Is this the end of the summer bull party?

The sentiment at the start of the year was positively geared towards a hard landing of the economy and above-average summer runs, painting a bearish picture for the market in Q3. But then the mood started changing and what was a guaranteed hard landing, became a probable soft landing.

Demand in the West remained robust and stocks remained below seasonal averages. With the sentiment shift commodity prices have been on a straight line trajectory (up) since May or June (depending on the product).

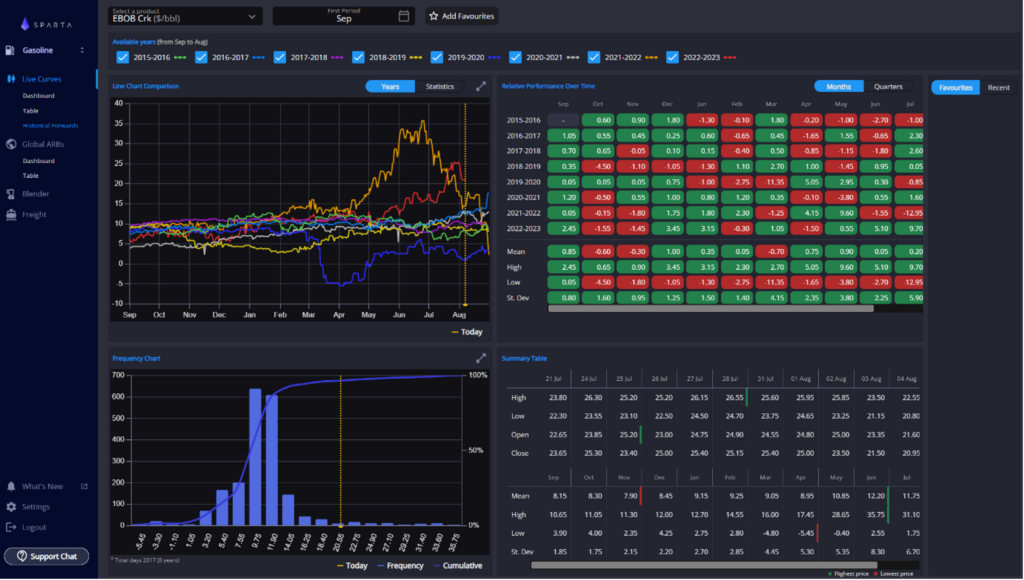

For those who thought that we could not see a repeat of last year…think again. We might have not hit the record cracks and spreads of 2022, but today both Sept cracks and Sept/Oct spreads are at the highest in the last 8 years.

Combined with a sentiment shift, and a probable short covering from financial institutions, we started to see the first unplanned outages in very sensitive locations close to pricing centres (Pernis for instance).

This triggered a recent rally in flat price, cracks, spreads, and gas-naphtha differentials. It seems that it didn’t matter how you expressed your bullishness, as long as you were long – happy days!

But did everything change on Wednesday 02 August 2023?

Wednesday EIA showed an unexpected build on gasoline inventories nationwide and prices fell the bearish pressure along cracks and differentials in US and Europe.

Every gasoline-related price changed overnight tumbling down looking for support. Ebob spreads only started rebounding at $70/bbl, after a $13/T drop in just a week.

Was last week’s surprise stock build a harbinger of a change in market sentiment and trend?

Looking at the price action in the window, one could argue that the sentiment has not changed. With only 1-4kt trading daily, the market is happy to trade at a $55-60/MT backwardation. Taking into account the summer/winter quality spread, Sep/Oct is trading also trading at a steep $40/MT backwardation.

The trend on the other hand could be shifting:

Following the dramatic 11cpg drop on trans-Atlantic ARBs last week, the market hasn’t recovered and all arbs to NYH remain completely shut for both traders and refiners.

At the time of printing, August and September ARBs are closed by 9.75 and 9.4cpg respectively. It is also worth noting that blending E10 is actually profitable by $8.50/MT and blending E5 is almost profitable.

Following the correction, the USGC has regained control over the shorts in the Atlantic basin and is now the cheapest source of supply into key shorts like Canada, Mexico, and Florida. Whereas we continue to see subdued demand for gasoline in Nigeria where imports remain 30% lower off the back of the scrapped government subsidies.

If imports were to resume, shouldn’t they attract AG barrels, that are landing $22/MT cheaper than ARA?

Given the above picture and with a $50/MT backwardation being printed, blenders have all the incentive to maximise E10 and E5 blends. Will we see more selling pressure in the window?

With the start of the week market rebound hitting the support of the trend channel on spreads and Sep/Oct closed the day at $73/MT.

The next days are crucial to see if the trend continues. Is this the beginning of a new bullish offense or simply a dead cat bounce?

Indeed the bulls still have many compelling arguments:

To start with the diesel September cracks are now $10/bbl higher than gasoline cracks. Perhaps in preparation for the winter season.

It’s also worth noting that the combination of lighter/sweater crudes and record-breaking temperatures have forced refiners to cut deeper to keep columns under control during the warmest of weeks.

In the near term, this will tighten the gasoline supply, just as we move into an uncertain hurricane period and seasonal refinery maintenance. With high water temperatures, experts are predicting an above-average hurricane activity by as much as 30%.

With this uncertainty in place, it’s hard to predict if the market had a healthy correction and is still pointing up or if this is the beginning of a new trend. We would be keeping an eye on the moving averages and trend channels.

Felipe Elink Schuurman is CEO and Founder of Sparta. A former trader, Felipe drives strategic vision and growth at Sparta. Before Sparta, Felipe worked and traded for BP, Vertical and Gunvor.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com