No one wants to be short

US and Caribs keep pulling high octanes in the form of reformate and eurogrades from NWE and Med. This is on the back of a heavy maintenance program in the region and a preference to blend relatively cheap European octanes with even cheaper domestic naphtha.

This 2022 trend will most probably continue in 2023. ARA will lose some of its blending allure and finish grades will now be blended in both USGC, Caribs and NY with cheap domestic naphtha.

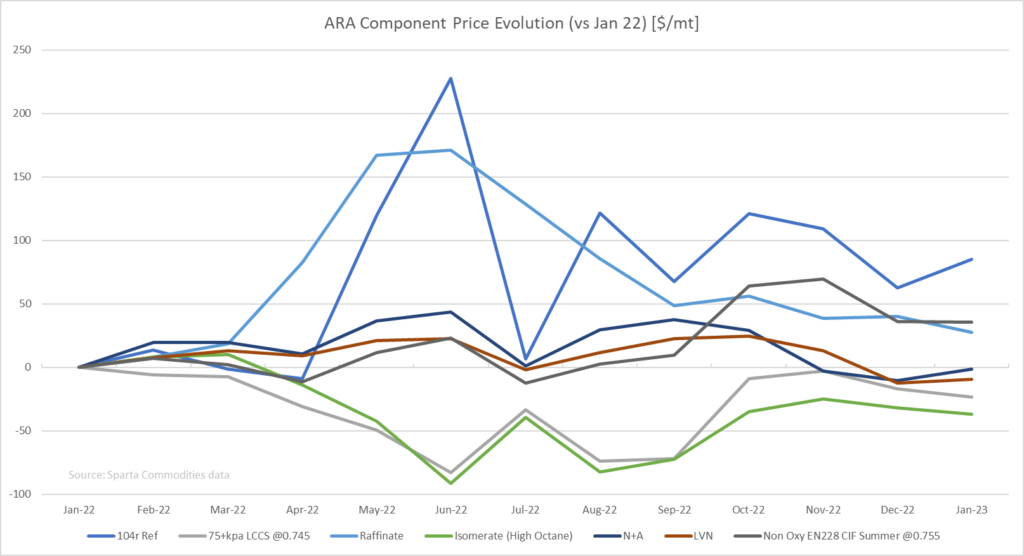

As you can see on the below chart, high octane/low RVP component cash diffs have clearly outperformed the other medium octane and medium/high RVP components since the start of 2022.

The constant exports of high octane material (to the AG in December and now TA) is making traders nervous about the potential lack of summer supply as we enter summer. This explains the run up of both cracks and spreads in Q2 and Q3.

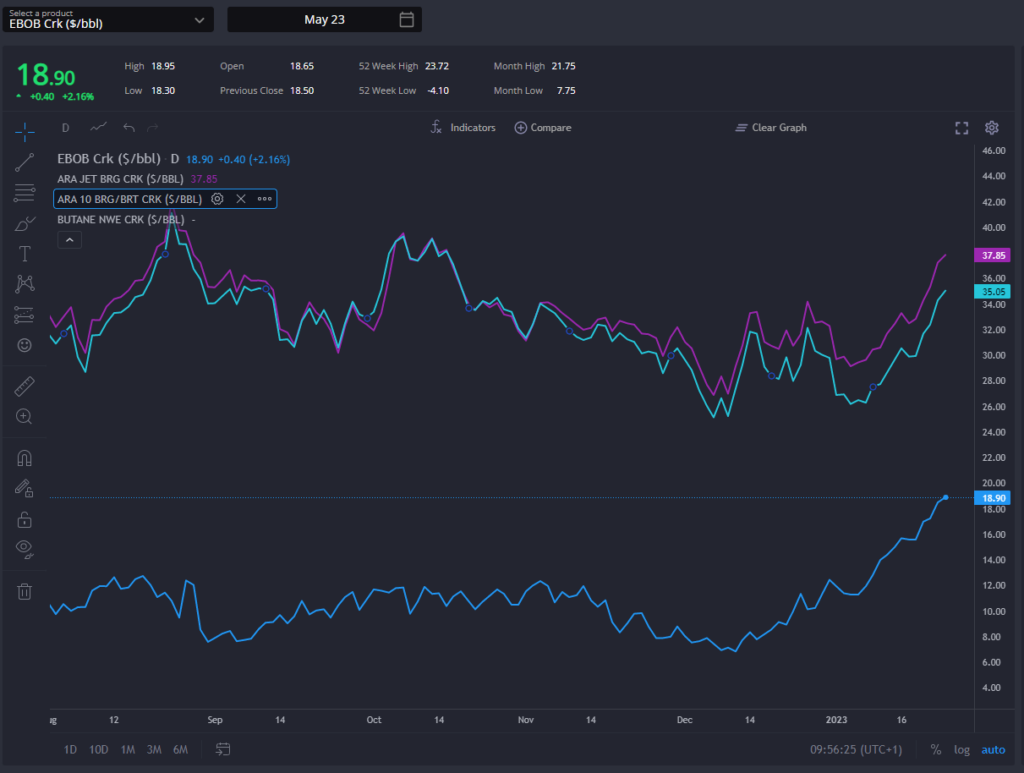

Gasoline cracks have clearly outpaced Diesel cracks over the last month with the objective of tempering refiners’ inclinations to maximise diesel at the expense of gasoline in the months ahead.

Although we are not there yet. But, as this bullishness was also expressed in time spreads, it has put Q1 gasoline cracks almost at parity to Q2. Is this justifiable? (Market makers must have had a blast matching summer crack buyers with spread buyers)

This continuous export of high octanes keeps making E5 blends un-economical. This in turn limits any selling pressure in the market (despite Feb/March now trading at +$9/MT). On the other hand we now see that E10 blends are now economical in both Feb and March (by $5/MT and 11 USD/T respectively).

Window activity this month has been timid with a very limited amount of volume trading. Yesterday, barges traded at flat to Feb. This can hardly be seen as a bullish signal and begs the question of why feb/March is trading at +$9/MT.

Naturally the whole market is concerned about what will happen to European supply post-Russian products ban. All European products spreads have risen over the last month in anticipation of a tight market. But then again we have had record imports of products in anticipation of these sanctions. It appears no one wants to be short here.

Finally, with the collapse of LR1 and LR2 freight rates globally, we now see open arbs from the AG into places like WAF and Brazil. Based on our cash diff forecasts this might be an ongoing trend and the AG will be a regular supplier into the Atlantic. Particularly with new refinery capacity as well as potential displacement of Russian barrels to be blended in AG

Once again no one wants to be short this market, and although the potential summer tightness is justifiable, we do see some weaknesses and inconsistencies in the prompt. But then again, who wants to be short?

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Felipe Elink Schuurman is CEO and Founder of Sparta. A former trader, Felipe drives strategic vision and growth at Sparta. Before Sparta, Felipe worked and traded for BP, Vertical and Gunvor.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com