Asia Pacific gasoil is weak, ME arbs point West, some surprising strength in the US whilst jet shows initials sign of recovery

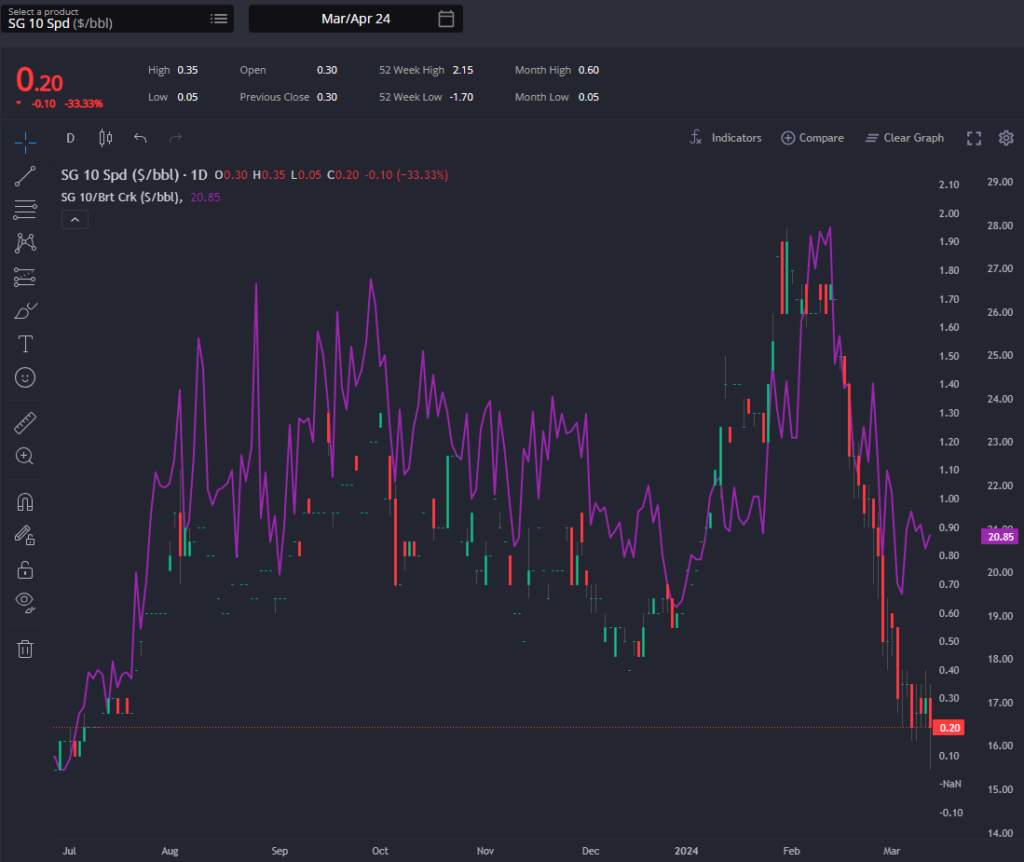

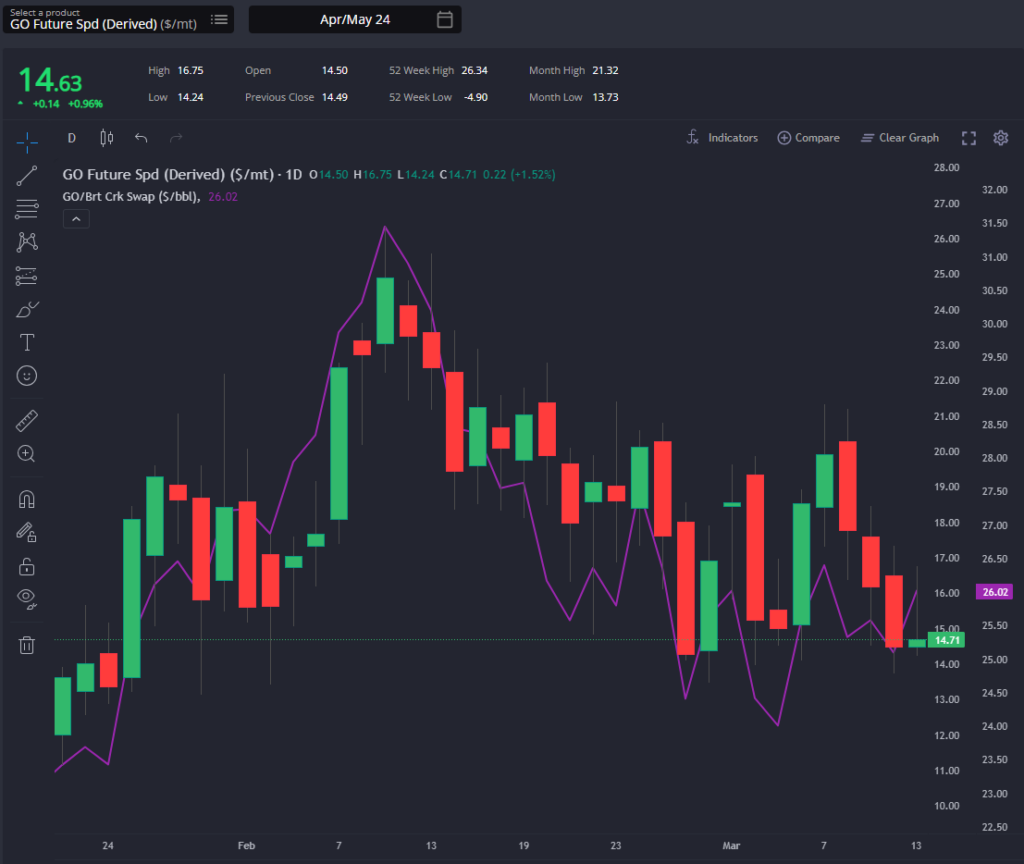

Singapore’s diesel cracks and spreads have shown a consistent downward trajectory since early February, although they stabilised somewhat this week.

The decline in Singapore’s gasoil market is attributed to substantial arrivals, particularly from China and South Korea.

March is projected to witness a surge in China-origin diesel exports to Singapore, reaching a level not seen in over a year, whilst South Korea-origin diesel exports are expected to nearly hit a 2.5-year high.

