Atlantic Basin, especially Europe, appears bullish diesel whilst Asia Pacific bearish, also for jet

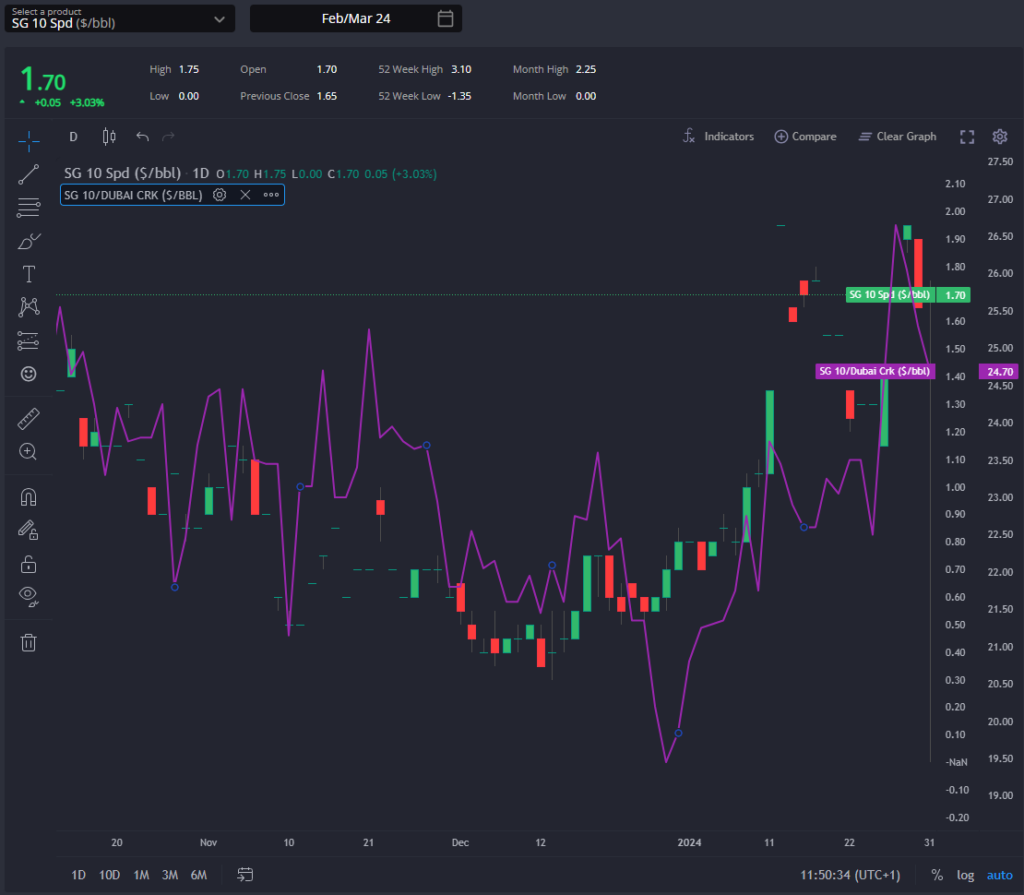

In what has been quite a dramatic shift, South Korean diesel arbs have staged a recovery, surpassing AG arbs and contending with those from WCI as the most cost-effective channels into Singapore.

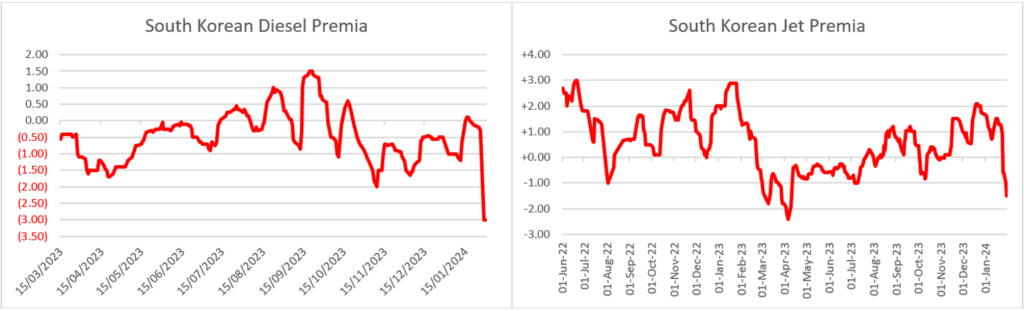

This owes much to the decrease in South Korean diesel (and jet) premia over the past week, as these barrels struggle to secure homes amidst soaring North Asian freight rates — a narrative mirrored in current Chinese premia.

