US PADD-3 pricing gets desperate as Houston prices into the world

The global gasoline market continues its winter downwards track, with the Singapore market facing stiff competition from cheaper US and European barrels into the Asia-Pacific region.

Despite a gradual easing in Singapore physical premiums and spreads, cracks remains relatively well supported – also a fixture of the European market currently.

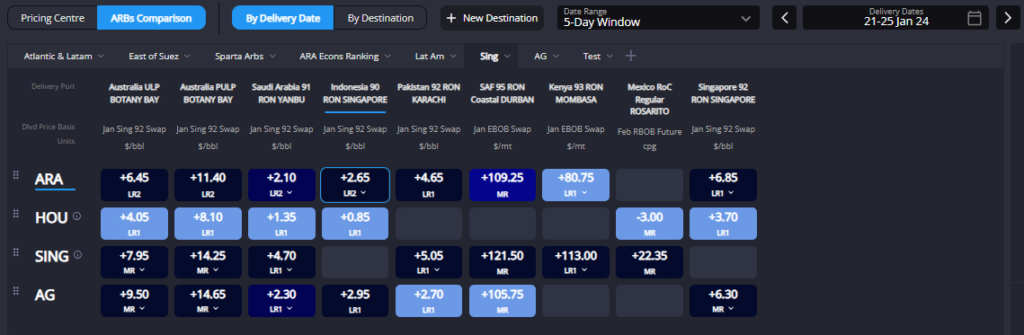

The absence of arbitrage outlets out of Singapore is notable, with the Middle East/East Africa still dominated by Europe, and destinations in Australia and other Southeast Asian regions pricing towards Houston.

In the absence of any particularly notable regional supply constraints, there is currently plenty of room for additional downside in the Sing92 complex.

In Europe, the Euro gasoline market is experiencing a weakening trend, prompting questions about the potential bottom.

