ARA barrels remain both sought after and affordable

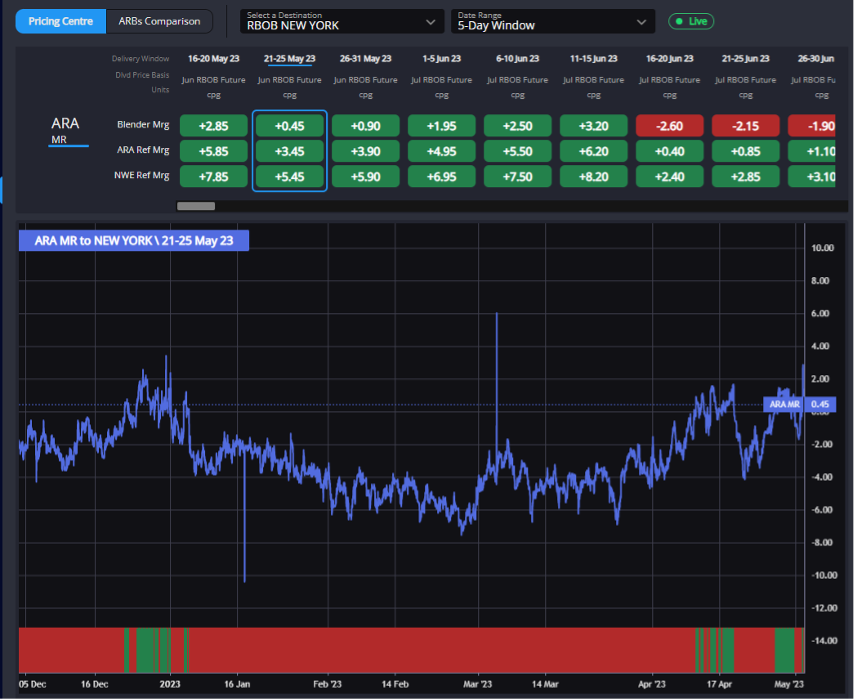

The last week saw something of a rebound for the NWE gasoline complex, with the TA arb returning open at the front on signs of a continued pull from the USAC, as well as stabilising component pricing on attractive arb econs on blends out of ARA.

Barges also began trading higher once more, as the gasoline and diesel markets diverged further, teasing a more ‘traditional’ summer gasoline strength story within the refined products.

These strength factors have translated into a sharply rising backwardation at the front in the EBOB structure, as well as an uptick in prompt cracks in recent days.

Premiums on gasoline components in ARA held steady overall in the last week, appearing to have bottomed out and now showing support from healthy blend margins and arb opportunities out of ARA.

As mentioned last week, whilst most components came off somewhat with the switch to summer grades, Alkylate premiums in particular have risen sharply, albeit the percentage figure helped somewhat by falling outright values.

Reformate, the mainstay of many a summer blend, should now see support from blending into export barrels, having fallen to price much more competitively in recent weeks.

Indeed, current reformate cash diffs in ARA are going a long way to support the overall picture of ARA’s attractiveness as a source of supply to the entire Atlantic Basin and are likely to begin appreciating once more as these blends become reality.

The steep falloff across much of the clean freight market in the Atlantic Basin over the last two weeks has certainly also contributed to the re-opening of the TA arb, with the TC2 collapse making this route workable also for blenders in ARA through to mid-June.

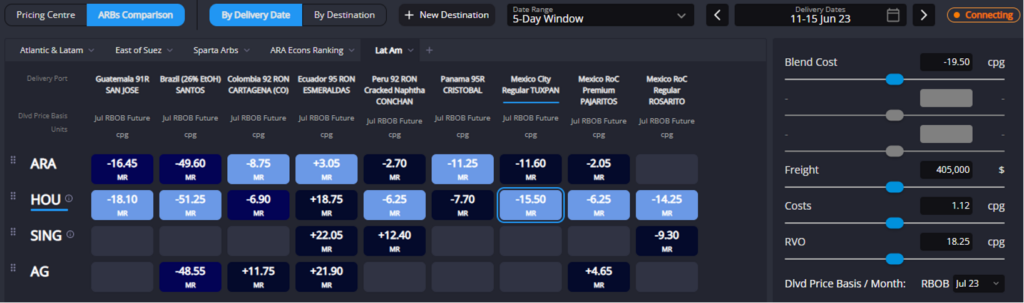

Furthermore, despite the recent widening of the E/W out towards the $8/bbl mark, ARA has managed to become again the cheapest source of supply into Nigeria, offering further support to blending opportunities in ARA at the expense of other regions.

