WTI strengthens position as marginal sweet barrel to Asia

Flat prices were roiled over recent days, but Brent was ultimately unable to hold on to $90 amid recent hefty US crude stockbuilds and signs that tit-for-tat escalation in the Middle East has ended for now.

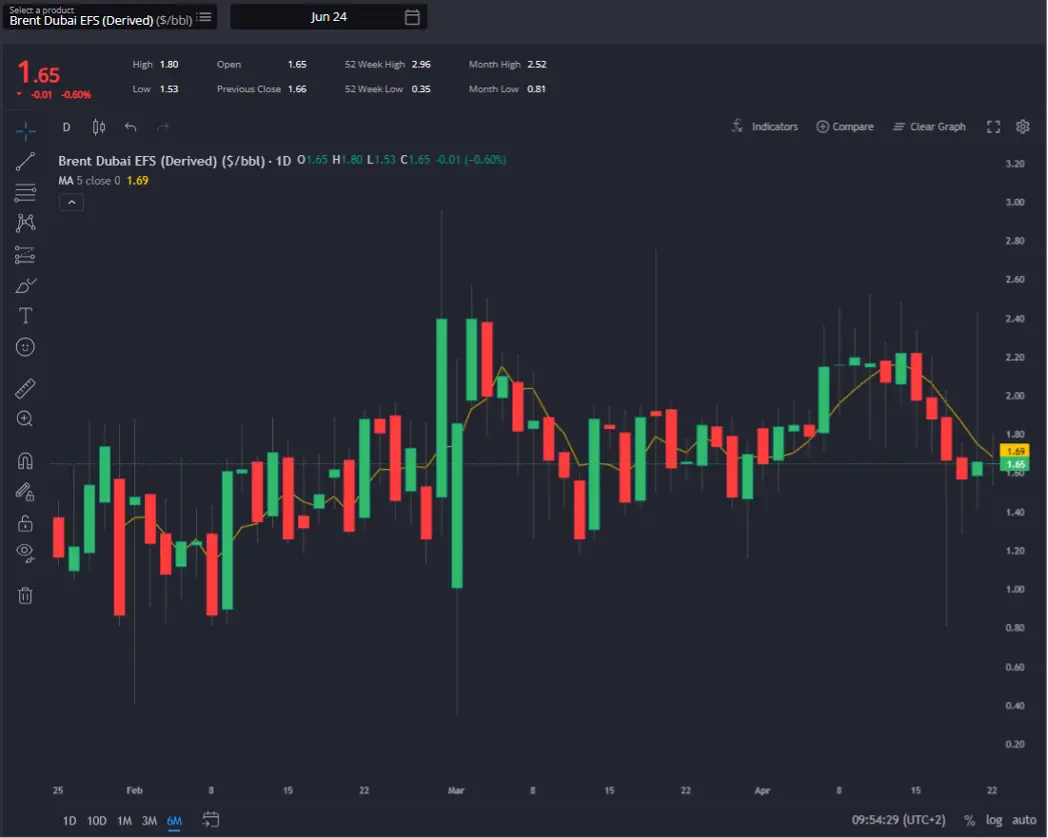

The Brent/Dubai EFS has dropped a substantial 50 cents vs last week. (Sparta Live Curves)

Last week this note referred to a limited timeframe for bearishness North Sea with broader arb opportunities from the Atlantic Basin to Asia beginning to improve and NWE refiner demand expected stronger soon.

Price action since has rather cemented this notion with the caveat that by now rather high crude stocks in the US may require some price pressure to be put onto NWE for a short time via a stronger exports out of the USGC.

