Bearish feel globally in diesel with Asia Pacific maintenance increasing whilst jet shows some recovery

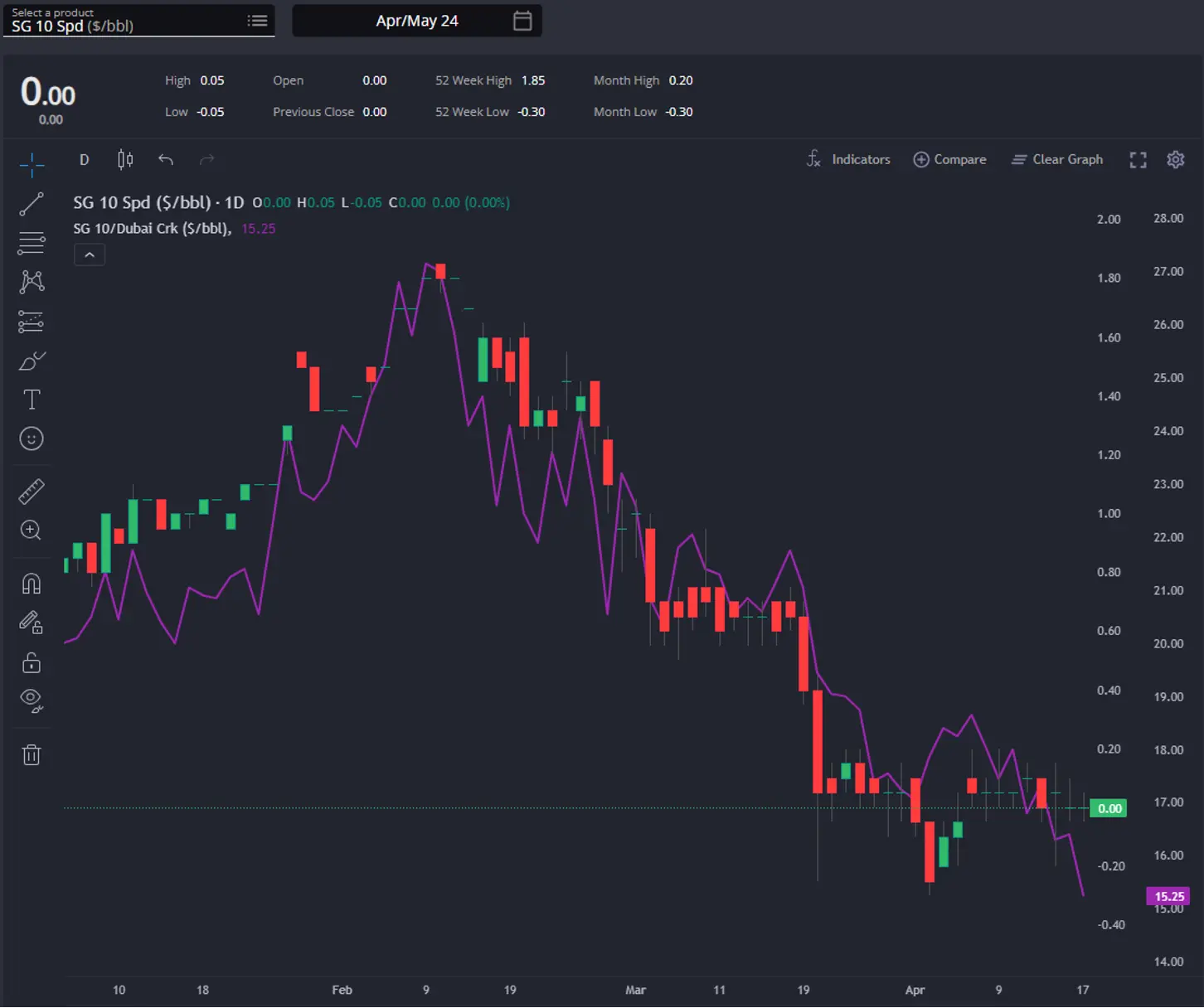

April’s Singapore diesel crack and spread. (Sparta Live Curves)

Singapore diesel cracks have extended their downward trajectory since early February, mirroring the prevailing bearish sentiment in the global diesel market.

Despite this, the diesel spread has largely stabilized at just above contango this week.

