Balances keep tight and backwardation steepens, but the bottom looks close and US points to more exports in the coming weeks

The naphtha market witnessed a bullish week for spreads and cracks, with physical premiums remaining steady yet strong, particularly with CIF Medin double digits.

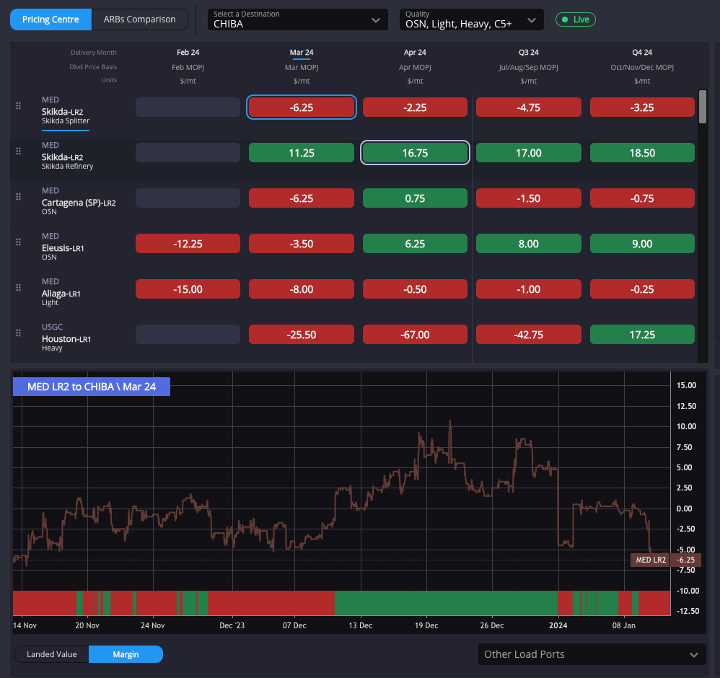

Following the correction in the first days of the year, renewed European interest and the continuous strength of MOPJ has influenced the global market.

Nevertheless, E/W failed to keep pushing for more arbitrage and the outlook for the coming weeks looks below $20/mt as Red Sea fears have apparently dissipated.

The big question now points to Middle East turnarounds. If Asia demands as much cracking naphtha as it did at the end of Q4 23 to deal with Q1 24’s lower supply, and as Skikda product keeps flowing to the East, we don’t expect E/W and Asian physical premiums to increase further in the short term.

This recent market trend has closed the arbitrage for cracking qualities to the Asia, although it remains open for HFRN qualities.

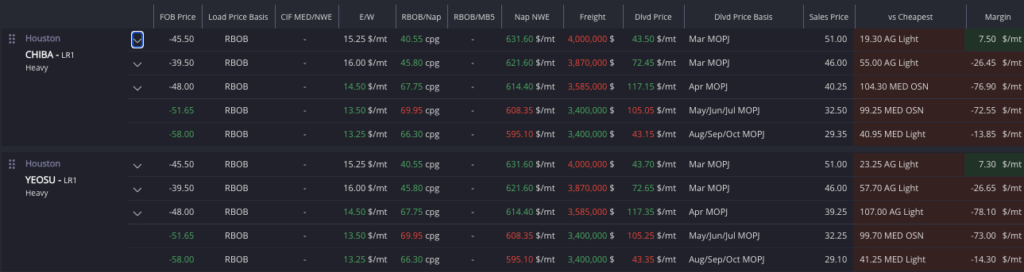

Heavy premiums are lower after a heavy cargo went from the Med to Asia, and the US potentially could place some heavy barrels in the East too since the economics show the arb open on paper currently.

Skikda Refinery and Eleusis product should keep heading to Asia. However, it would be harder to see more paraffinic cargoes heading to the East.

The imbalance in Asia is structural due to lower Middle East supplies, and despite Russia being able to cover some of this supply imbalance, tightness in the general market will be a common theme for Q1.

Spreads and cracks are under pressure, and E/W has the potential to climb slightly over current levels, although it may not reach December highs.

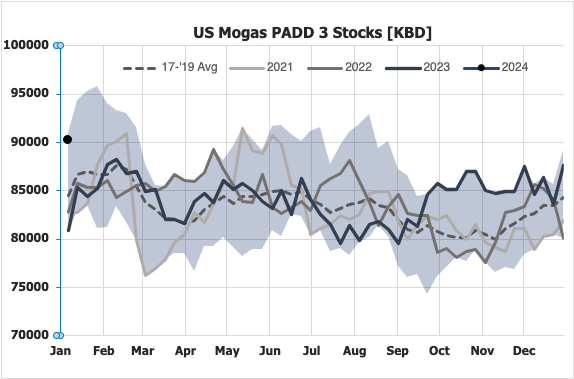

In the US, high gasoline stocks in PADD 3 is being reflected in the naphtha physical premium in the Gulf, while overall US gasoline stocks are below the five-year average, primarily influenced by levels in PADD 1 and 5.

On the back of this, US product emerges as a clear alternative in foreign naphtha markets after the recent decline in naphtha premiums in the Gulf.

While NYH remains robust, reflecting current gasoline stocks, it is the primary choice for most shipments.

However, the drop in physical premiums in USGC, reduced transit waiting times in Panama, and the decline in associated freight costs will allow for increased exports during Q1 from the Gulf to both Europe and Asia. A clear reflection of this situation is seen in the cumulative relative loss of C5 against naphtha benchmarks in Europe and Asia.

Freight rates differentials will also play a significant role in the arbitrage to Asia in the short term. As seen in the following chart, while TC15 remains strong due to the risk premium of transit through the Red Sea and tensions in the Middle East, Western freights have dropped considerably, both TC2, to which the reduced pressure in Panama contributes, and TC6.

This has significantly improved the numbers for the product to stay in the West, forcing Asia to maintain high prices to try to compete for foreign naphtha.

This will keep the market in backwardation, with high physical premiums in the medium term.

Jorge Molinero is Commodity Owner for Naphtha and LPG at Sparta. Starting his career as a financial analyst with BBVA, Jorge quickly transitioned to market intelligence within the energy sector, spending 4 years as a naphtha analyst with Repsol before joining Sparta in early 2023.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com