Surprise OPEC crude production cut and signs of recession weigh heavily on global diesel cracks

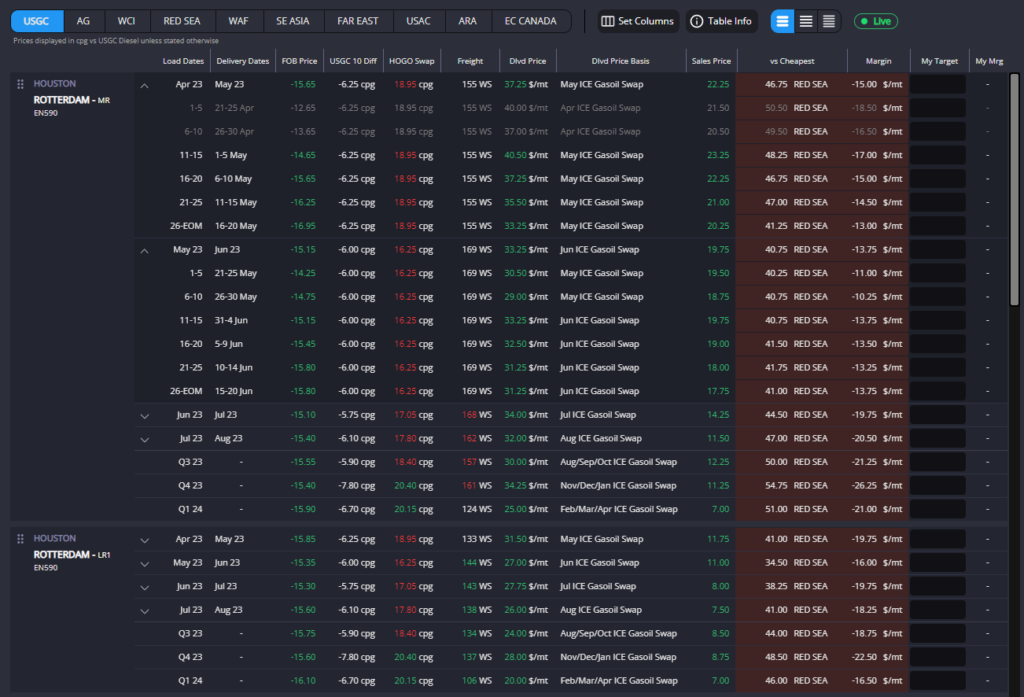

The Red Sea ULSD arbs into ARA have remained open and are, as has become standard, the first point of ARA re-supply.

In fact, they have moved further open on the back of strengthening European cash diffs through late March amid falling ARA ULSD stocks due to the French strikes and Russian sanctions, as well as weakening cash premiums in the AG and WCI as these exporters are forced to react to a narrowing E/W to keep flows viable.

Relative European strength combined with a narrowing HOGO spread and weakening MR freight rates to bring the USGC->Europe arb close to breakeven at the front at the beginning of this week, but has since seen a small rebound in US cash premiums and the April HOGO to push the USGC down the relative pecking order.

This should see USGC exporters once again focused on placing barrels into LatAm for the time being. Finally, WCI barrels have become the next most attractive source of resupply, despite recent narrowing of the E/W spread, as FOB prices have decreased in the region to compensate for the moves on the paper side.

Consequently, the picture for European cracks and spreads is a bearish one, with falling cash diffs East of Suez meaning that in the short term, with the Singapore region under the shadow of increased Chinese gasoil exports and elevated inventory, all flows point West.

The floor for the European diesel complex will be when we start to see significant pull from the Singapore region, signs of which will come from a narrower than current E/W.