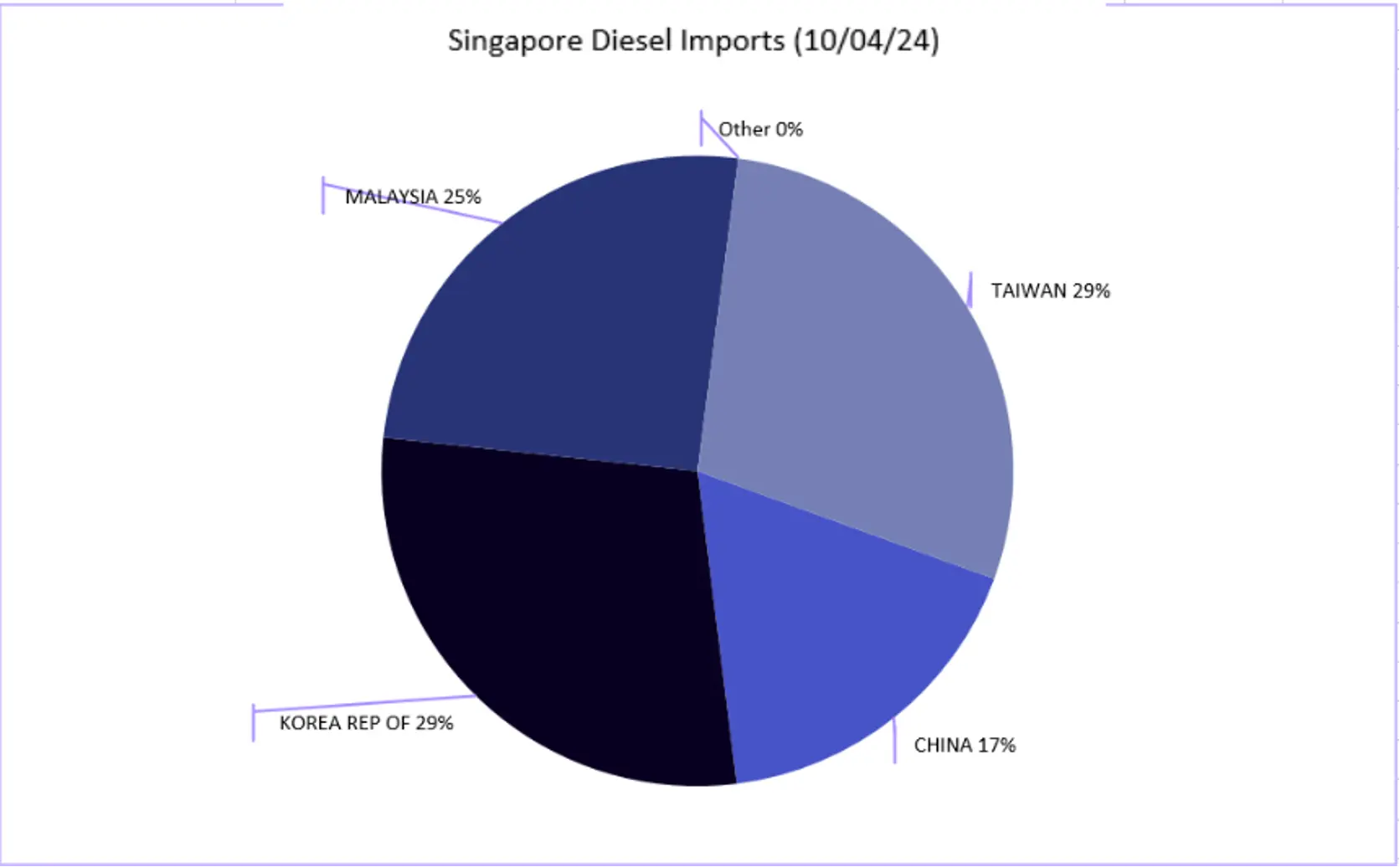

Singapore Diesel Imports; week ending 10/04/2024 (Enterprise Singapore via Sparta Commodities)

Contributing to this trend is the substantial buildup of Singapore’s middle distillate (MD) stocks, currently at their highest levels in over 2.5 years. The influx of diesel imports from China, Taiwan, and South Korea have further exacerbated this situation.

