Supply constraints in US and AG helping strengthen ARA market

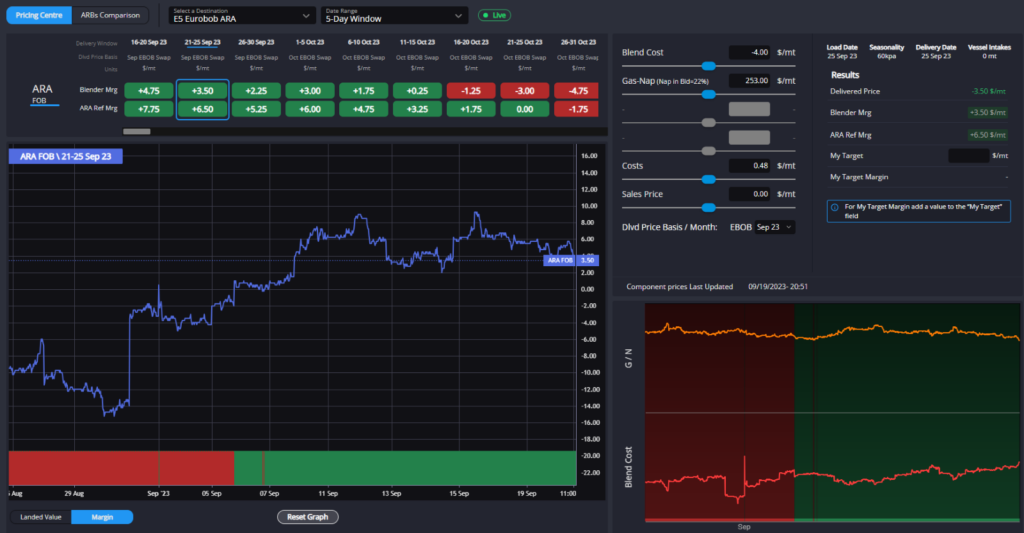

Spot and forward gasoline component pricing in ARA as well as the TA spread is keeping the RBOB arb firmly shut all the way through Q4.

The October TA arb spread has flipped into negative territory through the morning today, carrying on a trend started at the end of last week which is helping to keep this arb shut.

The 6-10 October load window on this route, for example, has moved from marginally open as recently as 12th September to almost 8cpg shut at the time of writing.

Whilst the EBOB window continues to appear a little too strong, with the prompt blend window still wide open, it has been narrowing steadily as physical players are taking advantage of this opportunity and narrowing the gap between blend cost and screen.

Renewed interest in blending component purchases in ARA has seen premiums on those components rising once more, with blend costs for the majority of export grades also having risen as a result.

The latest news of an unexpected outage at Shell’s Pernis refinery – which has seen a hydrocracker leak take the unit offline – is unlikely to have a notable impact on the region’s gasoline market, but we would expect continued attractive export barrel blend costs to drive keep the market well supported in the weeks ahead.

ARA remains the supplier of choice for Mexico City reg spec, as well as into South American markets.

Prompt physical pricing on blend components in Houston remains well supported by a raft of regional refinery outages and turnarounds, with MTBE premiums in particular still very strong in the USGC.

This has had a knock-on effect on ARA, with October MTBE now pricing at over 150% of EBOB in ARA as opposed to below 130% at the beginning of the month, but tightness elsewhere is continuing to allow ARA to price higher and still maintain its status as cheapest source of supply.

US tightness is helping ARA exporters place barrels into Lat Am, but supply constraints in the AG on regional turnarounds there is also opening the door to arbs to the east despite a continuously negative E/W spread.

Tight AG supply this is likely to last well into Q4 on the back of refinery turnarounds and reduced Russian inflows since August.

On the flip-side, Oman’s Duqum refinery has been exporting its first regular cargoes of naphtha recently, as the region’s new refining capacity is beginning to make itself felt and we expect to see a longer regional gasoline balance than that seen in recent years over the winter months once the current turnaround period ends.

As such, although the AG’s competitiveness into markets such as Brazil and Nigeria has been comprehensively shutdown since the beginning of the month, we wouldn’t be surprised to see a return to competition from AG into these markets towards the end of the year and beyond.

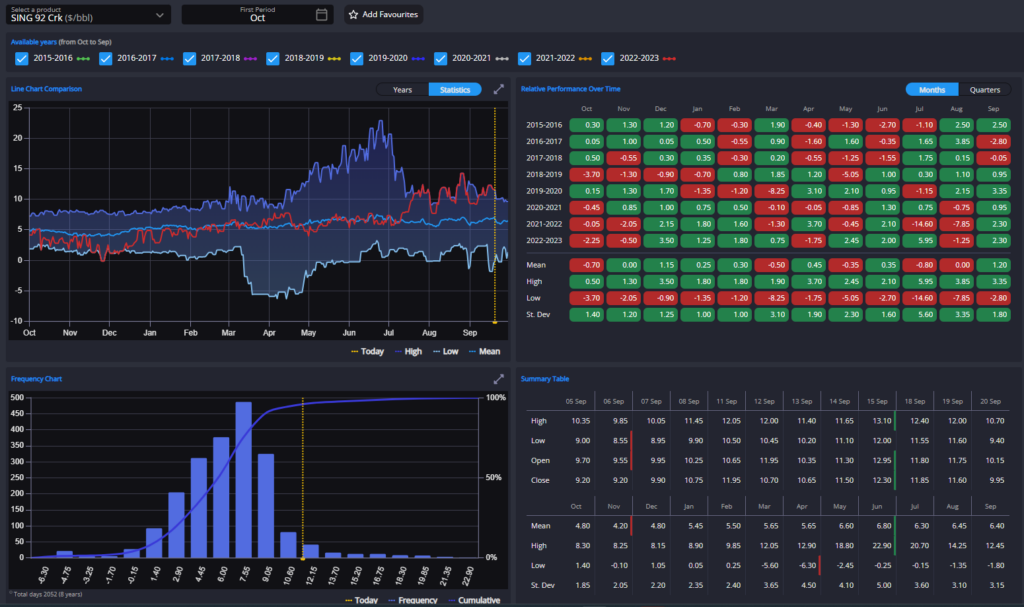

Finally, Singapore continues to price itself out of its regional export markets – at least in comparison to the arbs out of the AG.

The market here continues to appear well supported by resilient end-user demand, with no signs of softening emerging in Asia either for now.

There is talk of Chinese fuel oil export quotas being potentially transferred over to clean products, which could offer some pressure to the Singapore mogas market towards the end of the year.

Any additional Chinese clean product quotas will be the consequence of comparatively high export margins, and with October Sing 92 cracks at their highest levels in recent history for this time of year, the likelihood of Chinese authorities allowing their refiners to capitalise on these margins looks good for now.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com