Octane crunch continues in ARA as gasoline premium over naphtha reaches record levels

We’ve been calling a summer gasoline crunch for a little while now, and the last week certainly saw it arrive in full force.

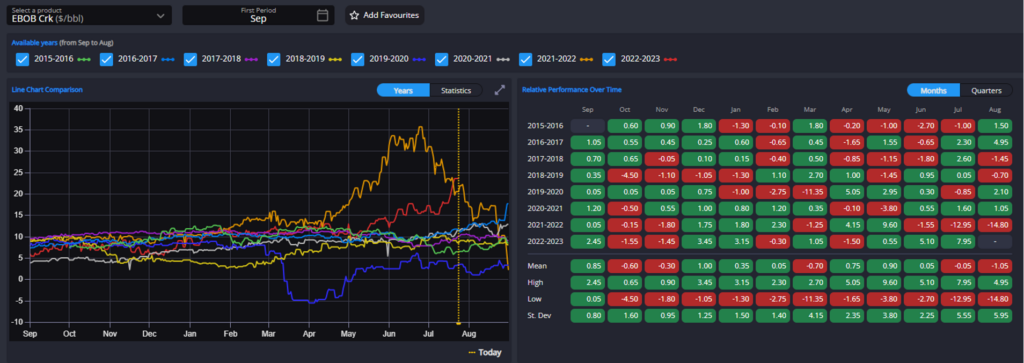

Although we are not *yet* hitting the same levels that forward cracks peaked at during parts of last summer, we are seeing July ($31/mt), August ($29/mt), and September ($24.50/mt) cracks all now above their end-July 2022 levels following last week’s rapid rises.

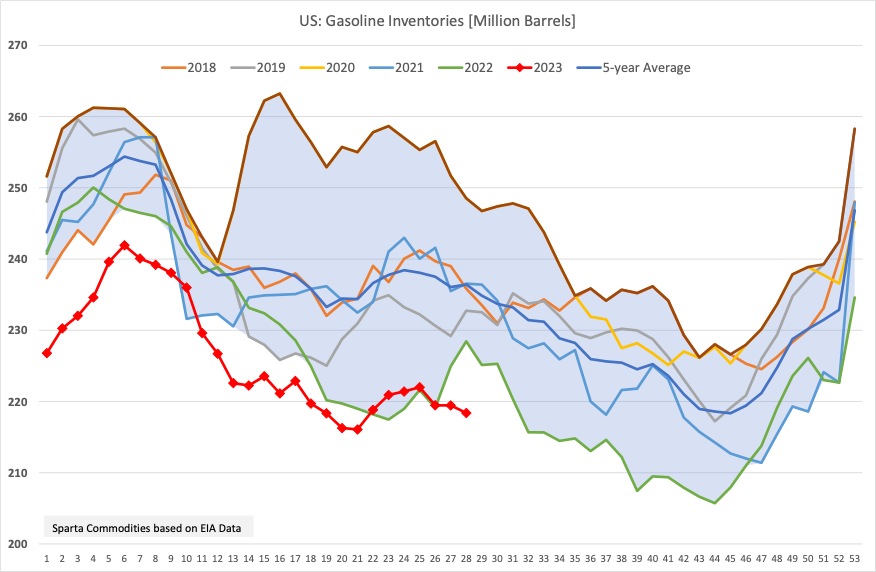

The Atlantic Basin gasoline market has been playing with fire all year long, with inventory building through Q1 unable to overcome its low starting point in the face of a heavy distillate focus in both Europe and the US, and now a supportive demand environment is putting increasing pressure on operational inventory levels in both Europe and the US.

Interestingly, whilst headline ARA gasoline stock levels appear rather healthy, relative pricing would suggest that the barrels filling those tanks are not the kind of quality that the market is crying out for as it faces of deluge of naphtha it remains unable to squeeze into the finished gasoline pool.