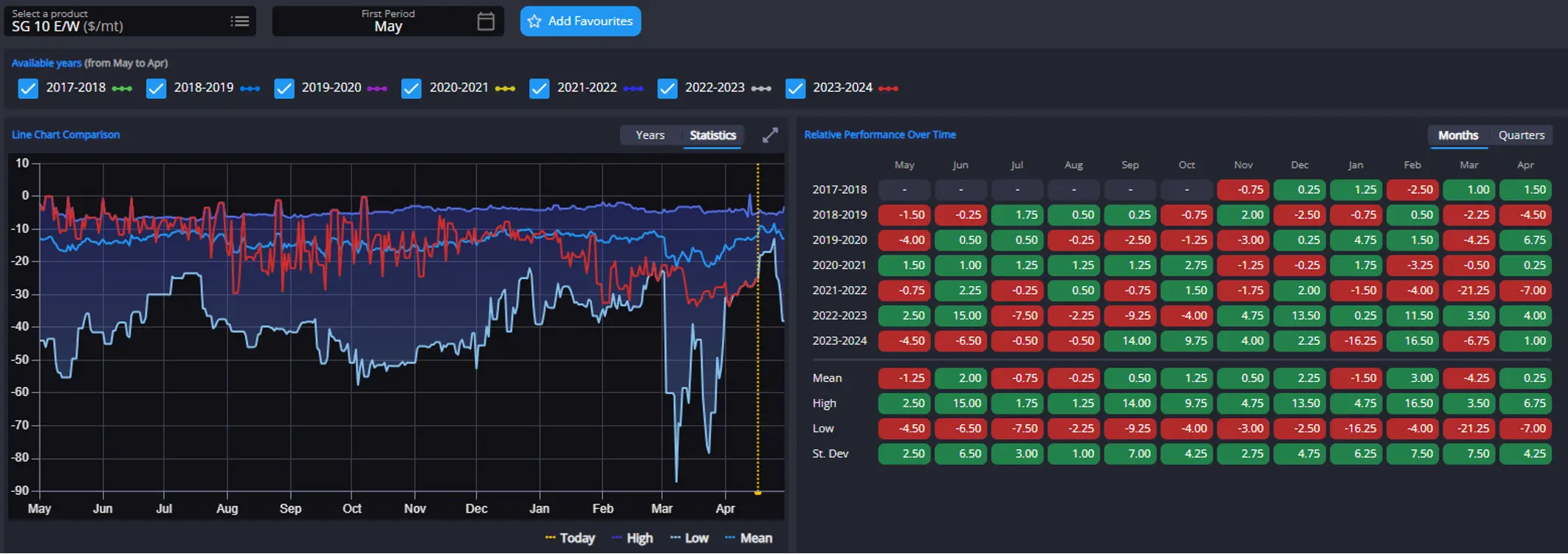

May’s GO E/W and By Origin Dashboard; Sikka. (Sparta Historical Forwards)

The recent flattening of the spread can be attributed to several factors.

Despite the ongoing narrowing of the GO E/W spread, AG/WCI exports are still directed towards Northwest Europe (NWE) rather than Singapore, a trend likely influenced by the impending turnaround season set to commence at the end of April.

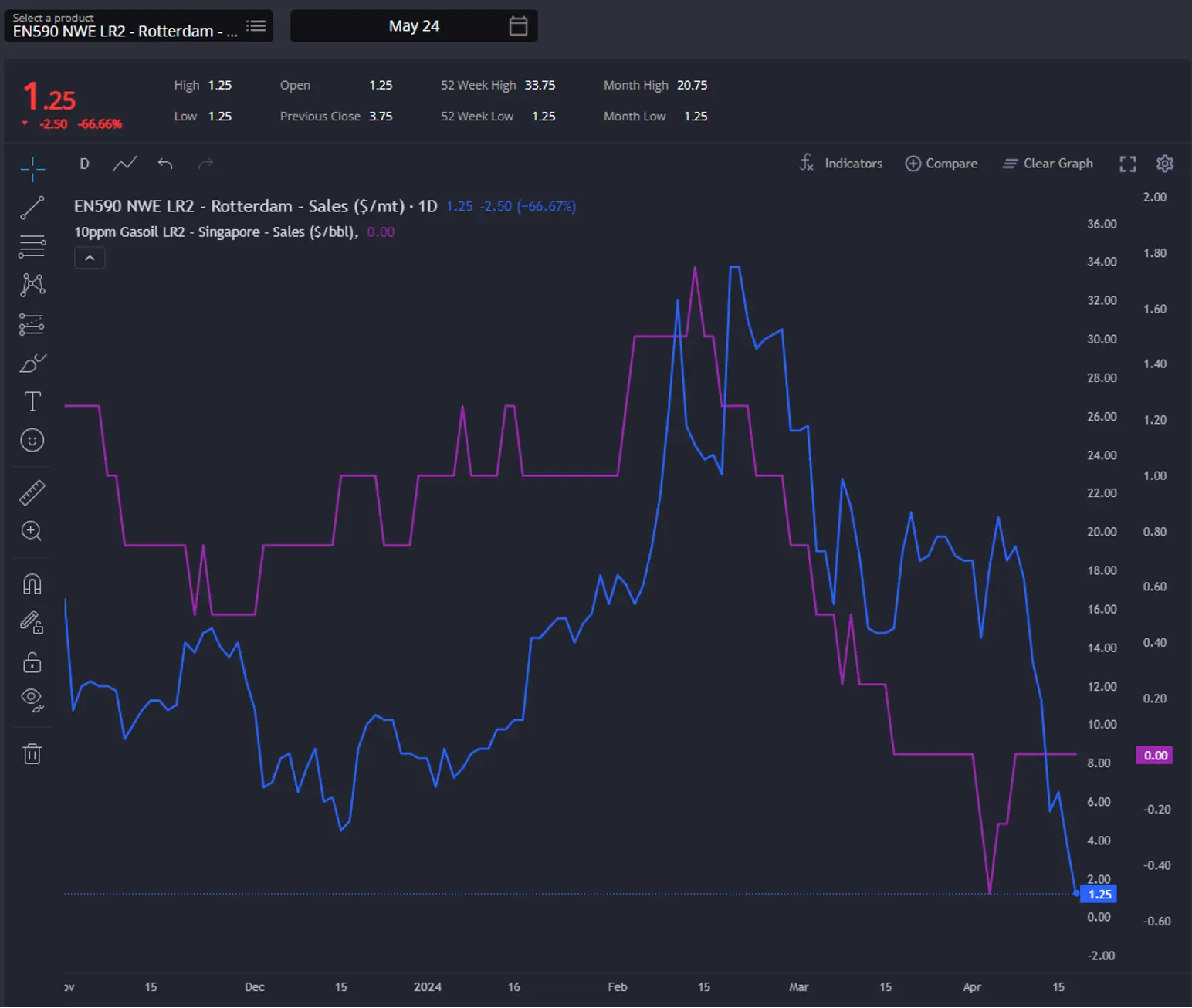

May’s Singapore and Rotterdam diesel LR2 premia. (Sparta Live Curves)

This phenomenon is also reflected in the diverging changes in diesel premia between Singapore and Rotterdam in recent times.

