Cracks under pressure from strong crude, cheap propane, but rebounding gasoline helps take bearish edge off of Q4

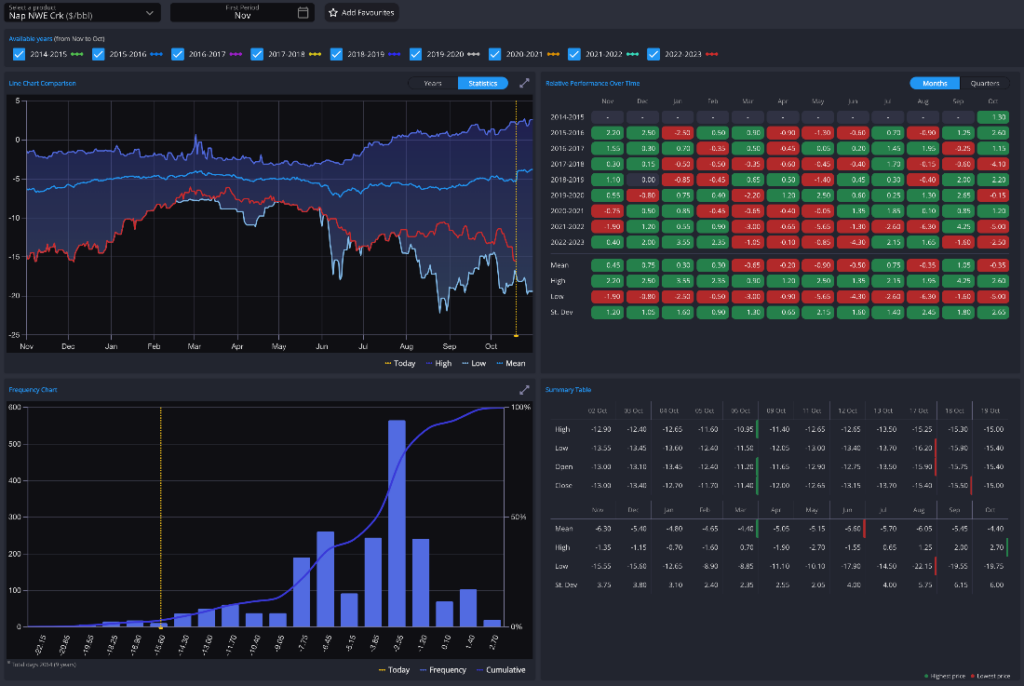

The bearish momentum in the naphtha market has been further reinforced from a crack perspective in the face of a rising Brent complex.

In the last two weeks, we have witnessed the NWE crack dropping by $4 to trade below $15/mt during this week.

Asia showed a slight recovery towards the end of the week, primarily during Thursday’s session, where time spreads strengthened, currently trading the Nov/Dec at $3/mt.

Asia has managed to keep OSN premiums positive for arrivals in Japan, despite slight negative figures in Korea or Singapore. This more positive sentiment from the East is mainly linked to a lower production on refinery TA’s, especially in Japan where refinery runs rates reached 3 months low.

Also the resurgence in the blending economics of the region is playing a big role, where premiums for heavy grades remain above $50/mt, marks a difference in Q4 expectations, further strengthening the E/W market.

From a fundamental perspective, the new data on propane inventories in the US are adding extra bearish pressure to the already weak petrochemical outlook for the year-end.

We do not anticipate an uptick in demand in either region, with margins remaining negative and operational rates below 70% in Europe and 80% in Asia.

This week, news arrived from the US about propane inventories reaching a record seasonal level for October, according to EIA data, in line with the long-term dynamics of increased production from the region’s gas fields.

With US exports on the rise, inventories at record levels, and Propane/Naphtha trading at -$115/mt in Europe, far from the petrochemical switching breakeven point, the outlook for Q4 at current prices suggests that naphtha will not easily find its way into the flexi steam crackers this winter during the seasonal period of high LPG prices. This adds further bearish pressure to naphtha demand for petrochemicals.

Despite this weakness in petrochemicals, the bullish point of the moment is marked by the rebound in gasoline across all markets, especially in the American market, where recent increases in counter-seasonal inventories had pushed the benchmark lower.

Spreads and cracks have recently strengthened with two consecutive weekly inventory declines (EIA), and blending incentives have increased with the rise of Gas-Nap, which has gained $30/mt in the last week to settle at +$130/mt currently for the November contract.

This gasoline market dynamic has primarily affected the US arbitrage as the largest consumer of gasoline and a marginal barrel of naphtha.

Physical premiums in NYH have strengthened due to inventory declines and increased blending incentives, closing the arbitrage for heavy products to Asia.

We have also observed an improvement in landed prices from Europe to NYH, which could increase the flow of this arbitrage in the coming weeks.

These market dynamics in the American market correlate with the recent trend in inventories, with two consecutive drops in the US (EIA) and Asian gasoline inventories reaching a three-month high (PJA).

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com