European strength filtering down the curve as winter brings only slight respite

The hot topic of the summer, gas-nap spreads, remained flat over the last week, maintaining their recent record highs. The wider market appears to have accepted that gasoline quality and excess straight-run naphtha are a problem that needs to be priced out of at least for the next few months.

Looking ahead, with the switch to intermediate and winter specs as we move into Q4, our blender is currently able to include much higher percentages of naphtha into the EBOB, RBOB, and CBOB blends that it is producing from October onwards. This helps to explain the discrepancy between current gas-nap spreads at over $300/mt and November which is currently trading around the $165/mt mark.

For context, the December gas-nap spread is currently sitting around the $140/mt mark – the same level at which it settled last year, potentially leaving some room to the upside in this contract given the exacerbated light crude slate issues and Russian product sanctions vs last year.

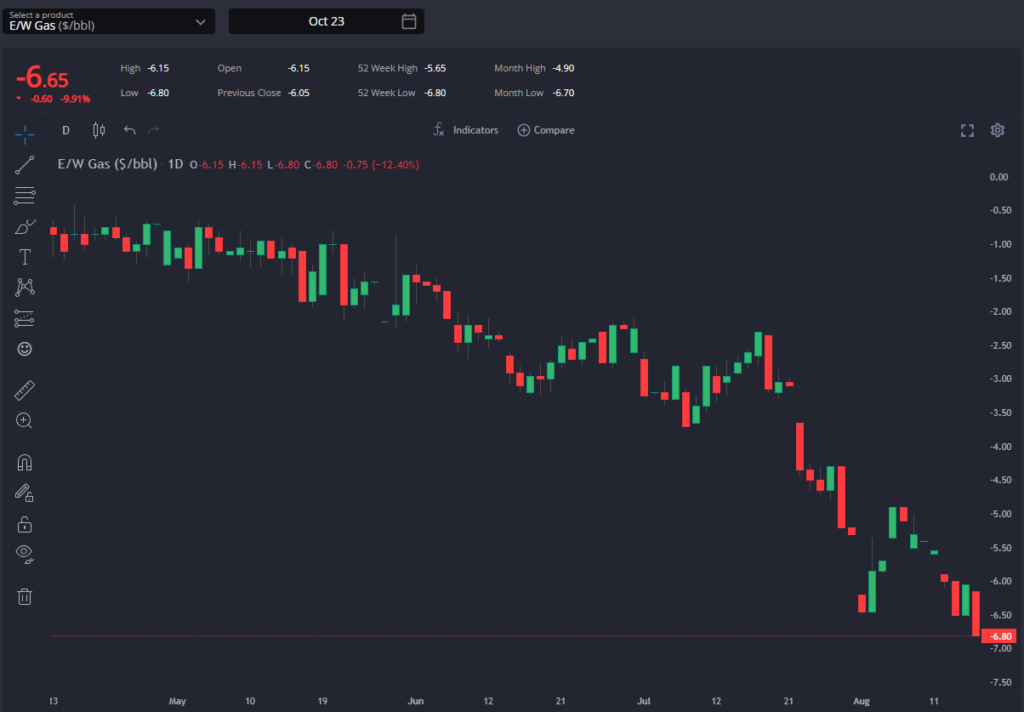

E/W spreads have been widening sharply down the curve through recent weeks as prompt Atlantic Basin tightness is seen filtering through into Q4 as well. This comes despite there being no apparent abundance of finished gasoline in the EoS (Singapore onshore stocks are at a 16-month low currently), and rather points to ongoing concerns around finished gasoline quality and availability out of ARA through Q4.

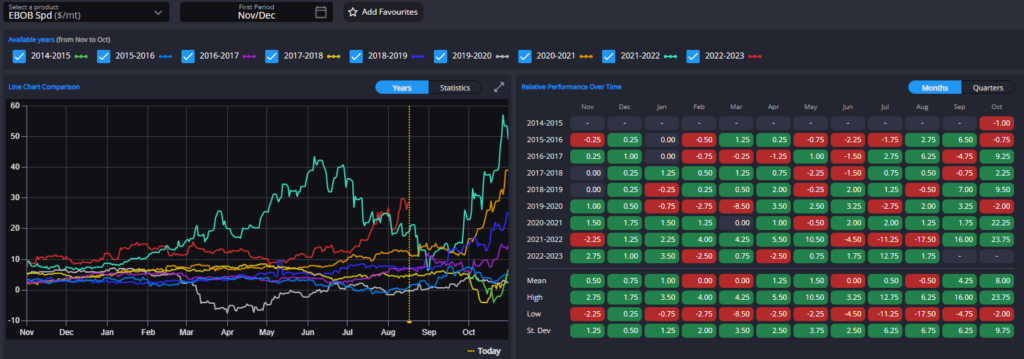

The Oct/Nov EBOB spread has recently ballooned out to just shy of $30/mt – its highest seasonal level in recent years – and may have even further to go if historical precedents are to be believed (see chart). The wider E/W spreads are keeping Europe-origin barrels firmly out of the EoS also into the winter gasoline season, with almost every major destination in the Middle East, East Africa, and Asia all pointing to Singapore rather than ARA as their supplier-of-choice after discounted AG barrels.

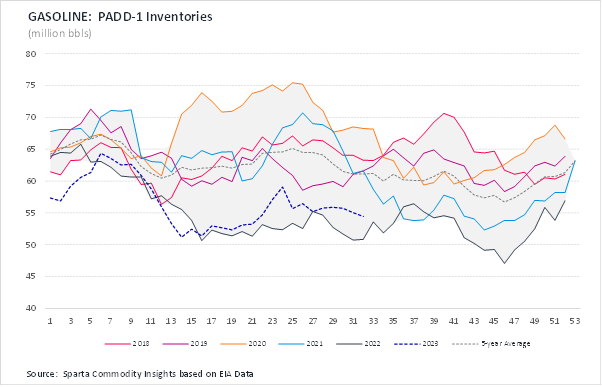

European strength is also evident in the continued narrowing of the TA arb, the September contract having flipped to negative values for the first time over the last few days whilst the October swap has dipped to single digits. The US side of the spread has softened marginally as recent weeks have seen US nationwide gasoline draws slower than their seasonal average rates, raising the prospect of a healthier inventory picture by the time potential hurricane disruption rolls around through September.

With the TA arb very firmly shut now through the prompt, any large hurricane which hits PADD-3 and leaves PADD-1 unscathed would likely necessitate some very large swings in this spread to incentivise additional prompt barrels into PADD-1.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com