Consequently, it is anticipated that the GO E/W spread will continue to narrow in the short to medium term.

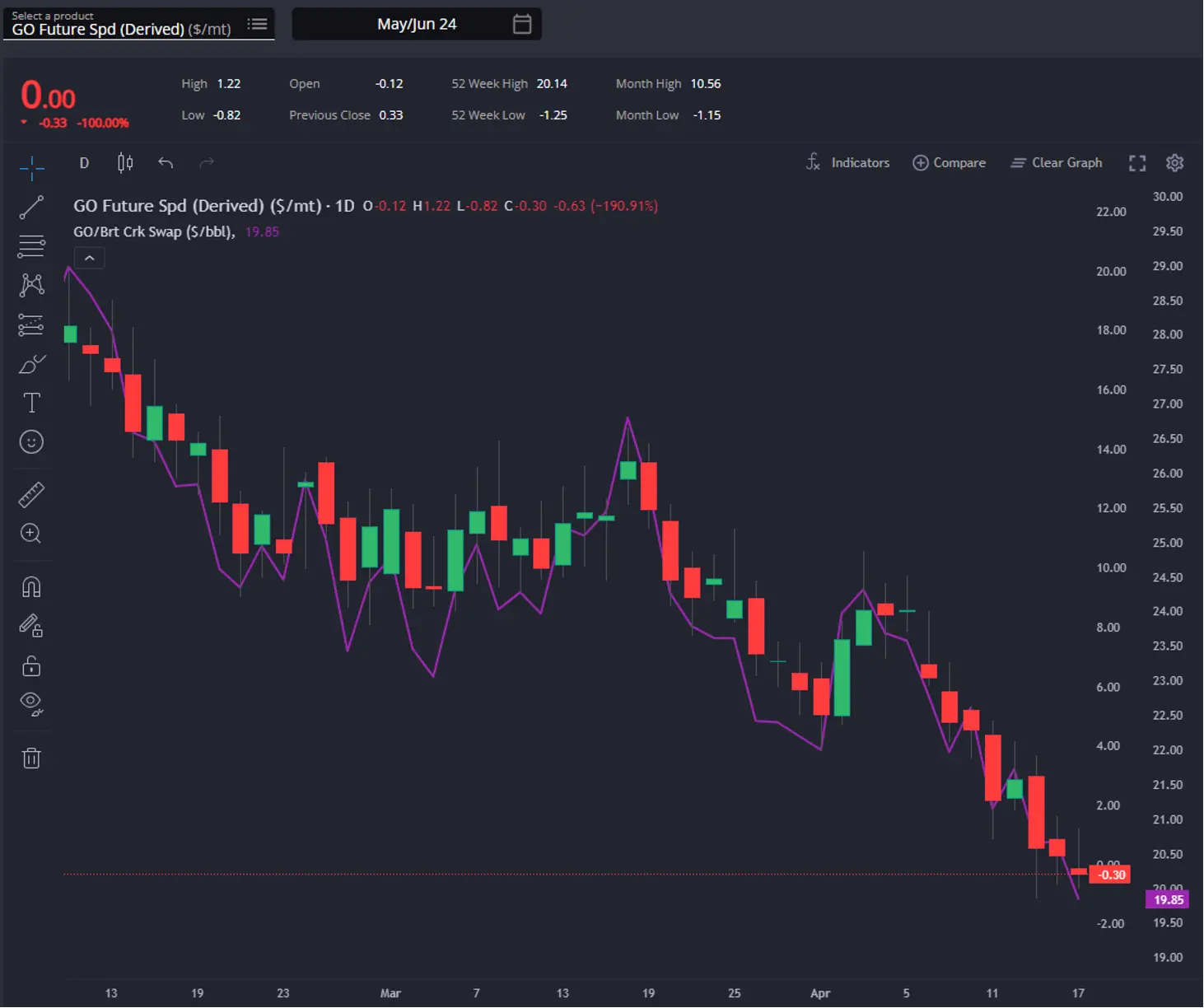

May’s ICE GO spread and crack. (Sparta Live Curves)

ICE GO diesel cracks have mirrored the downward trajectory observed in Singapore since February.

However, ICE GO spreads have experienced a further decline, slipping into contango in the prompt.

However despite these trends, the market is expected to continue receiving a significant amount of diesel from AG/WCI in the short term as these arbs continue to point West as discussed above.

This influx of supply, coupled with ongoing struggles in European demand and the likelihood of increasing stocks, is contributing to a prevailing bearish sentiment in the market.