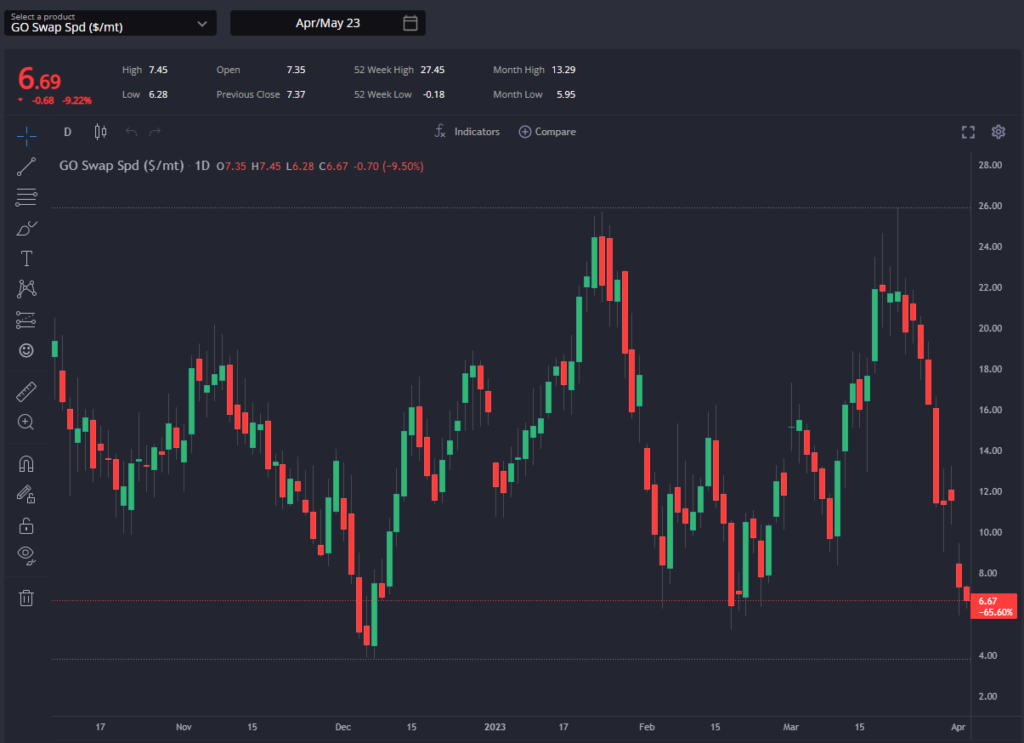

The bearish fundamentals picture has already made itself seen in the recent collapse of GO Swap spreads – with the Apr/May spread falling to single digits for the first time since February – and we are struggling to see a path for this to steepen again in the short-term.

With the North African shorts currently filled by Baltic and Black Sea barrels cutting off a source of Med tightness, there is a renewed focus on the Morocco short as a destination which is adhering to the Russian sanctions. Despite this being a typically US-supplied short, the MR Weco Amelie has been booked to move from ARA into Morocco in a further sign that there is little concern over NWE diesel supplies currently.

