T/A, E/W stubbornly narrow; Asian gasoline to come under pressure from softer aromatics, persistently strong AG exports; further RBOB upside needed to lure ARA into NYH

The gasoline E/W spread has remained out of double-digit territory out along the curve but just barely so, meaning East of Suez barrels are still not needed in the Atlantic Basin.

Despite strong gasoline demand data from the likes of China and India being recently released, a distinct lack of liquidity over the next few days due to holidays in China and Eid are unlikely to entice players to take up more substantial positions to either sustainably open the TA arb or widen the E/W to lure those barrels West.

As expected, Singapore has lost ground to AG barrels into Asia given the deluge of Middle East product now available with the full exit of regional refineries from turnaround season.

About a $2-3/bbl difference separates Singapore from AG suppliers’ arbs, meaning a heavier reliance on freight rates to decline, which the Sparta freight tool is not currently signalling.

That said, a recent uptick in regional high-octane components values has quelled somewhat and the overall downward trend in regional gasoline pricing should resume as integrated refinery-petrochemical complexes wind down maintenance season by mid-May, upping the flow of aromatics.

EoS suppliers will have to do the heavy lifting to either open the TA arb or widen the E/W spread given the onset of the seasonal gasoline demand shoulder season to ensure their barrels find homes in the Atlantic Basin.

Indeed, despite our ongoing neutral-to-bearish outlook for the overall diesel complex, European diesel cracks have recently outperformed those of EBOB.

While the upcoming European turnaround season has largely been priced into the complex, any further Russian refinery strikes by Ukrainian drones or unexpected outages at NWE or Med refineries should provide greater upside to gasoline rather than diesel given the imminent arrival of the summer driving season, pushing EBOB’s crack above that of GO once again.

However, capping significant EBOB upside is a decreasing number of destinations pointing towards ARA for resupply this summer.

This is partly due to the lack of product during April-May turnarounds, but more concerningly even deeper in the summer as USGC material gains a firmer foothold. It is only in Q3 where ARA material begins to hold sway in WAF markets.

Going forward, we continue to expect RBOB to widen TA as it exhibits further upside with US exports trending above historic averages as PADD 3 stocks stubbornly remaining below levels seen in the last two years.

This comes even as PADD 3 refineries fully exit turnarounds and are expected to hit year-ago levels this week.

Indeed, the ARA arb into NYH is inching open for the admittedly rapidly closing April window but is unworkable well into the summer.

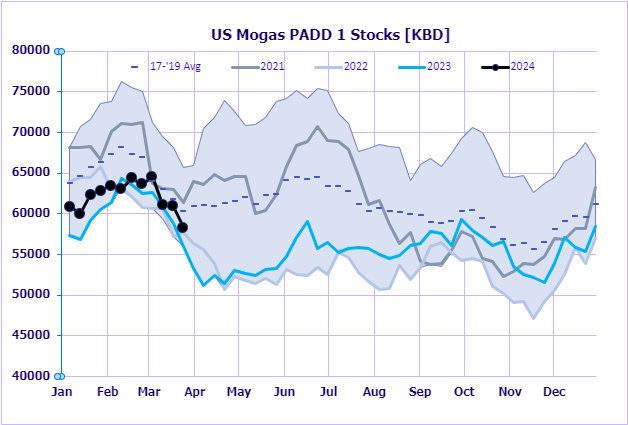

PADD 1 gasoline stocks remain higher than levels last seen in past two years for this time of year, keeping incremental spot cargoes at bay.

That said, any extension of the Irving St John refinery turnaround well into May with mild support coming from an over-nomination on Colonial Pipeline into Baltimore and a cascading effect on inbound truck and rail volumes into the mid-Atlantic seaboard area, could well prise open the arb that month.

Samantha Hartke, a veteran in commodity management, boasts substantial expertise in energy analysis and product management. In her role at Energy Aspects as Head of NGLs, she analysed global natural gas liquids markets. Previously, at PetroChem Wire, Samantha provided high-quality analysis of North American NGLs and olefins. Her expertise also extends to leading the commercial and operational aspects of IHS Chemical’s daily business information service.

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com