May’s HOGO swap and TC14 freight. (Sparta Live Curves)

Whilst there is some relief from a currently closed arb from the US Gulf Coast (USGC) due to a widening HOGO, concerns persist regarding TC14 freight.

According to our broker contacts, the USG market has been grappling with oversupply generated from muted activity in recent weeks.

This oversupply may impede the flow of tonnage, particularly as freight struggles have persisted.

Consequently, it seems that freight dynamics may play a crucial role in maintaining the flow of these arbitrage opportunities to Europe.

Rotterdam. (Sparta Global ARBS – Pricing Centre)

However, one caveat to consider is that with HO spreads moving into contango, there may be an incentive for the US to build diesel stocks in the short to medium term—a topic we will delve into further in subsequent discussions.

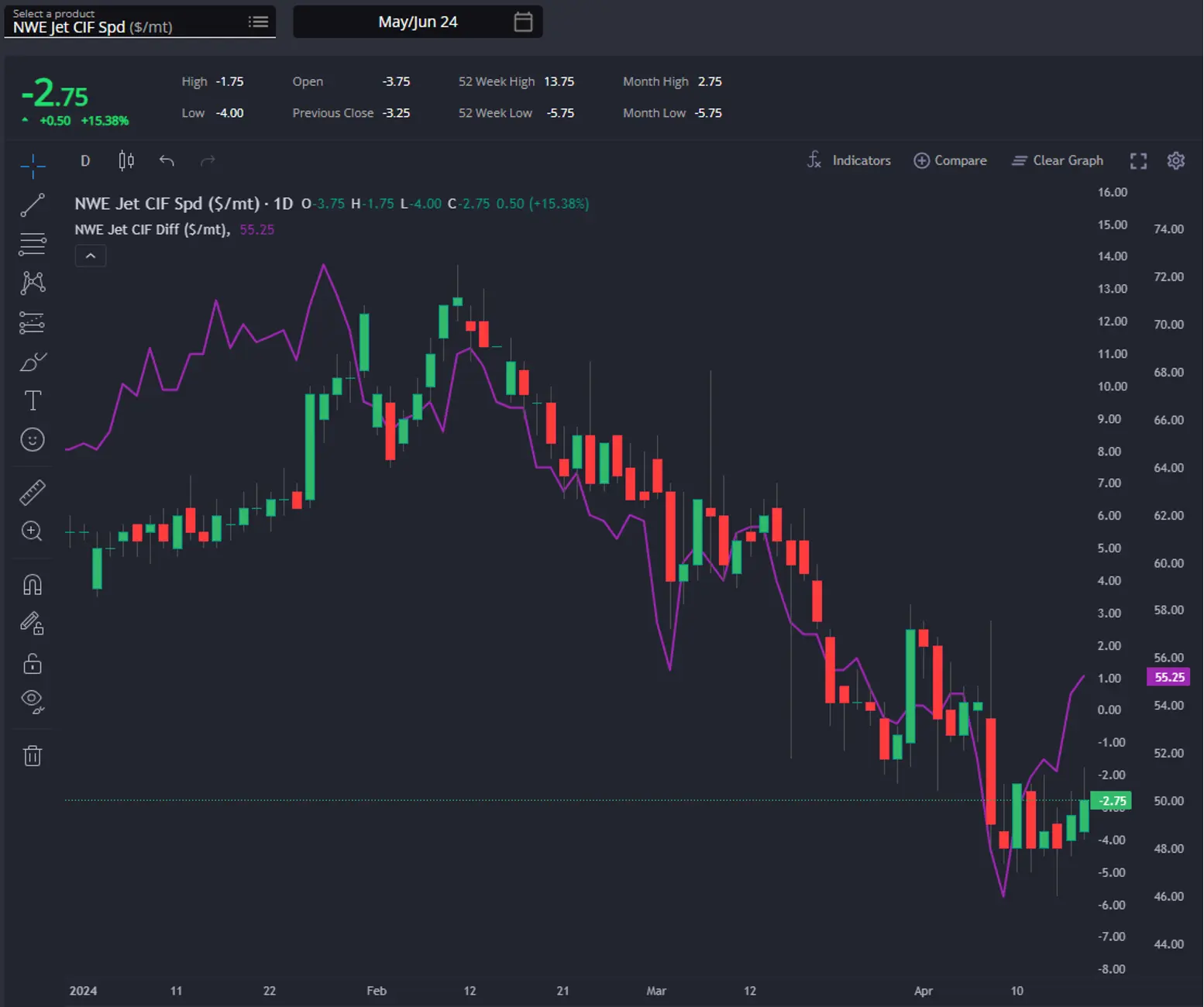

May’s NWE Jet CIF diff and spread. (Sparta Live Curves)

European jet fuel has seen a resurgence this week, with NWE Jet CIF differentials and spreads experiencing an uptick.