Despite this, the title of the most cost-effective arb into Singapore is still held by WCI, largely owing to the previously mentioned high North Asian freight rates.

Intriguingly, adjusting arbitrage calculations given the recent disruptions in the Red Sea, it suggests that several AG and WCI arbitrage routes now favour an eastward trajectory.

As the prospect of increased arrivals into Singapore looms from AG, WCI, and North Asia, the recent increases in Singapore diesel cracks and spreads are poised for a correction in the coming weeks.

Increasingly warmer weather conditions in Japan, coupled with the anticipation of substantial Chinese jet exports in February, suggests that the Singapore regrade is likely to maintain its current width, if not widen further.

Red Sea routes have emerged as the best arbs into Europe, with industry insiders revealing that Aramco continues to navigate through the Suez Canal from Yanbu/Red Sea.

However, this advantage comes with a caveat, as charterers undertaking this route bear additional costs due to heightened insurance premiums.

Amidst this, the relatively small Eastern Canada (EC) arbs, along with AG and WCI routes, follow as the most favourable paths into Europe.

Yet, a significant caveat looms large again, as the inclusion of extra freight costs for circumnavigating the Cape to Europe renders these arbs, as mentioned earlier, impractical and orients them eastward.

The near absence of WCI diesel cargoes reaching Europe in 2024 underscores this.

Complicating the picture are critical maintenance issues plaguing several European refineries, including major players like Shell and BP in Rotterdam, Exxon and Total in Antwerp, and Leuna, among others, as the region approaches or is already immersed in maintenance season.