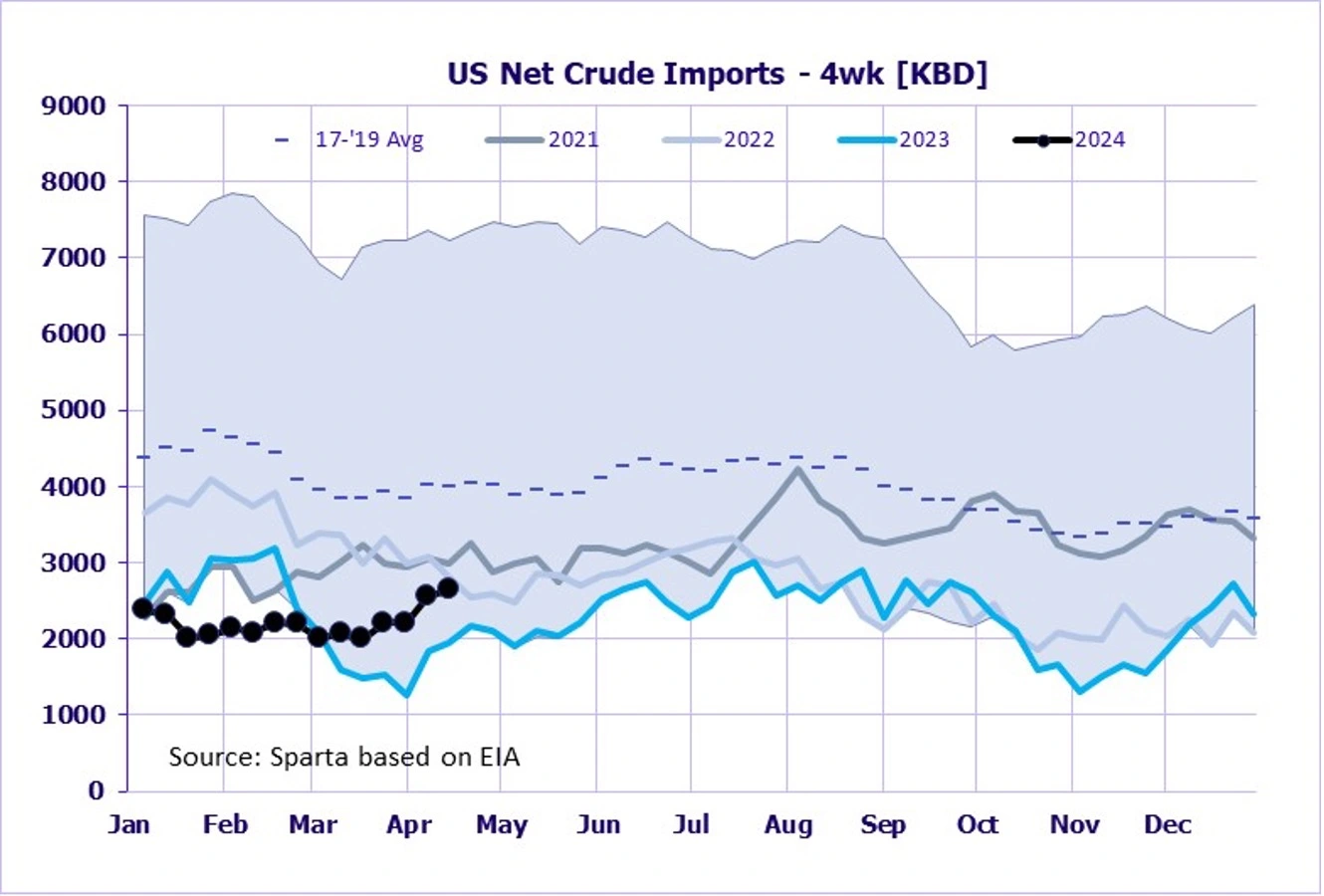

US net crude imports are a solid 650 KBD higher than a month ago (on a rolling 4-wk avg basis – see chart).

US net crude imports have trended substantially higher recently, largely on lower exports. (Sparta based on EIA)

Nevertheless, there has indeed been a substantial softening in the EFS, down $0.50/bbl w-o-w, as well as a wider WTI/Brent spread, which has further opened up econs both for WTI and for WAF/Brent to the Far East, at least on a landed value basis.

