April E/W gasoline to bottom out as Asian gasoil/gasoline short emerges; Q2 TA to widen as EBOB nears ceiling, RBOB bulls eye summer demand

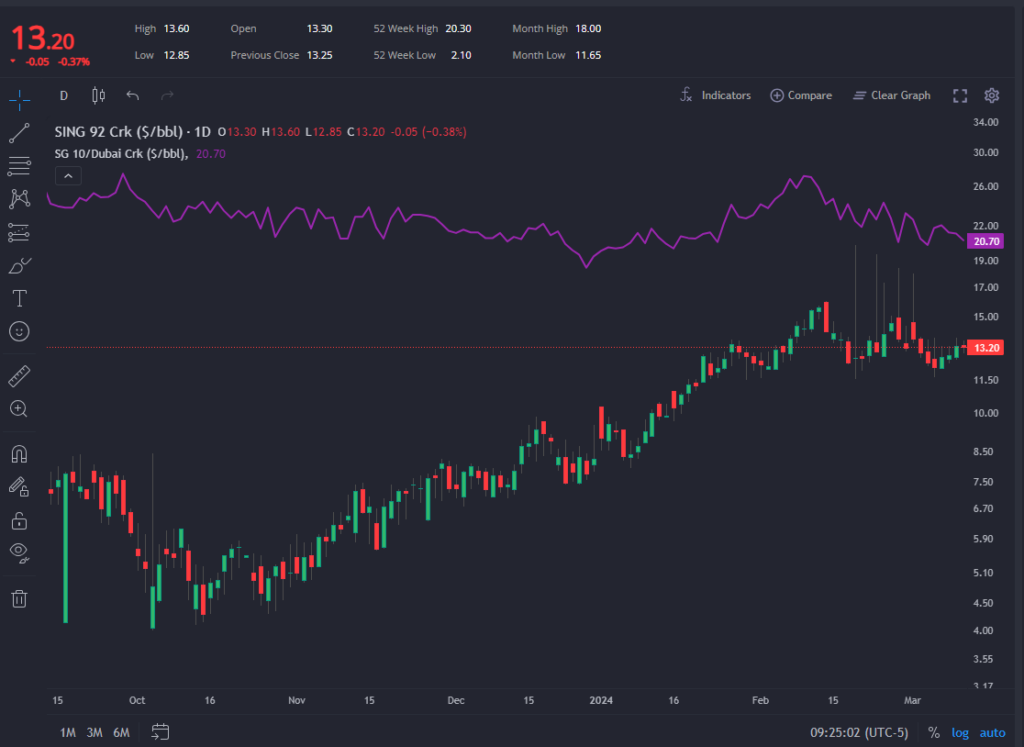

The April E/W appears to be bottoming out as Singapore barrels lose their competitiveness in Asia due to increasing Middle East availability.

East of Suez gasoline will therefore need to price itself back into the Atlantic Basin but—as the Sparta platform currently indicates—those markets are not yet signalling that possibility into Q2 at least.

As such, Asian gasoline cracks have been steadily strengthening through the summer even as a slightly heavier refinery maintenance season compared to year-ago levels looks set to wind down from May.

Meanwhile, a widow-maker trade is emerging given ample supplies of Chinese and South Korean diesel cargoes into the Singapore hub, combined with large arrivals from the Middle East and WCI.

Given recent indications of strong Chinese and Indian gasoline consumption from January-February flash data, the Asian gasoline/gasoil spread could be ripe for further narrowing this summer.

In the US, the switch to the pricier summer grade gasoline has given an already bulled-up RBOB complex an added boost.

Meanwhile, PADD 3 refineries are swiftly exiting a heavy round of seasonal maintenance and are likely to hit average utilisation rates by end-March.

With this expected increase in supply availability, Atlantic Basin arbs are looking more profitable for USGC-sourced cargoes from May delivery onward.

While this has buoyed summer RBOB swaps to above most historical moving averages, the question of a ceiling now comes into play, especially considering returning supply despite lower-than-average PADD 3 gasoline stocks.

Last week’s EIA statistics have given an early indication of robust product supplied in the US, although domestic market players are likely to wait on more solid direction from the next two weeks’ data releases.

Meanwhile, the upside for EBOB is likely to be limited given both returning Middle East and USGC refinery capacity and, between June and August, restarting Northwest European gasoline production.

As such, Q2 gas-nap looks to have already hit its highs and should narrow further during the quarter with ARA naphtha doing much of the heavy lifting there.

A dearth of Asian petrochemical imports, courtesy of the ongoing geopolitical tensions in the Red Sea, are resulting in European steam cracker operators running their units as much as 10-20% higher than year-ago levels.

This West of Suez naphtha bullishness can only be meaningfully countered by normalisation of petrochemical cargo movements.

That said, the ultimate impact is likely to be seen in the TA arb, which is already at historic lows and could be ripe for widening by mid-Q2.

As mentioned above, we do expect EBOB to give way and likely take on much of the heavy lifting to reopen the TA arb.

Whether US gasoline plays a part in those efforts are largely a function of the importance market players’ put on quickly replenishing PADD 3 stocks and bets on a banner US summer driving season.

Samantha Hartke, a veteran in commodity management, boasts substantial expertise in energy analysis and product management. In her role at Energy Aspects as Head of NGLs, she analysed global natural gas liquids markets. Previously, at PetroChem Wire, Samantha provided high-quality analysis of North American NGLs and olefins. Her expertise also extends to leading the commercial and operational aspects of IHS Chemical’s daily business information service.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com