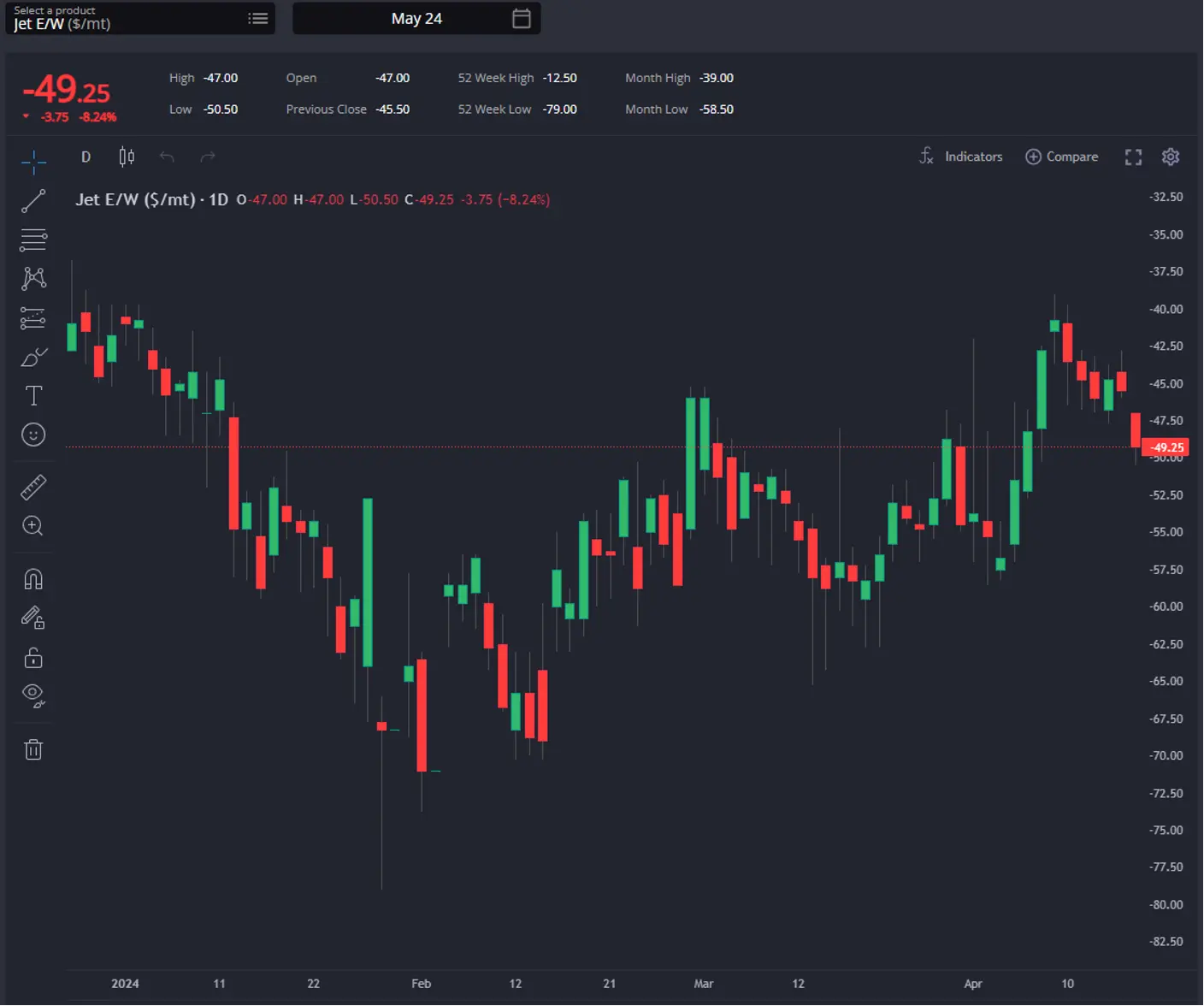

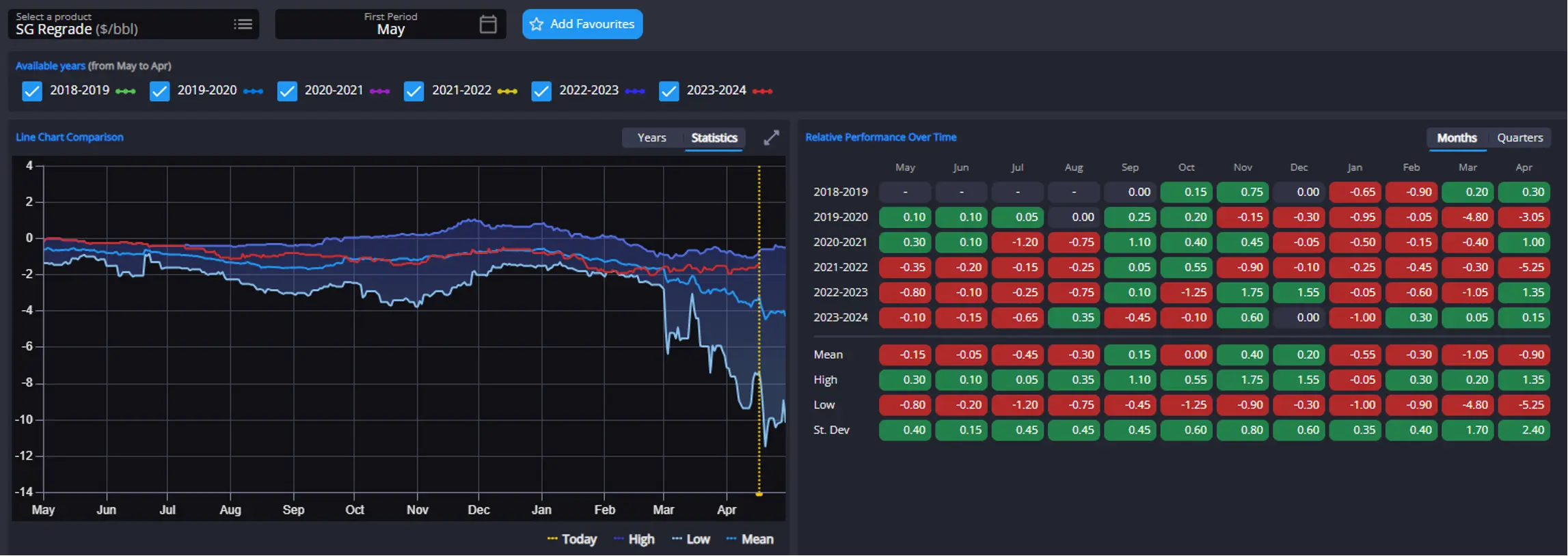

May’s Singapore regrade & Live Curves Dashboard; May’s Jet E/W. (Sparta Historical Forwards)

The narrowing of the Singapore regrade and Jet E/W, along with improving arbs to New York, indicates a trend likely to persist in the foreseeable future.

May’s HO spread and crack. (Sparta Live Curves)

HO cracks and spreads have mirrored the trajectory of ICE GO, with HO spreads deepening into contango.

