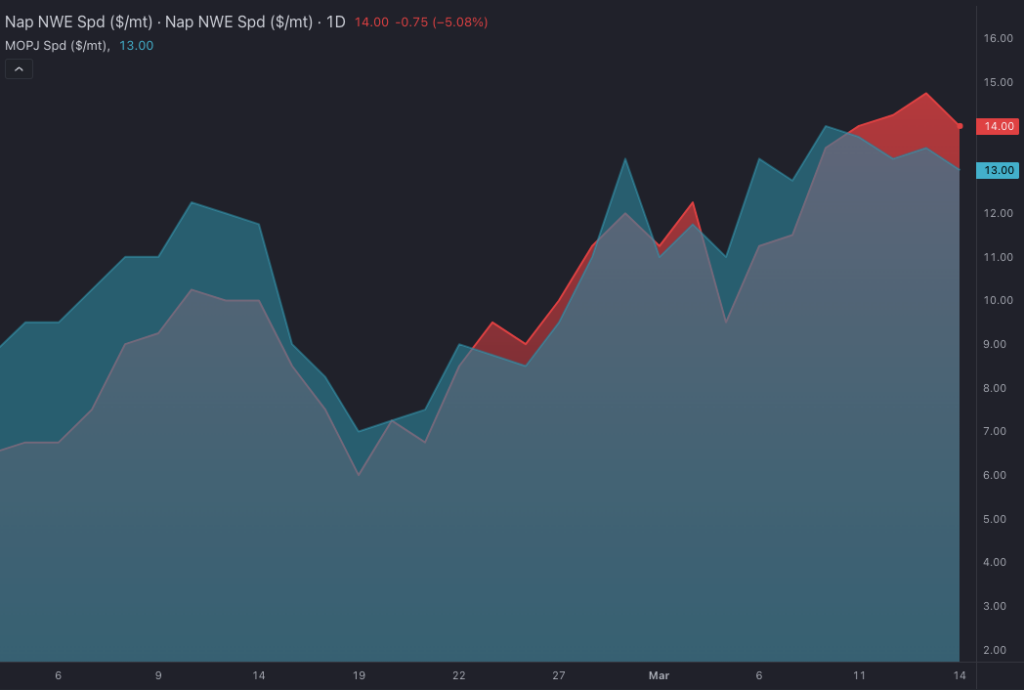

Backwardation continues to exert pressure in a European market that is displaying increasing blending margins

The European market continues its upward trajectory, after halting the E/W decline and increasing premiums in Asia, which improves the economics of arbitrage.

Additionally, a shipment from Skikda has been finalised for arrival in the second half of April. The European backwardation maintains its ascent, and the E/W box is trading again at negative values.

The increases in the European crack spread have placed it at the highest levels of the year, despite Brent crude breaking through the $82/bbl resistance level. This reflects the current bullish momentum in naphtha.

With the petrochemical demand covered for the remainder of the month, the focus of the European market’s strength is shifting more towards short-term blending demand.

Despite the arbitrages from the Med remaining closed, the recent rise in gas-nap and the price correction of aromatic blending components have opened a Trans-Atlantic arbitrage in the gasoline market, and the blending margin for E10 in Europe is now well established in positive territory.

A new round of drone attacks on Russian refineries has also driven up prices. The attacks in Novgorod and Ryazan worsen the outlook for Russian exports heading East, which could manifest as Asia’s need to stimulate arbitrage from the West with increases in East/West and physical prices.

The Brazilian market is also emerging as a short-term alternative to European exports, with barrels from the Mediterranean positioned as the best current option.

This is confirmed by a shipment from Skikda arriving on Brazilian shores in the first half of April. This was a major driver for the February price spike in Europe and will be a market to watch closely, as further exports could keep the Mediterranean tighter.

This could be further compounded should April’s petrochemical demand from Northwest Europe remains high for steam crackers.

In the freight market, declines in TC5 are reflected in the arbitrage to Asia, while TC5 remains strong with significant backwardation. Again, this is another signal of strong European petrochemical and blending demand.

