European tightness continues to drive market, exposing PADD-1 into Q4 and providing support to the East of Suez market

The story of the week continues to be the ongoing deficit in the ARA gasoline market. Barge prices have begun to settle down a little following the Total Antwerp refinery disruptions, but the EBOB timespreads remain highly elevated.

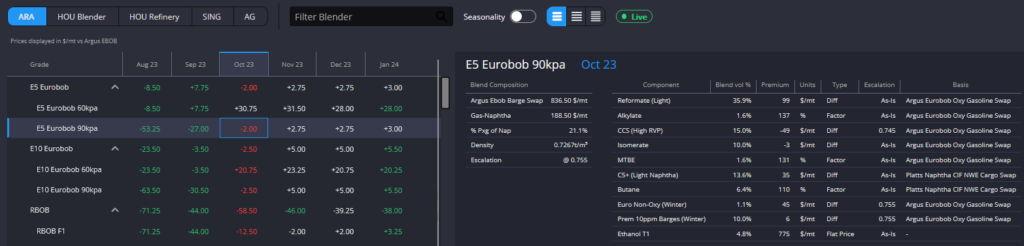

Whilst the Sept/Oct spread obviously contains the RVP switch seasonality, our blender currently puts the difference in the cost of producing 60kpa vs 90kpa E5 at ~$35/mt, leaving a $55/mt timespread which is consistent with the posted $45-50/mt spread in the Oct/Nov EBOB spread.

Whilst the exact level of the backwardation becomes largely theoretical at a certain point – the signal is clearly at “clear your tanks” levels – the impact that this is having on arbs is pronounced.

EBOB strength has pushed the TA arb to -7cpg in September, negating any new RBOB flows out of Europe for the time being and likely diverting EoS high-octane barrels which may otherwise have been destined for PADD-1.

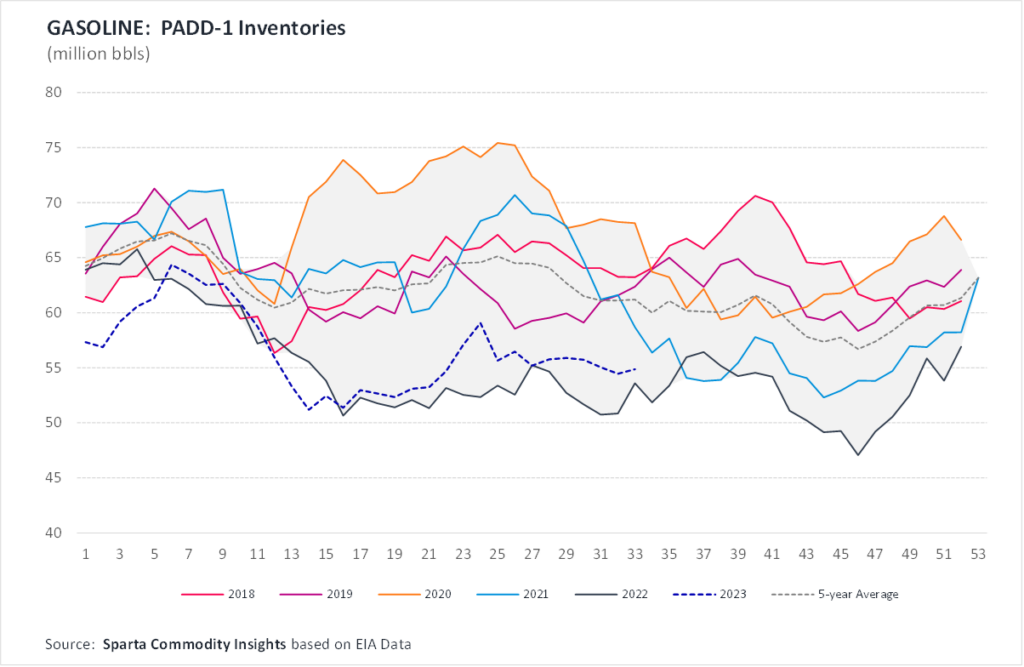

With the TA arb extremely closed, the PADD-1 balance is set to see more sustained deficits for at least the next few weeks. As such, we should expect Colonial space to be filled at increasing premiums, with competition for barrels out of the USGC remaining robust.

The negative TA spread is helping boost the attractiveness of Houston-origin barrels in the Americas over those from ARA. The arb into Brazil, for example, favours barrels out of Houston in the prompt even over volumes out of the AG in early-October, but is pricing less competitively towards the end of October as the HO complex strengthens again relative to EBOB and Singapore pricing into Q4.

Finally, although higher-octane destinations are favouring ARA, the largest volumes in the Americas continue to point primarily towards Houston in the prompt, which is likely to see the HO complex needing to price up to retain USGC volumes domestically once inventory draws begin to pop up again in the EIA data for PADD-1.

Strength in Europe is influencing the whole of the Atlantic Basin, and in doing so is opening up opportunities for Eastern barrels to find homes in destinations typically supplied by either ARA or the USGC.

We have mentioned repeatedly in recent weeks that the Nigerian/WAF short should be looking to lift exclusively from the AG at current levels, but also in Western Mexico we are seeing economics pointing directly at Singapore rather than the USGC.

Whilst this is certainly being helped by the ongoing Panama Canal delays, Pemex currently have a number of fixtures coming in from the East and the forward arb levels continue to point to this being the preferred source of resupply for the Pacific Americas through Q4.

Although the EoS balance has been lengthening in recent years, and is being significantly boosted by cheap Russian naphtha arrivals and capacity additions in the Middle East and China, the current global arb matrix appears unsustainable throughout the winter.

With the AG providing the cheapest source of supply into WAF, EAF, ECSAM and the whole Middle East – and Singapore the 2nd cheapest source for the whole of the EoS even into the winter months – a negative E/W throughout the entire winter curve is going to place a real stress on physical EoS availabilities.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com