Spreads tumble though Asia remains in backwardation, Gas-Nap narrows as a potential demand side bright spot amid RBOB weakness

We close this week in line with last week’s bearish sentiment, with the weakness in the European naphtha market deepening for another week.

Petrochemical plant operation rates remain below 70% in Europe, and the recent drop in Brent has not helped support naphtha prices in global markets.

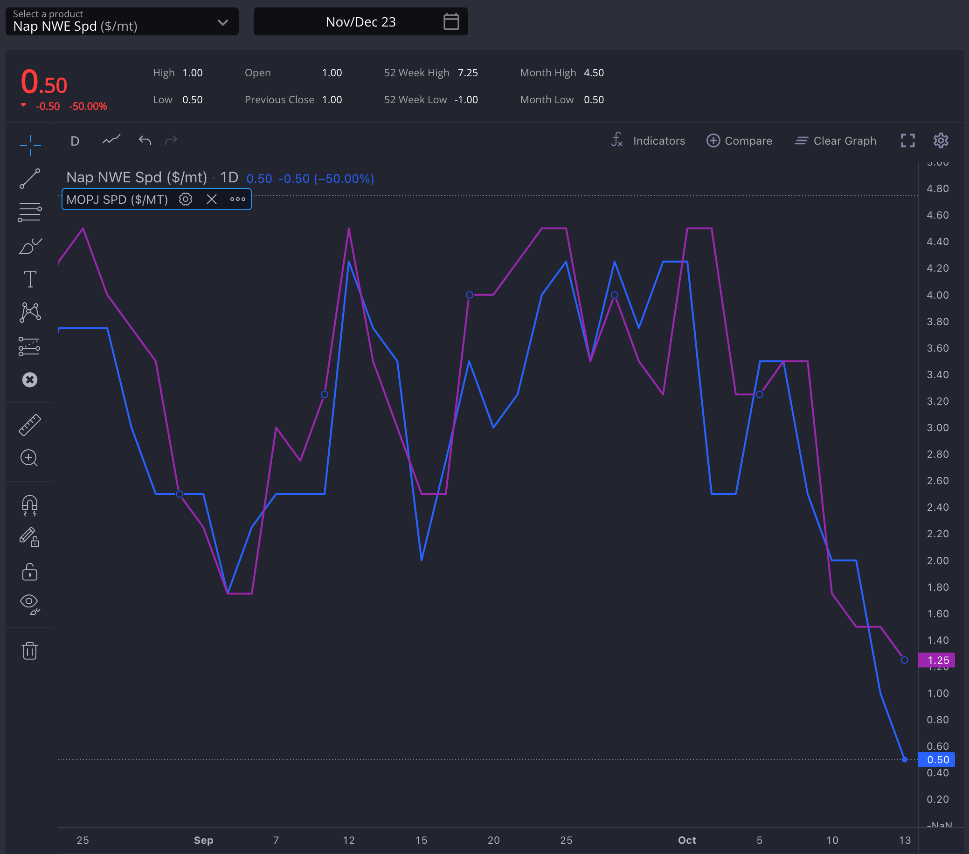

Contango arrived in the prompt NWE naphtha spread and all eyes are now on the Nov/Dec spread trading at $0.5/mt in NWE and $1/mt for MOPJ in the Asian market.

If Asia is unable to generate sufficient spot arbitrage to stimulate European demand, next week may confirm that contango has become widespread in the market.

Despite a rebound in cracks due to Brent poor performance this week, the physical market the trend remains bearish, with deepening negative premiums for OSN cargoes in NWE.

Asia resisted the impact, and although it is trading lower, it still maintains backwardation throughout the forward curve.

After the severe correction of the Nov E/W spread last week after it traded $10/mt two weeks ago, now the current spread for November is at +$7/mt.

A significantly high level, considering the levels it has moved within this year, reaching its lowest point during Q2 with negative values hitting -$6/mt.

Since then, despite the inherent volatility in the E/W market, the trend has been upward, and although there is still some way to go to reach pre-2023 average values, the overall dynamic suggests increased Asian imports of European products in Q4.

The weakness in gasoline demand has compounded lacklustre petrochemical demand in the past month to help push the bearish naphtha narrative.

However, this week it appears that the declines may have bottomed out, and blending incentives remain strong even at these relatively reduced spreads, which limits the options for contango to deepen in the global market with at least this undercurrent of naphtha demand remaining robust.

SING 92 has been unsurprisingly comparatively resilient vs European and US gasoline benchmarks after the summer. This has kept the physical market premiums for blending qualities reasonably high and maintains the arbitrage well open from USGC, with moderate options for importing heavy qualities from the European market.

Finally, a significant rise in the TC6 during Wednesday’s session resulted in a 130-point WS increase in the benchmark, translating into a $10/mt rise in spot freight.

This has significantly increased the cost of arbitrages from the Mediterranean to Northwest Europe in the short term.

With poor demand that is wreaking havoc in Northwest Europe and a Mediterranean region that is also witnessing a drop in physical premiums, the options to Asia have substantially improved their landed value in the Asian market, which is currently attracting attention for new arbitrages of full-range qualities.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com