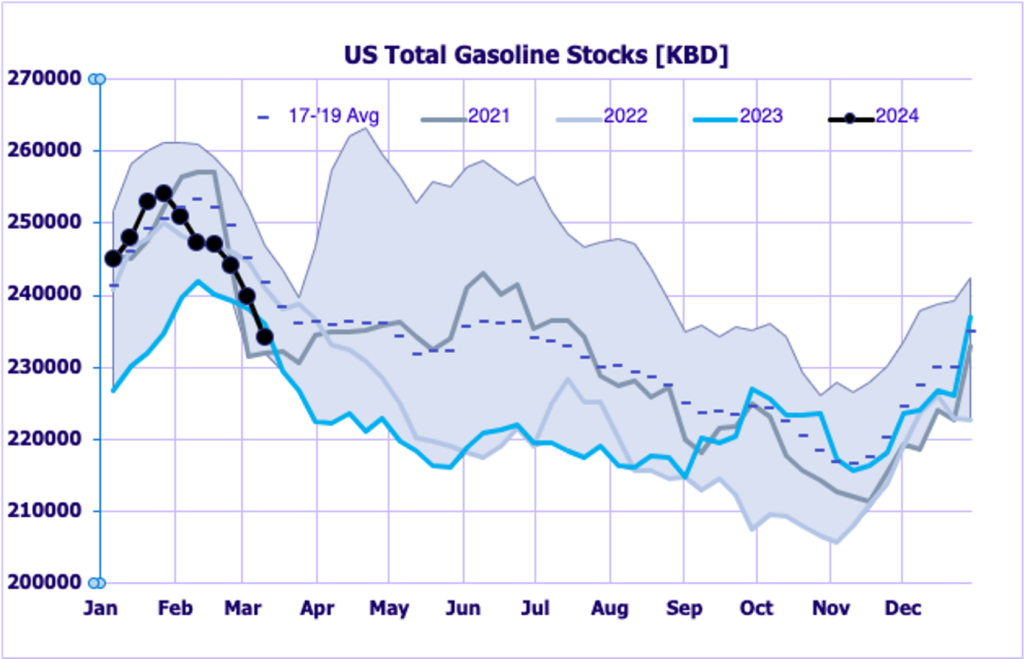

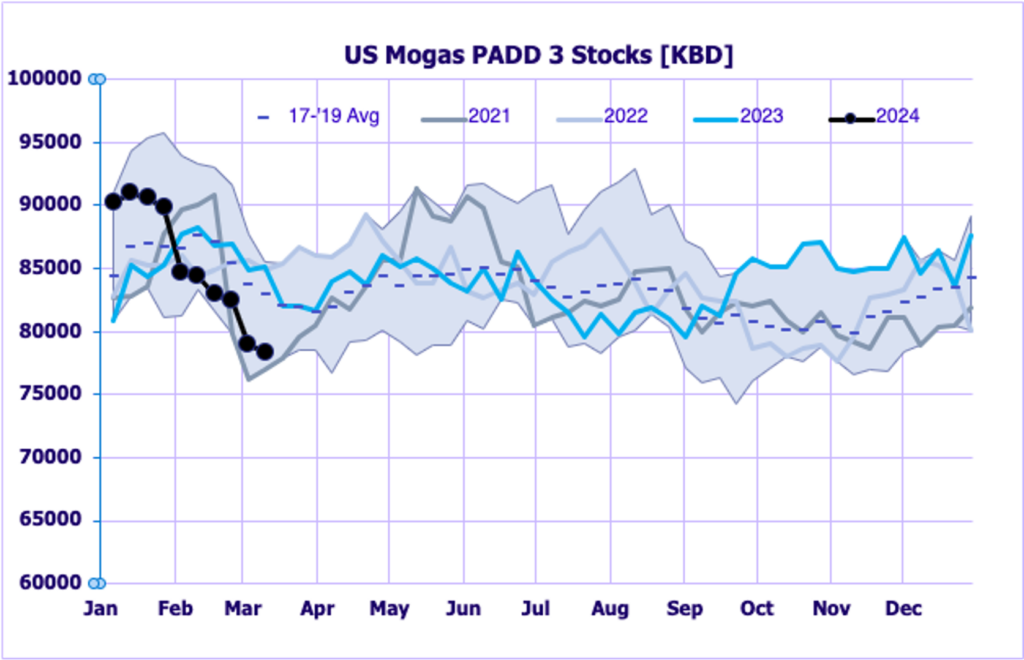

On the US side, naphtha prices in NYH continue to rise in response to the sustained drop in inventories.

This week, a very bullish report from the EIA shows further drops in gasoline inventories in PADD3, keeping the light ends complex bullish with RBOB and naphthas particularly becoming more expensive, especially on the Atlantic coast.

However, USGC runs also continue to rise as we approach the end of the refinery turnaround season.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com