A bearish sentiment is manifest; poor US diesel demand with increasing runs, all diesel arbs pointed at Europe, high North Asian diesel exports.

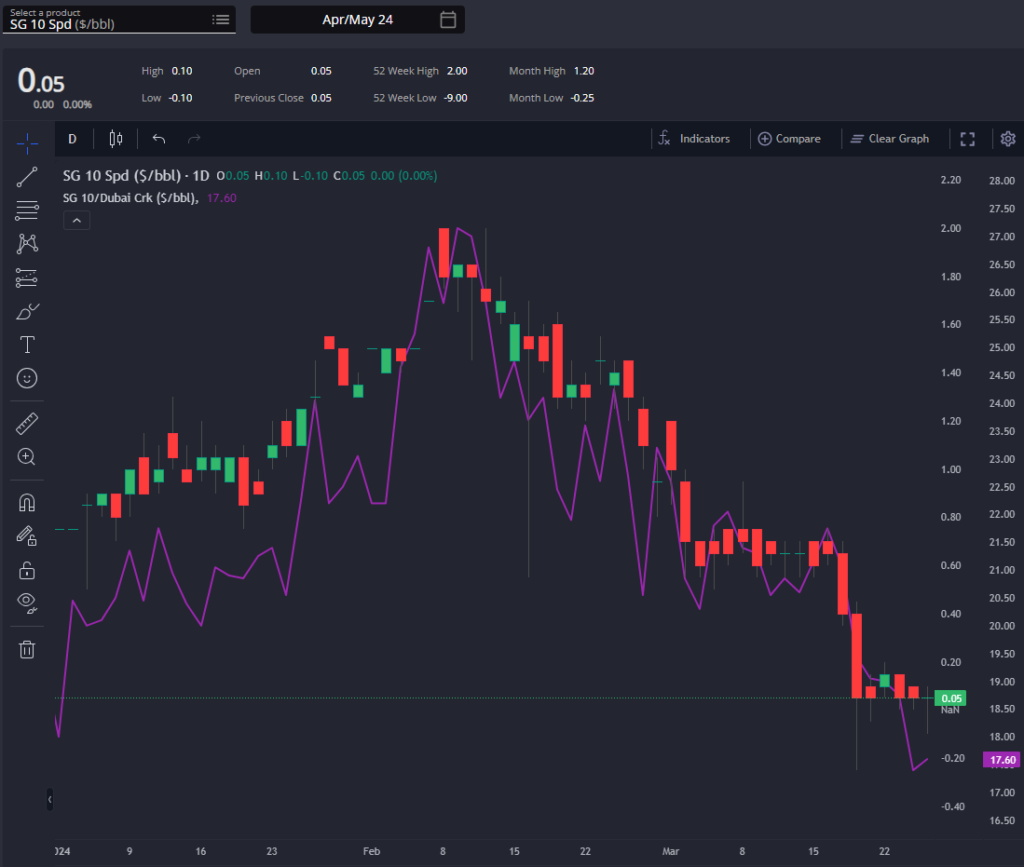

Singapore diesel cracks, spreads, and premia have sustained their downward trajectory since early February and are continuing the trend into this week. Of note are Singapore spreads that have edged even closer to contango, with April’s currently at +$0.05 /bbl.

This movement aligns with cracks, which have approached their five-year average for the first time since September 2023, registering at $17.60 /bbl for April.

Senior Pricing Analyst Thomas Cho’s insights highlight the significance of upcoming South Korean diesel tenders in April that are expected to exceed 5 million bbls, further compounded by sluggish regional diesel demand.

This prompts an imminent shift into contango for Singapore diesel, despite a forecasted slight reduction in Chinese diesel exports from March to April.

