Prompt RBOB arb open and E10 blending opportunities providing outlet for ARA blenders otherwise under continued pressure from US and EoS into typical outlets

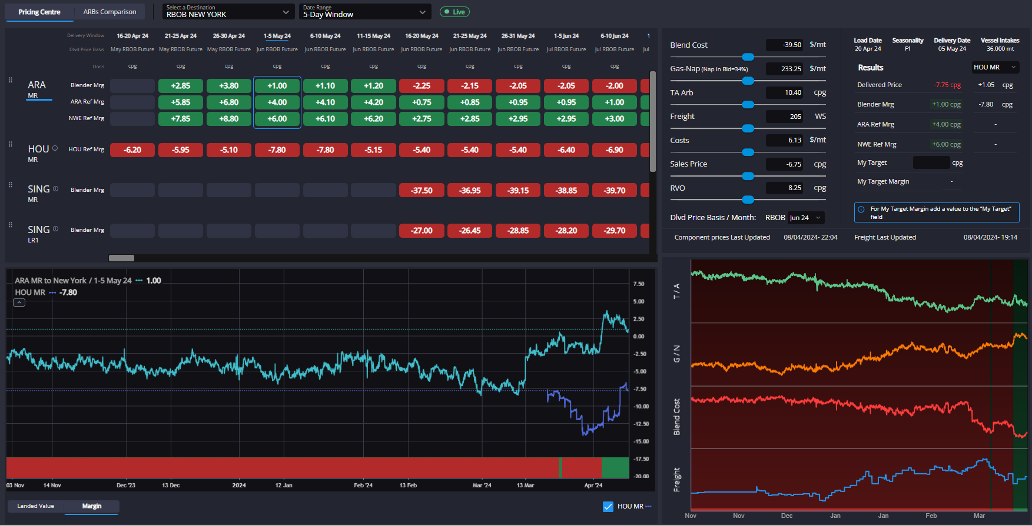

The prompt RBOB Arb has jumped open over the last week or so, with wider gas-nap spreads helping to open up opportunities also for blenders to put together RBOB cargoes and move them in April.

This is likely to see the call on MRs increase dramatically in the short-term, and indeed this market is already relatively elevated, with a $23/mt delta between an MR and LR1 freight rate moving from ARA to WAF currently.

With TC2 likely to pick up some support, and gas-nap spreads already well above their seasonal record levels currently, there’s still an argument to be made that the underlying paper TA spread will need to widen further if this Arb should continue to work through into May.

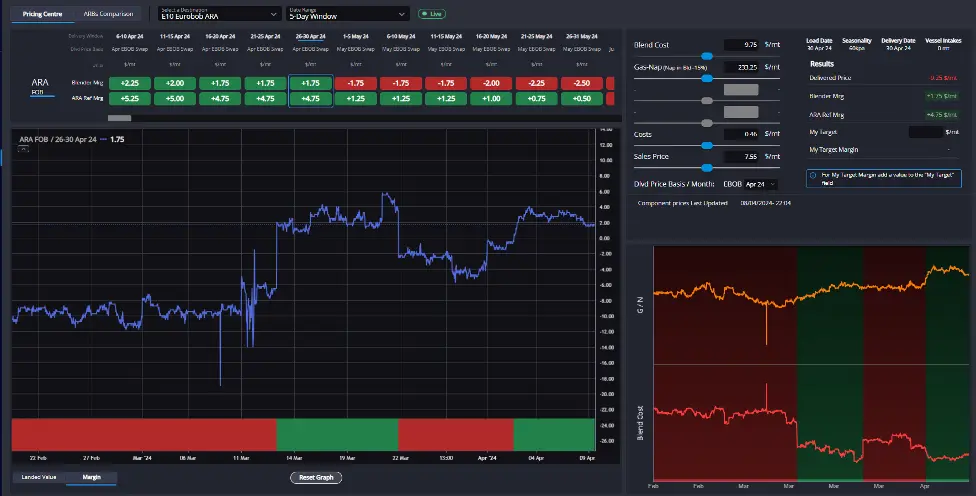

Another opportunity to soak up ARA gasoline components currently is also the E10 blending margin, which has now been open for a week or so.