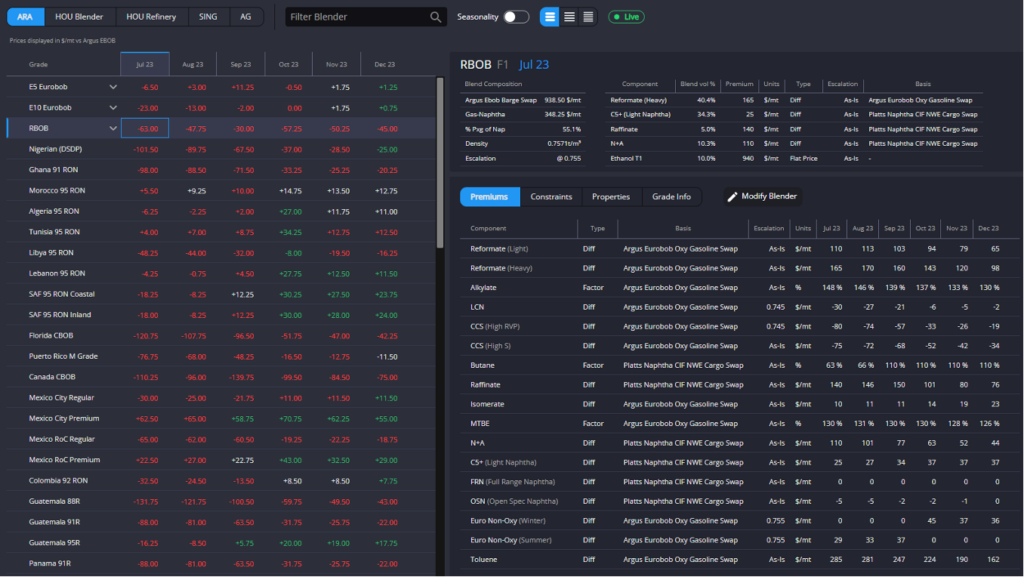

This is being borne out in physical component premiums in ARA, where prompt Alkylate barrels are trading around 150% of the EBOB quote, heavy reformate has moved up to a $170/mt premium in August, up from low triple-digits at the beginning of summer, and Toluene and MX premiums have soared by another ~25% since the start of the month.

All this is proving troublesome for producing many finished grades – including EN228 – but is keeping the door just about open for producing RBOB blends which can place economically into PADD-1.

With RBOB spec theoretically able to take around 55% of naphtha-type components, the sharp discounts on naphtha-linked barrels mean that even at 40% heavy reformate the RBOB blend is still coming in $65/mt cheaper than EBOB in July and over $50/mt cheaper vs August EBOB.

It is therefore unsurprising that TA freight rates have begun to pick up, likely on the back of increased fixtures interest as blenders look to markets able to absorb finished barrels with greater naphtha shares.

Brazilian barrels for example, with their large blend of high octane ethanol, are perfect candidates (our Brazilian spec blend in ARA currently contains around 75% naphtha-priced components pre ethanol-blending), and ARA is currently pricing as the cheapest prompt source of supply into Brazil on the back of discounted naphtha availability.

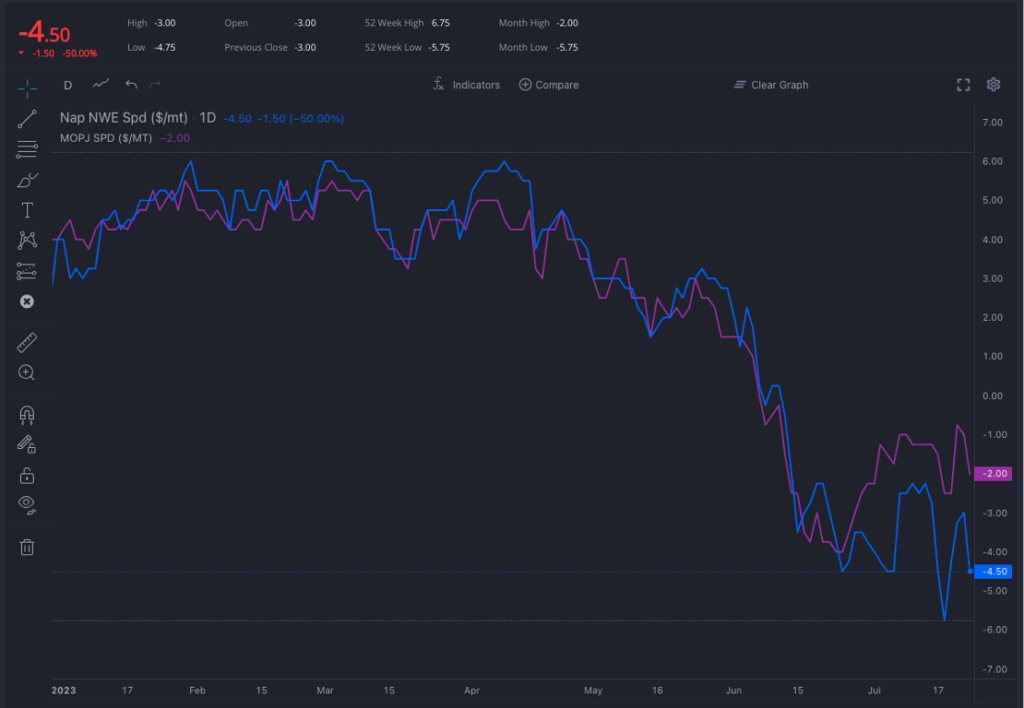

With gasoline strength set to remain, our attention turns to the naphtha market, which remains in contango through Q3 in both Europe and Asia as storage plays become unavoidable in this weak demand scenario for the lighter specs in particular.

The E/W spread has widened marginally over the last week, but the current $8/mt spread for August swap is not enough to open the arb to Asia for paraffinic grades despite low physical premiums in Europe as the demand in Asia for OSN is keeping physical premiums there similarly depressed.

Nevertheless, last week values showed spot opportunities for A-grade from the Med, given the price escalation for N+A content. Furthermore, heavy qualities from USGC could join these arrivals with the current -110cpg discount to RBOB.

The widening gas-nap spread is keeping heavy naphtha premiums over 100 vs OSN in Asia and Europe, while the Asian market shows small discounts for OSN and NWE dropped last week to -$10/mt in a bleak outlook for petrochemical demand.

With current prices the focus for this week would be if Med lifters are able to get a better netback from Asia than NWE in the short term, while NWE keeps punishing light grades and keeping storage as an option for the petrochemical feedstock.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com