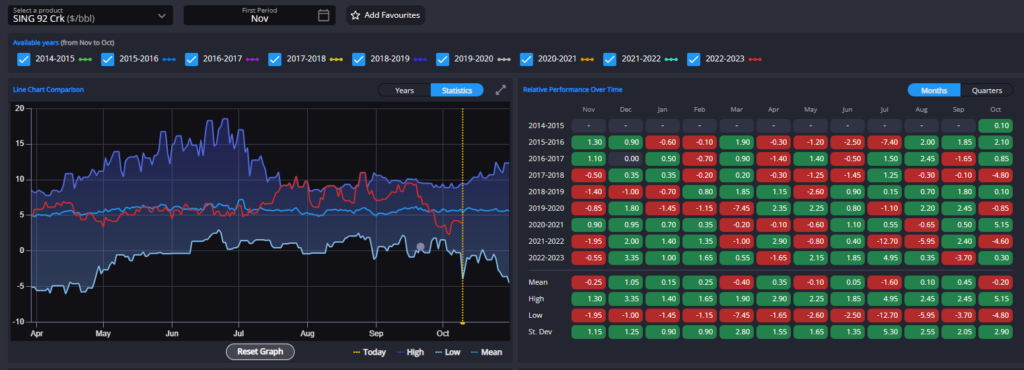

Gasoline cracks and spreads settling in for a more realistic winter following an explosive summer

Apparently not immune from the stronger-than-usual seasonal downturn in gasoline cracks in the Atlantic Basin, also Singapore markets have taken a turn for the worse recently, compounded by recent plentiful outflows from China and a return to service after maintenance from some major exporting facilities across the continent.

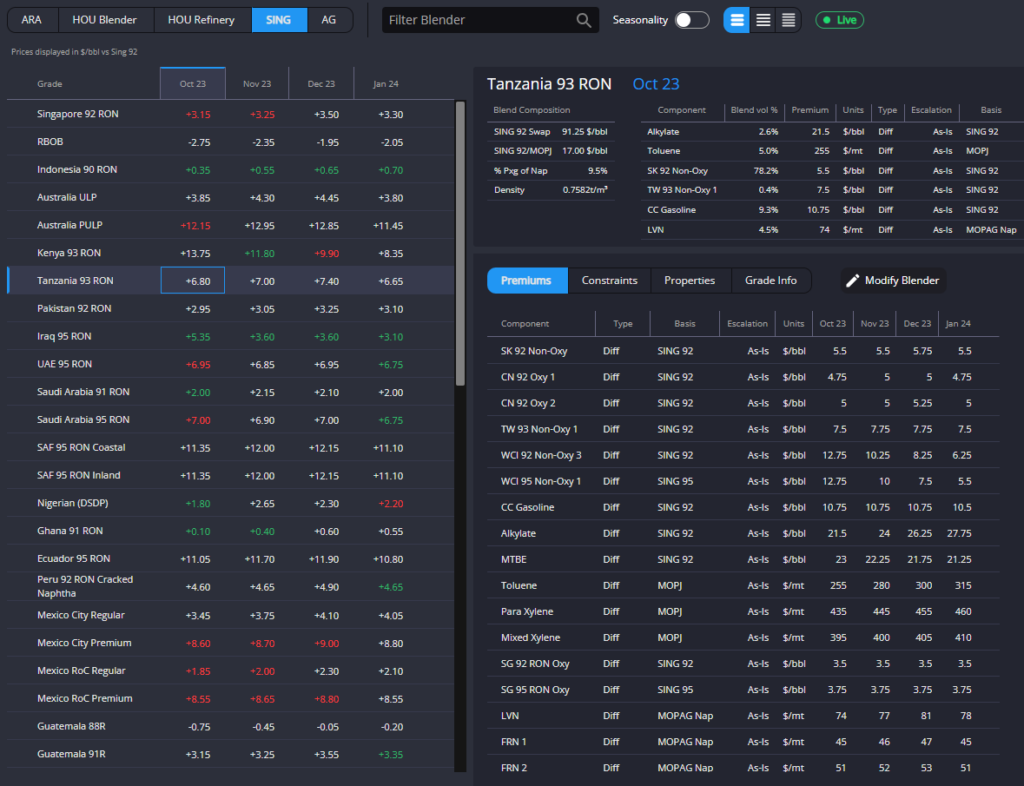

Looking ahead, component pricing in Singapore is such that Singapore-origin barrels are finally becoming consistently competitive with those out of ARA into South Africa, East Africa, as well as holding an advantage into Pakistan and SE Asia/Oceania destinations.

This should now provide a solid floor for the Singapore gasoline complex for the short-term at least, but with Atlantic Basin demand continuing to fall seasonally and volumes produced in the West likely to remain high for the time being, Singapore’s position as origin-of-choice is set to come under increasing threat from ARA.

Bullish bets on Sing 92 spreads or cracks are therefore difficult to justify at the moment, with short-term support from a competitive export position likely to erode as we move through the quarter.

In Europe, despite cracks falling to below 5-year average levels, both timespreads and physical component premiums remain only slightly below their historical highs from last year.

Gas-nap spreads remain similarly elevated, pointing to plenty of opportunity to blend finished grades for export, but E5 and E10 blend margins in ARA remain firmly closed thanks to last weeks dramatic selloffs.

The current market serves as a reminder that the physical market cannot and will not provide the answers to every price move, with financial players and herd mentality sometimes moving the market strongly in the short term.

However, eventually both refiners and traders need to be given adequate pricing signals to fill real world physical gaps, and for now that will likely mean keeping backwardation near current highs and not allowing the gas-nap spread to narrow significantly.

Finally, the TA arb remains firmly shut through the whole of Q4 and beyond following the recent sharp upticks in US weekly inventory figures as product supplied indicators show a dramatic fall in end-user demand for gasoline in the US in recent weeks.

Whilst this is likely an anomaly in the data and we would expect to see demand rebound somewhat in the next weekly data, it is true that also on a 4-week average basis demand has been poor in the US recently, keeping the TA arb shut for the foreseeable future and improving the availability of barrels out of the USGC.

Indeed, already USGC barrels are more competitive into West Coast Mexico once again after having to cede this destination to barrels out of Singapore through the summer months, and both East Coast Mexico and Guatemala have returned to pointing towards USGC for resupply rather than ARA for the first time in months, suggesting there is a healthy floor remaining for the PADD-3 market for now.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com