EBOB hangs on but plummeting Houston market is a red flag

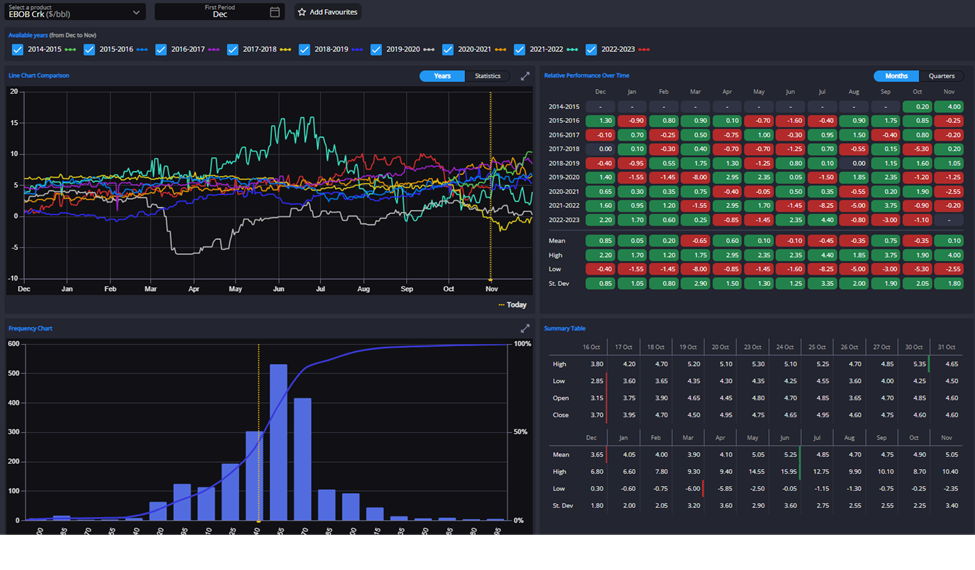

EBOB cracks gained $0.50/bbl since last Tuesday while prompt spreads widened a little. The Dec crack, however, has seen a much more muted rally of late, while end-year and Q1 spreads do not paint a tight picture.

That still contrasts with historically strong deferred gasoil spreads & cracks – though gasoil has weakened substantially over the month – and points to ARA mogas tightness being short-lived.

What’s clear is that EBOB has priced itself out of international markets almost entirely, a situation which surely cannot last.

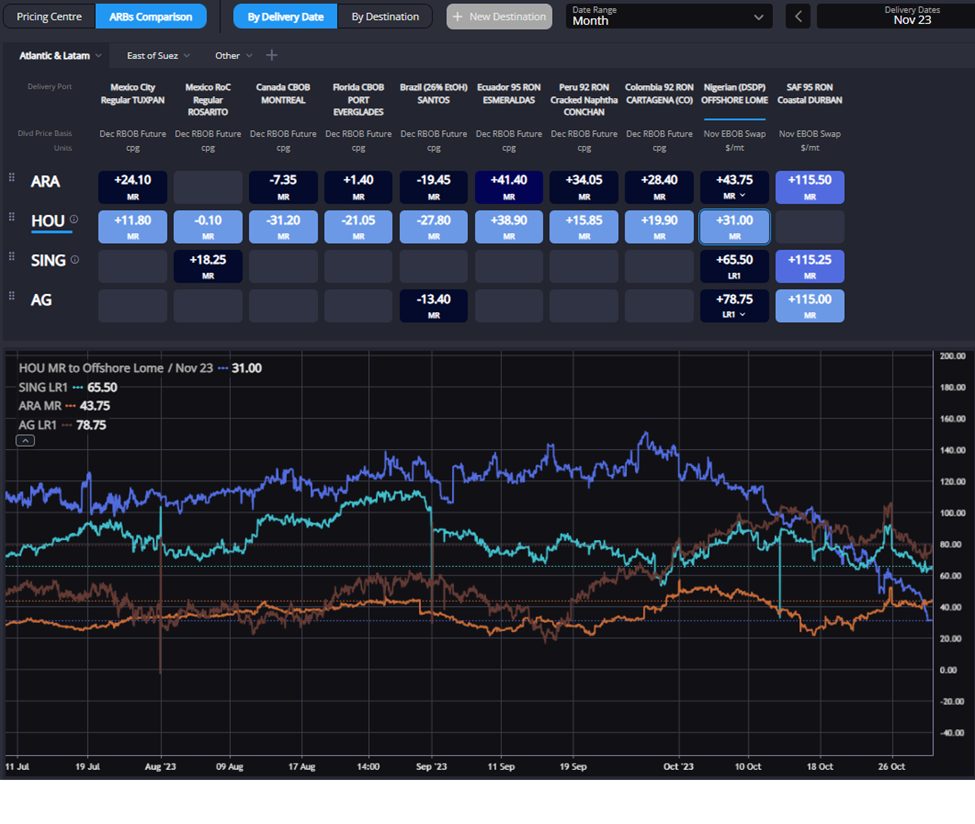

Since last week the Nov TA arb has moved from -5cpg to -8cpg for blenders, while even NWE refiner margins – normally the most advantaged – are now negative in Nov and Dec. That is despite 3 consecutive weeks of draws in PADD 1 mogas stocks.