Diesel; Singapore. (Sparta Global ARBs – Pricing Centre)

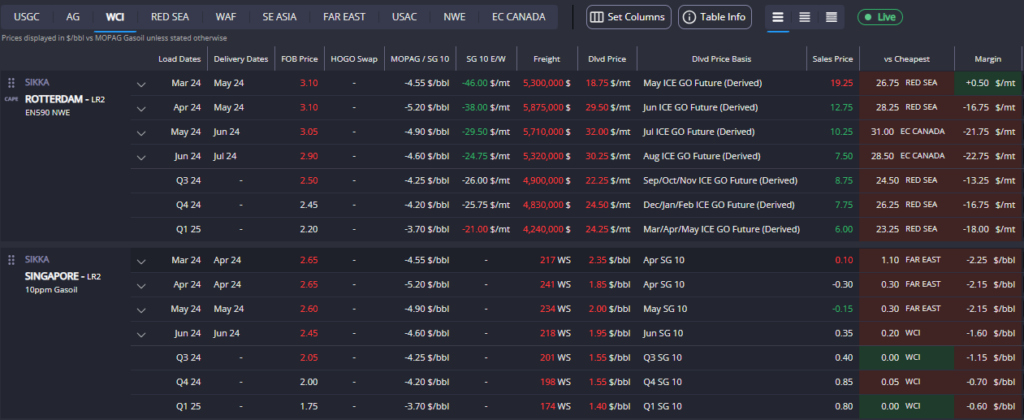

With South Korean arbs now more favourable than those from the Middle East into Singapore, aided by their reduced FOB premia, March Singapore diesel spreads have weakened considerably, and are not far from a contango structure.

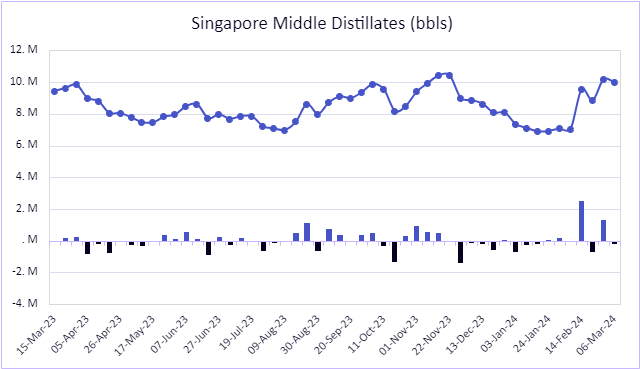

Concurrently, Singapore’s middle distillate stocks have surged to their highest level since November 2023, with a probable expansion in the medium term and signalling a continued weakness in the Asia Pacific gasoil market.

