USGC pushing barrels out of the region offering opportunities to snap up winter bargains

The US continues to provide the most entertaining pricing stories this week, both in terms of current spreads and arb values as well as the potential for further extraordinary developments in the coming weeks.

With PADD-3 pricing to shift gasoline inventories which built rapidly through October, the spread between PADD-3 and PADD-1 pricing is putting a premium on Colonial line space.

Of course, there is also a certain amount of pull coming from PADD-1 thanks to the extremely narrow TA arb of recent months, but PADD-1 inventories are far from pointing towards a crunch here and inflows appear to have been perfectly sufficient despite a closed TA arb recently.

Looking ahead, the spread between PADD-3 and PADD-1 pricing likely has a hard ceiling around 13cpg (the current cost of a Jones Act MR from USGC to NYH), but already at current levels the USGC remains an extremely attractive source of supply across the Atlantic Basin and beyond.

The USGC’s advantage over other sources of supply has narrowed into most Atlantic Basin destinations as freight rates have begun to creep higher, and this is currently providing the greatest threat to USGC arbs into Lat Am destinations in particular.

As a side note, sharp upticks in TC14 have not been enough to curtail an open distillate arb from the USGC into NWE and support also from distillate exports is likely to push USGC-origin freight rates even higher in the coming weeks.

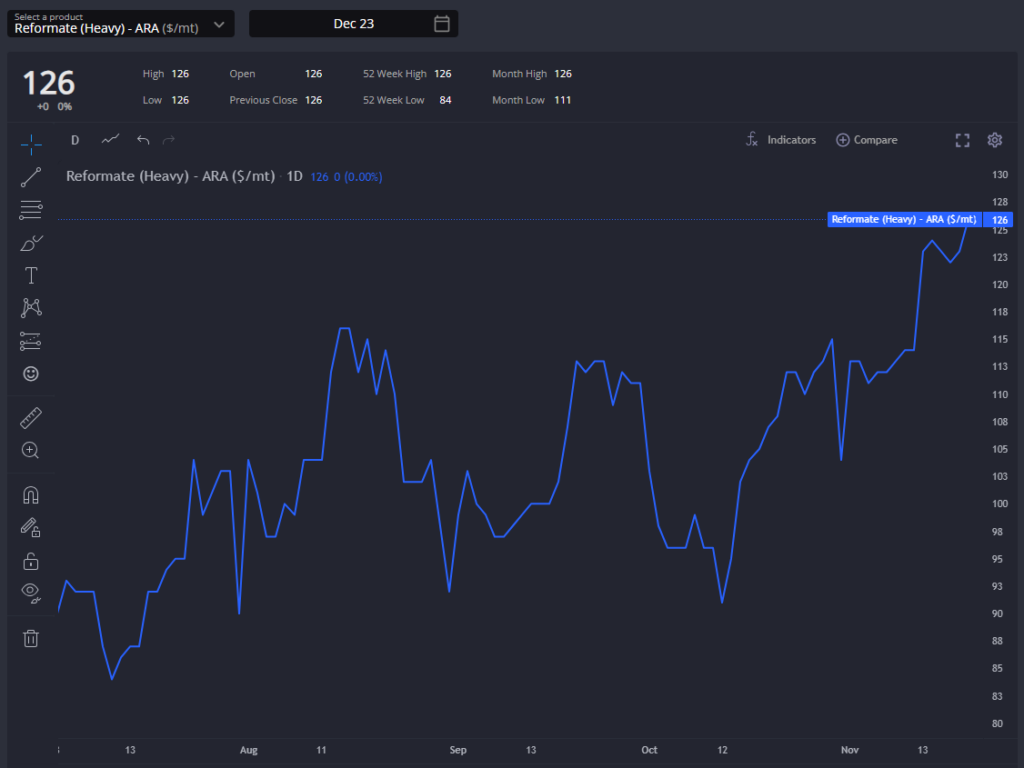

The return online of Marathon’s reformer in Galveston has aligned with developments in component pricing in the USGC over recent weeks, as reformate premiums have dropped off and heavy naphtha premiums have picked up significantly.

This has been a large part of how the USGC has come to dominate the region as the cheapest source of supply, and with the USGC now operating at strong utilisation levels given still attractive cracks, we should see recent dynamics continuing into the New Year.

Looking to the East, US barrels have flipped the long-standing status quo of the summer months and are now pushing into Southeast Asia, having had to take a backseat to Singapore-origin barrels for arbs into Mexico through much of 2023.

The AG remains the cheapest source of supply for most of the East of Suez, however, just about fending off US-origin barrels into local markets Tanzania and Saudi Arabia for now.

Weekly inventory data out of PADD-3 is likely to be one of the drivers for the TA arb spread through the rest of the year as the market determines the need to move barrels out, and a narrowing of just over 1cpg would be enough to see Houston pricing into East Africa and beyond at the expense of the AG – a situation which would almost certainly prove unsustainable.

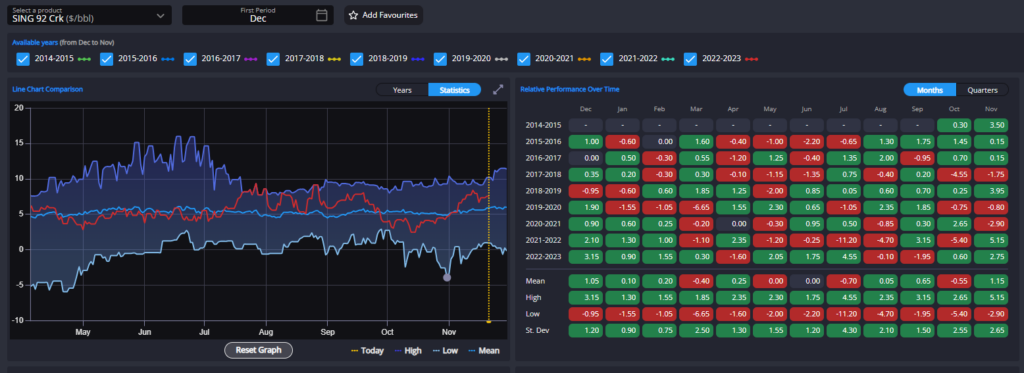

Finally, the Singapore market remains well-supported despite a lack of export options out of Singapore. Cracks and spreads in Singapore remain above their long-term average levels and the slowdown in Chinese exports has helped to keep premiums on barrels out of other major exporting centres elevated.

As such, blending opportunities in Singapore remain few and far between with most supply in the region currently moving directly or being sourced from outside of the region altogether.

With no expected shift in the underlying fundamentals through the rest of this year and into Q1, there is little reason to suspect any significant shift in gasoline E/W levels as Atlantic Basin supplies continue to compete into the EoS.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com