Prompt TA arb re-opens on wider gas-nap whilst AG discounts return to challenge Atlantic Basin destinations

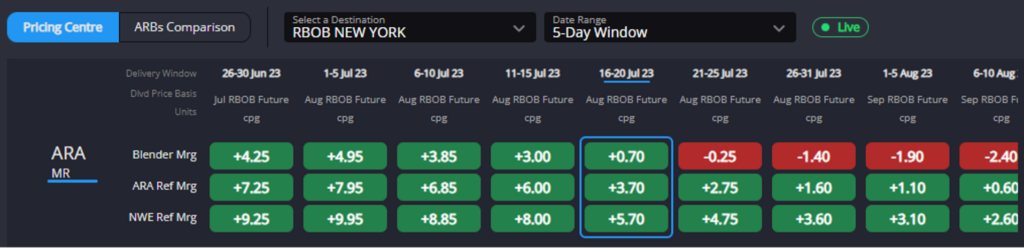

The TA arb rebounded to wide-open levels at the very front on a wider gas-nap that has (belatedly) rolled through from the previous month.

Whilst there has not yet been a commensurate uptick in physical blending/loading activity, the economics are certainly there to see another batch of cargoes fixed on the TA route now for the end of June/early July period, relieving some supply-pressure on a PADD-1 market which is still hovering around 2022’s record seasonal lows.

More broadly for ARA and Houston pricing, not much has changed in the relative competitive order for landed cargoes into Atlantic Basin/Lat Am destinations in recent weeks.

Houston maintains a strong advantage, now including discounted supply vs ARA into Canada and Florida. The resultant downtick in MR fixtures out of ARA is seeing freight rates out of ARA coming off again, but these remain too high to allow much competition, especially with the TA spread narrowing.

Similarly, the AG continues to hold a significant competitive advantage into all destinations it can reasonably supply.

This currently includes Nigeria and Brazil (Santos) and signals a full reversal of the situation through almost the entirety of May when the European market was pricing more aggressively into its non-US export markets.

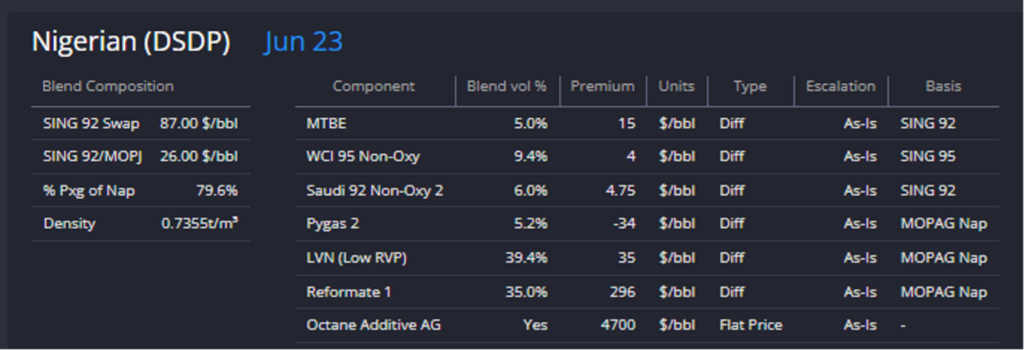

This is not a signal of weakness from the AG market, however, where component premiums continue to move from strength to strength, but rather a reflection of strong naphtha availability in this market and a relatively wider E/W spread on ample East of Suez supply.

Indeed, as we can see from the AG-based Nigerian blend composition and the price development chart of reformate premiums in the AG, it is a testament to the strength of the Atlantic Basin gasoline market that a blend with 35% reformate in it is still so much cheaper landed into Nigeria even when reformate premiums in the AG are up a further 10% since mid-May.

With weak naphtha likely to drag gasoline cracks lower in the coming days and weeks, the outlook for the naphtha market becomes ever more important – and here the spread between heavier and lighter volumes is leading the picture.

Heavy qualities are taking advantage of gasoline’s strength, and this has now supported US naphtha pricing and stimulated reforming and blending qualities, with premiums now in triple-digits over OSN in Europe and Asia.

Our naphtha Commodity Owner, Jorge Molinero, comments that: “In the short term the most interesting thing is to see if naphtha physical cargoes for open spec and paraffinic naphthas drop to discounts and if the paper goes to contango for summer and Q3 contracts.”

So far the wider gas-nap spreads have been more than enough to bring additional naphtha molecules into the gasoline pool, with premiums for typical petchem naphtha qualities holding out in premium territory.

However, with no end in sight for weak petchem demand, European naphtha’s descent into contango at the beginning of this week could be set to remain or even fall further in the short-term.

[hubspot type=cta portal=7807592 id=38c8d3f4-d2d3-4781-a4a2-ba10ca4055bc]

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, pre trade analytics platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com