PADD-1 tightness bolsters Atlantic mogas market, AG barrels looking to take advantage

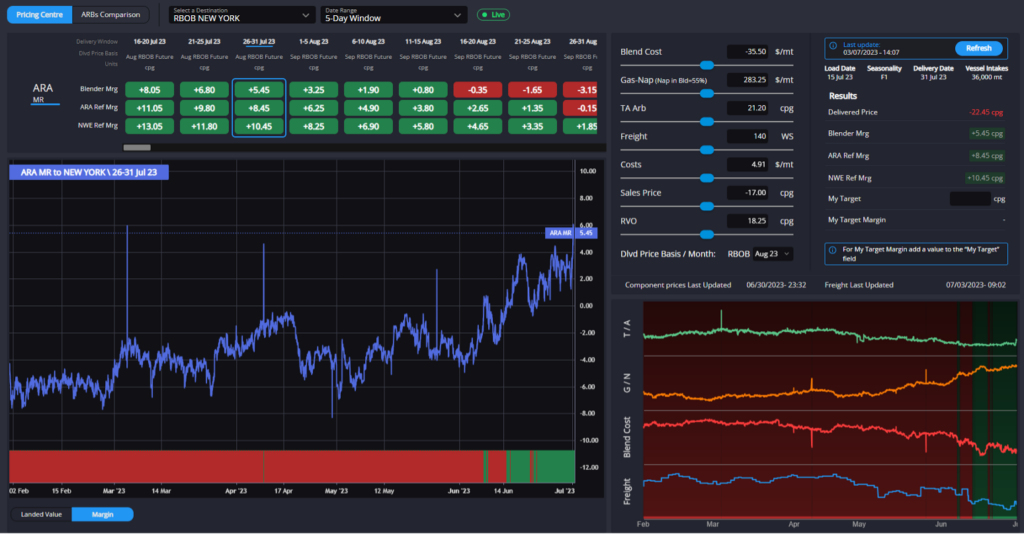

Beginning in Europe, the blowout in prompt gas-nap spreads has helped to make E5 blending economical throughout most of July, before these econs fall off a cliff once again come August.

The European gasoline complex continues to be pressed for quality barrels, despite an abundance of naphtha availability, and a combination of regional demand and a wide-open TA arb remain enough to sustain a well-supported gasoline complex in Europe currently.

End-user demand in Europe appears to be holding up well as the holiday season kicks off in earnest, with little sign that the bullish sentiment here has reason to ease just yet.