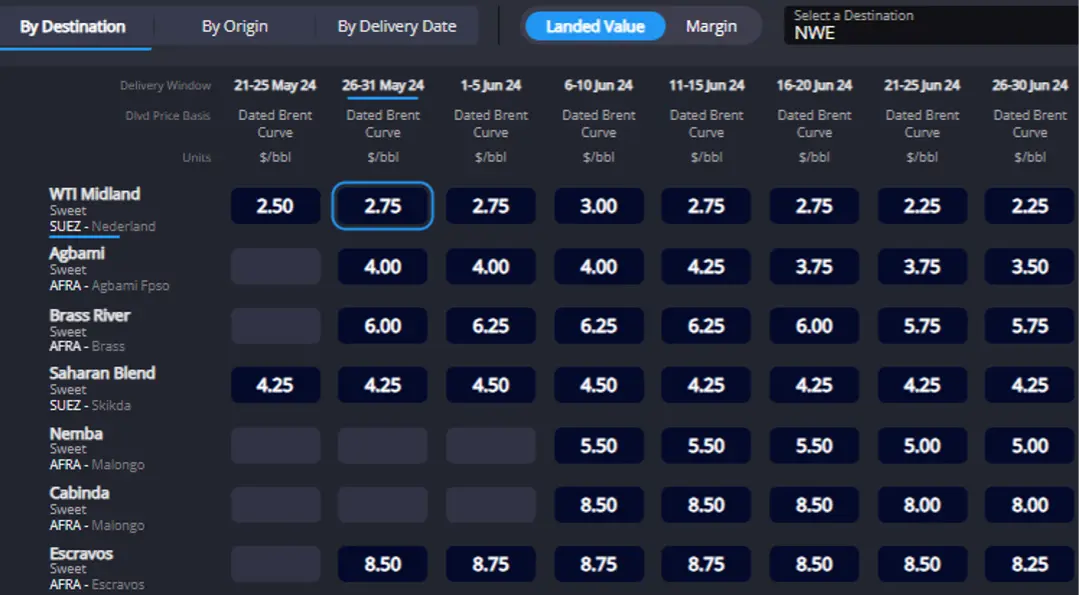

For WTI, landed values into NWE are now some of the lowest vs light & medium sweet competitors for late May delivery.

In Asia WTI landed values have held onto their new-found competitiveness against e.g. Murban (despite freight for the latter dipping substantially over the last week).

WTI landed values are low vs light and medium sweet competitors. (Sparta Global ARBS – ARBs Comparison)

The above looks to have spurred a flurry of WTI trading last week, for both Asian and European destinations. This has not yet had much of an impact on USGC pricing, where particularly low exports (partly weather-related) in recent weeks have led in part to strong PADD-3 stockbuilds.

However, a return to higher export numbers and improved arbs econs should turn this trend around and may also push – initially – pressure onto the North Sea prior to higher NWE buying.

With Cushing stocks flattened off and PADD-2 runs with upside ahead, the TI/Brent spread may be expected narrower from here.

For BFOET, FOB premia are a little stronger w-o-w, while a softened EFS and steady freight rates to the Far East have dropped landed values a healthy $1/bbl for late June delivery.

However, on paper both North Sea and WAF are still landing relatively expensively against medium sour spot grades out of the MEG & LatAm, while relative WTI landed values are now substantially lower vs early April.

That points to the marginal Asian barrel rather being WTI for the time being.

WTI & Murban landed values narrowed recently; WTI landing significantly cheaper than the rest of the North Sea/WAF. (Sparta Global ARBS – ARBs Comparison)

The WAF weakening we had alluded to in recent weeks continues to materialise, with Nigerian FOB premia down substantially w-o-w, and still potentially some downside ahead.

Qua Iboe is now landing cheaper than Ekofisk round the Cape into West Coast India and just marginally higher than Saharan Blend on the same basis.

On a margin basis Qua Iboe is a touch stronger than both.

However, in all the other key destinations (USGC, NWE/Med, Far East), both light sweet and medium sweet WAF is not clearly competitive yet and a reported overhang still of Nigeria’s May programme should contain FOB premia for now, at least until NWE demand returns in earnest.

In the Middle East the picture of general tightening avails continues apace with Al Shaheen the latest medium sour to be bid up; its spot premiums against Dubai rose 40 cents w-o-w.

Upper Zakum flipped recently to a premium against lighter Murban with exports of the former constrained by higher feed into the Ruwais refinery.

Lower freight rates to Eastern destinations are potentially providing room to the upside to these premia, with seemingly little still in the way of competition from other regions for similar grades outside of Brazilian and Latin American.

A tighter fuel oil market (stronger high sulphur cracks and narrowed Hi5’s) is surely also at play and may keep medium sour GPW assessments supported during the summer burn season.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com