ARA barrels looking increasingly for outlet to the East, as EoS market strengthens despite maintenance coming to a close

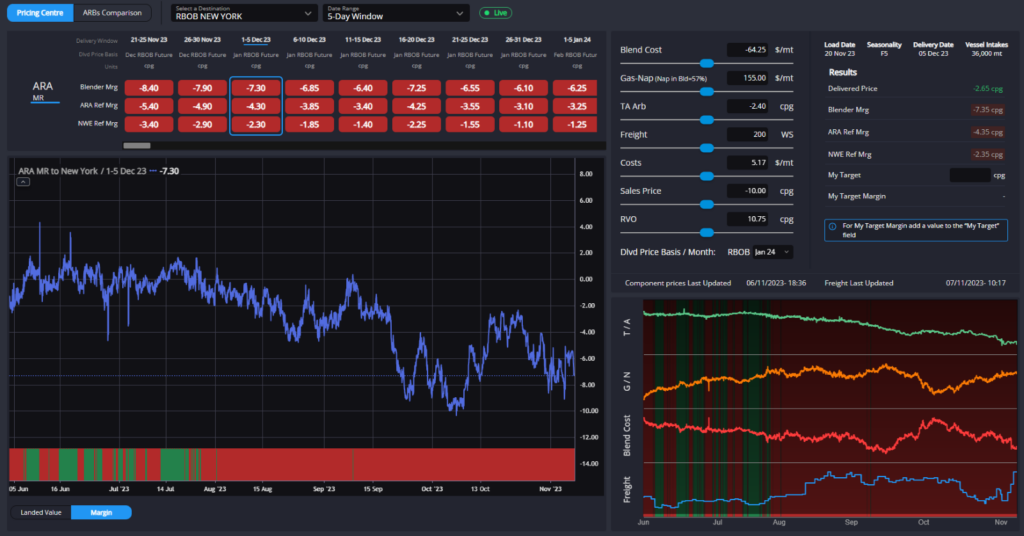

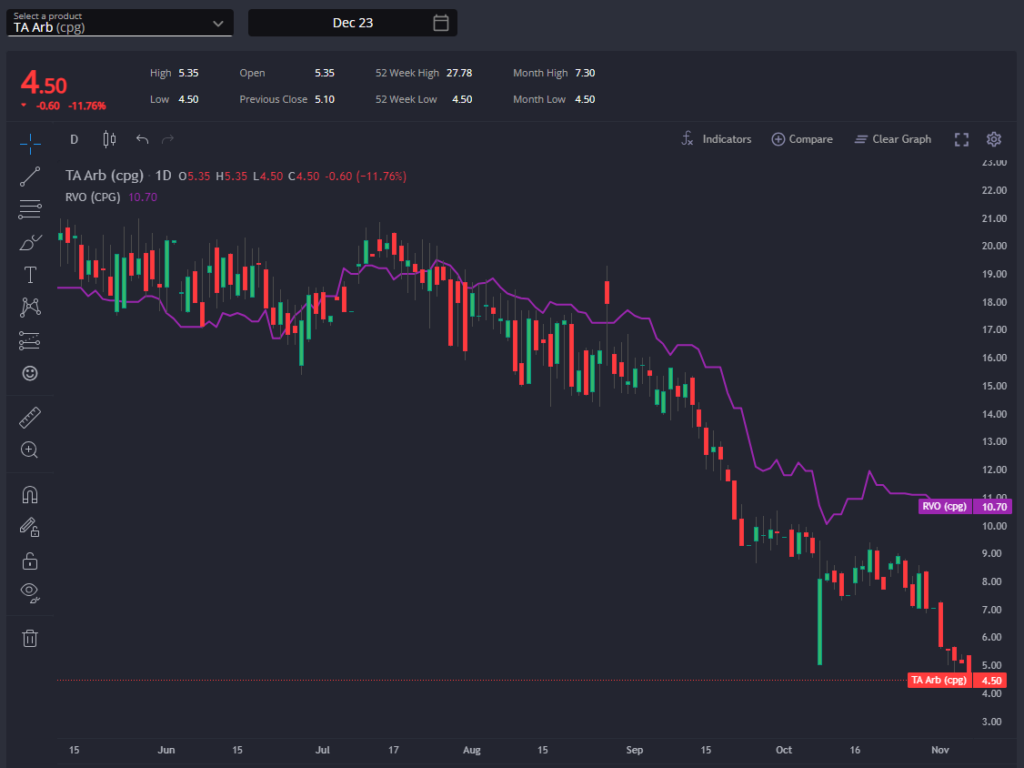

Over the last week, the RBOB arb has been helped a little bit by a widening gas-nap and softening component pricing making RBOB cheaper to blend in ARA, but the underlying paper (TA arb) continued to narrow and freight has shot up over the last week, holding this arb firmly shut.