Nov & Dec E5 & E10 blender margins in ARA remain rather subdued, with brief forays into positive territory for E10 quickly shut down.

That could normally be taken as a bullish paper signal going forward, but given the above and combined with high-octane component cash diffs in Europe being still strong, it may simply be a reflection of the lack of prompt component availability at the moment but limited need for marginal EBOB supply.

Most notable this week is the further rapid weakening in the Houston market. Stocks in PADD 3 continue to accumulate and local blender margins have come off strongly w-o-w.

Houston barrels are now the cheapest source of supply for delivery for Nov arrival into Nigeria(!), ahead of ARA.

That is essentially Europe’s key short to fill. (Note in that context the relative high reformate percentage in Nigerian blend, as well as a recent relative weakening in Houston reformate cash diffs vs still-strong ARA reformate).

Houston is even pricing into Indonesia for Dec arrival ahead of the AG. The hub’s weakening even ahead of a likely rebound in PADD 3 refinery runs spells trouble for EBOB near-term.

The Houston market should at the minimum bottom out given it is now the cheapest source of supply for all of Latin America for Nov delivery, in addition to other large short markets globally.

But continued builds in PADD 3 mogas stocks could also simply see the pressure exported abroad and onto EBOB prices – watch out for tonight’s weekly DoE release.

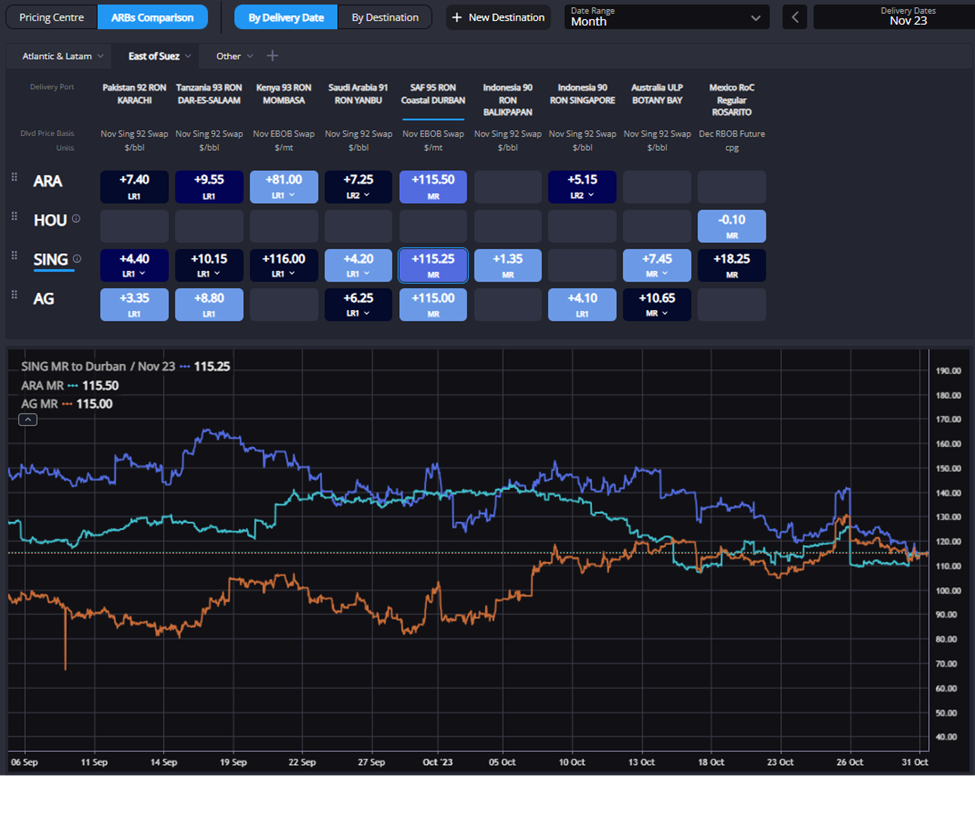

The E/W remains rangebound w-o-w at reasonably weak levels (some -1/bbl as of this morning).

The arb picture is now somewhat mixed for November delivery, with Singapore the cheapest source of supply to its core markets but the region priced out of more marginal locales such as Pakistan.

The last few days has seen some attempt from Singapore to stay competitive with the AG & ARA in South Africa, with blends sourced from all three regions now landing at roughly the same pricing into Durban for Nov delivery.

Singapore and thus the E/W possibly won’t weaken further until maintenance season is over – butlatest weekly data out of Japan for example show declining crude runs and some draws on mogas inventory for the time being.

Neil Crosby is an experienced energy market and commodity analyst, specialising in crude oil, oil products, biofuels, and carbon. With roles at OilX and JBC Energy, he has extensive expertise in global oil industry analysis, forecasting tools, bespoke research, and client communication. His focus on refining and petrochemicals underscores his specialisation.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com