Finally, although European gas-nap spreads have been narrowing recently, they remain at the top end of the historical range (2022 excluded) and continue to offer attractive econs for blending Nigeria spec (our May Nigeria blend is currently running around 28% naphtha).

Looking at the Asian market, the widening E/W recently appears to be driven by both European strength and a softening of the market creeping into the Sing complex.

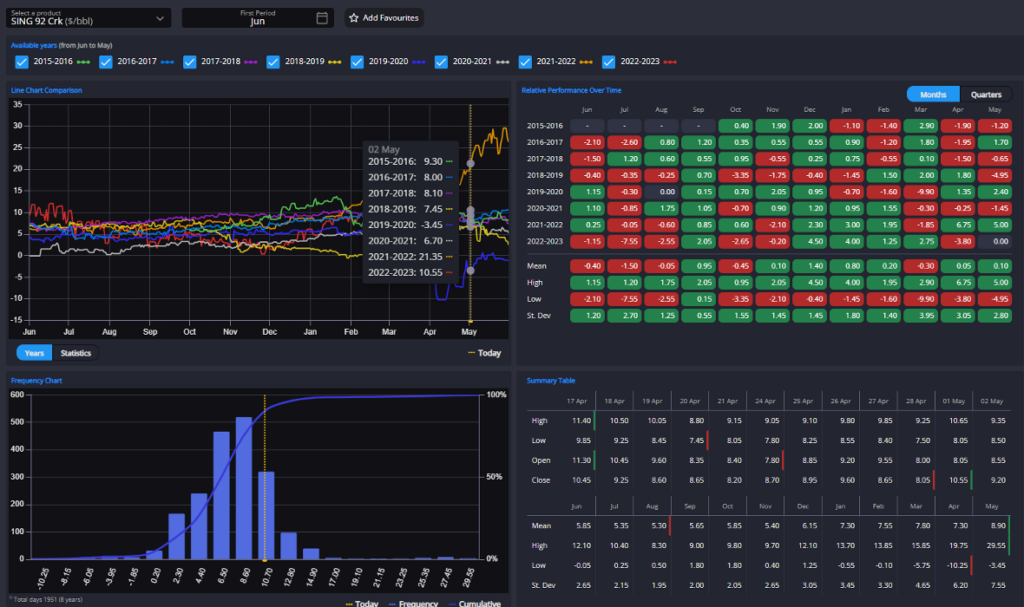

Sing 92 cracks and spreads have fallen off in recent weeks despite a raft of refinery maintenance still visible in the region and a stated reduction in export quota volumes out of China in the next batch.

The support which had been seen from potentially placing SE Asia barrels into the west coast of Central and Southern America has since dissipated, however, with both west coast Mexico and Peru pointing very much towards the USGC are a cheapest source of supply currently.

This is not to say that the Singapore gasoline market is not still in a relatively healthy place in its historical context, however. Our Historical Forwards tool shows that prompt Sing 92 cracks remain at their strongest levels for this time of year, although upside support from here is now likely to be difficult to find.

Singapore is already being comprehensively priced out of any destinations to the west, and with Taiwan’s Formosa refinery back online recently, the ceiling for Sing gasoline cracks is likely already reached.

Finally, the Americas appear to be entering the summer season in a strong position. Demand indicators for gasoline in the US are improving, with product supplied up and inventories drawing in recent weeks, whilst Houston is currently pricing as the most competitive source of supply into enough of its ‘home’ destinations to keep any surplus from building up in tanks in PADD-3.

Colonial line space continues become more expensive once again on PADD-1 tightness, painting a healthy picture for arb opportunities out of the USGC. Furthermore, RBOB swaps have moved in line with the EBOB structure recently in strengthening.

The only caveat here to bear in mind is the overwhelming ability for the US refining complex to respond to pricing signals quickly. With capacity coming back online in the Midwest and pricing pointing very strongly towards max mogas yields currently, this positive start to the summer season may well be eroded by the supply-side response before the end of Q2.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com