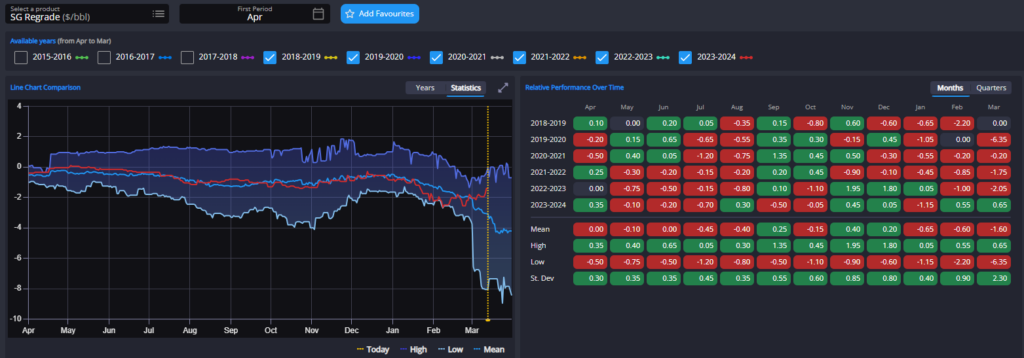

Moreover, Singapore’s regrade has surpassed its five-year seasonal average for the first time this year, resulting in the closure of all Asian jet arbs to Europe that necessitate rerouting around the Cape (except for South Korean arbs that can perhaps transit the Suez).

