Asia softens as EBOB spreads poised to rip higher in the coming weeks

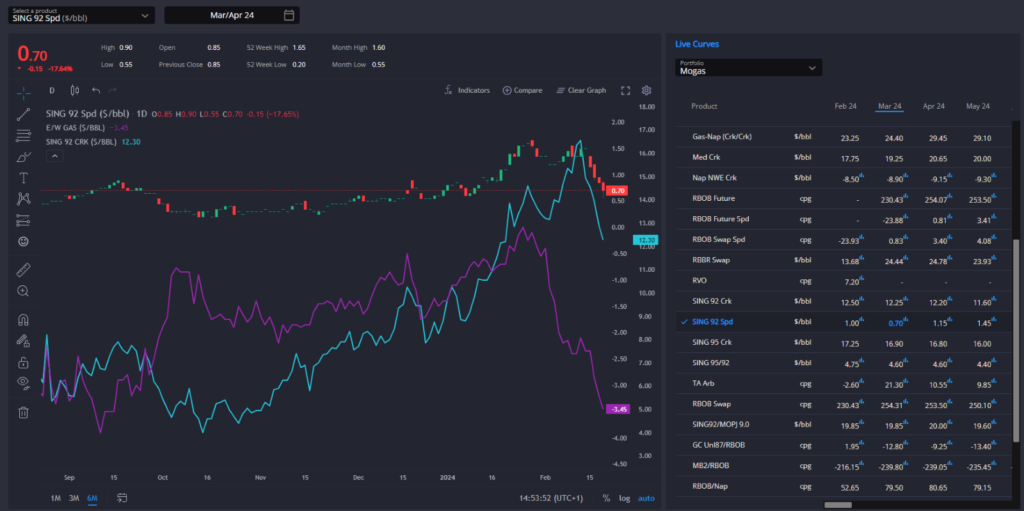

In Asia, Sing92 backwardation is narrowing, with cracks and E/W also under pressure. Refiners are returning to the market with cargoes which are running up against reduced appetite as the EoS market lengthens again, although price spreads to the Atlantic Basin should provide a floor soon enough.

There could be additional room to the downside in the short-term as this filters through, but the floor should not be far away given the impact the shift so far has already had on arb economics.

Arbs into EoS destinations which faced intense competition from Atlantic Basin barrels until recently are now pointing definitively at Sing or AG for their resupply, in a turnaround which should be a positive for the Sing92 complex as well as helping to sustain recent strength in EoS product tanker markets.

The most indicative shift has been the return of opportunities to place barrels out of Asia into the West Coast of the Americas (Mexico, for example), and this trans-pacific route should now see an uptick in flows once more.

Both the E/W and TA Arb have moved in recent weeks to accommodate this switch around in arb flows, and combined with prompt tightness in the USGC gasoline market thanks to reduced crude intake there, we may now see this arb in place through into Q2 and beyond.

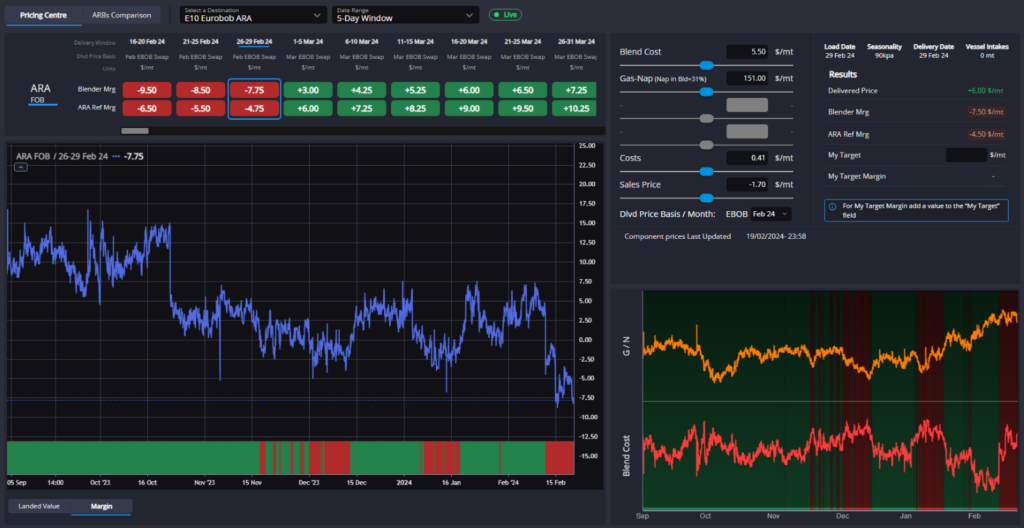

In Europe, the rise in EBOB cracks in March has been enough to open the E10 blend margins wide, but come Q2 the picture turns around and pricing remains a long way off this blend margin being open.

This feeds into an overall picture that prompt tightness has not yet fully made its way through the pricing chain into Q2 cracks and spreads, which are already near their historic highs but could have further upside in them as we move through the rest of Q1.

Whilst the April EBOB crack is already at its seasonal record high over the last nine years at least, the April/May spread does not yet match this signal.

Assuming that physical gasoline tightness in the Atlantic Basin can be maintained through into Q2 (which looks likely given low US crude intake and the fact that the RBOB arb may well open up into Q2, providing an additional outlet for/drain on ARA supplies), the kind of sharp uptick in the April/May EBOB spread that was seen just last year (2nd chart below) looks very much on the cards again this year.

Last year’s incredible rise in backwardation as we reached March was in large part driven by the imposition of the most important Russian clean products sanctions.

However, with those underlying dynamics still present in the market (lack of Russian naphtha and VGO available to the European system) – as well as reduced Russian refining activity now potentially going forward following Ukrainian drone attacks – the market appear ripe to see EBOB spreads rip higher once more.

Finally, strength in Europe is being mirrored (and in part driven by) the continued uptick in the US gasoline market, led by competent premiums in the USGC on the back of refinery and unit outages both planned and unplanned.

For now the Atlantic Basin remains split between ARA and USGC origins largely into their typical ‘home’ markets.

With expectations that US crude intake may remain diminished for a little while longer, there seems little chance that the USGC will need to price more aggressively to capture additional export markets in the short term, with further narrowing (inversion) of the TA Arb spread certainly possible through the rest of the quarter.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com