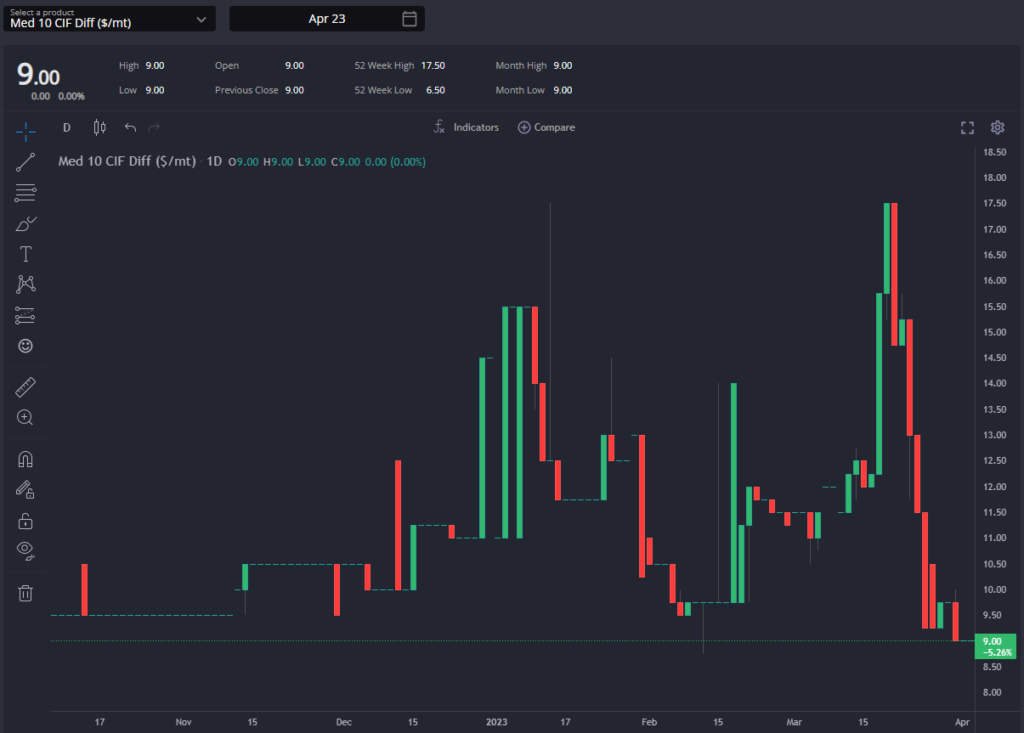

Consequently, the weakness in the GO complex has been mirrored in the April Med CIF diff, which has fallen almost 50% in the last two weeks and may well have further to go with barrels out of the Black Sea, AG, ARA, and USGC all available to the Med currently.

A spate of fixtures through late-March to move barrels out of the AG, Red Sea, and WCI into Europe has contributed to the recently steep narrowing of the prompt E/W spreads, which have now reached a level where barrels out of these origins are looking increasingly to the east. In fact, the MRs Pacific Ruby and High Freedom were observed to have been fixed loading Sikka with Singapore and Australia options, respectively, this week.

With arbs into Singapore currently closed, however, this is clearly not a case of Singapore pulling on these barrels as cracks and spreads here have also weakened.

There remain some flickers of potential strength for the Singapore market, however. One; almost all Red Sea, WCI and AG ULSD fixtures having pointed West for the past few weeks, depriving SE Asia of these barrels. Two; the record high Singapore middle distillate stocks are rumoured to be contain a larger than normal proportion of jet due to the regrade levels over December, January, and February and are as such not as bearish for ULSD as it may otherwise seem.

Three; the large flows of ULSD into Australia, Malaysia, Indonesia, and the Philippines this year has helped to direct NE Asian barrels directly into these destinations rather than first arriving into tanks in Singapore. All of which have combined to move the Sing 10 E/W to its narrowest level for over a year – helped of course by the most recent European wobble.

Will Europe’s or Singapore’s current weakening continue at the faster pace? Europe under the pressures described above? Or Singapore under the shadow of increasing Chinese gasoil exports due to increasing export margins? The signals to look out for, presuming freight levels remain fairly consistent, will be the E/W!