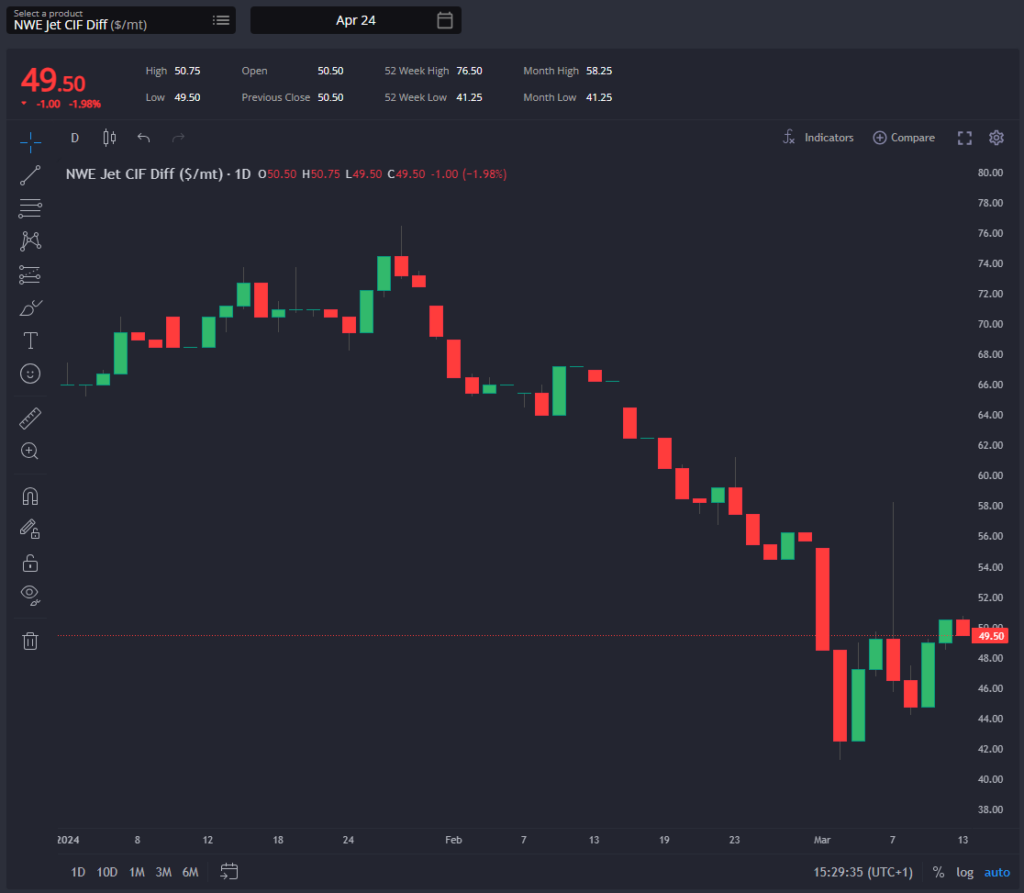

Consequently, the recent uptick in European jet differentials is anticipated to persist, bolstered by growing optimism regarding an increase in European jet demand by the end of April.

European diesel spreads have stabilised whilst diesel cracks exhibit a slight improvement this week.

The prolonged closure of the US diesel arb to Europe allied with ME diesel loaders directing some shipments East in recent weeks and Europe’s current peak refinery maintenance period, have contributed to this dynamic.

Consequently, the GO E/W continues to widen, with April’s spread reaching its widest seasonal position when data from 2022 is excluded.

March and April AG and WCI diesel loaders unmistakably favour the West, indicating a substantial influx of diesel supply to Europe via the Cape in the forthcoming months.

This is especially true as the Middle East starts to come out of turnaround season. With our Freight Commodity Owner, Michael Ryan, still reporting an even distribution of East and West options for Middle Eastern fixtures, Europe must continue to price up relative to Singapore, necessitating further widening of the GO E/W spread.

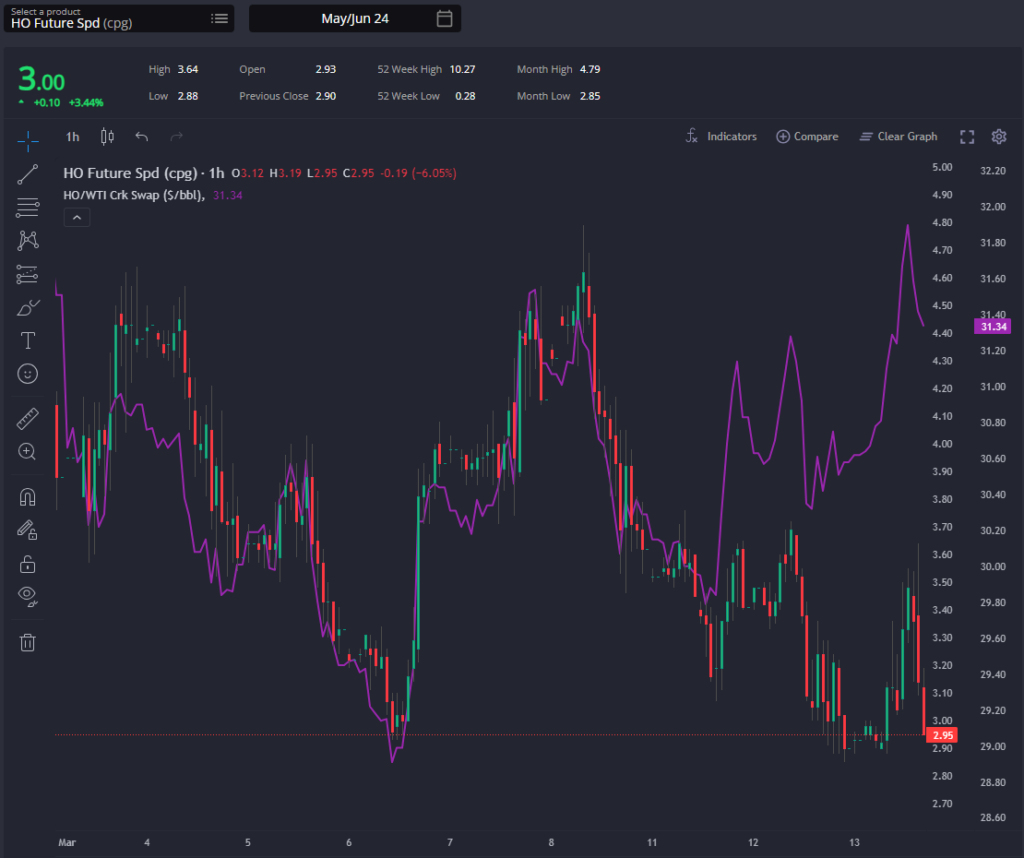

HO cracks and spreads have mirrored the trend in ICE GO, with spreads levelling off whilst cracks show gains over the past week.

