Prompt optimism continues but early signs of a correction emerge in Asia

The naphtha market has been buoyed on multiple fronts recently. Firstly, crude weakness has helped give a leg-up to prompt cracks and dressed up a market that is still reasonably well-supplied even immediately post-refinery turnarounds.

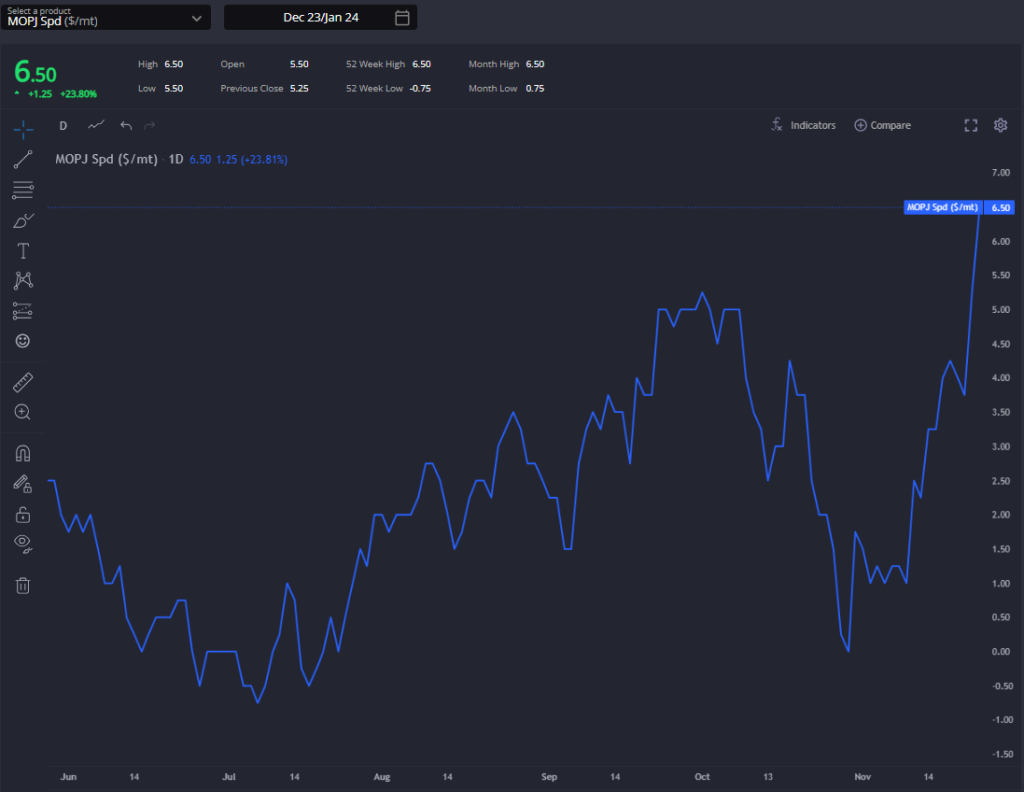

Seasonal optimism from naphtha players in Asia, particularly post-cracker maintenance, has sent MOPJ spreads higher and kept the E/W strong for now. It’s also the time of year to start thinking about 2024 needs with recent days seeing flurry of term discussions for 2024.

But this optimism should have a fairly low ceiling and there are already signs of a correction both in prompt and deferred pricing.

OSN arbs into Chiba are wide open from the Med across the whole of Q1 despite higher freight costs. That comes down to a still-strong E/W – now approaching +$20/mt in Nov – and weak FOB prices.

Chiba sales prices themselves are now correcting lower, presumably to try to squeeze this flow, and indeed most OSN arb margins have eased substantially over the last few days from high levels.

Light naphtha arbs into Chiba are now almost all closed down the curve. From the Med, stronger FOB prices and freight probably reflects healthy eastbound flows over the last few weeks.

FOB prices in the AG remain steady and weakened freight suggests a relative squeeze on prompt supply there for now. Any correction on these two metrics might spell renewed arb flows from the AG going forward.

The demand situation for 2024 is still mixed at best; expensive propane due to Panama canal issues has been a bright spot for naphtha demand in theory. But flex-feed crackers may simply reduce runs. FEI propane cracks have already started to correct lower, as has pro-nap in Asia.

On China, naphtha imports in October customs data showed a sizeable correction lower down to a ytd low of just 250 KBD and LPG imports also weakened after a strong summer.

All this appears to be manifesting in Q1 E/W, which corrected some $4-5/mt over the last two weeks (though rallied d-o-d yesterday), in contrast to the prompt.

In the Atlantic basin, open arbs to Asia have provided limited support and Nov NWE spreads have ticked up to some $2/mt. ARA C5+ premiums remain strong while N+A naphtha premiums rose to $17/mt, from $5/mt a week ago.

Interestingly the stark correction in reformate premiums in ARA and Houston – partly related to the restart of Marathon’s large reformer at Galveston this week – has not yet translated into pressure on heavy naphtha.

There is still a wide margin on placing heavy grades into NYH from both HOU & ARA amid healthy blending demand in PADD-1 (and a prolonged shutting of the TA gasoline arb). Look to a re-opening of the TA gasoline arb for a correction on heavy naphtha.

A still wide-open and improving NYH arb for light naphtha out of Houston is also reflection of generally over-supplied light ends market on the USGC.

With that and ARA gasoline under pressure to price into Asia, it looks like Atlantic Basin naphtha availability will be ample for now and the Asia rally should begin to cool.

Neil Crosby is an experienced energy market and commodity analyst, specialising in crude oil, oil products, biofuels, and carbon. With roles at OilX and JBC Energy, he has extensive expertise in global oil industry analysis, forecasting tools, bespoke research, and client communication. His focus on refining and petrochemicals underscores his specialisation.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com