Asian market gains momentum for Q2 on surging petrochemical demand; European blending challenges in lower gas-nap and rising aromatic components

Last week witnessed a resurgence in the Asian market with its crack and spread outperforming the European market, which had recently led the market in gains due to increased petrochemical production and, consequently, naphtha demand in February.

It has also been reflected in an accumulated increase of over $5/mt in the E/W since the beginning of the week, with the E/W trading in positive territory after several sessions ofthe front of the time spread curve stronger in Europe.

The stimulus in Asian demand is driven by an improvement in cracker demand Recent gains in ethylene and butadiene prices have boosted margins and the demand for both naphtha and LPG, raising utilisation rates in South Korean crackers.

Crackers from Taiwan and South Korea exiting turnaround season at the end of February and Chinese runs rising after Lunar New Year and ahead of the May Labour Day are leading the demand increase.

We expect this trend to persist, and higher demand could push naphtha and LPG prices higher for the beginning of Q2.

We see the reflection of this trend in the E/W, as Asia attempts to improve the economics of arbitrage from Europe, which is currently closed for April deliveries.

However, further declines in European FOB prices due to deteriorating blending margins and a prolonged rise in E/W and physical premiums in Asia could stimulate a higher level of arbitrage if the trend persists.

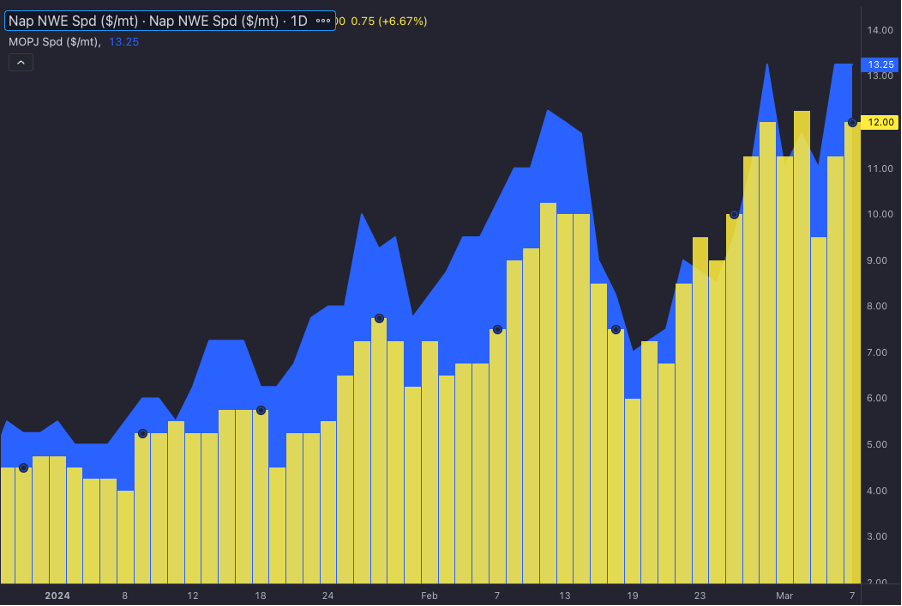

Regarding physical premiums, the Northern European OSN has corrected by $4/mt during the week, and premiums for blending grades have also decreased due to the fall in Gas-nap, which has significantly broken the $200/mt resistance level.

This has disincentivised naphtha blending in Europe in the short term, closing the margin for E10 in March.