With the spread between USGC and PADD-1 rising, and reported blending components arriving into PADD-1 from EoS, and a seasonal inventory picture which has returned to pre-pandemic (2017-2019 average) levels, the pull from PADD-1 on European barrels should remain limited through the weeks ahead.

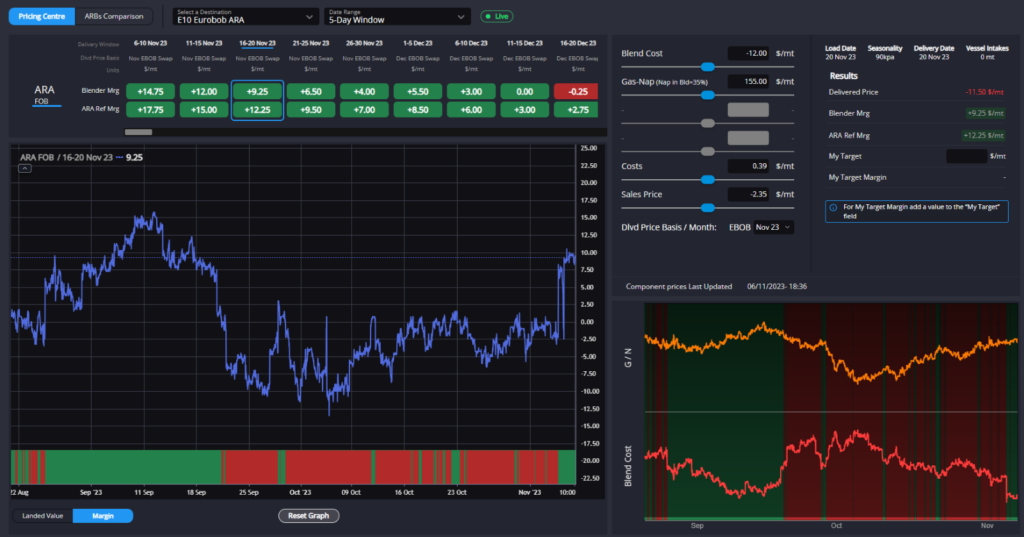

Weaker component pricing in ARA has just about opened up the E5 blend market, and E10 margin now wide open.

Indeed, with ARA being priced out of all Lat Am destinations by quite a margin and even being pressured by Houston into WAF follow the recent collapse in PADD-3 pricing, this was an expected response and this blend window will likely remain open for a little while now.

This, in turn, typically pressures EBOB barge markets a couple of weeks down the line and we would expect to see pressure from reduced arb outlets and positive EBOB blend margins being felt also on the paper market in the second half of this month.

As the narrow TA arb spread shuts the door on arbs into the Atlantic Basin, however, an improving E/W is offering some opportunities into the East for ARA exporters, with Tanzania, Saudi, and SAF all pointing ARA over Sing (AG still cheapest, but not yet producing enough volume to offset entirely the need to bring in barrels from further afield).

The E/W has been widening on the back of a resurgence in the Sing 92 market, with both cracks and spreads strengthening here – signalling that expected supply in the region may not be materialising post-maintenance.

These arb outlets may yet provide a lifeline to the EBOB market in the short term, and current forward pricing suggest they will remain open well into 2024, with the E/W spread looking very much to be determined by which pricing centre needs to move barrels out most urgently through the winter.

Finally, there have been some reports that PADD-1 has been sourcing high-octane blending components from India and South Korea, helping to tighten the EoS market further.

This is now likely behind us, however, with PADD-1 inventories having recently returned to their pre-pandemic average seasonal levels and further TA arb spread narrowing (well above and beyond the impact of lower RIN costs in recent months).

Any flows that there have been were likely fixed in September or early-October, when the underlying pricing basis and the physical market were asking for blend components to move into NYH.

Since then, however, the underlying paper prices in both the East and Atlantic Basin have moved to shut this opportunity and the premiums on higher octane components across the Atlantic Basin are beginning to soften again.

As such, EoS flows into the Atlantic Basin should now be a thing of the past as they now look a lot more difficult to make work at current levels.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com