Returning AG gasoline supply challenging Singapore’s competitiveness; lacklustre US demand remains main risk to narrow T/A arb

Singapore gasoline resupply is beginning to lose its grip over East of Suez end-markets as Middle East refineries begin to full fully exit their turnarounds, providing stiffer competition, particularly for May deliveries.

That said, the west coast of Mexico remains a lock for Singapore gasoline through June delivery, providing a much-needed outlet as Singapore stocks reportedly hit a six-week high at the beginning of the month.

Components into Singapore continue their downtrend and should keep Singapore gasoline competitive in the near term, helped in part by the ongoing strength in the European gasoline complex, which is keeping west of Suez resupply out of their usual end-use markets.

Meanwhile, European gasoline continues to be on a tear with the T/A arb narrowing further and remaining closed well into summer.

Ongoing heavy refinery maintenance in Europe, coupled with higher-than-average stocks in PADD 1 will likely ensure this dynamic remains in place at least through end-April.

Increased supply into Europe as Middle East refineries wrap up their turnarounds through mid-month should slow EBOB’s run.

That said, a full reopening of the arb will heavily depend on US driving demand come summer with the upcoming March spring break providing a window into impending summer appetite.

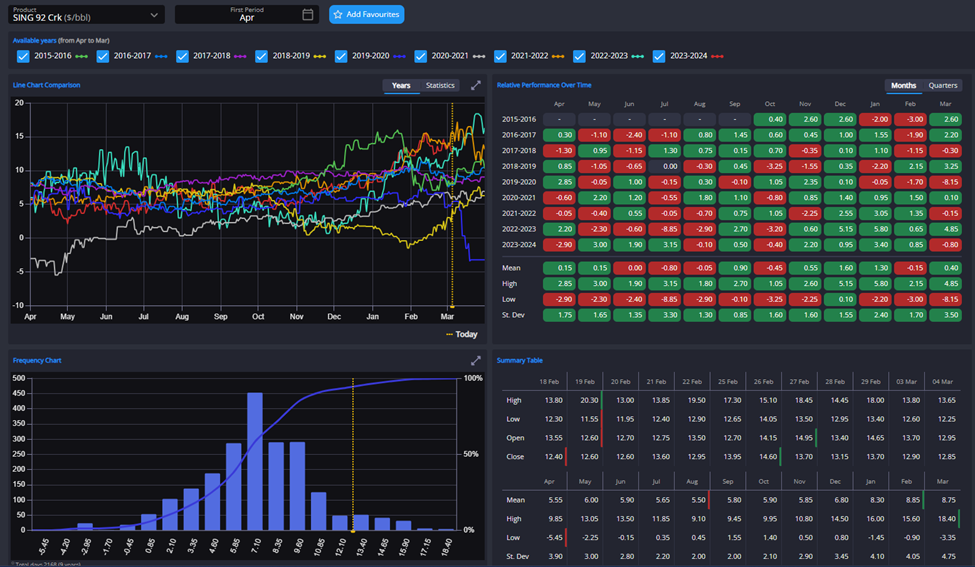

Finally, cracks should continue to come off their recent highs as US refinery utilization creeps up slowly as a heavy turnaround season draws to a close by end-April, but should remain relatively strong given the sideways trade of Brent as the OPEC+ voluntary cuts into Q2 had been largely priced in.

Crack strength has partly fuelled hedge funds’ recent piling on bullish bets into the RBOB complex compounded by return of the ‘summer octane tightness’ narrative, which was a hot topic at recent IE Week cocktail receptions.

Returning supply from a heavy Q1 turnaround season would suggest otherwise, as do widening swap spreads in Europe and Singapore, meaning the onus of providing price direction will soon pivot towards the demand side.

Samantha Hartke, a veteran in commodity management, boasts substantial expertise in energy analysis and product management. In her role at Energy Aspects as Head of NGLs, she analysed global natural gas liquids markets. Previously, at PetroChem Wire, Samantha provided high-quality analysis of North American NGLs and olefins. Her expertise also extends to leading the commercial and operational aspects of IHS Chemical’s daily business information service.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com