USGC keeps pricing to export but an RBOB rebound remains on the cards

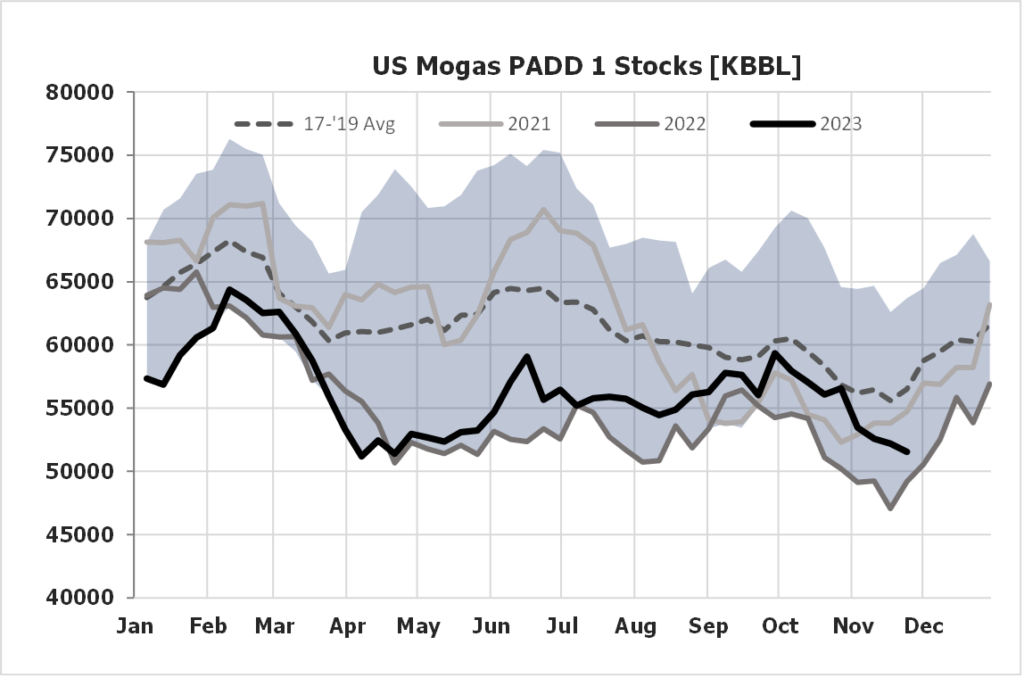

The Atlantic Basin market continues its recent winter profile with PADD-1 seemingly unconcerned with resupply at this stage.

The Dec TA arb initially responded to another draw in PADD 1 gasoline stocks last week but those gains were quickly reversed. Q1 TA arb remains on a weakening trend.

As a consequence, the RBOB arb out of ARA remains slammed shut. With absolutely nothing open on a forward basis through Q1, the market is signalling that PADD-3 pipeline flows into PADD-1 as well as blending component (heavy naphtha) flows from NWE and elsewhere are being relied upon to supply RBOB for the foreseeable future.

Whilst inventories are not yet at levels which are likely to see a rebound in the RBOB complex just yet, with PADD-3 still pricing attractively into Lat Am and therefore likely seeing barrels pulled south, the TA arb certainly has room to widen again to help keep some of those US barrels domestically if the draws out of PADD-3 start to materialise.

Overall RBOB spreads remain essentially unchanged, but if PADD-3 can overcome increasing MR freight rates (Panama-canal congestion to blame there) to start showing meaningful inventory draws then this can help tighten the entire complex.

Until then, as we can see from the recent moves in the GC Unl/RBOB spreads, the pressure to evacuate barrels out of PADD-3 continues and at these levels we are close to looking at finding Jones Act vessels to move gasoline from USGC to PADD-1.

By contrast, the market looks in a reasonably healthy state for EBOB. Dec EBOB cracks topped $10/bbl yesterday, which is at the top end of the seasonal range, but Dec/Jan spreads have been rangebound for the past month and contango continues to paint a less rosy picture into Q1.

