European and Asian markets moving away from lows, bearish trend in US prompts USGC export rise

There was a marked bounce in time spreads and cracks on both sides of the Suez following the severe correction of the last two weeks.

The market oversold the decline in petrochemical demand, and although physical prices remain $5/mt lower in NWE than the March average, they have recovered part of the losses.

A moderate rebound and the correction of Brent at the beginning of the week have given cracks the wings to rebound from last week’s lows, with gains of $3/mt in the European and Asian time spreads.

European and Asian market paper trading higher after a big downtrend. European physical joining the rebound. (Sparta Live Curves)

Gas-nap keeps pointing to high bending margins and despite the considerable drop in petrochemical demand at the beginning of Q2, the economics of gasoline blending in Europe continue to show open margins for E10 and open TA arbs for NWE refineries.

This is marking a significant shift in the market, with a return to escalation in blending, LVN, and Heavy naphtha, where especially Heavy naphtha in Europe has surged $30/mt in just a few days, trading at $70/mt vs Nap NWE.

Source: Live Curves: Heavy naphtha prices reaching new highs on the back of stronger gas-nap and blending margins. Could reach a peak soon on the last gas-nap correction and increasing blending cost. (Sparta Live Curves)

On the other side of the Atlantic, the prolonged decline in naphtha prices vs RBOB and C5 has opened up new export opportunities from the Gulf, as reflected in the light and heavy naphtha arbitrage in the Sparta tool, which have been open since April 17 to NWE.

Arbs from USGC to NWE just opened for light and heavy barrels, supported by lower USGC FOB prices and NWE rebound. (Sparta Global ARBS – ARBs Comparison)

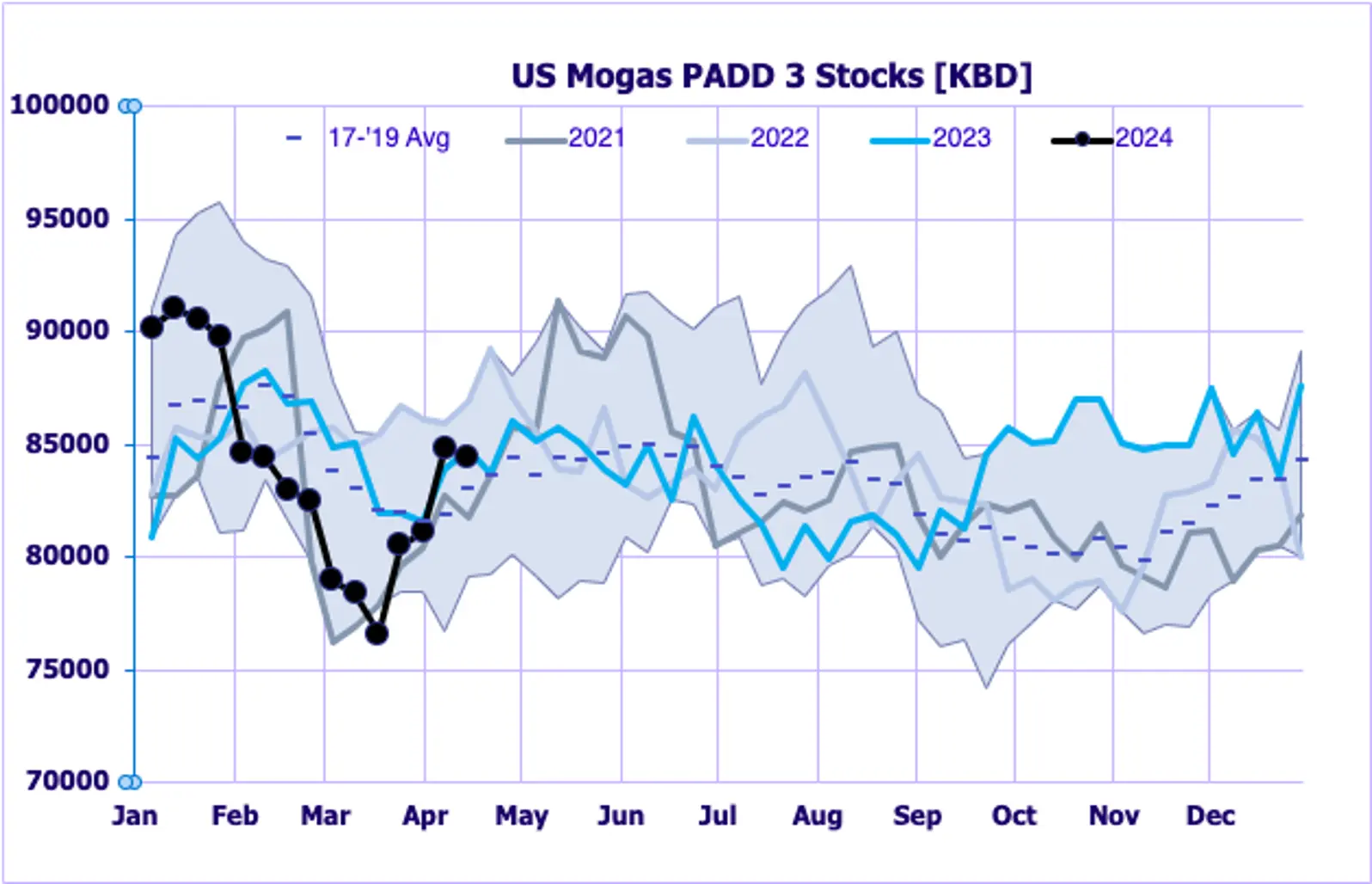

Currently, light sweet, sour, and heavy barrels show profitable deliveries from USGC to the NWE area for May deliveries, an opportunity that might be shortlived as USGC FOB prices could find a bottom now with stocks stabilising in PADD 1 and PADD 3.

Additionally, the forward curve of RBOB and C5 shows closed economics for deliveries from June onwards.

PADD 3 mogas stocks returning to historical averages. (Source: EIA)

On the Asian side, the dynamics have been similar to the European market in recent weeks with lower volatility and no rush to raise prices to attract outside shipments from during the start of Q2.

Regional demand appears well covered and maximizing LPG in steam crackers does not encourage importing.

However, the recent decline in physical prices for the fifth consecutive week, may be nearing its end in the single low digit territory, avoiding further discounts in the Asian market.

The lack of arrivals from the West due to the decrease in shipments from Skikda in recent weeks, as well as the increase of the E/W by $7/mt in the last 10 days, has improved the economics of arrivals to Asia from both Europe and the US, and although currently the arbitrage is closed, opportunities may arise as we move into Q2 and demand from steam crackers increases due to the end of maintenance at several facilities.

Lower delivery prices from Med and USGC into Asian outlets could point to renewed arb opportunities if E/W keeps climbing. (Sparta Global ARBS – ARBs Comparison)

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com