Summer crunch building steadily

The European gasoline market hasn’t made any particularly startling moves over the last week, but there remains the sense that the market is struggling to clear a potentially uncomfortable level of prompt tightness.

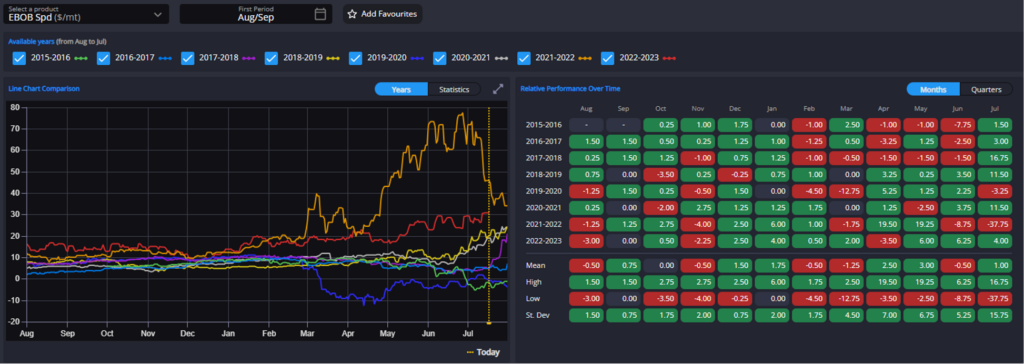

To demonstrate, EBOB spreads remain volatile but at elevated levels. The July/Aug spread, for example, is currently trading at around $30/mt, its highest level for this time of year in our records (with the exception of 2022).

Even if we do not discount 2022, the July/Aug spread is almost at levels seen during last year’s extraordinary circumstances, pointing now to an underlying structural deficit in the European gasoline market that even more than 12-months after the imposition of sanctions on Russian oil products is still causing issues.

That being said, a lack of naphtha barrels in the market appears to be far from the main problem for the European complex.

Gasoline’s premium over naphtha remains at extremely high levels, with weak PMI readings in Europe contributing to the very bearish naphtha demand picture.

Both July and August gas-nap spreads are now extremely close to their 2022 levels, whilst the September and October swaps are already marginally higher than their 2022 equivalents were at this time last year.

We mentioned last week that there may be some green shoots of recovery from the Asian petchem market, but it is looking likely to be too-little-too-late to rescue the European naphtha market this quarter at least.

Conversely, RBOB swap spreads have come off sharply in recent days along with the broader PADD-1 gasoline complex.

The prompt TA arb has consequently dropped from almost 22cpg last week to trade around the 17.8cpg mark currently, abruptly slamming the RBOB arb out of ARA shut for blenders despite continued extreme gas-nap spreads.

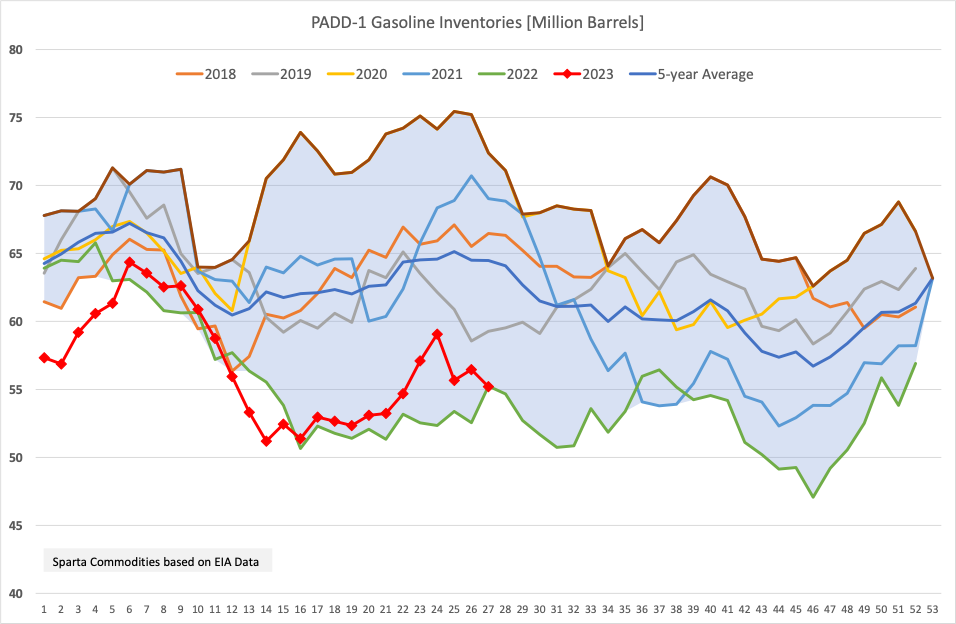

The move also comes counter to the fundamental indications from the US, where PADD-1 inventories have returned to last year’s lows and nationwide stocks are at their lowest levels in recent memory for early-July.