Some support could come from the fact that E5 & E10 Blender margins have taken a hit over early Dec, largely due to gas-nap narrowing down to knocking on the door of double-digit $/mt figures once more.

Indeed, the market for light blending naphtha in ARA looks tight, as seen in strong C5+ premiums, and diffs on Prem 10ppm Barges (Win) are going through the roof as pockets of prompt tightness remain.

The E/W spread sitting around parity currently continues to allow Atlantic Basin barrels into the EoS, with ARA still pricing into parts of Asia (running AG close in majority of locations) indicating that there should be a solid floor for the European gasoline market at least at current levels.

Interestingly, despite spiralling MR freight costs, longer-range arbs out of the USGC on LR1 vessels are looking extremely competitive, with Houston currently the cheapest source of prompt supply into Tanzania, Indonesia, and Australia.

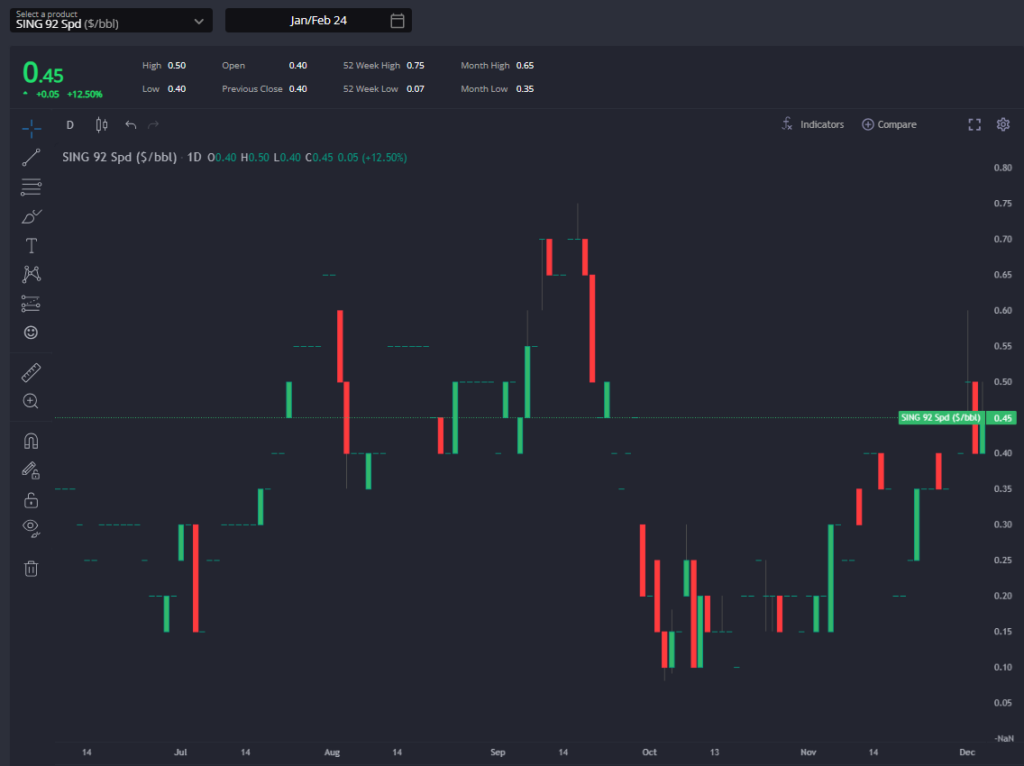

Finally, the Asian market is beginning to show its first signs of softening, with physical premiums on a number of blending components gradually moving lower and Sing 95/92 spreads in particular under a lot of pressure over Dec.

So far it hasn’t been enough to impact the E/W particularly, but the direction of travel from here should see the E/W moving back into negative territory through the rest of the month and into Q1 as the pressure emanating out of the US on the whole Atlantic Basin complex should wane once PADD-3 inventories return to more seasonal-average levels if exports are finally able to ramp up.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com