Little change into the New Year but supply constraints and robust demand should keep market well supported

The US remains the supplier of choice for the Atlantic Basin, including muscling in on the WAF market for much of the prompt market as TA spreads remain narrow and components outside of reformate in the US remain well-offered.

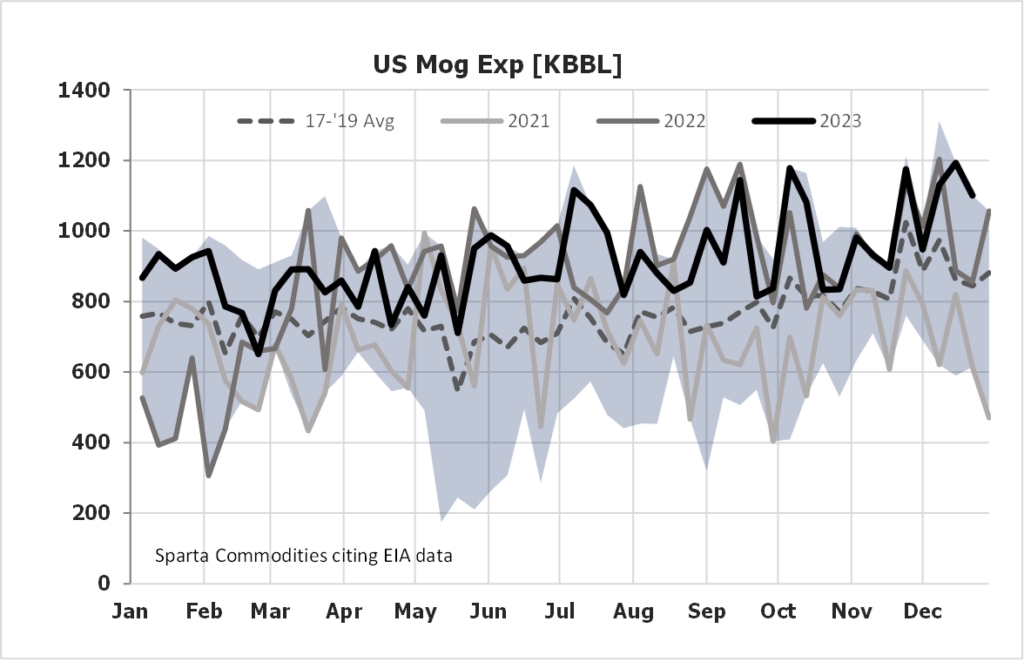

The shift we saw to see the USGC pricing more aggressively to export in November appears to have begin bearing fruit in December, with US gasoline exports averaging consistently above the 1 million b/d mark in the last five weeks.

With US pricing remaining in a similar space, exports should remain high through January.

PADD-3 inventories have begun to take a dip as a result, and with a hefty maintenance schedule on the horizon in PADD-2 and PADD-3, the typical Q2 stockbuilding pattern in the US could unseasonably slow this year, setting up a strong Q2 further down the pipe.

On the other side of the Atlantic, Europe is still pricing attractively into African and Middle East destinations, with the AG pricing uncharacteristically high thanks to turnarounds there too.

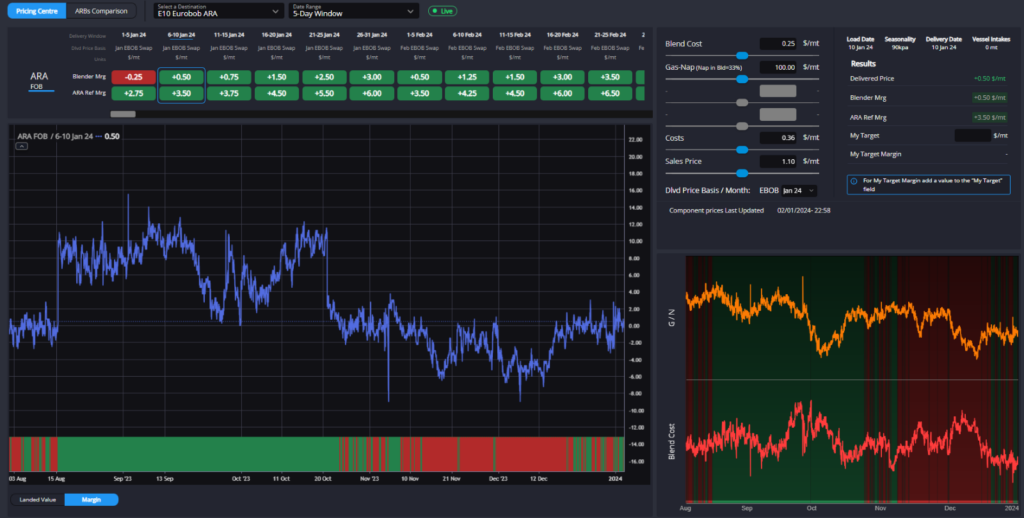

This is providing a timely outlet for ARA blenders, but appears not yet enough to move EBOB out of its Q1 contango or provide a noticeable uptick in component pricing (with a notable exception of reformate, which appears well-supported globally currently as octane premiums continue).

