Market lacking direction as regional disparities level out and hints of AG tightness emerge

The Singapore gasoline market continues to look very healthy on paper, with prompt Sing 92 cracks near double-digit territory (well above their seasonal average) and spreads solidly in backwardation through Q1 (unlike their Atlantic Basin counterparts).

However, underlying physical premiums are beginning to soften as supply out of the Far East gradually ramps up once more.

With the exception of MTBE and Indian export barrels, the premiums on blending components in Singapore have been softening, and this should begin to filter through to the Sing 92 quote before long.

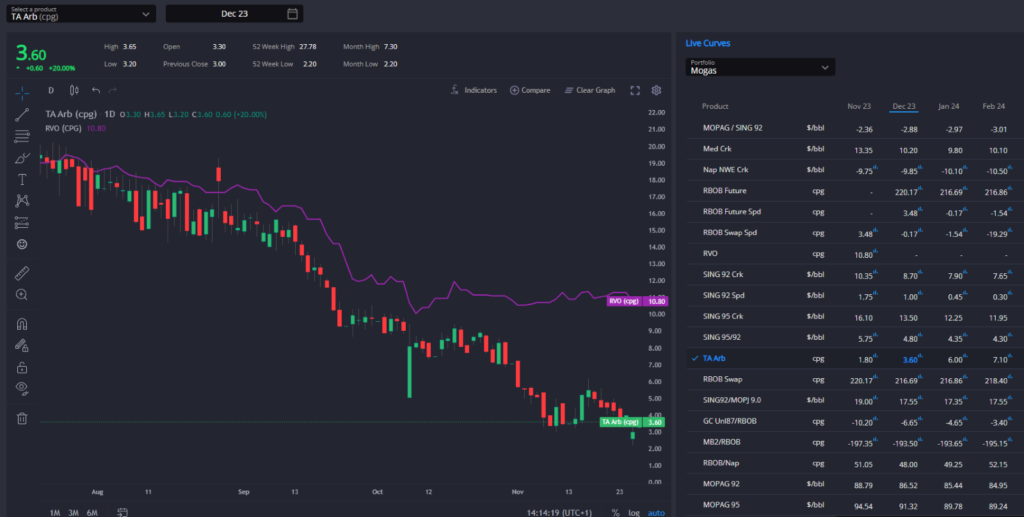

Alkylate premiums – as shown in the chart above – are just one example of this, and premiums on export barrels out of South Korea, Taiwan, and China have all been softening gradually over the last few weeks.

The same cannot be said for Indian export barrels and the predominantly Saudi-sourced MTBE volumes, premiums for both of which have risen recently alongside alkylate, pygas, and various naphtha streams in the AG.

The steadily increasing blend cost for various export grades out of the AG has been largely compensated for by falling freight costs out of the region.

The availability of vessels in the AG appears to be high given developments in freight rates currently and may reflect lower product availability/exports rather than a lack of interest in sourcing barrels out of the region.

Without wanting to sound like a broken record, we often caution against assuming that the AG can actually supply all of the various destinations to which it is theoretically the cheapest source of supply, and instead should look to the comparison between Singapore and ARA landed values to determine relative East/West strength.

On the basis of this, the E/W is finely poised and looks largely component/grade specific as to whether ARA or Singapore is cheaper, giving no strong direction either way for the next few weeks of E/W Gas movements.

In the Atlantic Basin, not much has changed as the region remains overall well-supplied with a tilt towards the US still providing the lion’s share of the pressure.

The US gasoline market is nothing if not price responsive, however, and already the RBOB/GC Unl87 spread has rebounded back to ~6.5cpg down from the 11cpg it bottomed out at when it almost opened up opportunities to move volumes on Jones Act vessels.

PADD-3 blendstocks pricing has stabilised recently and we’re beginning to see some small rebounds as US crude runs appear not particularly high at the moment, despite decent cracks on the East Coast, with PADD-3 runs impacted by the need to avoid escalating stockbuilds.

The latest weekly data saw the US running almost a full 1 million b/d below recent seasonal levels, with around half of that coming from PADD-3.

PADD-3 appears to be mirroring the AG market currently, with increasing freight rates hampering masking much of the underlying discount available in pure blend costs for Lat Am grades out of Houston vs ARA.

The current level of difference in landed price into Mexico, for example, shows that the actual competition is for placing barrels currently into the likes of Brazil or other ECSAM destinations, where the competition has been increasing recently thanks to higher freight rates out of the USGC.

Finally, with PADD-3 apparently successfully evacuating excess gasoline volumes and curtailing new production slightly, PADD-1 becomes the focal point for determining the direction of the TA Arb.

Although the prompt TA arb continues to fall, and there is likely still some downside for Jan and Feb, we are no longer quite as bearish on the Q1 TA arb and a bottom now around the 5cpg level seems likely assuming RVO values don’t move dramatically between now and then.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com