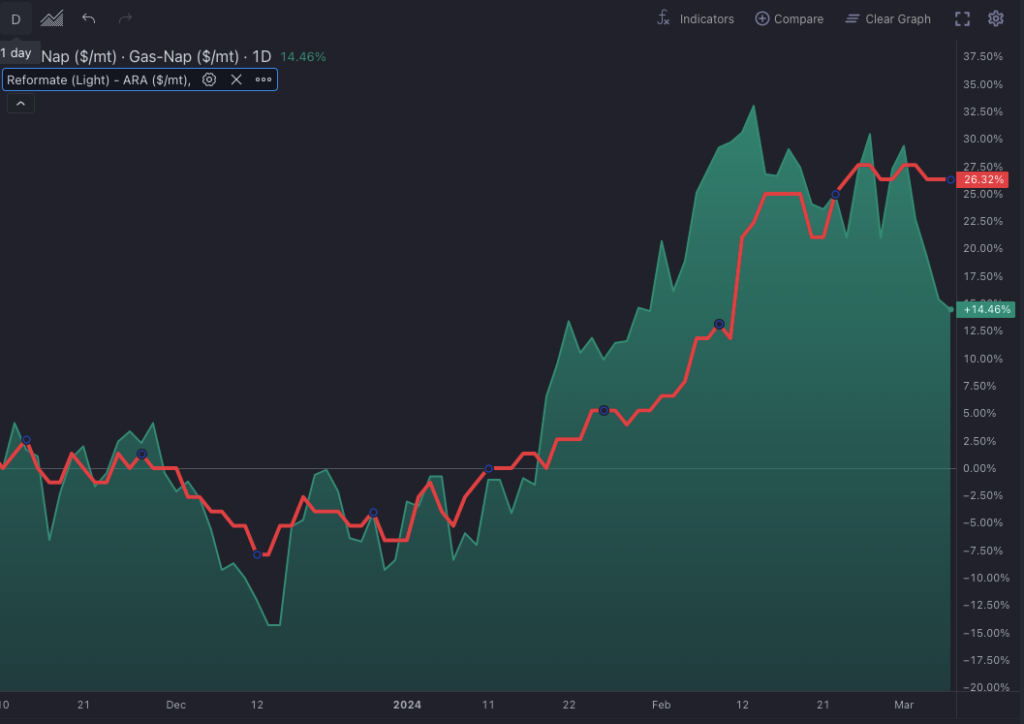

Gas-nap is trending lower, but the main factor currently weakening blending margins, especially in Europe, is the increase in the cost of aromatic products used in blending.

This factor could intensify with the switch to summer gasoline specifications.

The origins of the scarcity of aromatics can be traced back to February 2023 when European refineries shifted their processing to lighter crudes, replacing the heavier and more sour grades from Russia due to sanctions.

This strategic change has led to historically high prices for Gas-nap, robust physical premiums for aromatic components such as reformate or alkylate, and substantial premiums for heavy naphthas over paraffinic ones, especially for petrochemical applications.

The dynamics intensify during the summer gasoline season, accentuating the demand for high-octane components due to lower Reid vapor pressure (RVP) limits.

Despite recent corrections, we anticipate that the market will continue to experience strong aromatic prices and elevated Gas-nap levels as the underlying factors persistently influence the industry.

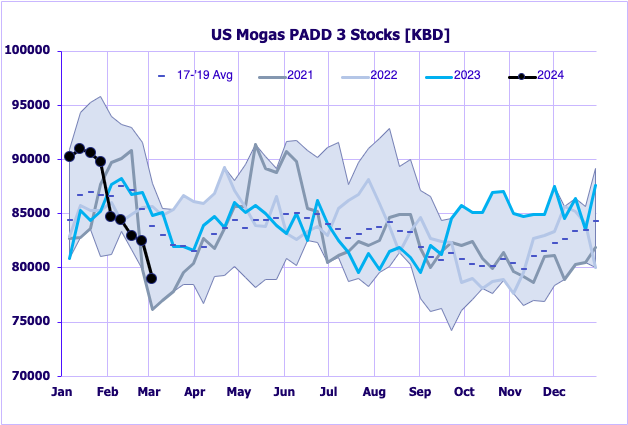

On the US side, the persistent decline in stocks and low operation rates of refineries (EIA) suggest a floor of support for RBOB, translating into similar support for naphtha prices as a blending component.

On the US Gulf Coast, inventories have decreased significantly amid heavy regional refinery turnarounds, while retail gasoline prices increased in all regions. The RBOB/C5 spread has fallen from recent highs and broken the 100 cpg barrier.

Should refineries not exit their works as expected, a prolonged decline in stocks would stimulate demand for Gulf Coast naphtha, exerting upward pressure on the prices of light and heavy naphtha.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com