Recent Ukrainian drone attacks on Russian refineries, coupled with generally decreased Russian diesel exports, may have bolstered the US market, particularly in competing for Latin American diesel demand.

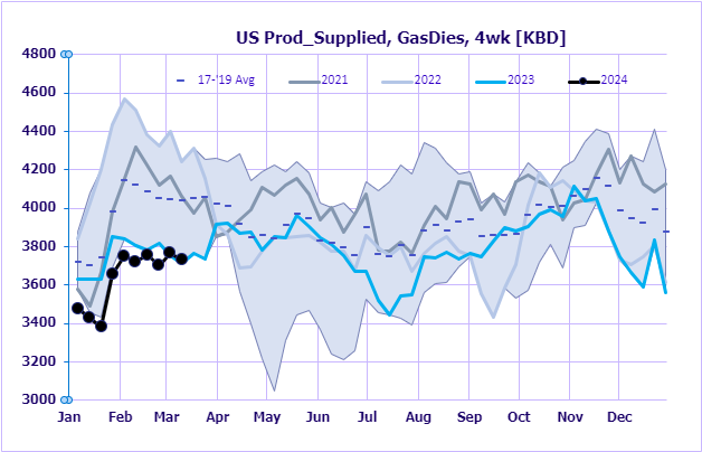

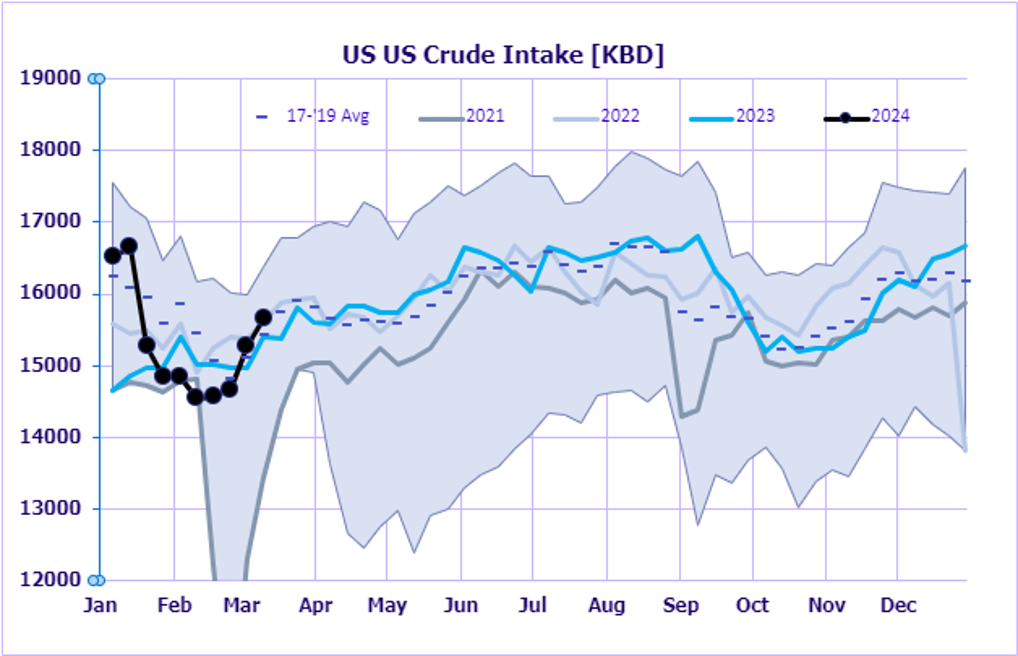

However, with large improvements in US crude runs, the persisting struggle in US diesel demand suggests a bearish outlook.

We expect the US diesel arb to Europe to move towards open in the coming weeks. Reflecting this bearish sentiment, US paper positions indicate a significant divestment in refined fuels, with investment managers selling off middle distillates, including a notable amount of US diesel this week.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com