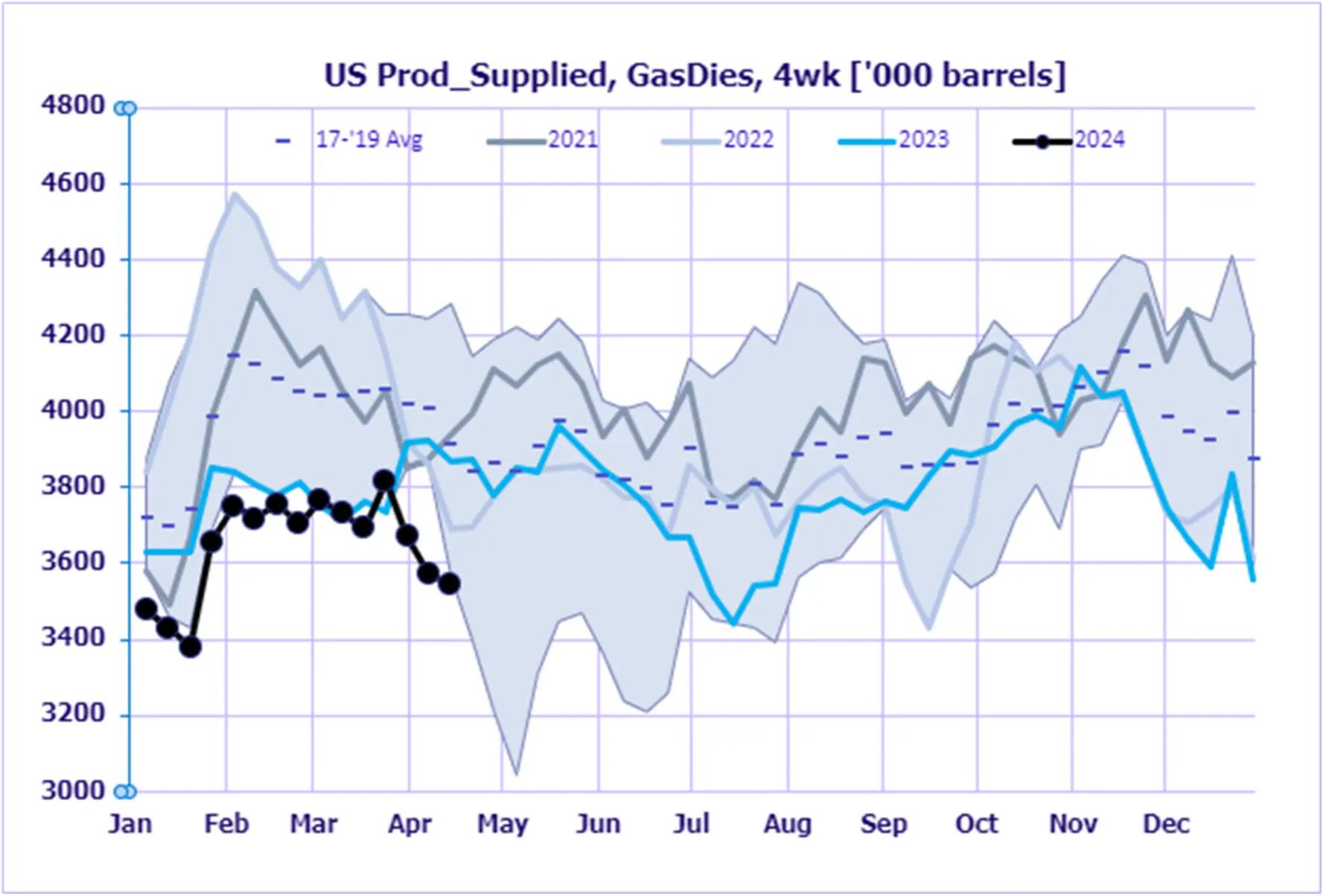

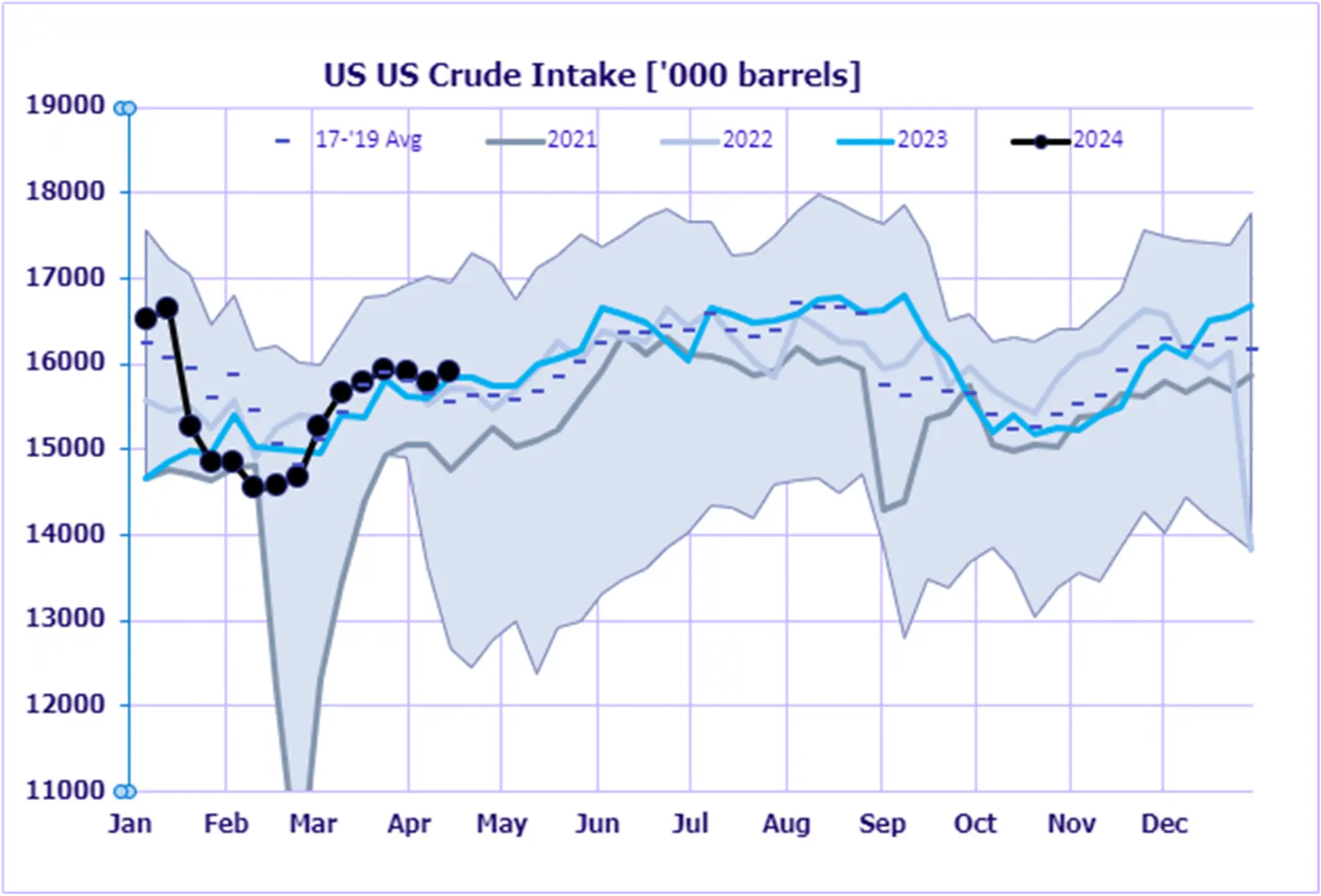

US crude runs and diesel demand (EIA data via Sparta Commodities)

This trend aligns with the backdrop of elevated US crude runs juxtaposed against dismal US diesel demand.

The anticipated consequence is a probable uptick in US diesel inventories, exerting downward pressure on pricing in the near to medium term.

USGC diesel presently finds a favourable entry point into Latin America due to the comparative strength of Asian diesel.

However, the anticipated surge in USGC diesel flow to Latin America may be tempered by swift repairs in Russian refineries, curtailing any significant reduction in Russian diesel exports amid ongoing Ukrainian drone attacks.

The recent adjustments to Brazilian diesel mandates is important here also.

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com