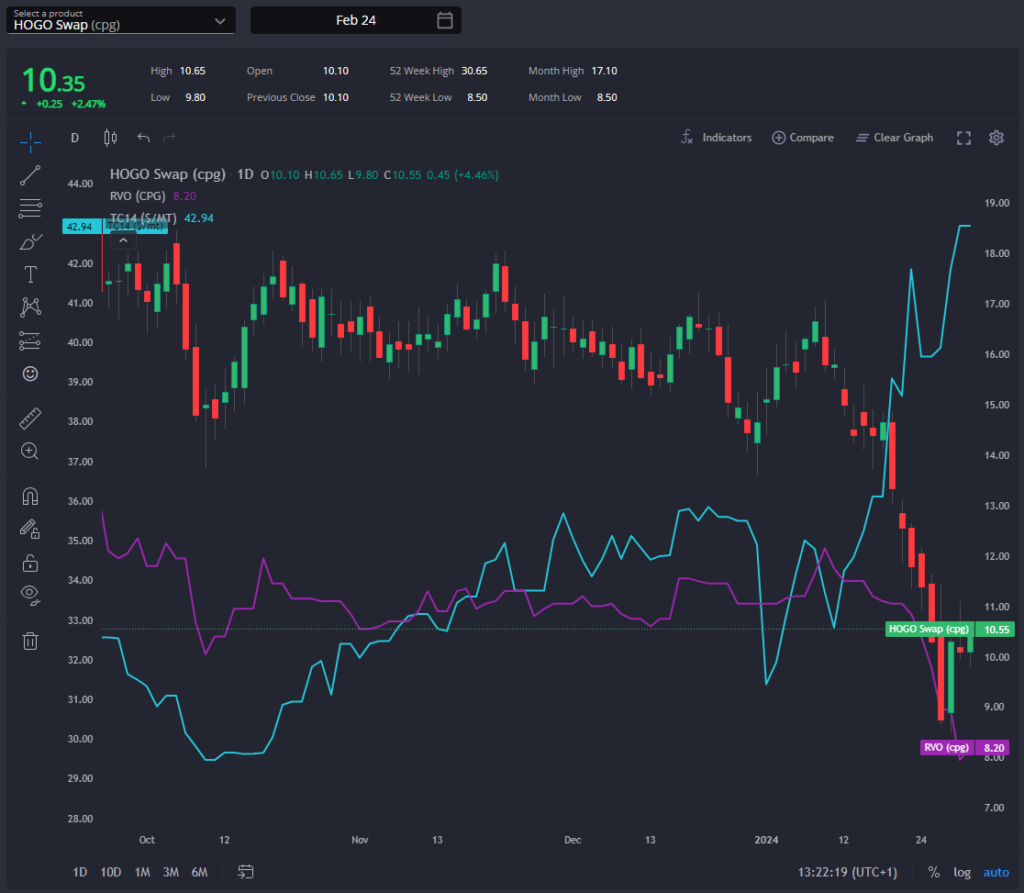

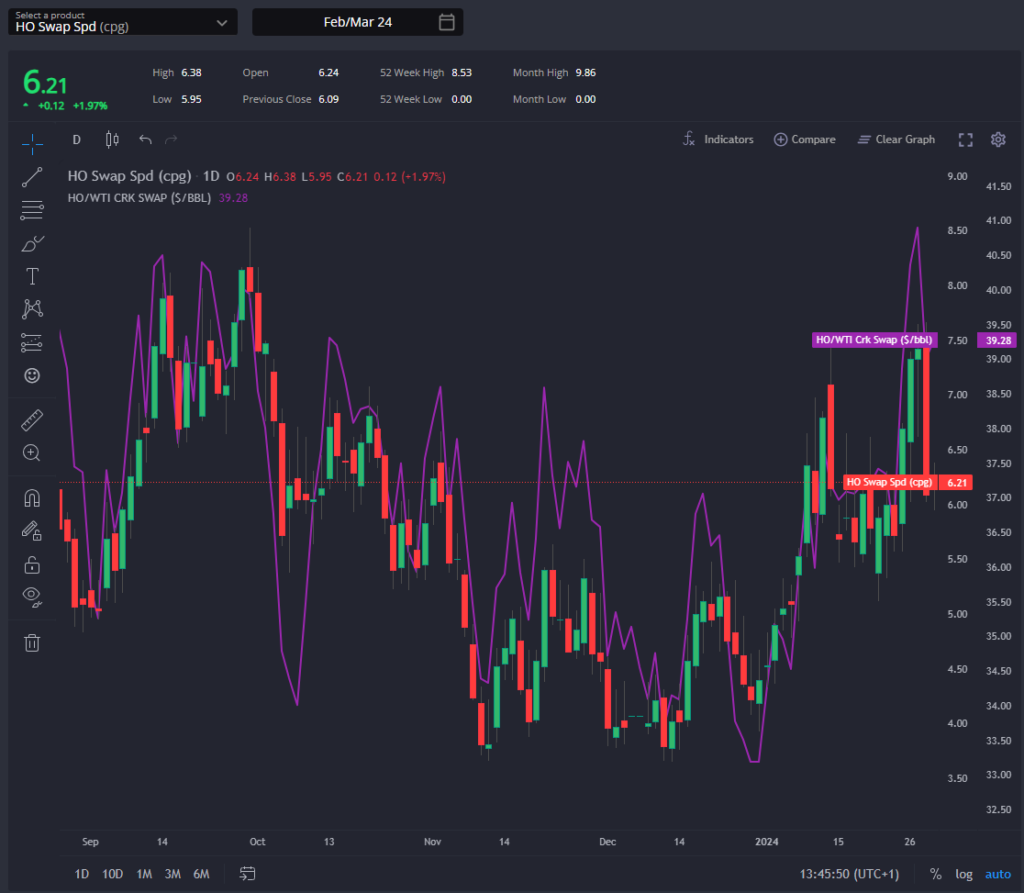

Foreseeably, this sets the stage for a narrowing of the HOGO, countering the selloff on RINS and elevated TC14 freight rates.