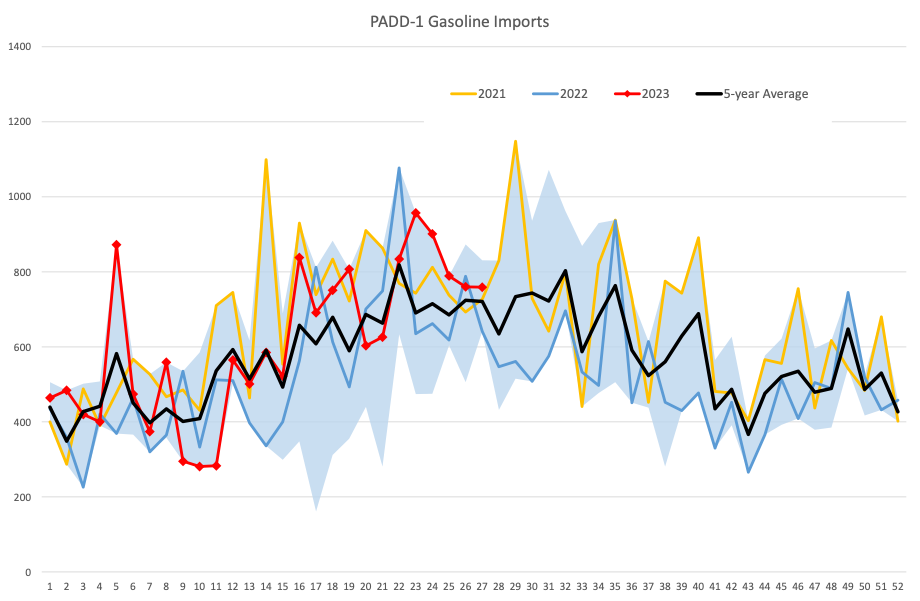

The situation is not being helped by the fact that PADD-1 gasoline imports have remained towards the upper end of their 5-year range in recent weeks but have come off their early-June highs recently despite a continued open TA arb through much of the last month.

This points to Europe itself still being relatively tight – as referenced in recent weeks as well as in continued strength in the inter-month structure – as well as potentially better netbacks for some European barrels into other Atlantic Basin destinations as the PADD-3 market tightened as we moved into summer.

Timespreads in Asia have also strengthened significantly in recent days, alongside a sharp uptick in gasoline cracks in the region.

Prompt supply concerns from Typhoon Talim-related disruption are potentially behind some of the move, whilst strong demand indicators from some of the region’s largest consumer centres remain.

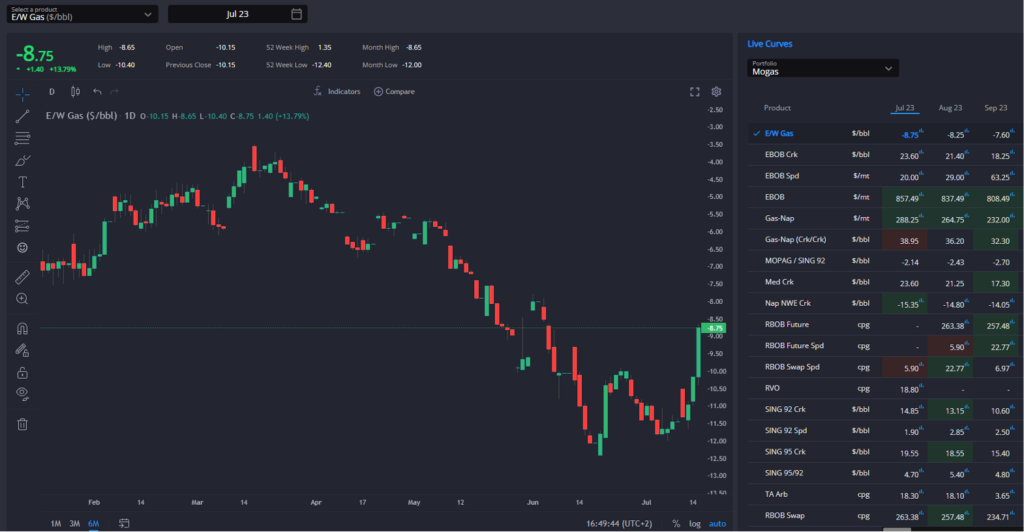

The E/W narrowing last week and today is the beginning of an indication to try and shut-off the flow of Middle East barrels back into the WoS, and Singapore pricing to attempt to capture more of these swing barrels in the short-term despite continued summer tightness in the Atlantic Basin.

This has demonstrated itself in the prompt E/W narrowing significantly in recent days (-$12/bbl back to -$9/bbl), and the curve has importantly also narrowed all down the curve for the rest of the year.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com