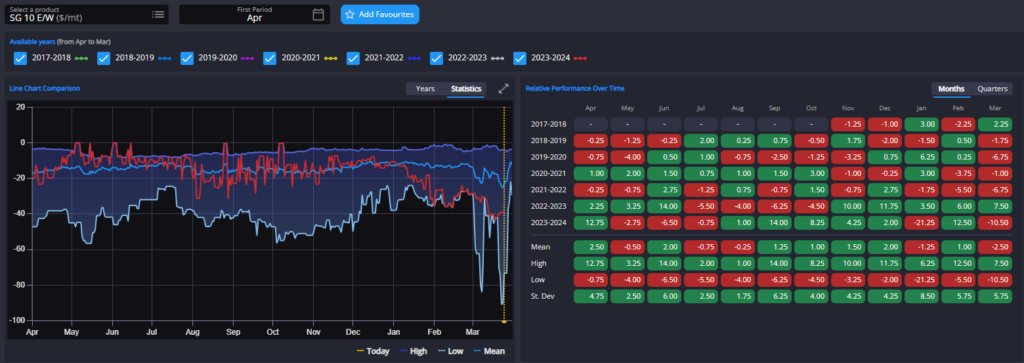

The GO E/W remains near its seasonal widest, the consequence of which is shown by our newly released “By Origin Dashboard” which shows a definitive westward trend for AG and WCI arbs, accentuated by recent drops in freight values observed by Freight Commodity Owner David Thwaite.

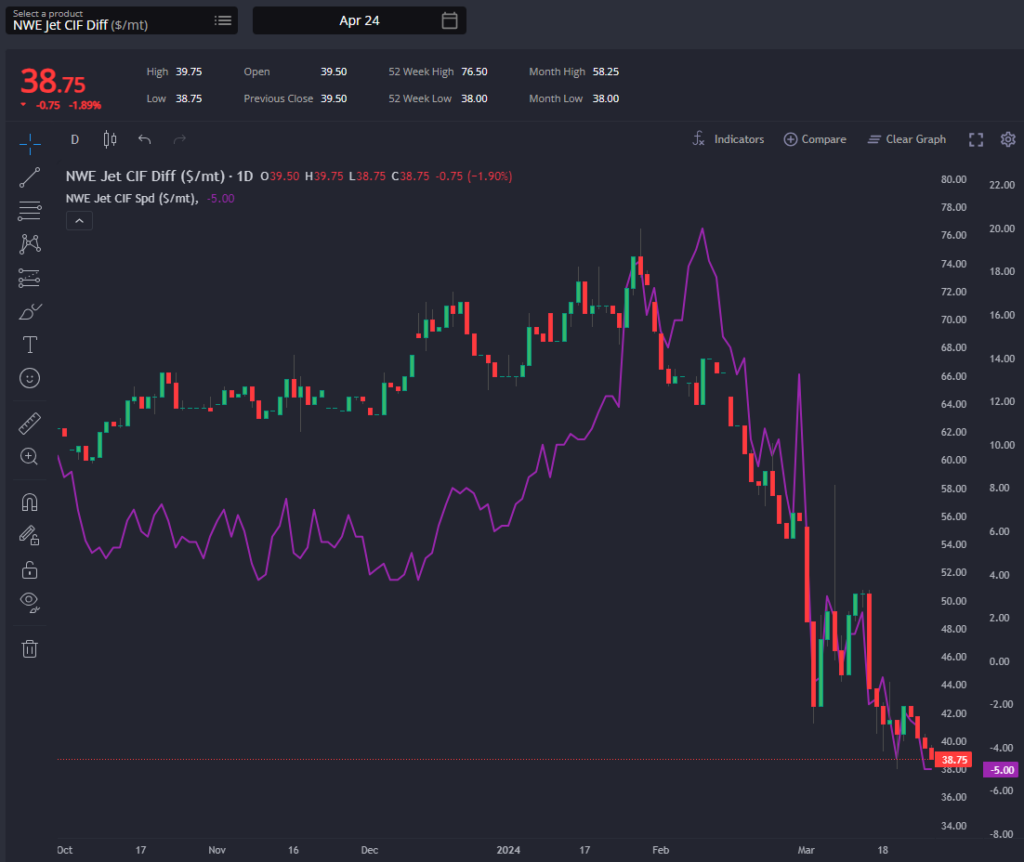

The improving Singapore regrade, fuelled by regional gasoil weakness, has led to the closure of most Asian origin jet arbs to Europe.

Consequently, European jet has firmly entered contango territory, with April’s NWE spread at -$5 /mt.

The only apparent solution for Asian jet arbs to the US lies in improving margins, a trend observed over the past week.