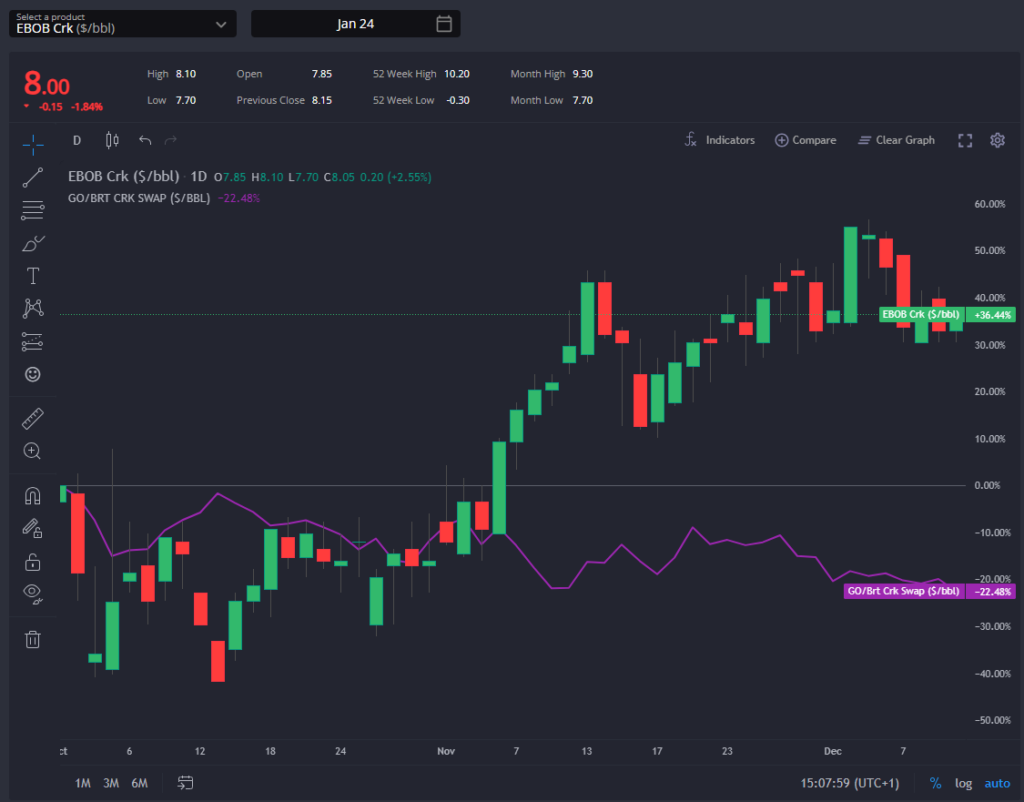

EBOB structure has slipped further into contango for the first quarter, reflecting the ongoing bearish sentiment.

The decline in gas-nap prices to $90/mt in January aligns with previous predictions, and any further decrease here is likely coming from a pressure on the gasoline side with European naphtha markets not yet tightening significantly.

Despite these concerns, gasoline cracks remain relatively robust, with any move significantly lower difficult without negatively impacting refining margins to the extent that utilisation rates could suffer.

Whilst distillate cracks are still the margin leader in Europe, the relative performance of Jan-24 distillate vs gasoline cracks since the start of Q4 points also to a hesitancy to now include gasoline cracks as an instrument to control gasoline supply.

Instead, blend margins remain notably negative, pointing to this avenue to naturally constrain supply, providing a potential stabilising factor.

Nigeria’s demand is showing signs of a return, particularly observed in higher winter premium spec barrels in the Amsterdam-Rotterdam-Antwerp (ARA) region at the beginning of the month.

This resurgence in demand has held something of a candle in the dark for the ARA gasoline market recently, but with premiums already falling off sharply once more, this spate of WAF buying which helped lift the floor in the market appears to be falling away.

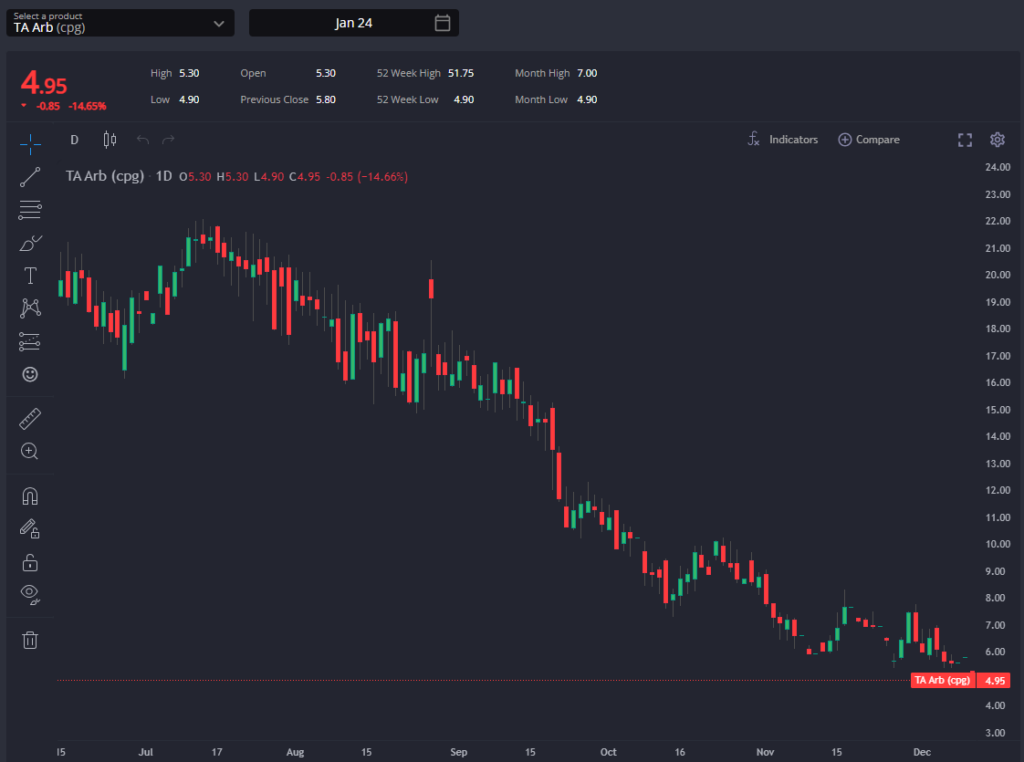

In the Americas, the TA resupply into PADD-1 – at least for Q1-24 – continues to pose no major concern.