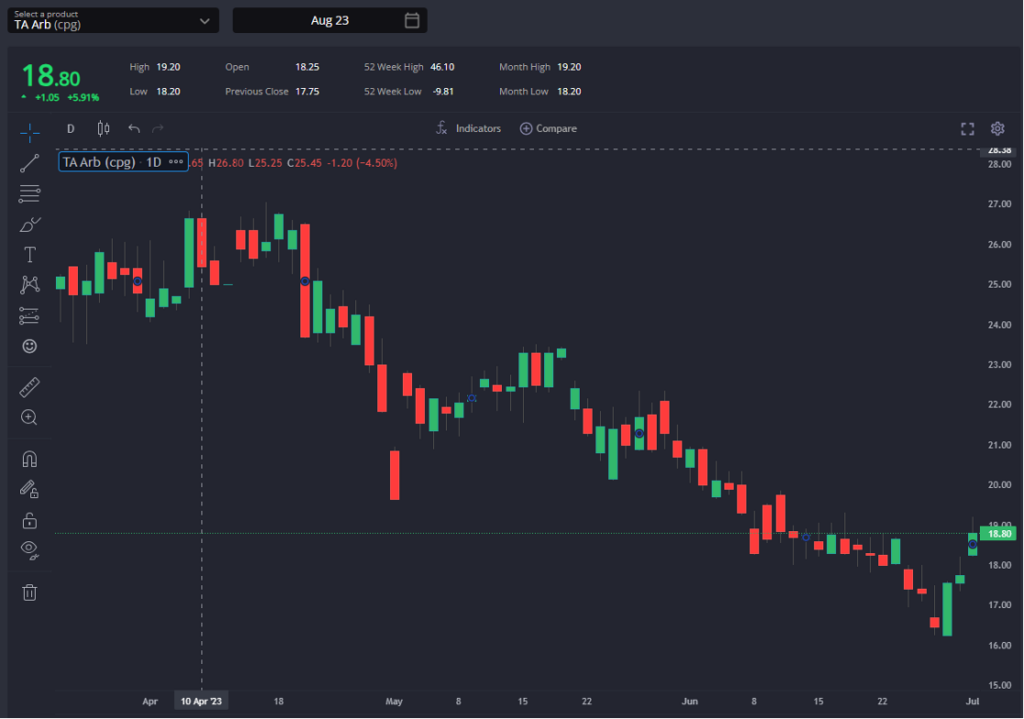

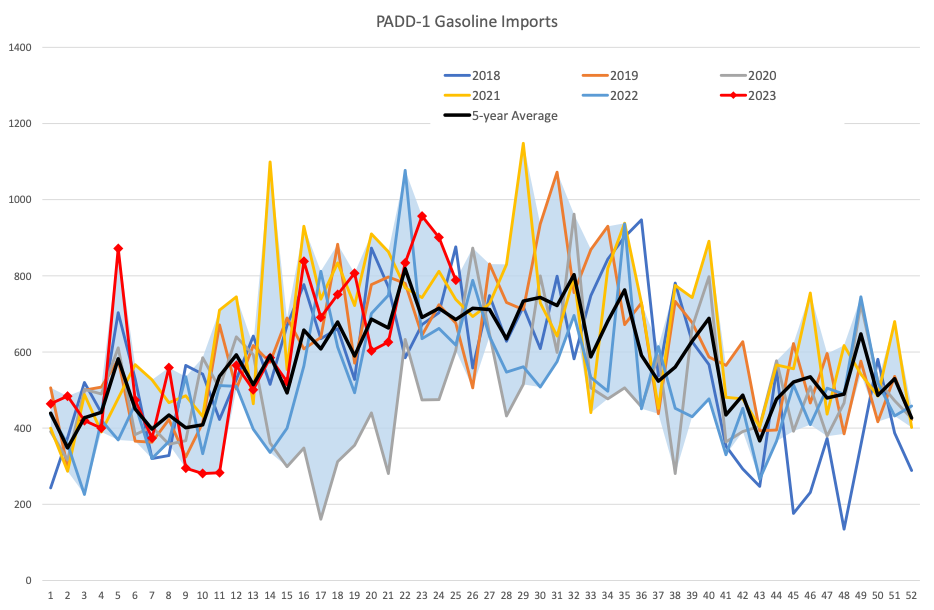

A significant driver of the strong Atlantic Basin gasoline market continues to be the TA pull, with PADD-1 fundamentals continuing to draw plentiful volumes out of predominantly European homes. This arb has now been firmly open since mid-June, and we should see a continuation of recent high import volumes into PADD-1 as a result.

