Resurgent European screen belies easing physical market

Written in the full awareness that this article has been very European-centric in recent weeks, it is once again movements in ARA and the EBOB swap which are dominating the market.

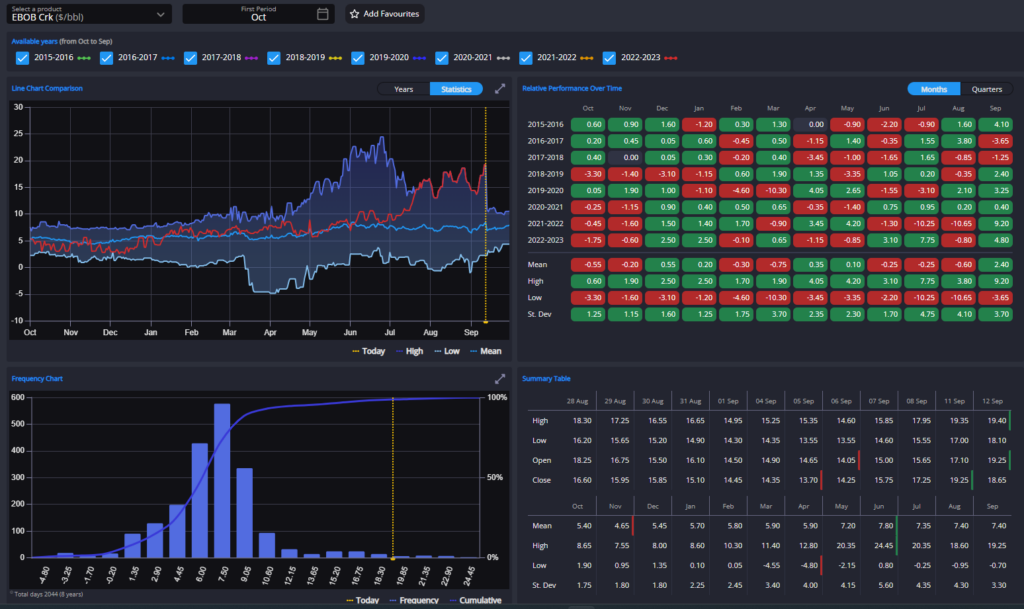

M1 EBOB crack and the Oct/Nov EBOB spread have both moved higher once again at the beginning of this week, reaching historical highs for this time of year.

In the absence of marked refinery outages in the region (the Antwerp FCC damage notwithstanding), the extent of the latest move higher is somewhat difficult to justify.

The upswing has not been isolated to gasoline, with the gasoil complex also rapidly rising in recent days – a move which has moved prompt distillate arbs into Europe wide open.

The distillate moves have largely been driven by the physical market, however, and fit with available fundamentals indicators.

On the gasoline side, however, inventories have been moving higher once more and demand is beginning to wane as the summer season ends.

