Physical market remains tight globally as high octane component premiums reach new heights

Backwardation in European gasoline prices has continued to strengthen, bringing it to its highest seasonal level in recent memory and reinforcing the impression that the supply-side issues providing such support to the market are not going anywhere.

Gasoline inventories in ARA remain seasonally high, but as we have established in this space previously, there appears to be a mismatch between the qualities available and those required.

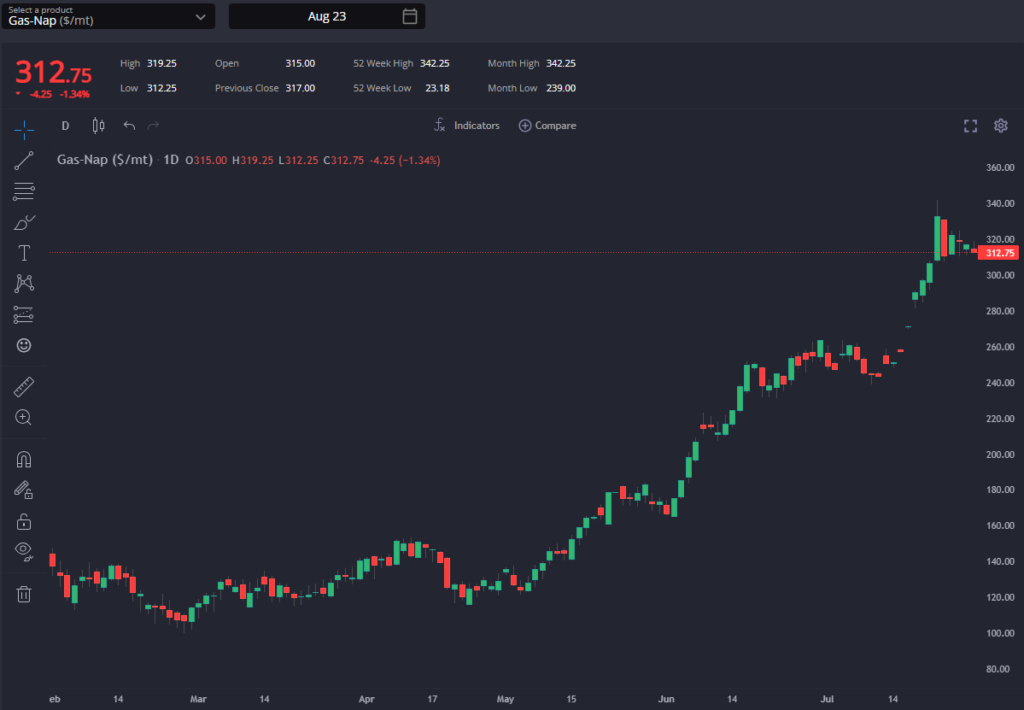

This mismatch remains evident in the spread between gasoline and naphtha pricing, and in the absence of major, sustained refinery unit shutdowns in Europe or elsewhere, one theory that deserves attention is the available crude slate in the Atlantic Basin.

Medium-sour Russian Urals crude has had to be largely replaced in Europe, and the marginal replacement barrel has likely been a lighter, sweeter quality.

Whilst traditional logic might suggest that this should be a positive for gasoline supply, in reality it appears as though an abundance of lighter molecules is struggling to find its way into the finished gasoline pool and premiums for heavier naphthas which are suitable for direct blending or reforming continue to press higher.

The high availability of straight-run naphtha has been a supportive factor in keeping the TA arb open for much of this summer, with RBOB blends able to take more naphtha than other finished grades thanks in part to its high-octane ethanol component added upon arrival.

The opening of this arb in recent weeks for the early windows of August, however, has seen a rapid recovery in freight rates and a narrowing of the TA spread, shutting the arb once again for blenders but keeping it open for those refiners with advantaged feedstock access.

The prompt strength in the Atlantic Basin gasoline market has extended into the East of Suez (EoS) now as well, with cracks reaching their highest levels this year and outperforming last year’s seasonal levels.

Such is the emergent strength in physical component premiums in Asia that HMEL are reportedly offering another opportunistic Pygas cargo into the market – drawing from their own tanks to take advantage of the current squeeze.

Asian gasoline demand appears to remain strong for now, and with the opportunity also for AG blenders now to place barrels into the Atlantic Basin, we would expect fundamental support for the EoS gasoline complex to be maintained for the next few weeks at least.

Beyond that, much will depend on the ability and willingness of Chinese and Korean refiners to return to the export market in greater volumes, but the usual seasonal pressure from the European market as we move closer to Q4 appears less and less likely with each passing week.

Finally, the USGC market continues to price strongly as US inventories continue their draws.

Despite ARA also being tight, barrels out of Houston are proving more expensive into Canada currently and essentially tied on cost into Brazil. Here, again, much of Latin America can look towards the EoS for a cheaper source of resupply currently.

Despite an anticipated slowdown in finished gasoline exports, however, we are unlikely to see USGC components pricing lower through the rest of this quarter at least, with inventories low and demand from export markets remaining high.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com