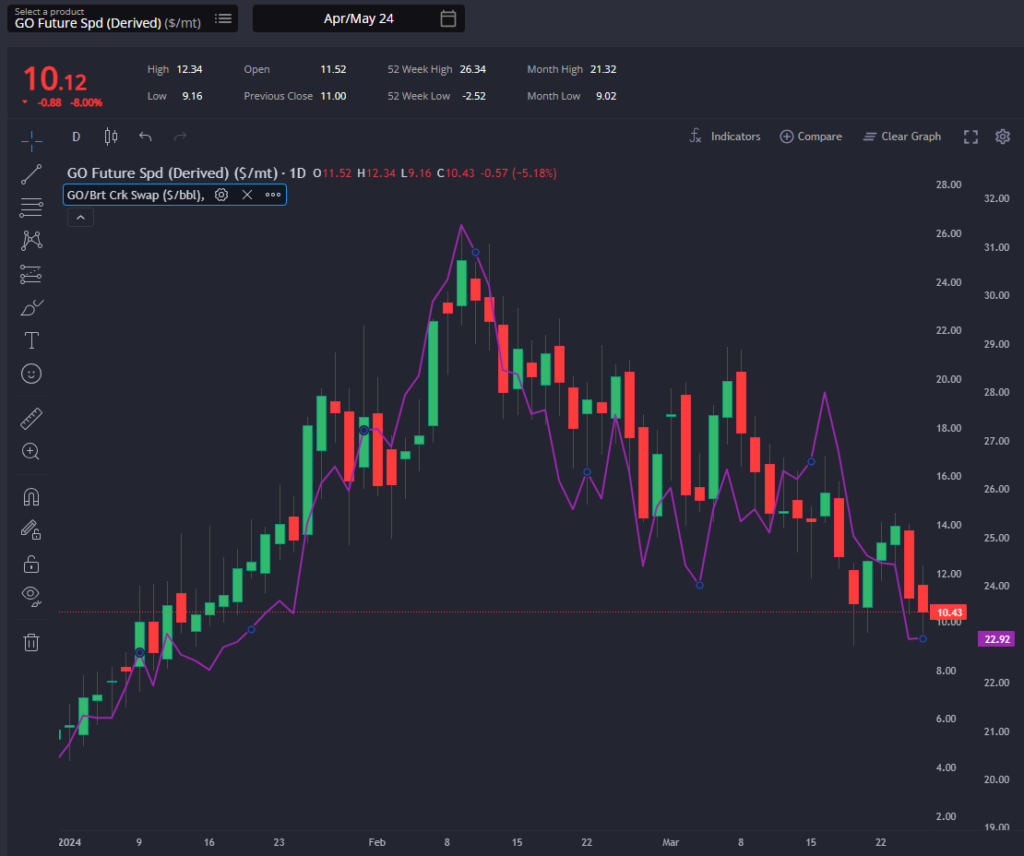

European diesel spreads experienced a notable decline in recent days, following a brief surge earlier in the week attributed to ongoing Ukrainian drone attacks on Russian refineries and Europe’s entrance into peak maintenance season in April.

This decline aligns with the continuous downward trajectory of the crack since early February.

