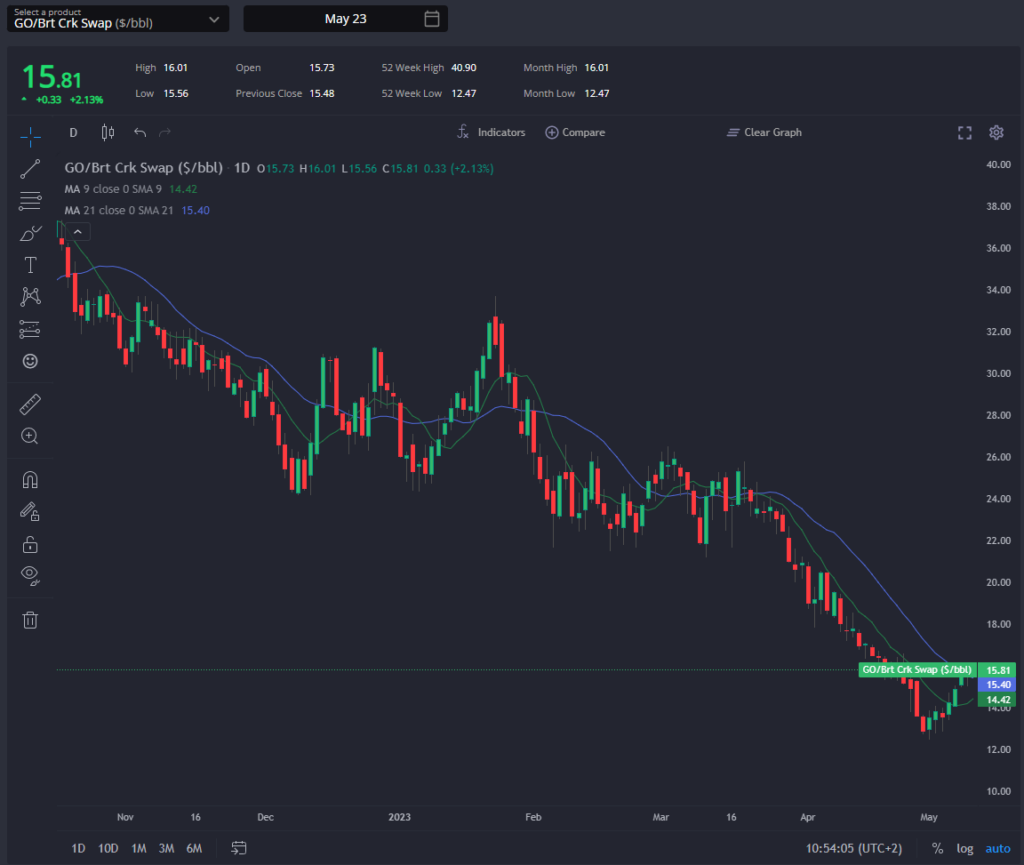

Diesel cracks rally on the back of crude selling

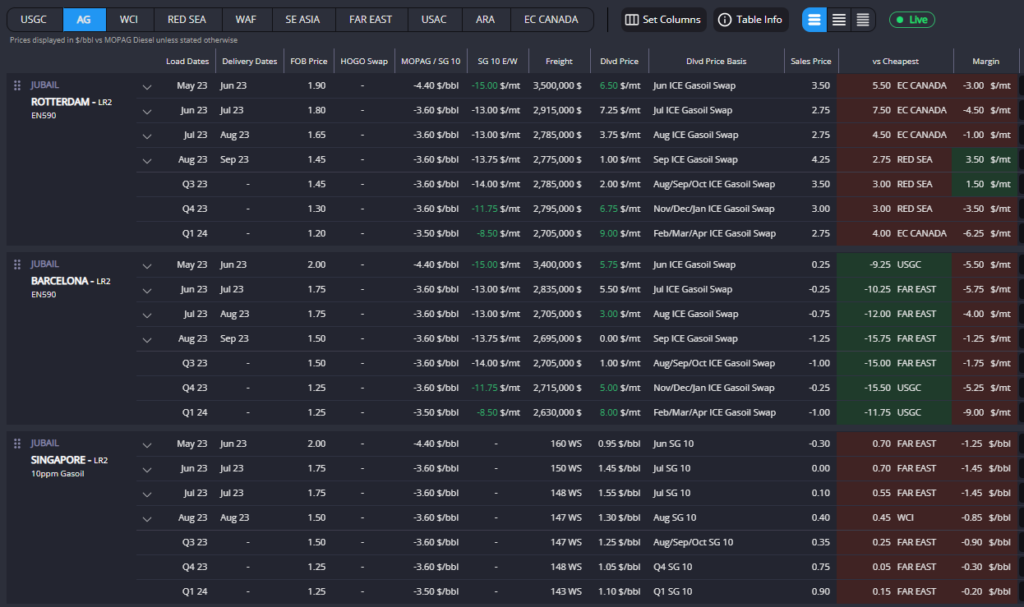

The Red Sea has returned as the primary resupply point for ARA and the MED, even with slightly rising FOB premia, if we discount the volumetrically insignificant EC Canada arb.

The drop in LR2 AG/Red Sea freight rates to Europe and Singapore to their lowest levels in over a year has been the main factor.

Arbs to Europe have been closed for over a month, causing a downward effect on AG/WCI/Red Sea regional freight prices.

This had manifested in recent weeks as AG/WCI/Red Sea regional freight LR2 fixtures having been fixed with both East and West options.

Our shipbroker contacts suggest that AG freight will continue to soften the longer this quiet arb spell persists. The AG/Red Sea/WCI arbs had faced competition from the USGC into Europe of late but increasing USGC diffs on the back of supportive LatAm demand have worked to close this arb.

Oil broker contacts note a big gasoil pull from Europe to WAF this past week, reflected in the currently rising WAF sales prices.

Current contango conditions and cheap freight make floating offshore Lome an attractive proposition, lending some relief to European gasoil prices.

The arb opening from Singapore to WAF on VLCC, helped by Singapore FOB prices falling to their lowest level this year, supports this view, with the Maran Danae, as noted last week currently loading to perform this voyage.

The recent rally in gasoil cracks, which have risen for the first time since early March, should not be expected to continue, given the downturn in European demand due to current recessionary problems, and ARA distillate stocks having risen this week at their fastest rate since before the Russian sanctions, both of these factors represented in the low position of the ARA diesel barge diff.

As a result, Middle Eastern arbs should be expected to firmly turn once more to Asia in the coming weeks, resulting in a further narrowing of E/W. The E/W live curve and Sparta freight tool will be the key to monitoring this change.

The first point of diesel supply into Brazil remains the USGC, largely on the back of the USGC MR freight market weakness.

Here, however, it is important to mention Russian diesel barrels are rumoured to have made up more than 50% of Brazilian diesel imports in April.

With Brazil currently requiring 700KT of diesel imports per month, implied from demand minus production, this still leaves 300-350KT (8-10 MRs) of diesel demand to be filled, in large part, from the USGC, and the Middle East/WCI.