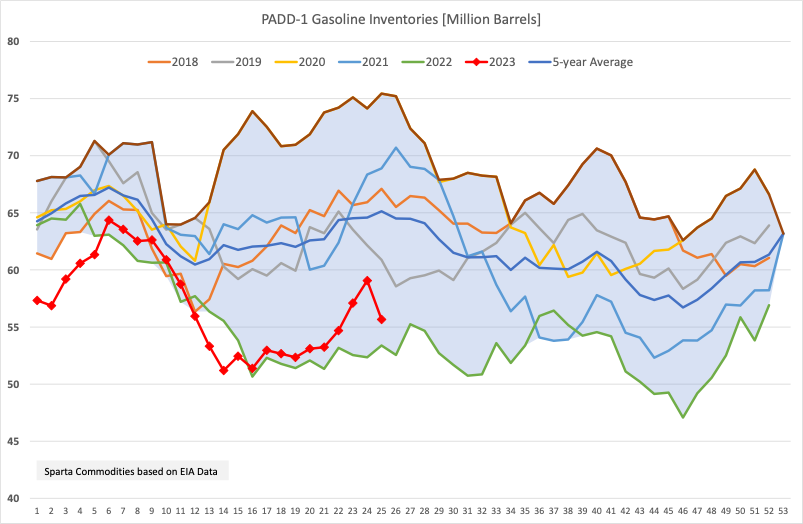

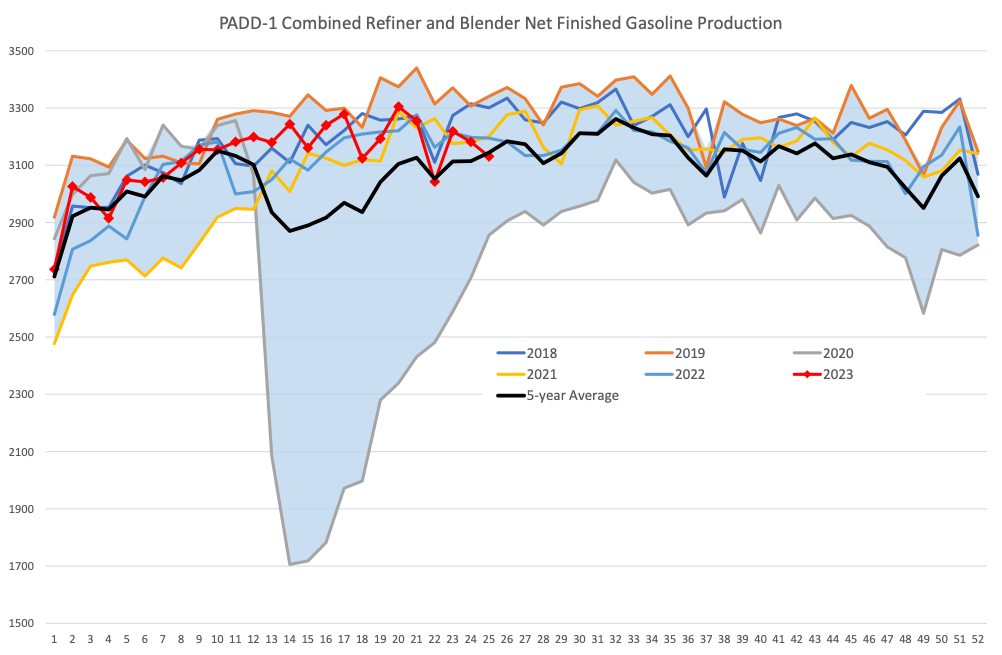

Total combined domestic (refiner and blender) gasoline supply plus imported volumes into PADD-1 have been at the high end of the historic range through June largely thanks to an uptick in imported volumes, and this trend looks set to continue, with the TA spread’s downward trend having also found a bottom recently and begun ticking higher once more.

The dynamic which has seen PADD-1 becoming more heavily reliant on imports is visible in the weekly EIA data as well as the fact that the front weeks of the TA arb as calculated in the Sparta platform have been consistently open since mid-May or even earlier.

Inventories fell in the latest weekly data on the back of a downtick on the supply side, although we are reminded to take individual weekly movements with a pinch of salt and rather average out recent weeks. When we do this, however, it remains clear that the reliance on imported volumes is not going anywhere anytime soon.

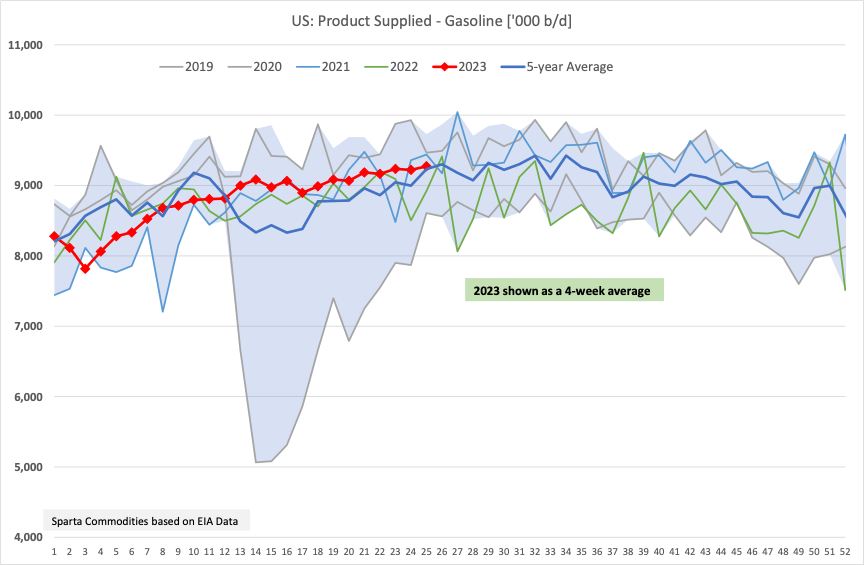

Despite a return to extremely wide gas-nap spreads, NYH/PADD-1 blending operations appear to be struggling to turn this into a noticeable uptick in regional supply. Again, this is being borne out in the open front end of the RBOB arb calculations, and with very few easing measures likely in the short-term, it seems likely that this will also roll down the curve into August as we move closer.

With the demand side of the equation in the US remaining solid but not extraordinary, it would appear as though PADD-3 (despite comparatively high run rates and gasoline supply figures) is being attracted to lucrative export markets at the same time as being asked to fill the colonial pipeline.

Houston remains the supplier-of-choice for the vast majority of the Americas in the prompt, and although US gasoline exports have been lagging 2022 in recent weekly figures, US export activity looks set to remain uncharacteristically strong through the summer months, with PADD-1 instead relying more heavily on European barrels.

This tight Atlantic Basin market is allowing the AG to become the cheapest source of supply into both WAF and Brazil currently, but it remains to be seen how quickly buyers in these regions are able to pick up on these signals and switch suppliers.

Finally, with naphtha remaining a driving force behind much of the open blending opportunities at the moment, we continue to see a relatively weak outlook for naphtha and associated petchems in Europe in particular.

Contango in this market is deepening, with storage calls the main outlet currently. OSN and cracking naphtha remain at negative premiums and heavy qualities moved away from the higher values reached two weeks ago, although escalation persists above 100 $/mt.

Despite gas-nap spreads in Europe exploding out towards last year’s levels, heavier naphtha premiums have softened recently, pointing once more to a limit already having been found for naphtha blending into the gasoline complex.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com