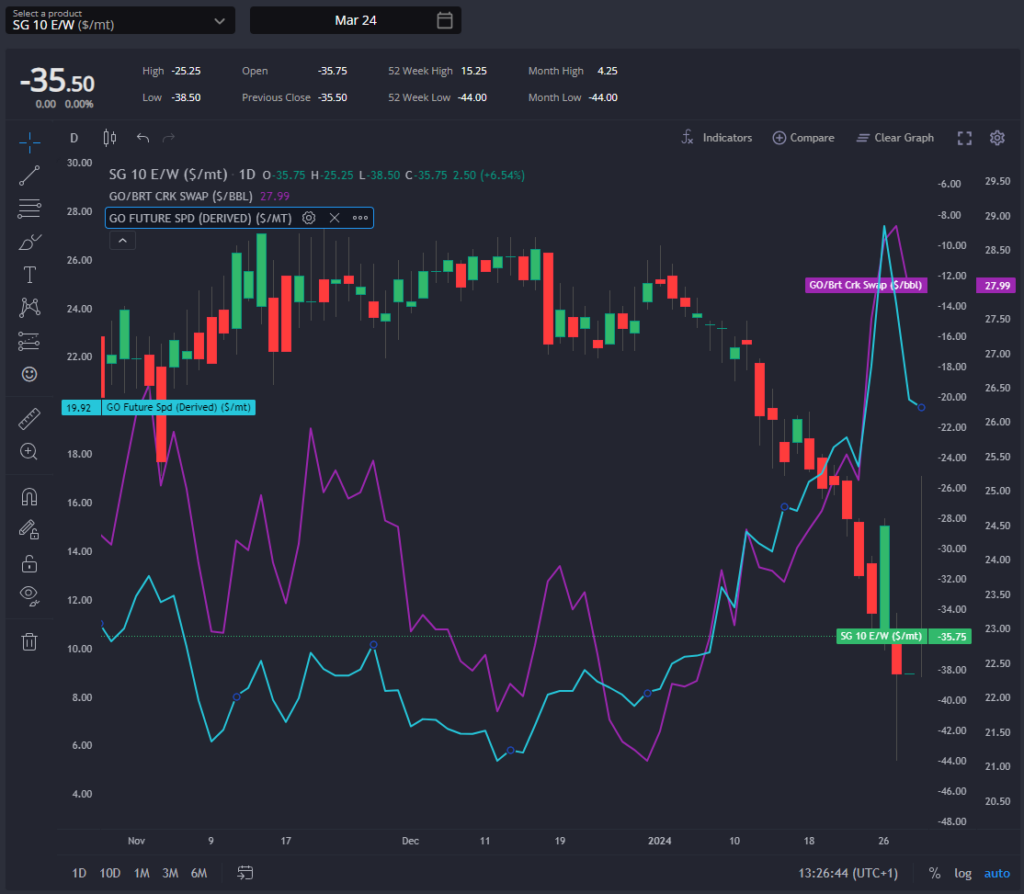

Simultaneously, the GO E/W spread is poised to widen even further, incentivising cargoes to circumvent the Cape and meet the typically increasing European demand anticipated as we move towards March each year.

In a similar manner, we should expect the recent increasing trend in both ICE GO cracks and spreads, despite the slight decrease of the past couple of days, to continue into at least the medium term.

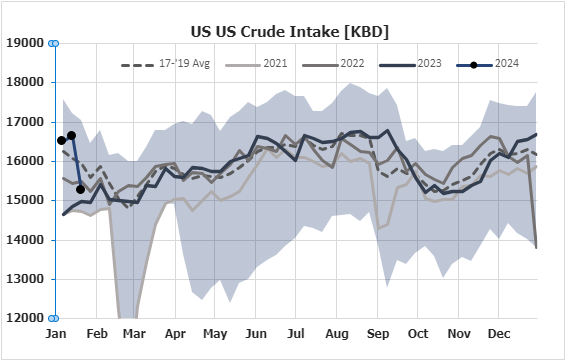

The latest U.S. runs data, as revealed in last week’s update by the EIA, underwent a marked correction, contributing significantly to the recent selloff in RINS.

Adding to this, December witnessed an unusually large number in RINS generation, particularly for D4.

As a consequence of the RINS story and TC14 freights, the USGC diesel arbitrage to Europe, as previously discussed, remains closed, yet the pull from Europe should be expected to prompt the movement of cargoes that find themselves out of the money.

The USGC emerges this week as the most cost-effective arb, or challenging, into its traditional markets in Latin America, fuelled in part by high freight rates in Asia.

However, it is important to consider here the anticipation of substantial exports from Russia and the Baltics in February, the recent attacks on Ust-Luga and Tuapse notwithstanding.

Also, the recent decrease in South Korean premia poses a challenge for arbitrages into the U.S. West Coast and West Coast South America, symbolized above by Quintero Bay, Chile.

With a dual pull from both Latin America and Europe exerting influence on the U.S. amid a decline in domestic crude runs, the trend of increasing HO spreads and cracks observed in recent weeks is anticipated to persist.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com