Atlantic Basin support eroding as focus shifts to EoS in Q4

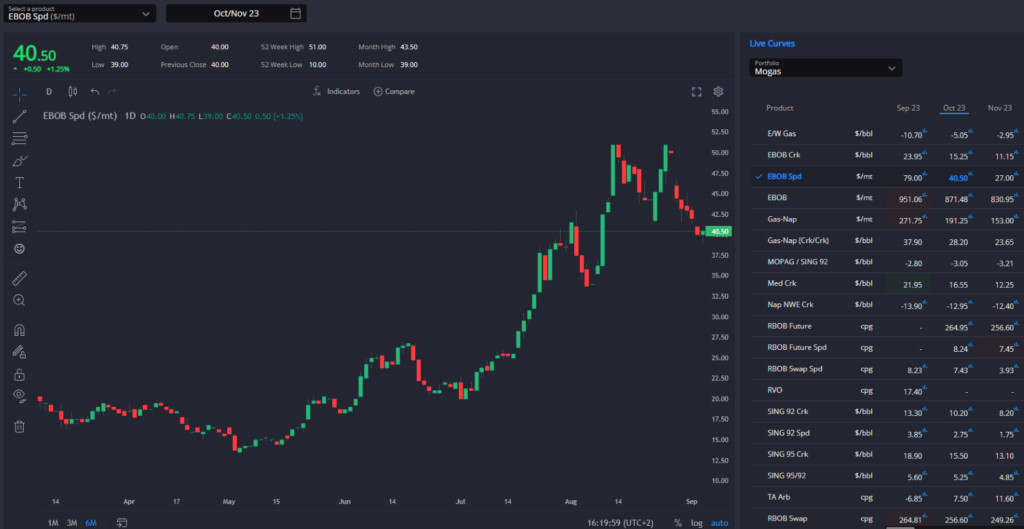

The end of summer is bringing with it the end of bullish momentum in the European gasoline complex, with ARA barges starting September much weaker than the Sept/Oct spread implied.

Timespreads have narrowed significantly as we moved into the first few days of the month, as the physical realities of the market have struggled to live up to the hype generated by the recent Antwerp-refinery FCC outage.

In retrospect the Atlantic Basin gasoline market has been riding almost a perfect-storm of bullish indicators through the summer and a certain amount of correction now seems unavoidable with traders’ appetites to buy at recent elevated levels saturated.

The window in Europe has been heavily offered at the beginning of the month, and with the TA arb remaining firmly shut, it is now prompt EBOB blend margins which have opened up in the last few days.

Both E5 and E10 blend margins are firmly open through September and October as component premiums have dipped across the board.

Premiums on heavy reformate and FCC-grade naphtha in particular have moved lower, as well as the winter-spec barges, to draw blenders back into the EBOB market and helping to stack the aforementioned offers side of the window.

On the contrary, October non-oxy barrels out of Saudi, UAE, and India are all trading at the top of their 52-range premiums, with reformate and alkylate barrels in the AG similarly maintaining their highest levels in recent history.

These higher physical premiums in the AG are in line with indications that inventories in the region are on the lower side.

So far this has not been enough to dislodge the AG as the cheapest source of supply for the entire East of Suez as well as many Atlantic Basin (Nigeria, Brazil, etc.) destinations.

The pull on barrels out of the AG will face an additional hurdle in the coming weeks, however, with the onset of maintenance at major refineries in the region curtailing supply.

Whilst we continue to see the arb levels out of the AG more as an indicator for potential flows than a predicator of actual volumes likely to be fixed – the AG simply is not yet able to supply the volumes required to meet its theoretical demand – the added tightness in the Middle East gasoline balance in early-Q4 should force the entire EoS complex higher still.

As mentioned in this space already in recent weeks, current negative E/W spreads are completely shutting European barrels out of the EoS market.

So far, the impact on the Singapore market has been muted, with Chinese exports likely to remain substantial on the back of the latest round of export quotas and no indications of physical market tightness just yet.

Forward Sing 92 crack levels have been coming under pressure over the last week, further indicating that the market is not yet sensing a need to respond to developing tightness in the AG.

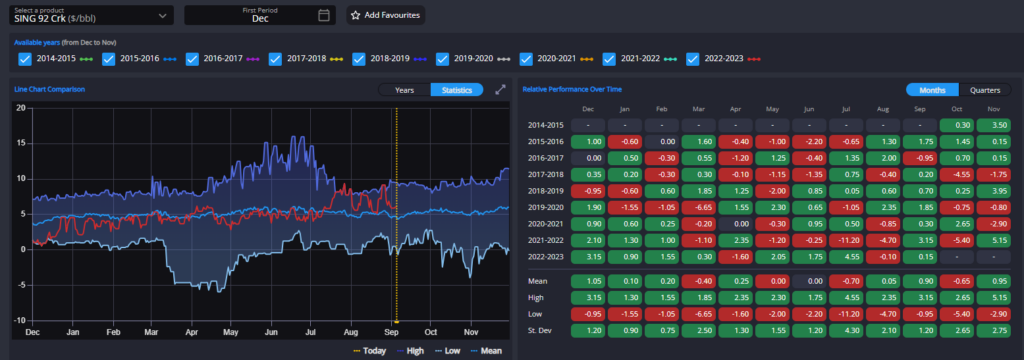

The December Sing 92 crack is currently trading just above its multi-year average levels, and has had a tendency to skew one way or the other sharply as we move through Q4 in recent years.

Given ongoing elevated crack levels in the Atlantic Basin, which are likely to remain higher than average through winter on the back of naphtha/quality issues, we would not be surprised to see the Singapore market skew to the upside through Q4 as European barrels may need to be called back into the East.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com