Gasoline market settles into a Q4 rhythm despite ongoing AG disruption

To begin with the most unusual piece of insight from Sparta’s platform this week, prompt arb opportunities to place barrels out of Singapore into the AG have appeared amid ongoing and lengthy refinery maintenance in the Middle East.

Forward pricing suggests that the opportunity may be short-lived, however, with late-November arrivals already pointing back quite evenly towards ARA or locally-sourced barrels.

The fact that this opportunity is open at all is becoming increasingly rare as both local refining capacity and inflows of blending components into the AG continue to move structurally higher.

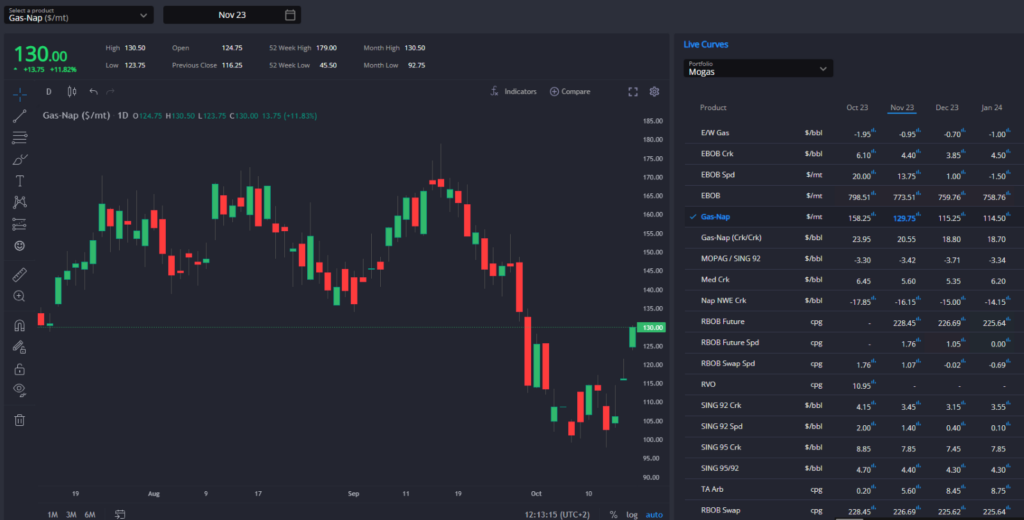

For now, however, traders will be snapping up comparatively cheaper barrels out of Singapore, helping to provide a floor after the Sing 92 complex largely follow Europe lower over the last two weeks.

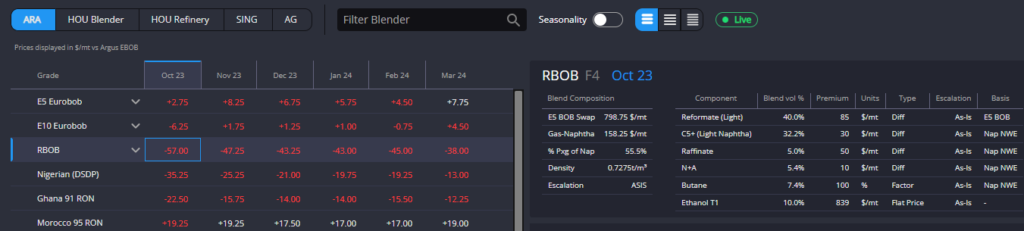

In Europe, EBOB blend margins are returning to more sustainable levels as the collapse earlier in the month evens out.

With the paper aligning to the physical market better once again, we should have reached a bottom for EBOB cracks now. Strongly negative blend marigns have had the anticipated impact on naphtha pricing, forcing naphtha cracks (-$16/bbl now vs -$11.50/bbl one week ago) and heavy naphtha physical premiums lower to open up the gas-nap spread once more.