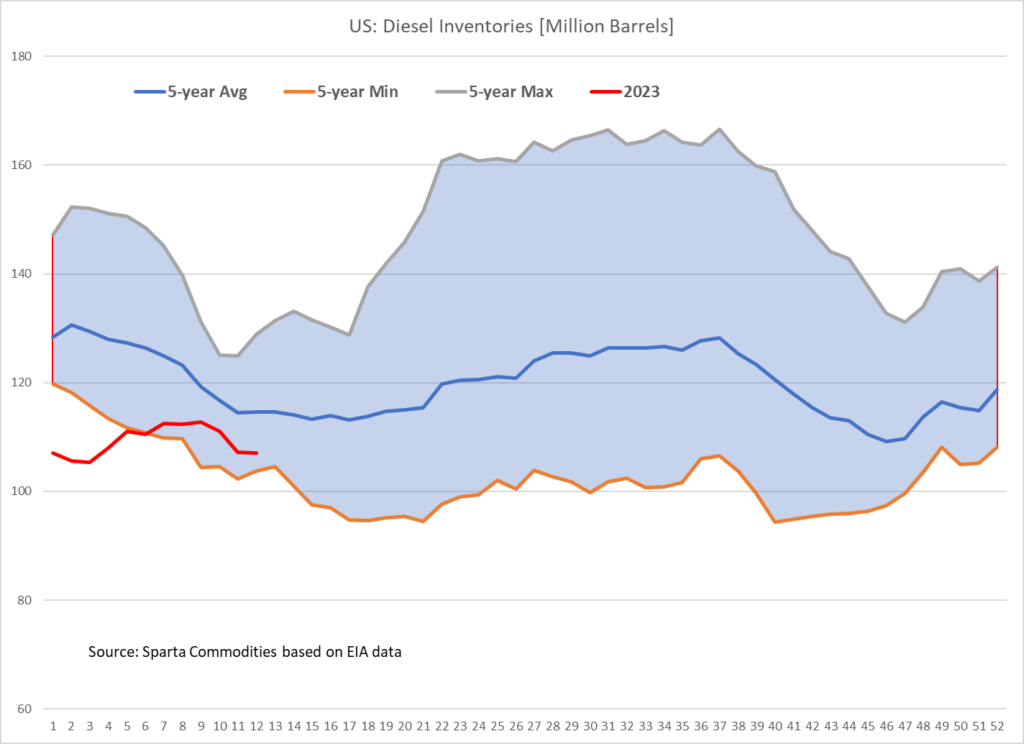

The week started with the “surprise” OPEC announcement that they intend to further cut crude production, a clear indicator of an impending economic slowdown, coming on top of falling US job numbers and increasing diesel stock levels in the latest EIA dataset.

US diesel stocks have been below the 5-year range for most of this year, having moved back into this range within the last 5 weeks due to slowing domestic demand. These factors have combined to detach diesel cracks from their historic positive correlation with crude flat price leaving European, Singapore and US diesel cracks at their lowest levels in over 10 months despite rising flat price.

The corrective instrument here may need to be refinery margins, as further artificially high flat prices continue to eat into end user demand.

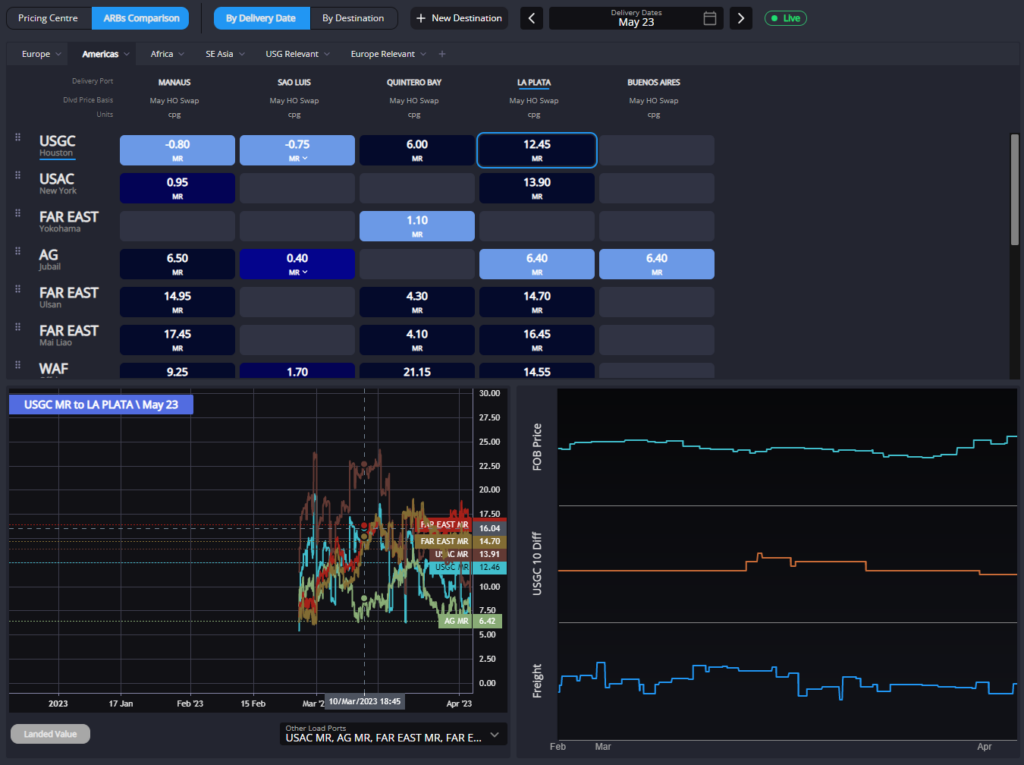

In continuing US based news, USG barrels continue to be best placed into their typical home in Brazil. In Argentina competition is being provided by AG origin product on the back of increasing USG cash diffs and a narrowing E/W. For similar reasons, Japanese barrels are best placed into WCSAM. The HO complex or USG cash diffs will need to weaken to displace these Asian origin barrels in Latam.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

James Noel-Beswick is Commodity Owner for Sparta. Before joining Sparta, James worked as an analyst for likes of BP and Shell, and leads our continued development of the distillate product vertical.

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com