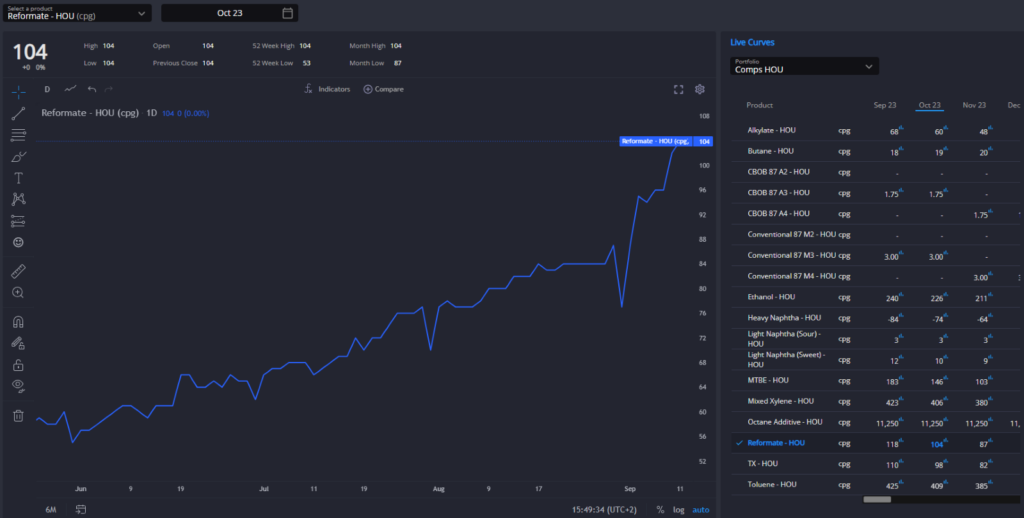

Physical premiums on gasoline components have also been gradually softening in Europe, with reformate and FCC naphtha streams in particular coming off.

The divergence in component and finished grade pricing has seen blend margins in ARA widen sharply, although we are yet to see any notable activity in terms of offers in the window.

At these levels, this is likely just a matter of time however, and we would expect to see the strength which has emerged in the EBOB swap over the last few days subside again quickly given component availability and pricing in ARA currently.

Blend margins have also notably been given a boost by another uptick in the gas-nap spread, and in Europe at least this is allowing our blender model to generate very competitively priced barrels for export to both Lat Am and WAF destinations.

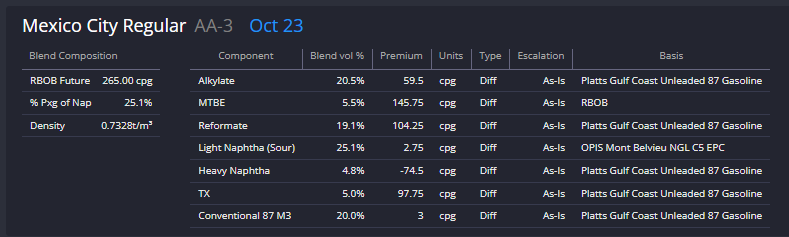

The discount on Mexican grades out of ARA vs those blended in Houston has risen to its widest level in the history of the October-23 delivery window and appears to be reflective of both a softening ARA components market and continued prompt strength in USGC component premiums.

The Mexico City Regular blend out of ARA is currently made up of 23% naphtha and rest largely a combination of light reformate and FCC naphtha streams – all components which have been coming off recently.

By contrast, the same grade blended in Houston is largely reliant on alkylate and reformate streams which are both sitting at 52-week highs for September and October deliveries.

Of course, here we’re looking at how components in Houston are pricing vs the Gulf Coast 87 gasoline swap, a quote which has itself strengthened markedly vs RBOB since mid-August.

Combined with the steadily and significantly narrowed TA arb spread, it is clear that PADD-1 is not pricing for resupply at current levels.

This is looking increasingly like a case of a tighter PADD-3 and European paper picture than a more relaxed fundamentals picture in PADD-1, supported in large part by the growing list of capacity currently offline in the USGC.

The list of planned and unplanned outages in PADD-3 has been growing in recent weeks, with an apparent emphasis on FCC units.

For the time being this is being dealt with by closing arb opportunities out of the USGC, with Florida and Canada also close to pointing to ARA for resupply in the prompt.

This is a situation which should see a natural relaxing of current higher pricing levels as demand eases and the hurricane season draws towards its close without a major system landing into a refinery-heavy area.

With current forward pricing levels having almost completely removed USGC barrels from export destinations all the way through Q4 as well, we would expect both the TA and GC 87/RBOB spreads in Q4 are in line for a reversion towards the mean before too long.

Finally, despite an E/W spread which should be cutting European barrels off from supplying EoS destinations through the winter months, the softening physical market is allowing blend and export opportunities to continue in a number of markets regardless.

Into both South Africa and Kenya, ARA-origin barrels are out-competing barrels out of Singapore, with blend costs in ARA on both grades having tumbled in recent weeks thanks to a re-widening of the gas-nap spread and easing reformate markets.

This comes despite an abundance of Chinese gasoline availability continuing to keep the Far East gasoline market well supplied and may help to keep E/W spreads narrow for the time being.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com