bound to find Mediterranean homes themselves or via StS operations.

With the narrowing HOGO, increasing MR freight rates and falling European sales prices having closed the Transatlantic arb, the US Gulf must currently look to its traditional shorts in Latam to relieve it of any excess diesel.

USG diesel diffs have reduced over the past week, partially to keep these arbs open, successfully in the case of Brazil. However, due to a widening E/W and falling AG FOB prices, this is being challenged from the AG.

Reports from the Brazilian trade ministry have shown record imports of diesel in March, with the vast majority coming from the US Gulf with significant shares from the AG and Russia.

The picture for Argentina is also a mixed one. We have witnessed a battle between reducing USG cash diffs and diesel East West over the last few weeks to see whether the AG or USG is the primary source of supply for Argentina.

Here any “grey” Russian barrels or HS European gasoil fixtures must be considered (It has been rumoured that these Russian exports should be at near record levels in April).

If as predicted previously, we see the East West narrow to pull some barrels to Singapore, the downward pressure on the USG cash diffs, of having to fight for Latam shorts, should be relieved over the coming weeks. In fact, we have started to see some of this in the relatively positive moves in HO spreads over the last week.

An early indicator of this relative Eastern strengthening should be the arbs into USWC or WCSAM; if here the best point of supply stops being Japanese and Taiwanese refineries, as these barrels are pulled into Singapore, Phillipines, Australia, Indonesia etc…

Despite falling sales prices in Singapore, the previously mentioned reduced WCI FOB prices combined with slightly reduced LR1 freight rates, have opened the WCI arb to Singapore from July arrivals, with the front also close to opening.

If we are to see these fixtures point to Singapore over the coming weeks, we will have to see a narrowing of the East West. To pull not just WCI barrels but also AG and Red Sea.

There are some extra factors to consider here;

i) With weakening gasoil margins, we should see reduced Chinese exports over the coming month

ii) Continuing increased gasoil exports from East Russian ports. However, this has tended to be higher sulphur gasoil

iii) Sing regrade is at its narrowest since end February indicating a change in the composition of Singapore middle distillate stocks to higher diesel over the last few weeks

iv) Continuing large number of diesel fixtures from Singapore region to Australia and the Philippines over the next few weeks

As ever the development of the E/W will be the instrument to monitor to see the results of these factors.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com