Again, the move in gas-nap from around the $200/mt mark to over $230/mt has been enough to do most of the work to open this margin, and combined with the open RBOB arb will likely be enough to give a further boost to reformate and other higher-octane component premiums in the short-term.

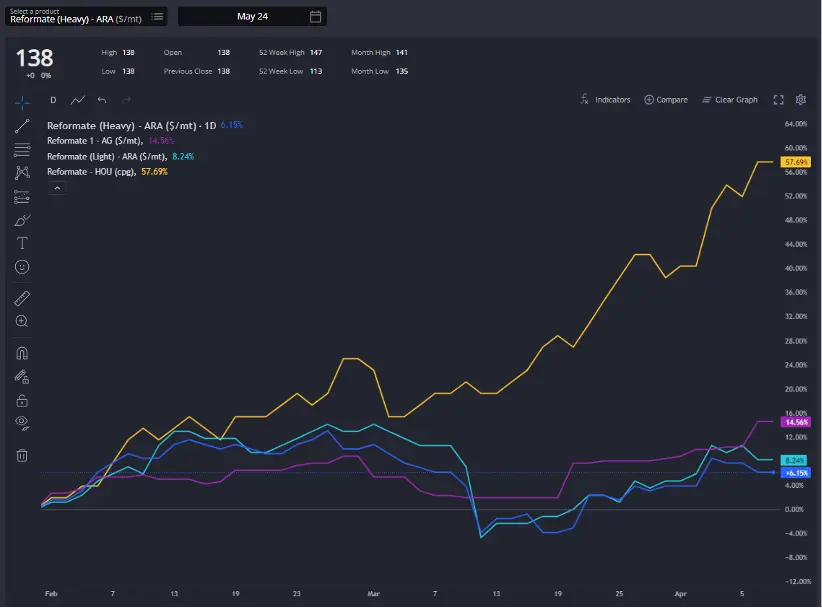

The reformate markets in Europe and the EoS have been trending essentially sideways for a little while now, with just gradual upticks over recent weeks being strongly outpaced by a very strong reformate (and wider high octane market) in the USGC.

Given the recent uptick in the European gas-nap spread, however, we would expect another jump higher for European high octane premiums in the coming weeks, taking many of them above their historical ranges – or, in the case of alkylate for example, showing a repeat of last year’s performance (see chart).

These positive factors (RBOB + E10 blend margin) for the European components market may be enough to keep the components premiums elevated, but the underlying paper EBOB levels still look a little too high vs their regional counterparts in the US and Asia. The Atlantic Basin market still looks very dominated by USGC-origin arbs, with RBOB still looking relatively undervalued vs EBOB for now.

Finally, EoS destinations are still dominated by Singapore or AG-origin arbs, but there has certainly been some narrowing of the spreads. Indeed, CARBOB arbs are pointing to Europe currently thanks to the complexities of the blend in a turnaround from the picture from a few weeks ago.

We’ve noticed that premiums on components and semi-finished grades have begun to soften alongside some fairly stark downsides in Sing92 spreads over the last week, with nothing in the arbs or physical market suggesting that this can’t slide even further over the next week or so.

Philip Jones-Lux is Commodity Owner for Sparta. Having worked with organisations such as JBC Energy and RP Global, Philip is a seasoned energy market analyst with expertise across the oil barrel and power markets

Sparta is a live, market intelligence and forecasting platform that enables oil traders, refiners, banks, hedge funds and wholesalers to have access to real-time and global actionable insights to capture market opportunities before others.

To find out how Sparta can allow you to make smarter trading decisions, faster, contact us for a demonstration at sales@spartacommodites.com