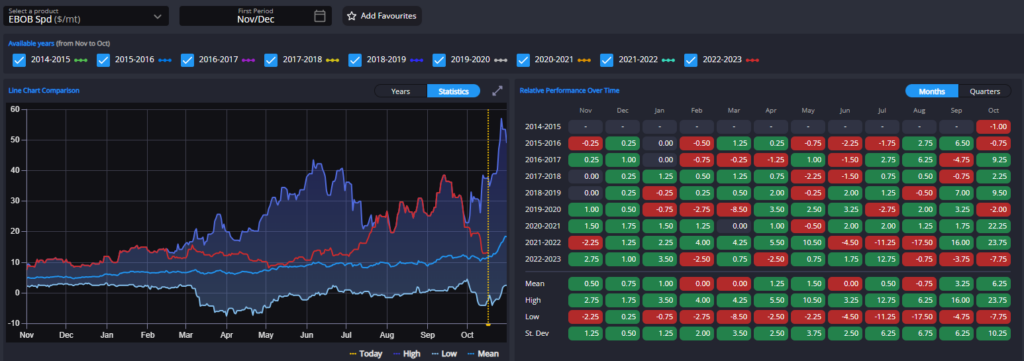

In terms of market structure, both EBOB and RBOB spreads through Q1-24 are now back in contango.

This is likely to stay that way through the months ahead, with no sign of strong northern hemisphere demand needing to interrupt typical stockbuilding behaviours and refiners anyway set to run hard to fill diesel shorts.

Prompt EBOB spreads have fallen on the back of a subdued market overall, but remain above their seasonal average levels.

The backwardation in EBOB spreads through Q4 is likely to remain given negative blend margins and attractive arb econs out of ARA, although there remains room to the downside from current levels.

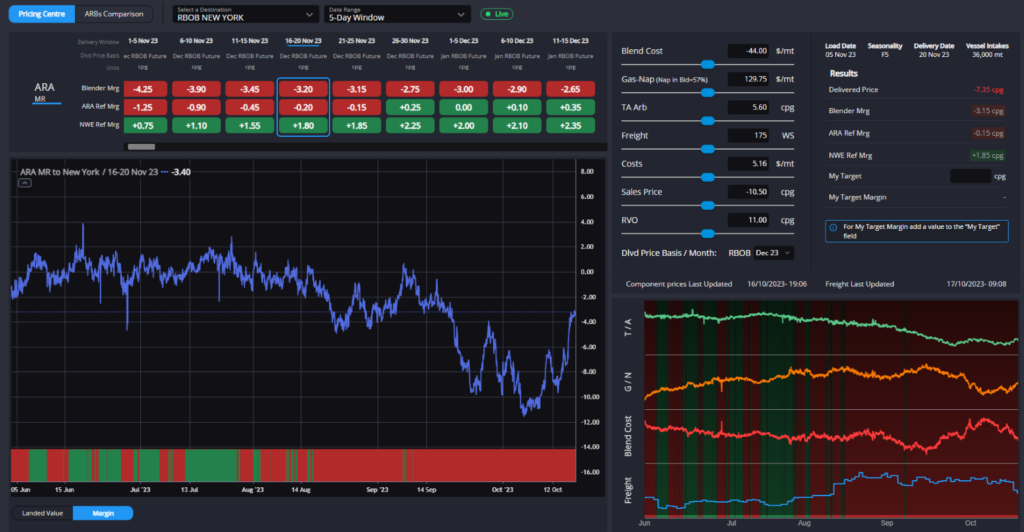

Finally, with regards to attractive arbitrage econs out of Europe currently, the TA arb has reopened through Q4 for the most advantaged European refiners only.

Falling blendstock costs (the high percentage of components pricing off of naphtha in the RBOB blend making the gas-nap spread particularly important) and a fall in freight rates have opened up this arb possibility again, especially through late-November and into December.

This route has already seen plenty of component flows continuing through recent weeks despite a closed RBOB arb, with heavy naphtha premiums in NYH in particular drawing blendstocks transatlantic, and we would be surprised to see this arb opening more from current levels.

The TA arb spread has been widening gradually in recent weeks, helped by weakness in the EBOB paper, but should be limited to the 6-7cpg range through the remainder of the quarter.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com