With lower Euro gas-nap spreads keeping the TA arbitrage tightly shut thanks to increased RBOB blend costs in Europe, Euro-grade barrels and blend naphtha are now heading directly into PADD-1 rather than undergoing blending in ARA, reflecting adjustments in trade patterns.

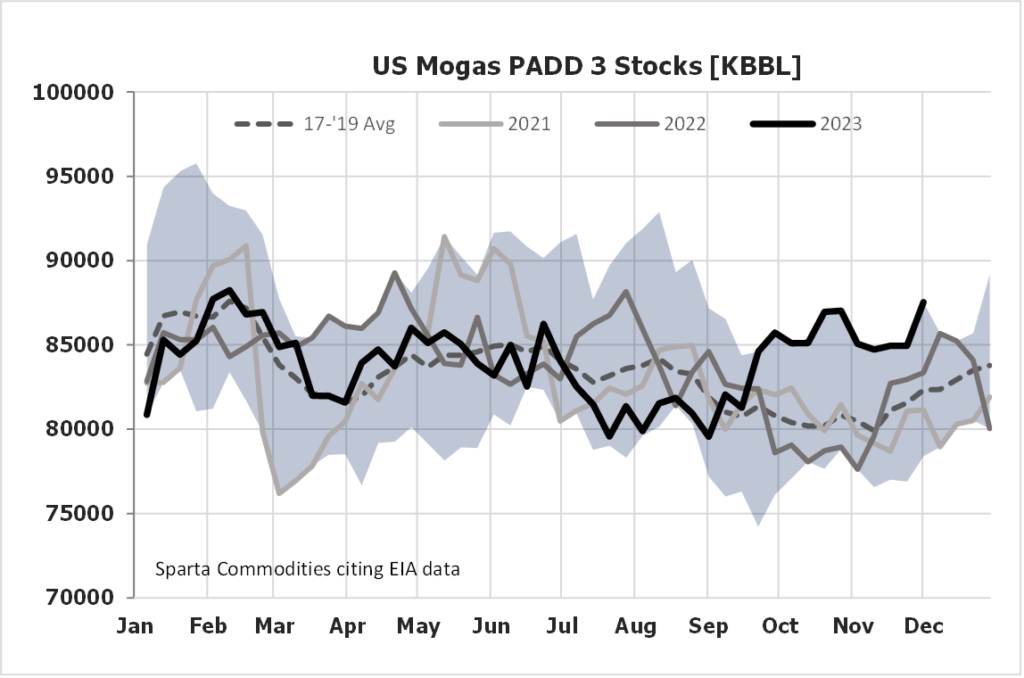

Finally, with PADD-3 stocks ticking up last week, the desperation in USGC pricing to start shifting barrels out of the region appear to be increasing.

The Jan-24 GC Unl98/RBOB spread has moved out to almost -9cpg, whilst that for Dec-23 is already closer to -16cpg. Houston is now comfortably pricing into Asian destinations and is even the cheapest source of prompt supply into Nigeria, Saudi Arabia, Iraq, and Tanzania.

With the above helped by a TA arb spread for December which is threatening to go negative just as the contracts before it did, our call that this spread had further room to narrow coming into the end of year is coming true and the Jan-24 TA at 5cpg likely also has room to the downside with PADD-3 as yet unable to curtail supply or significantly ramp up exports (with the exemption of the latest weekly data point).

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com