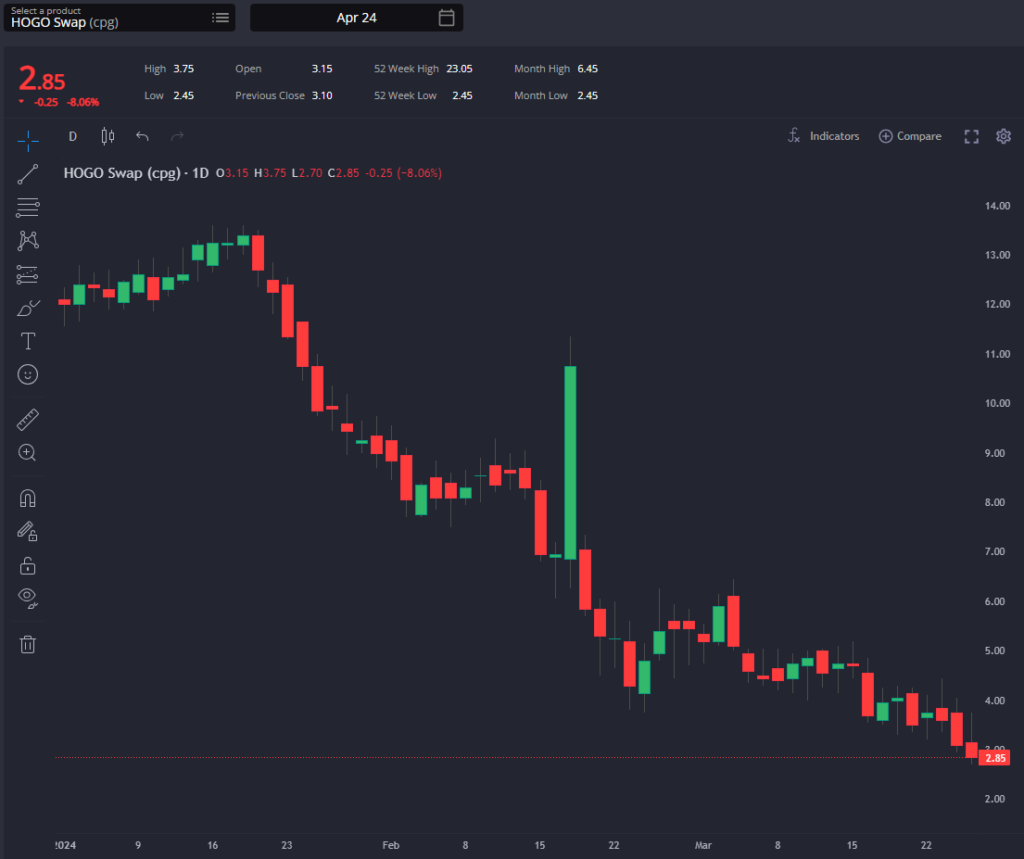

As discussed earlier in the piece, AG/WCI arbs firmly point to Europe over Singapore, while the narrowing HOGO reflects heightened US crude runs and subdued US diesel demand.

Consequently, USGC diesel arbs have opened for April arrivals into Europe, with both these factors signalling an influx of marginal diesel resupply from both the US and Asia in the near term.

Despite Europe’s impending peak maintenance period, a bearish outlook persists for European diesel pricing in the short to medium term.

Surprisingly, recent paper market activity has seen substantial purchases of European gas oil, with acquisitions totalling +18 million barrels in the past week.

Looking ahead, as Asia Pacific gears up for its peak turnaround phase beginning May, the GO E/W spread is anticipated to reverse its widening trend from mid-April onwards.

HO cracks and spreads have closely mirrored the trends observed in Singapore diesel this week, with May’s future spread hovering close to contango.

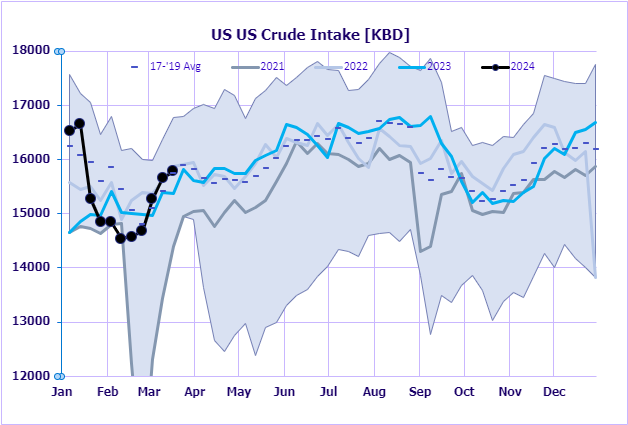

The overarching factors contributing to this pattern include escalation of US crude runs and persistently weak US diesel demand, as discussed previously.

Additionally, despite the recent Ukrainian drone attacks on Russian refineries, the USGC’s traditional exports to Latin America are currently challenged by AG, WCI, and South Korean diesel, particularly due to the softening of Asia Pacific gasoil pricing.

This competition has been further fuelled by a recent increase in TC5 pricing, resulting in a relative decrease in MOPAG pricing and enhancing the attractiveness of AG/WCI barrels for Latin American markets.

Consequently, for the foreseeable future, a narrowing of the HOGO and a downward adjustment in HO pricing are imperative to find homes for this surplus of US diesel in the short to medium term.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com