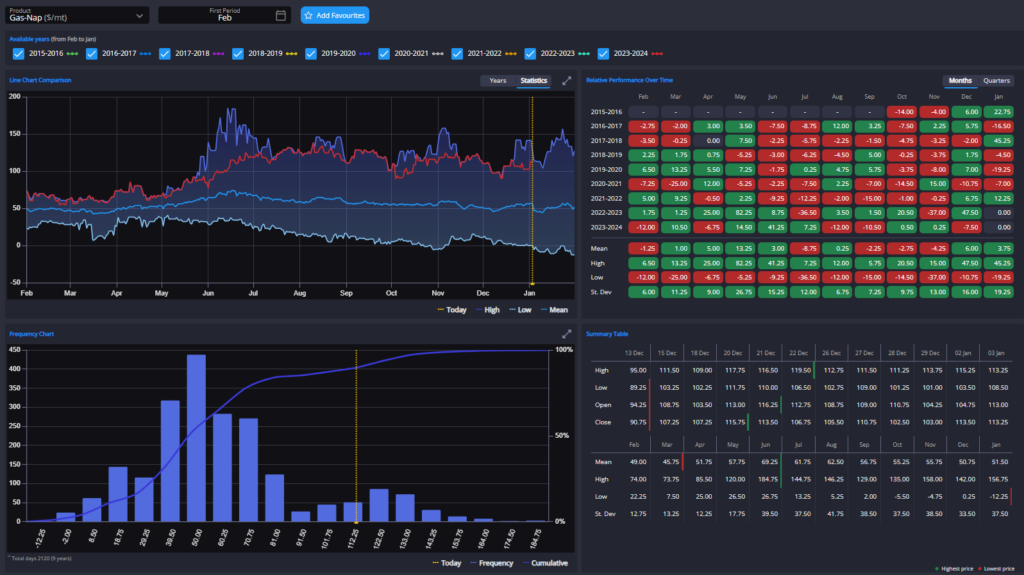

Component pricing has remained distinctly rangebound indeed, with a rebound in gas-nap spreads since they dipped below $100/mt before Christmas allowing E10 blend margins to move back toward parity in the prompt and back into thoroughly workable territory come February.

Although there is not the same noise around turnarounds in Europe as there is in the US or Middle East, the incentive to provide finished barrels to the market remains high and with current blend and export economics it may not be too long now before EBOB returns to backwardation in February.

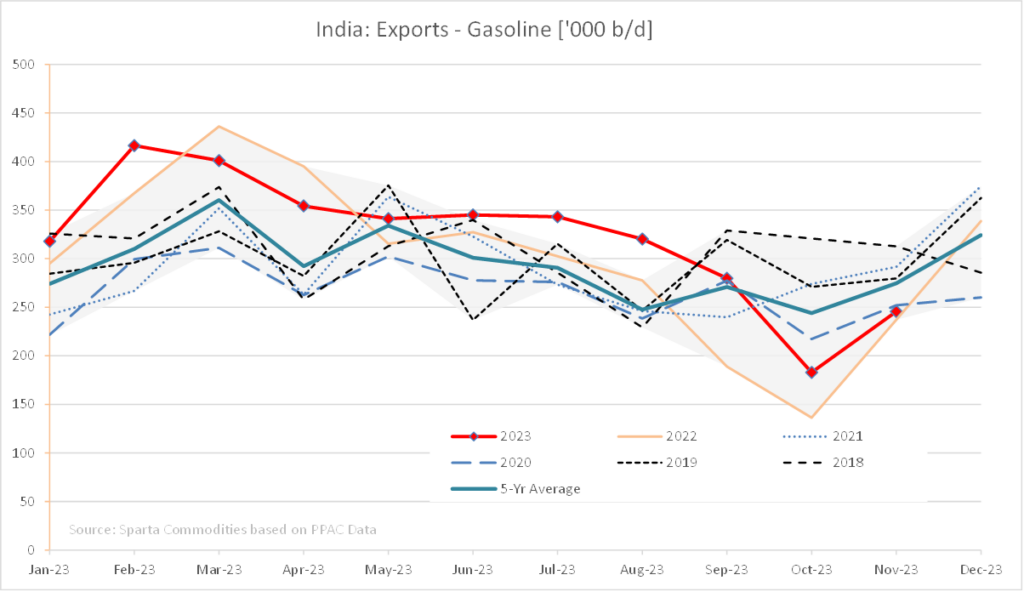

In Asia, the absence of export growth from major exporters China and India is helping to maintain a healthy market outlook, with regional demand apparently strong enough to negate any need to price more competitively into export markets outside of Asia or even to defend its ‘core’ markets from more aggressive US and European pricing.

The Sing92 structure remains in a mild backwardation as of late, and is unlikely to come under any increased pressure despite a lack of obvious export outlets going forward as supply from major producers into Singapore remains constrained and regional demand robust.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com