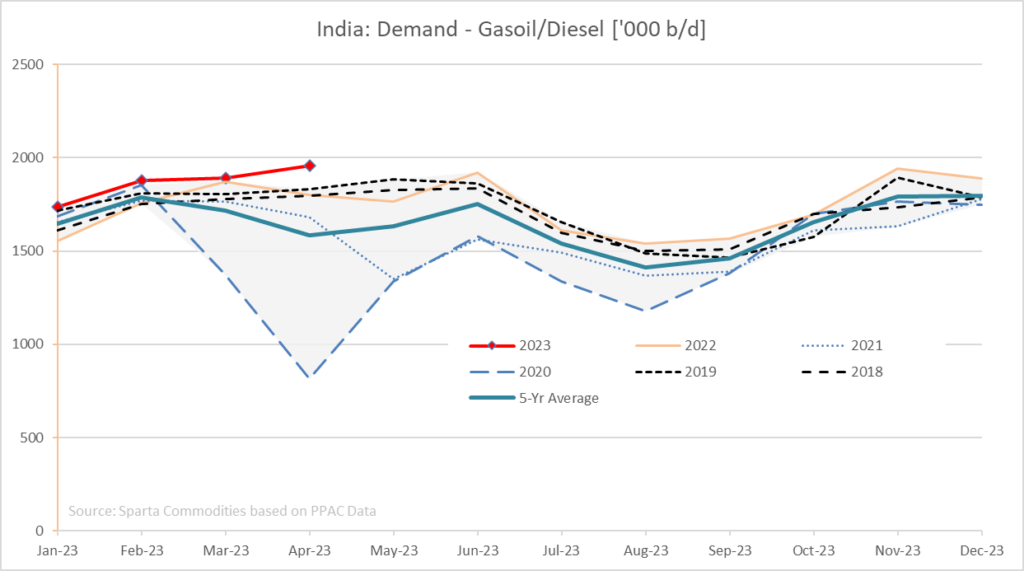

Argentina’s first point of supply, on the other hand, is the AG due to AG freight, now at close to their lowest level this year, and falling AG FOB prices, which are now at parity with WCI due to April’s Indian diesel demand surging to record levels and record Russian diesel arrivals in April.

The ARA diesel barge diff has fallen so much that movements from ARA to Argentina have become desirable also, with MR Torm Eric currently loading to perform this route.

This should result in further pressure on USGC diffs and HO spreads if USCG diesel is going to effectively compete with AG and ARA into Argentina.

In the WCSAM region, USGC diffs may be rising, but cheap USGC MR freight combined with strength in the North Asia MR freight market have resulted in Far-East and USGC diesel landing even into WSCAM. Far East MR Freight to WSCAM is at its highest level since early February 2023.

Despite US diesel stocks being close to their 5-year minimum currently, with competition into its typical LatAm outlets, and US diesel demand currently flagging, the recent increase in USGC diesel diffs and the resultant recent rally in HO cracks is not expected to continue.

One caveat being that David Thwaite, our in-house Freight Commodity Owner, sees further downside to USGC MR freight, stating that “the USGC is looking poor again …MR vessels are ballasting from the USAC to the USGC rather than heading back to NWE as now Europe looks pretty bad in terms of earnings. There was a vessel on subs for TA at WS90, but this is looking to return to dry dock so may not be reflective just yet.”

The steep decline in diesel sales prices in Singapore to their lowest level this year has resulted in the closure of all arbs into the region, with the previously mentioned strength in North Asian MR freight compounding the issue.

Additionally, AG/WCI/Red Sea diesel arbs are pointing back to Europe.

Chinese gasoil exports in May are expected to be subdued compared to April due to currently raised Chinese gasoil demand.

The slightly unusual current import of diesel and MGO into Zhoushan and Hong Kong, China, on board the MR Yasa Orion from Ulsan, South Korea is also an indication of the rising domestic demand for gasoil in China.

Our in-house Senior Pricing Analyst Thomas Cho has the following to say “South Korean gasoil often goes to China as MGO and is stored in bonded warehouses, according to traders who have noticed the trend, and is a sign of rising domestic Chinese demand for gasoil.

Traders have noted that Sinochem operates only 1 refinery in China, the 301 kb/d refinery in Quanzhou, and they have a special approval to import a small amount of ULSD to meet domestic demand in contrast to the other state oil companies like Sinopec and PetroChina.

For January to March 2023, the total import quantity of diesel into China was 563MT, according to the latest data from the Chinese customs.”

Chinese and Indian diesel demand surging combined with Singapore’s distillate stocks currently declining in comparison to those rising in ARA, suggest there may be some relative strength in Singapore to be manifested via cracks and spreads over the coming weeks.

With Asian strength appearing to currently be outweighing European diesel, things in the short term would seem to point to arbs turning back to Asia over the short to medium term.

However, the situation is fluid with neither demand centre showing particularly strong signs of demand, and we instead see something of a race to the bottom to avoid receiving surplus barrels, generating some volatility in the E/W in the medium term. This all needs to be monitored closely through the E/W via our arb and live curves dashboards.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com